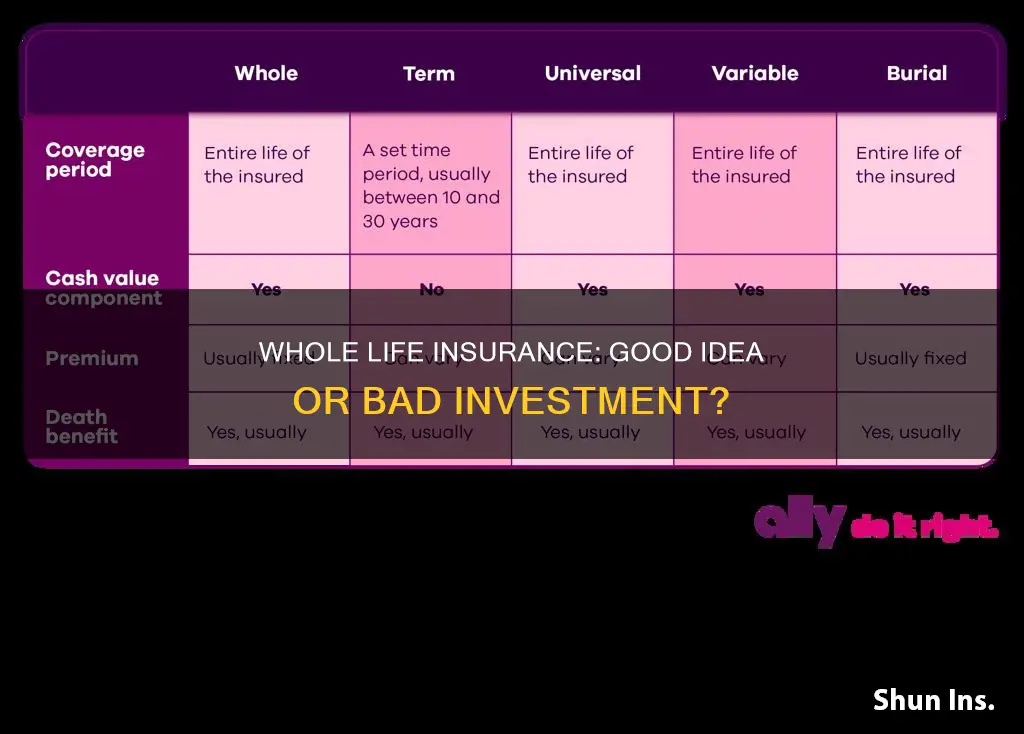

Whole life insurance is a type of permanent life insurance that provides coverage for your entire lifetime as long as you keep paying your premiums on time. It is often criticised for being expensive, having low returns on the cash value investment, and being sold on commission. However, some people may find it useful for family protection and financial flexibility.

| Characteristics | Values |

|---|---|

| Cost | Whole life insurance is more expensive than term life insurance. |

| Returns | Whole life insurance has low returns compared to other investment options. |

| Purpose | Whole life insurance is not always necessary. |

| Risk | Whole life insurance is a low-risk option. |

| Commission | Whole life insurance is sold on commission. |

What You'll Learn

Whole life insurance is expensive

Whole life insurance is often criticised for being expensive. Whole life insurance is more expensive than term life insurance, but this is because it is a different product. Term life insurance provides protection for your family or other beneficiaries in the event of your death for a specified period of time. Whole life insurance, on the other hand, provides that kind of protection indefinitely. It also builds cash value, has the opportunity to earn dividends, and can offer some tax advantages.

Whole life insurance policies can offer more and, as a result, they tend to cost more than term insurance. However, this does not mean that whole life insurance is appropriate for everyone. It can be the ideal thing for those folks worried about family protection and also looking for some financial flexibility down the road.

Life Insurance and Taxes: What You Need to Know

You may want to see also

Whole life insurance returns lag the market

Whole life insurance is a type of permanent life insurance. It provides coverage for your entire lifetime as long as you keep paying your premiums on time. Whole life insurance policies also include a cash value component that grows over time. The point is to provide a savings or investment feature in addition to the death benefit. The cash value of a whole life policy grows over time through a combination of premium payments and interest credited by the insurance company.

Whole life insurance policies are more expensive than term life policies. This is because the cash value feature, lots of fees, and the fact that the cost of life insurance increases as you age.

The cash value of a whole life policy will pretty much always pale in comparison to other investment and savings options. The main thing to know about whole life is that the growth of the cash value in a whole life policy will pretty much always be lower than the kind of growth you’d expect from other investments, like good growth stock mutual funds.

VA Employees: Are They Covered by Life Insurance?

You may want to see also

Life insurance is sold on commission

Life insurance is often sold on commission, with agents receiving a percentage of the premiums paid by the customer. This commission can be as high as 50-110% of the first year's premium, and it incentivises agents to push whole life insurance policies, which offer higher commissions than term life insurance. Whole life insurance is often a bad idea for the customer, as it combines insurance and investment in one package, with high fees. It is a poor investment product because returns are low, and it is a poor insurance product because it is expensive.

Commissions on whole life insurance policies are often much higher than those on term life insurance. Agents typically receive 40% to 115% of the policy's first-year premiums for whole life insurance, and 30% to 80% for term life insurance. Commissions are a percentage of premiums, so agents are incentivised to promote policies with higher premiums, like permanent life insurance. This may lead some agents to recommend permanent policies, even if the commission percentage is the same, since the total commission they stand to earn is higher.

Life insurance companies sometimes pay higher commission percentages for permanent policies, which further boosts their appeal to agents. This is mainly because cash value life insurance policies require more "servicing" by insurers. They're typically in force for a longer period of time, and some policies require constant monitoring of the investments.

Commissions slow the cash value growth in permanent life insurance policies, especially in the first few years of a policy. With these long-term contracts, it's more important to look at the 20- or 30-year projection of a policy's performance to determine whether the agent's commissions would have a substantial impact.

Commissions on life insurance policies can vary for a number of reasons. For example, an agent's commission percentage may increase based on the dollar amount of premiums they place with a company over a year. They may receive a commission of 60% at the beginning of the year, but that percentage could increase significantly as the year progresses.

In some states, agents are required to disclose the amount they're earning in commission if the applicant requests it.

Bankers Life: Term Insurance Options and Features

You may want to see also

Some people don't need whole life insurance

- Whole life insurance is expensive: Whole life insurance premiums are usually far higher than term life insurance premiums. This is because whole life insurance includes a cash value feature, which allows you to borrow against the policy or withdraw funds. However, this feature comes with high fees and can reduce the death benefit if not managed properly.

- Whole life insurance returns lag the market: Critics argue that the cash value growth of whole life insurance policies is lower than the returns offered by market-based investments such as stocks, fixed income, real estate, and commodities. However, these investments come with market risk, while whole life insurance offers a guaranteed level of cash-value growth without the volatility of the market.

- Some people don't need life insurance at all: This depends on individual circumstances, such as finances and family situation. For example, if you are single with no dependents and have sufficient savings and investments, you may not need any life insurance at all. On the other hand, if you have limited income and want basic protection for your family, term life insurance may be a more affordable option.

- Whole life insurance is sold on commission: Critics argue that the commission-based sales model adds to the expense of the product and creates an incentive for salespeople to push whole life insurance even when it may not be the best option for the customer. However, commission-based sales are common in many industries, and it can be efficient for allocating costs to the right products.

How 401(k) Changes Affect Group Term Life Insurance Benefits

You may want to see also

Whole life insurance is a bad investment

Whole life insurance is also a bad investment because it is often sold on commission, with agents receiving a large chunk of the first year's premium as a commission. This creates a conflict of interest, as agents are incentivised to sell whole life insurance policies over other types of insurance that may be more suitable for the customer. Whole life insurance is also inflexible, as it is designed to be held for the policyholder's entire life. This means that if a policyholder's circumstances change and they no longer need or want the policy, they will lose out if they cancel it, as they will usually have to pay a surrender charge and will only receive a percentage of the policy's cash value.

Whole life insurance is also criticised for its low returns, which lag behind the market. However, this criticism ignores the fact that whole life insurance removes volatility from the equation, as the insurance company takes on the risk of market fluctuations.

Medicare Life Insurance Scams: What You Need to Know

You may want to see also

Frequently asked questions

No, but it's a bad idea for most people. Whole life insurance is a type of permanent life insurance that provides coverage for your entire life as long as you keep paying your premiums on time. It's more expensive than term life insurance because it includes a cash value component that grows over time. However, the returns on these accounts are pretty low, and there are plenty of other ways to avoid taxes on investments that also happen to provide far better returns.

The main advantage of whole life insurance is that it provides a guaranteed death benefit to the beneficiaries after the death of the insured. It also has tax-deferred growth, and some policies may pay dividends, which can be used to increase the cash value, reduce premiums, or purchase additional coverage.

Whole life insurance premiums are usually far higher than term life premiums. The cash value feature, lots of fees, and the risk of losing the cash value completely if you die are some of the disadvantages of whole life insurance.