When you receive proceeds from life insurance, it can be a significant financial windfall, especially if you've recently lost a loved one or are facing unexpected expenses. Understanding the process and your options is crucial to making the most of this benefit. The proceeds from a life insurance policy can provide much-needed financial security for your family or beneficiaries, offering peace of mind and a means to cover various expenses, such as funeral costs, outstanding debts, or even everyday living expenses. It's essential to know the tax implications and any restrictions on how the funds can be used to ensure you make the best decisions for your situation.

What You'll Learn

- Tax Implications: Understand tax laws to avoid penalties when claiming insurance proceeds

- Distribution Methods: Choose how to distribute the money, e.g., lump sum or annuity

- Beneficiary Selection: Designate beneficiaries carefully to ensure proper distribution according to your wishes

- Investment Options: Explore investment opportunities to grow the proceeds over time

- Legal Considerations: Be aware of legal requirements and potential disputes regarding the insurance payout

Tax Implications: Understand tax laws to avoid penalties when claiming insurance proceeds

When you receive insurance proceeds, whether from life insurance, health insurance, or any other type of policy, it's crucial to understand the tax implications to ensure you comply with the law and avoid any penalties. The tax treatment of insurance payments can vary depending on the type of insurance and the circumstances, so it's essential to be well-informed.

In general, insurance payments received as a result of a life-threatening event, such as a death or critical illness, are typically not taxable. These proceeds are often considered a form of compensation and are not subject to income tax. However, there are some important points to consider: Firstly, if the insurance policy was taken out for the specific purpose of covering funeral expenses or other final arrangements, the proceeds may be taxable as ordinary income. This is because the primary intention behind the policy might be to provide financial assistance for these expenses. Secondly, if the policyholder is still alive and receives a lump sum or regular payments, the tax treatment can differ. In such cases, the insurance proceeds may be subject to income tax, and the amount received could be considered a form of taxable income.

One key aspect to remember is that the tax laws regarding insurance proceeds can be complex and may vary by jurisdiction. For instance, in some countries, life insurance payments are treated as taxable income, while in others, they may be exempt, provided certain conditions are met. It is essential to consult the specific tax regulations in your region to ensure compliance. For example, in the United States, life insurance proceeds are generally not taxable if the policy was owned by the deceased and was not a modified endowment contract. However, if the policy was owned jointly or had a cash value, the proceeds might be taxable.

To avoid any potential issues, it is advisable to consult a tax professional or accountant who can provide guidance tailored to your situation. They can help you navigate the intricacies of tax laws and ensure that you understand the specific rules applicable to your insurance policy. Additionally, keeping detailed records of the insurance policy, including the purpose of the coverage, the premium payments, and any relevant documentation, can be beneficial when dealing with tax authorities.

In summary, while insurance proceeds from life insurance policies are generally not taxable, there are specific scenarios and considerations that can impact their tax treatment. Being aware of these nuances and seeking professional advice can help you make informed decisions and ensure that you comply with tax laws, ultimately avoiding any unnecessary penalties. Understanding the tax implications is a crucial step in managing your finances effectively when dealing with insurance claims.

Life Insurance and Terrorism: Payout Scenarios Explained

You may want to see also

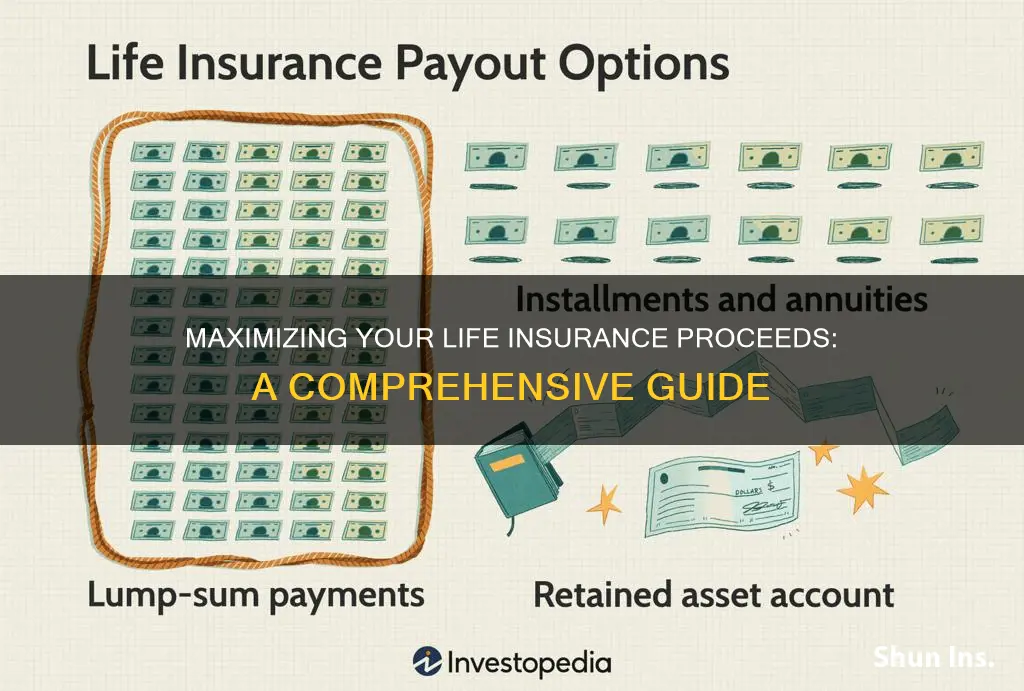

Distribution Methods: Choose how to distribute the money, e.g., lump sum or annuity

When you receive life insurance proceeds, you have several options for how to distribute the money. This decision is crucial as it can significantly impact your financial future and that of your beneficiaries. Here's a breakdown of the common distribution methods:

Lump Sum:

A lump sum distribution means you receive the entire insurance payout as a single, large payment. This option provides you with immediate access to the full amount, allowing you to make significant financial decisions. You could use it to:

- Pay off debts: Eliminate high-interest debts like credit card balances or medical bills, reducing long-term financial burden.

- Invest for the future: Build a retirement nest egg, fund your child's education, or invest in assets like stocks, bonds, or real estate.

- Create a reserve: Build an emergency fund or set aside money for unexpected expenses.

Annuity:

An annuity is a financial product that provides regular payments over a specified period. Instead of receiving the entire amount upfront, you choose to receive a series of payments. This option offers a more structured and predictable financial plan. Here's how it works:

- You select a payment frequency (monthly, quarterly, etc.).

- The insurance company guarantees a fixed payment amount for a predetermined period.

- Some annuities offer guaranteed interest rates, ensuring your money grows over time.

- Annuities can be a good choice for those seeking a steady income stream in retirement or for those who prefer a more conservative investment approach.

Other Distribution Options:

Beyond lump sums and annuities, there are other distribution methods to consider:

- Paying Off Debts: Using the proceeds to settle debts can be a strategic move, especially if you have high-interest loans.

- Charitable Giving: Donating a portion of the proceeds to charities or non-profit organizations can leave a lasting legacy.

- Starting a Business: If you've always dreamed of entrepreneurship, using the insurance money to launch a business can be a fulfilling use of the funds.

- Travel or Experiences: Some people choose to use the proceeds for once-in-a-lifetime experiences, creating lasting memories.

Making the Right Choice:

The best distribution method depends on your individual financial situation, goals, and risk tolerance. It's essential to carefully consider your needs and consult with a financial advisor if needed. They can help you evaluate your options and make an informed decision that aligns with your long-term financial well-being.

FBAR and Life Insurance: What You Need to Declare

You may want to see also

Beneficiary Selection: Designate beneficiaries carefully to ensure proper distribution according to your wishes

When it comes to life insurance, the proceeds can be a significant financial benefit for your loved ones. It is crucial to carefully select and designate beneficiaries to ensure that the funds are distributed according to your wishes and intentions. This process requires thoughtful consideration and attention to detail to avoid any potential legal complications or disputes among family members.

The first step is to identify the individuals or entities you want to benefit from the life insurance payout. This could include your spouse, children, parents, or even charitable organizations that hold a special place in your heart. It is essential to have a clear understanding of your relationships and the potential impact of your decisions. For instance, if you have minor children, you might want to consider naming a trusted family member or a legal guardian as a secondary beneficiary to ensure their financial security in the event of your passing.

Once you have a list of potential beneficiaries, it's time to decide on the distribution. You can choose to leave the entire proceeds to one primary beneficiary, ensuring they receive the full amount. Alternatively, you may opt for a more complex distribution, such as splitting the funds equally among multiple beneficiaries or providing a larger portion to a specific individual based on their needs or contributions to your life. It is advisable to consult with a legal professional to understand the tax implications and any legal requirements associated with different distribution methods.

Another important aspect of beneficiary selection is the use of contingent beneficiaries. This allows you to name additional individuals who will receive the proceeds if your primary beneficiaries are unable or unwilling to accept the funds. For example, if your primary beneficiary passes away before you, the contingent beneficiary will step in to ensure the distribution according to your original plan. This adds a layer of flexibility and security to your life insurance strategy.

Lastly, it is crucial to regularly review and update your beneficiary designations. Life events, such as marriages, divorces, or the birth of a child, may require changes to your beneficiary list. Keeping the information up-to-date ensures that your wishes are accurately reflected and that the proceeds are distributed efficiently. It is recommended to consult with a financial advisor or insurance representative to guide you through the process and provide personalized advice based on your unique circumstances.

Cancer Patients: Finding Life Insurance Options

You may want to see also

Investment Options: Explore investment opportunities to grow the proceeds over time

When you receive the proceeds from a life insurance policy, it presents an opportunity to make your money work for you. One of the key strategies is to explore various investment options that can help grow your funds over time. Here's a detailed guide on how to approach this:

Diversify Your Portfolio: Consider investing in a mix of assets to balance risk and reward. Diversification is a powerful strategy to ensure your money is spread across different sectors and markets. You could allocate a portion of the proceeds to stocks, bonds, mutual funds, or exchange-traded funds (ETFs). Each of these investment vehicles offers unique advantages and caters to different risk appetites. For instance, stocks provide the potential for high returns but come with higher volatility, while bonds offer more stability but with lower potential gains.

Long-Term Investments: Life insurance proceeds can be an excellent foundation for long-term wealth creation. You might want to invest in assets that have a proven track record of growth over extended periods. Real estate, for example, can be a lucrative investment, offering both rental income and potential capital appreciation. Alternatively, consider investing in high-quality companies with a history of strong performance and steady growth. These long-term investments can help build substantial wealth over time.

Consider Index Funds and ETFs: These investment vehicles provide instant diversification and are known for their low costs and strong performance. Index funds and ETFs track specific market indexes, such as the S&P 500 or NASDAQ-100, allowing you to invest in a basket of carefully selected companies. This approach is ideal for those who want to benefit from the overall market's growth without the hassle of picking individual stocks.

Consult a Financial Advisor: Given the complexity of investment options, seeking professional advice is highly recommended. A financial advisor can provide personalized guidance based on your financial goals, risk tolerance, and time horizon. They can help you navigate the various investment products, understand the associated risks and rewards, and create a tailored investment plan. This ensures that your life insurance proceeds are utilized effectively and efficiently.

Remember, investing is a long-term game, and it's essential to stay committed to your strategy. Regularly reviewing and rebalancing your portfolio can help you stay on track and make adjustments as needed. With the right investment choices, you can turn your life insurance proceeds into a powerful tool for building a secure financial future.

Life Insurance and the IRS: Do They Ask for Payouts?

You may want to see also

Legal Considerations: Be aware of legal requirements and potential disputes regarding the insurance payout

When you receive proceeds from a life insurance policy, it's crucial to understand the legal considerations that come into play. The process of claiming and distributing these funds involves a series of legal requirements and potential pitfalls that can significantly impact the outcome. Here's an overview to help you navigate this complex area:

Legal Requirements and Documentation: Obtaining life insurance benefits often requires a thorough and meticulous process. The insurance company will typically request various documents to verify the identity of the policyholder and the beneficiary. These documents may include death certificates, official identification, and proof of relationship, especially if the beneficiary is not the spouse or immediate family member. Ensuring that all the required paperwork is in order and submitted promptly is essential to avoid delays in receiving the payout.

Beneficiary Designation: One of the most critical aspects of life insurance is the designation of beneficiaries. The policyholder has the power to choose who receives the proceeds. This decision should be made carefully, as it can lead to legal disputes if not handled properly. It is advisable to have beneficiaries designated in writing and to keep multiple copies in secure locations. If there are any changes to the beneficiaries, these should be updated with the insurance company to avoid confusion and potential legal challenges.

Potential Disputes and Challenges: Despite careful planning, disputes can still arise. Common issues include disagreements between beneficiaries, especially in cases of multiple beneficiaries or complex family relationships. Additionally, the insurance company may scrutinize the claims process, requiring additional documentation or investigations. In some cases, fraud or misrepresentation can lead to legal consequences and the denial of claims. It is essential to be transparent and provide all necessary information to the insurance provider to mitigate these risks.

Legal Advice and Representation: Given the potential complexity, seeking legal advice can be beneficial. An attorney specializing in insurance law can guide you through the process, ensuring compliance with legal requirements. They can also help in the event of a dispute, providing representation and advocating for your rights. This is particularly important if the insurance company denies a claim or if there are complex family dynamics involved.

Timely Action: Time is of the essence when dealing with life insurance proceeds. Insurance companies often have specific time frames within which they must process claims. Missing these deadlines can result in delays or even the rejection of your claim. Being proactive and staying informed about the process will help ensure a smoother experience.

Update Your ICICI Prudential Life Insurance Address in Easy Steps

You may want to see also

Frequently asked questions

The timing of receiving life insurance proceeds depends on the specific policy and the claims process. Typically, after the insured individual's death is confirmed, the beneficiary or beneficiaries named in the policy should receive the payout within a few weeks to a few months. The insurance company will handle the claims process, which may involve verifying the death, gathering necessary documentation, and processing the payment.

The full amount of the life insurance policy is usually paid out in a lump sum, but it can also be structured as periodic payments if the policy offers that option. The entire process can vary, but it often takes around 30-60 days from the time of death verification to when the beneficiary receives the final payment. This timeline can be influenced by factors such as the complexity of the claim, the insurance company's procedures, and the availability of required documents.

In most cases, the timing of receiving life insurance proceeds is not customizable by the beneficiary. The insurance company has its own policies and procedures, and the payout schedule is typically predetermined. However, some policies may offer options for accelerated benefits or different payment structures, which should be discussed with the insurance provider.

If a life insurance policy has multiple beneficiaries, the proceeds are typically divided equally among them. The insurance company will follow the instructions provided in the policy regarding the distribution of benefits. It's important to ensure that the policy is properly updated with the latest beneficiary information to avoid any complications during the claims process.

In many jurisdictions, life insurance proceeds are generally not subject to income tax for the beneficiary. However, there may be certain tax implications for the insurance company or the estate of the deceased. Additionally, there could be small administrative fees associated with processing the claim, but these fees are usually minimal and deducted from the total payout.