Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. When your loan amount is more than your vehicle is worth, gap insurance coverage pays the difference. For example, if you owe $25,000 on your loan and your car is only worth $20,000, gap insurance covers the $5,000 gap, minus your deductible. Gap insurance is not required by any insurer or state, but some leasing companies may require you to purchase it. You can typically buy gap insurance from car insurance companies, banks, and credit unions.

| Characteristics | Values |

|---|---|

| When to get gap insurance | When you owe more on your car loan than the car is worth |

| When to skip gap insurance | When you've made a down payment of at least 20% on the car or you're paying off the car loan in less than five years |

| Who offers gap insurance | Car insurance companies, car dealerships, banks, credit unions |

| Cost of gap insurance | $20-$61 per year on average; $500-$700 from a car dealership |

| How to get gap insurance | Contact your car insurance company or car dealership, or buy it when purchasing a car |

| How to check if you have gap insurance | Check your car insurance policy, the terms of your lease or loan, or your financial documents |

What You'll Learn

Gap insurance is optional

Gap insurance is designed to cover the "gap" between the amount you owe on your car loan or lease and the actual value of the vehicle. This situation can arise when you finance or lease a vehicle without a down payment, as the amount borrowed may be more than the total value of the car. In the event of an accident or theft, standard car insurance will only pay up to the current value of the vehicle, which may be less than the outstanding loan or lease amount.

For example, if you owe $25,000 on your loan and your car is only worth $20,000, gap insurance can cover the $5,000 difference, minus your deductible. This type of insurance is particularly useful if you made a small down payment (less than 20%) and/or have a long payoff period, as you may owe more than the car's current value.

You can usually purchase gap insurance from car insurers or dealers, and it can be added to your existing auto insurance policy. However, it is important to note that gap insurance is not required in all cases. If the amount you owe on your car loan or lease is less than or close to the car's value, you may not need gap insurance. Additionally, gap insurance may not be necessary if you can afford to pay the difference between the amount owed and the car's value in the event of a total loss.

Michigan's Insured Vehicles: How Many?

You may want to see also

It covers the difference between the loan balance and the car's actual value

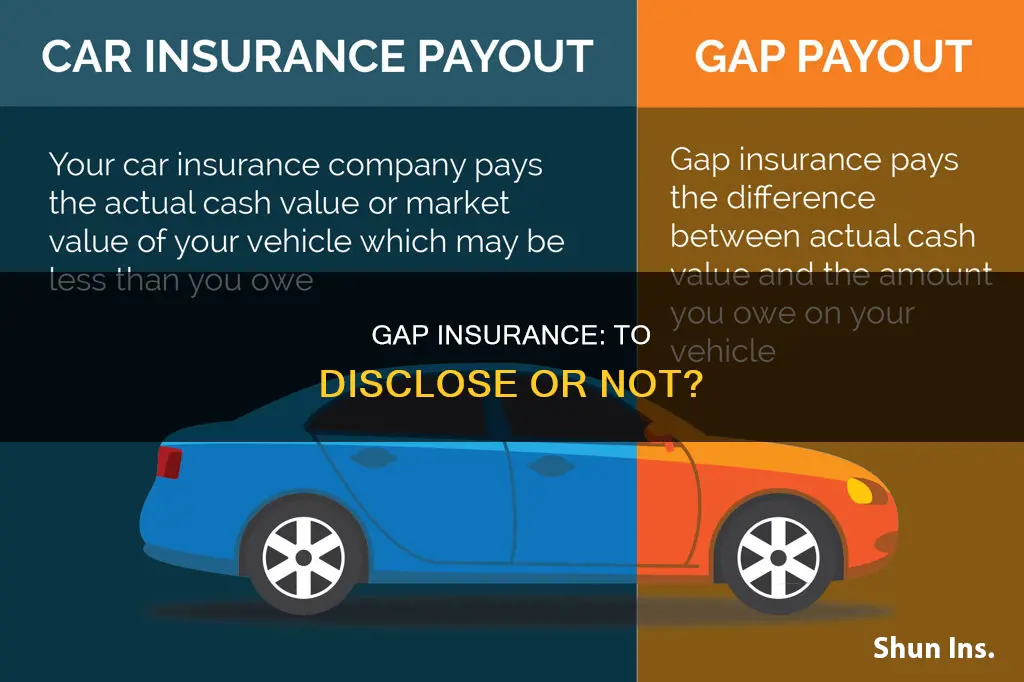

Guaranteed Asset Protection (GAP) insurance is an optional product that covers the difference between the amount you owe on your auto loan and the amount the insurance company pays if your car is stolen or totalled. This is the difference between the depreciated value of the car and the loan amount owed.

Standard auto insurance policies cover the depreciated value of a car, which is the current market value of the vehicle at the time of a claim. This value is usually less than the outstanding loan or lease amount. In the event of an accident, GAP insurance covers the difference between what a vehicle is currently worth (which your standard insurance will pay) and the amount you owe on the loan.

For example, if you total a new car after 12 months, your insurance company will calculate the current value of the vehicle, which is likely to be 20% less than you paid a year ago. If you have GAP insurance, you will be reimbursed enough to cover the outstanding balance on your car loan and may even be left with money to put down on a replacement vehicle.

GAP insurance is intended for people who have put down a small deposit and chosen a long payoff period, as they may owe more than the car's current value. You may be able to skip GAP insurance if you made a down payment of at least 20% on the car when you bought it, or if you’re paying off the car loan in less than five years.

Gap Insurance: Protecting Your Car Loan in NC

You may want to see also

It's available from car insurers and dealers

Gap insurance is available from car insurers and dealers. If you're thinking of buying it from a dealer, it's worth comparing the cost to what traditional insurers may charge. Dealers typically charge more than major insurers, with an average flat rate of $500 to $700 for a gap policy.

Your car dealer may offer to sell you gap insurance on your new vehicle, but most car insurers also offer it and they typically charge less than the dealer. On most auto insurance policies, including gap insurance with collision and comprehensive coverage adds only about $20 a year to the annual premium.

Gap insurance is usually offered as optional coverage by insurers or as an extra add-on by dealers. Some dealers include gap insurance as part of your monthly loan payments. You can find this information in your sale documents. If you financed through a bank or other lender, check the documents from both the dealer and the lender. Either of them might have included gap coverage automatically.

Many dealers will automatically include gap coverage, but you can decline their coverage if you prefer to buy through your insurer or if your loan terms don't require gap coverage.

Vehicle Insurance: Name Fraud

You may want to see also

It's needed even with full coverage

Gap Insurance: Needed Even with Full Coverage

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It is needed even if you have full coverage because full coverage does not cover the difference between what you owe on a loan/lease and the car's actual cash value, which gap insurance does.

When you take out a loan to buy a car, the amount you borrow may be more than the total value of the car. If the car is then involved in an accident or is stolen, standard car insurance will only pay up to the current value of the car, which may be less than the outstanding loan or lease amount. This is where gap insurance comes in.

Gap insurance, or "guaranteed auto protection", reimburses a car owner when the payment for a total loss is less than the outstanding loan or lease balance. It covers the difference between the depreciated value of the car and the loan amount owed if the car is involved in an accident. For example, if you owe $25,000 on your loan and your car is only worth $20,000, your gap coverage will cover the $5,000 gap, minus your deductible.

Gap insurance is particularly useful if you put no money down on the car and choose a long payoff period, as you may owe more than the car's current value. It can also be useful if you lease a car, as it is generally required for a lease.

You can usually buy gap insurance from your auto insurance company or from a dealer, bank, or credit union. However, it is often cheaper to add it to an existing policy than to get a separate policy from a dealer.

Vehicle Insurance: A Necessary Evil?

You may want to see also

It's worth it if you owe more than the car is worth

If you owe more than your car is worth, gap insurance is worth considering. Gap insurance, or "guaranteed auto protection", covers the difference between the depreciated value of a car and the loan amount owed if the car is involved in an accident. This type of insurance is particularly useful if you have not made a down payment and have chosen a long payoff period, as you may owe more than the car's current value.

For example, if you have taken out a loan of $25,200 for a car with a sticker price of $28,000, with a five-year auto loan and a 0% financing deal, your monthly payment is $420. After 12 months, you've paid $5,040 and still owe $20,160. If your car is then involved in an accident and is deemed a total loss, your insurance company will calculate the current value of the vehicle. If your car has depreciated by 20%, its value is now $22,400. Your coverage will reimburse you enough to cover the outstanding balance on your car loan and leave you with $2,240 to put towards a replacement vehicle. However, if your car has depreciated by 30%, your insurance payout will be $19,600, leaving you with a shortfall of $560. In this scenario, gap insurance would be beneficial.

You can calculate the potential value of gap insurance by estimating your car's value using Kelley Blue Book and reviewing your loan terms to see how much you will still owe in payments after each year of ownership. You can then compare this to your car's estimated value and calculate how much you will pay in gap coverage during that time. The difference between your car's value and the amount you will owe in payments is the amount that gap coverage will protect you from having to pay.

Gap insurance is usually inexpensive, costing around $40 to $60 per year if added to a car insurance policy that includes collision and comprehensive insurance. It is worth noting that gap insurance won't pay out if your car is damaged but not deemed a total loss, and the insurance company can decline payments if you haven't paid your insurance premium. Additionally, some gap insurance policies limit the total amount you can receive, so it's important to carefully review the terms and conditions before purchasing.

Vehicle Insurance Carrier: What You Need to Know

You may want to see also

Frequently asked questions

Guaranteed Auto Protection (GAP) insurance covers the difference between the depreciated value of a car and the loan amount owed if the car is involved in an accident.

If you've made a down payment of at least 20% on the car or if you’re paying off the car loan in less than five years, you may not need GAP insurance.

It's best to get GAP insurance when you buy a new car or within 30 days of leasing or financing the vehicle.

GAP insurance costs an average of $61 per year but can be as cheap as $20 per year.

You can typically buy GAP insurance from car insurance companies, banks, credit unions, or car dealerships.