Personal injury protection (PIP) is auto insurance coverage that pays for medical expenses and lost wages from car-related injuries, regardless of who is at fault. PIP is mandatory in some states and optional or not offered in others. It covers medical bills, lost wages, household services, disability, and rehabilitation costs. It also includes a death benefit. While PIP is not available in all states, it is a valuable addition to a car insurance policy, offering peace of mind and financial protection in the event of an accident.

| Characteristics | Values |

|---|---|

| What does it cover? | Medical expenses, lost wages, household services, disability, funeral costs, death benefit |

| Who is it for? | Policyholder, family members in the household, passengers in the vehicle, other drivers with permission, pedestrians, cyclists |

| When is it required? | In 15 states as part of "no-fault auto insurance" laws; in 3 other states without such laws |

| When is it optional? | In 4 states and the District of Columbia |

| When is it unavailable? | In some states |

| Deductible | In some states, with a range of deductible amounts to choose from |

| Cost | Varies with each company |

| When it doesn't apply | Intentional injuries, injuries sustained while committing a felony, racing activities |

| How to reject | In writing |

| How to claim | File a claim with your car insurance company, regardless of who caused the accident |

| How to choose the right amount | Consider your health insurance and its deductible |

What You'll Learn

What does PIP cover?

Personal injury protection (PIP) insurance, also known as "no-fault insurance," covers medical expenses and related costs resulting from an accident, regardless of who is at fault. PIP insurance is a form of auto insurance that pays for the policyholder's and their passengers' medical and disability expenses. It provides primary coverage, meaning it may need to be used before your health insurance policy. PIP insurance covers hospitalization fees, therapy or rehabilitation costs, and death and disability benefits. For example, if you or your passenger is killed in a car accident, the PIP policy would cover funeral expenses. If you are unable to work due to your injuries, the insurance would reimburse you for a percentage of your lost wages, up to the policy limit.

PIP insurance is mandatory in some states, optional in others, and not offered at all in certain states. In no-fault states, every driver must file a claim with their insurance company after an accident, regardless of who caused it. In these states, all drivers need to purchase PIP coverage as part of their auto policies. Additionally, PIP coverage may be required or offered as an optional add-on in some at-fault states.

It's important to note that PIP insurance does not cover all expenses. It will not reimburse you for car repairs or damage to another person's property. It primarily focuses on medical expenses and lost wages. Other notable exemptions include buses and taxis. If you are injured in a bus or taxi, you will not be covered under that vehicle's PIP insurance policy. However, if you have your own PIP coverage, you may still be able to file a claim, even if your vehicle was not involved.

Podcasts and Insurance: Who's Covered?

You may want to see also

When is PIP not applicable?

Personal Injury Protection (PIP) is not applicable in situations where there is damage to property or vehicles. It also does not cover injuries sustained while driving for work purposes or while committing a crime.

PIP covers medical expenses, lost wages, and other related costs if you or your passengers are injured in an auto accident, regardless of who is at fault. It is required in some states as part of "no-fault auto insurance" laws that restrict your ability to sue for car crash injuries.

- Damage to your vehicle: PIP does not cover damage to your vehicle. If you want protection against damage to your car, you need to add comprehensive car insurance coverage and auto collision coverage.

- Theft of your vehicle: If your car gets stolen, PIP won't help. Comprehensive coverage is what you need in this case.

- Damage to someone else's property: If you're responsible for an accident and need to pay for someone else's damaged vehicle or property, property damage liability coverage is what you need, not PIP.

- Injuries while driving for work: If you're injured in an accident while driving for work purposes, PIP won't cover it.

- Injuries while committing a crime: If you're injured while committing a crime, PIP won't cover those injuries.

Malpractice Insurance: A Must-Have for Lawyers?

You may want to see also

Who does PIP cover?

Personal Injury Protection (PIP) covers the policyholder and their passengers. In some states, PIP also covers the policyholder's family members, even if they are not in the vehicle at the time of the accident. In Florida, you can choose whether you want your PIP to cover just yourself or other residents in your household.

PIP covers children in the vehicle and also when they ride the school bus. If there are individuals in the policyholder's vehicle at the time of the crash who don't own a vehicle and therefore don't have their own PIP coverage, they may be able to recover compensation under the policyholder's policy.

PIP covers pedestrians or cyclists who are injured in a crash with a motor vehicle.

Missouri Workers Comp: Who Needs It?

You may want to see also

How much does PIP cost?

The cost of Personal Injury Protection (PIP) insurance depends on factors such as coverage level, age, type of vehicle, your auto insurance company, and location.

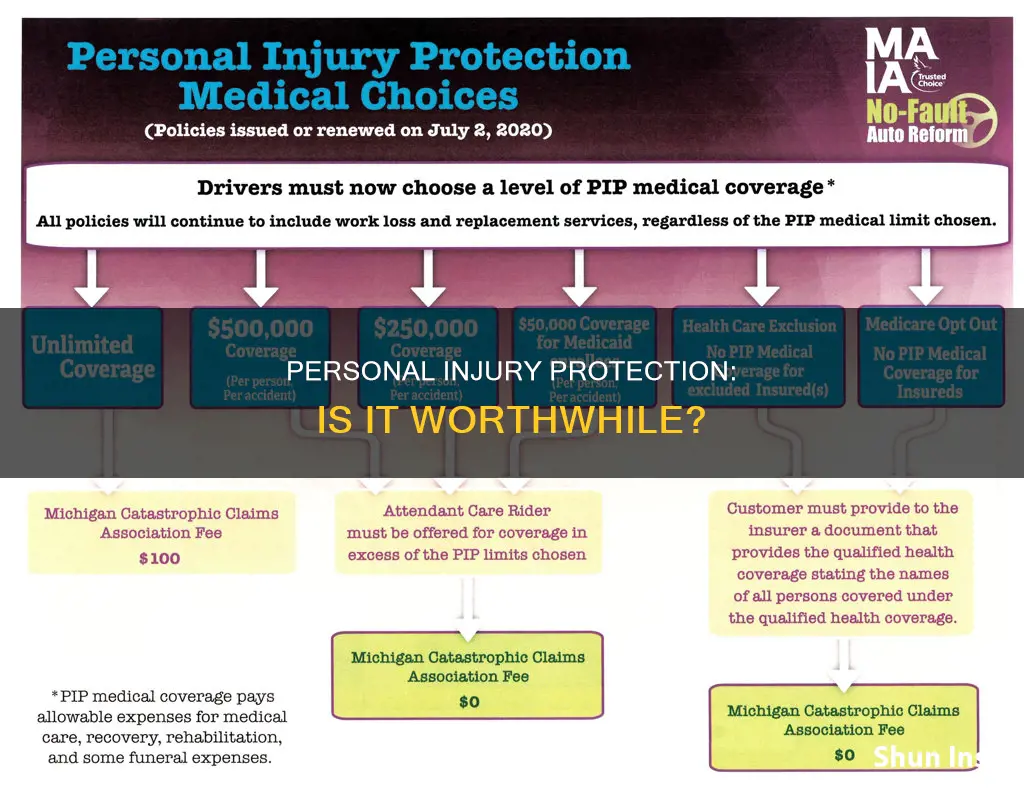

For example, in Florida, PIP insurance will typically cover 80% of medical bills and 60% of lost wages, up to $10,000. In other states, PIP coverage levels can be much higher or much lower. For instance, drivers in Michigan have much higher PIP limits, which is one of the main reasons car insurance is expensive in Michigan.

In Minnesota, the personal injury protection limit is $40,000, which includes $20,000 for hospital/medical expenses and $20,000 for non-medical expenses. In New York, PIP coverage includes a $2,000 death benefit in addition to the $50,000 in coverage for medical expenses.

The Zebra provides an example of the average cost of PIP insurance for a 30-year-old male driver with no accident history, good credit, and the owner of a 2016 Honda Civic.

According to NerdWallet, PIP is relatively cheap car insurance, with coverage limits ranging from $5 to $50 per month.

Insurance Carrier: Steps to Success

You may want to see also

What are the alternatives to PIP?

Personal Injury Protection (PIP) is mandatory in some states and optional or not offered in others. If you live in a state where PIP coverage is optional, you may want to consider the following alternatives:

- Medical Payments Coverage (MedPay): MedPay covers medical expenses from crash-related injuries, regardless of who is at fault. However, it does not cover additional expenses related to your injuries, such as lost wages, funeral costs, or household services.

- Liability Insurance: Liability insurance covers any injuries or property damage you cause when you are at fault in an accident. It does not pay for your own injuries or damage to your property.

- Health Insurance: If you have good health insurance, you may not need PIP. However, keep in mind that health insurance may not cover all the same expenses as PIP, such as lost wages or household services.

- Life Insurance: Adding life insurance can help your family cover unforeseen expenses in the event of a fatal accident.

- Collision Coverage and Comprehensive Car Insurance: If you are concerned about damage to your vehicle, you can add collision coverage and comprehensive car insurance to your policy.

Certified Mail Insurance: What's Covered?

You may want to see also

Frequently asked questions

Personal Injury Protection (PIP) insurance covers medical expenses and lost wages for you and your passengers if you're injured in an accident, regardless of who is at fault. It also covers household services, disability, and funeral costs.

PIP insurance is mandatory in some states and optional in others. If you live in a state where PIP insurance is required, you will need it even if you have health insurance. If you live in a state where it is optional, consider your health insurance coverage and your ability to cover lost wages if you are in an accident and have to miss work.

If you live in a state where PIP insurance is offered, your insurance company must offer it to you. If you don't want it, you must reject it in writing. Check with your insurance company or agent to increase your PIP coverage amount.