Auto insurance premiums in Texas are determined by a variety of factors, including personal and vehicle-specific considerations. Texans pay an average of $2,426 annually for full coverage and $693 for minimum coverage, with monthly insurance payments averaging $202 and $58, respectively. Teen drivers in the state pay higher rates, with 16-year-olds on their parents' policies incurring an average of $5,250 per year for full coverage. Texans with excellent credit pay around $2,111 per year for full coverage, while those with poor credit pay approximately $5,971.

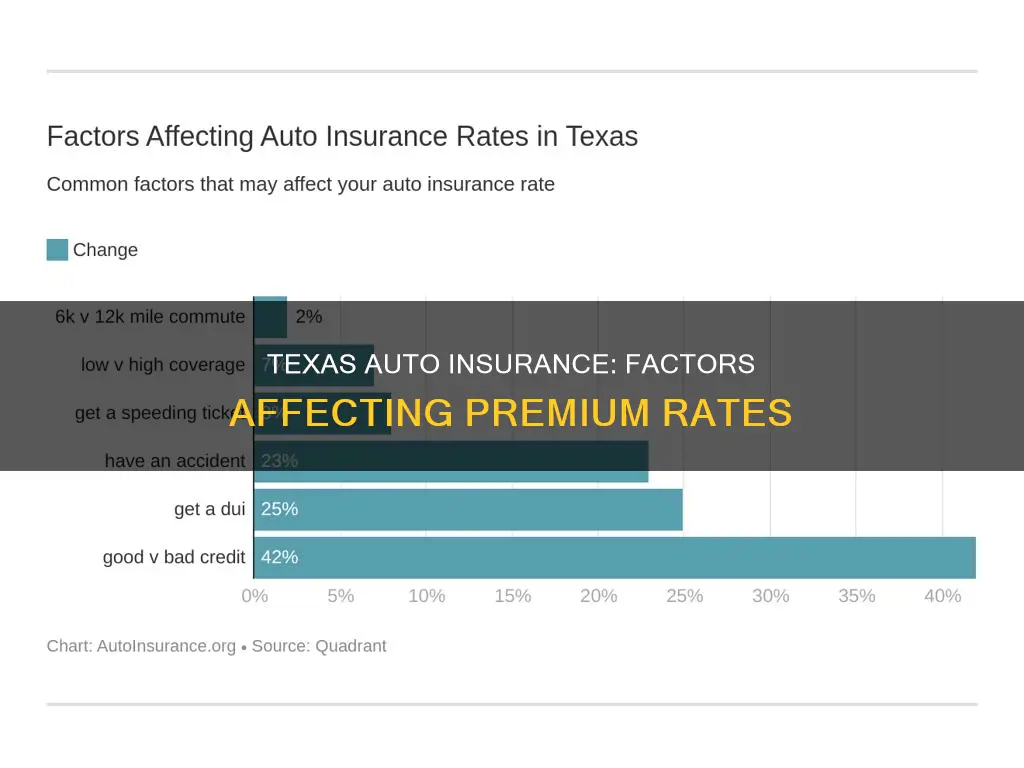

Personal factors influencing auto insurance premiums include age, gender, marital status, credit score, driving record, and claims history. Vehicle-specific factors include the type of car, its age, the cost of replacement, and safety features. Additionally, the likelihood of accidents, theft, and vandalism in a particular area can impact premiums. Texans can lower their premiums by taking advantage of discounts, such as those offered for good driving records, anti-theft devices, and multiple policies with the same company.

| Characteristics | Values |

|---|---|

| Age | Younger drivers are classified as high risk due to inexperience and pay more for car insurance. |

| Driving record | A bad driving record can increase car insurance costs as drivers with violations are considered high risk. |

| Credit score | A poor credit score can increase insurance premiums. |

| Car type | The cost of insurance depends on the value of the car and the cost of repairs. |

| Location | Urban areas have higher accident, theft, and vandalism rates, increasing insurance costs. |

| Traffic density | Higher traffic density increases the risk of accidents, leading to higher insurance premiums. |

| Natural disasters | Texas is prone to natural disasters, which increase the risk of vehicle damage and insurance claims. |

| Highway density | Texas has a higher-than-average highway density, increasing the likelihood of accidents and insurance claims. |

| Speed limits | Texas has higher speed limits, increasing the risk of crashes and insurance costs. |

| Vehicle theft rate | Texas has a higher-than-average vehicle theft rate, impacting insurance premiums. |

What You'll Learn

Age and driving experience

Age is a significant factor in determining auto insurance premiums in Texas. Younger drivers, especially teens, are considered high-risk due to their inexperience behind the wheel, and thus tend to pay more for car insurance. The cost of auto insurance gradually decreases as drivers enter their early 20s and gain more driving experience. By the age of 25, drivers typically notice a significant reduction in their premiums. This downward trend continues throughout adulthood, provided that drivers maintain a clean driving record and safe driving habits. However, as drivers reach their 70s, insurance rates may start to increase again due to factors such as vision or hearing loss and slowed response time.

In Texas, a 16-year-old driver will pay around $3,548 per year for car insurance, while a 30-year-old driver will pay approximately $1,094, and a 40-year-old driver will pay around $1,316 per year. These variations in premiums across different age groups reflect the insurance companies' assessment of risk, with younger and older drivers perceived as having a higher likelihood of being involved in accidents.

It is worth noting that Texas law prohibits insurance companies from using age as the sole factor in determining premiums. Other factors, such as driving record, credit score, and the type of car, also play a significant role in calculating auto insurance rates.

Get Discounts on Your GEICO Auto Insurance: Tips and Tricks

You may want to see also

Driving record

A driver's record is a significant factor in determining auto insurance premiums in Texas. A driving record can indicate the likelihood of a driver engaging in risky behaviour and can therefore influence the cost of insurance.

In Texas, a driver's record is maintained in a "permanent driving record" database, which includes a complete driving history such as accidents, violations, speeding tickets, and other traffic citations. This information is used by insurance companies to assess a driver's risk profile and set insurance rates accordingly.

Insurance companies typically look back at a driver's record over the previous three to five years when calculating premiums. The impact of a driving record on insurance rates can vary depending on the company and the severity of the violations or accidents. For example, a speeding ticket for exceeding the posted limit by 15 miles per hour will likely result in a higher insurance increase than a ticket for going 5 miles over the limit. Similarly, a red-light ticket that results in a collision will lead to a more significant insurance increase than a speeding citation.

Maintaining a clean driving record is crucial for keeping auto insurance premiums low. Drivers with a history of accidents, traffic violations, or DUI/DWIs are considered high-risk and will be subject to higher insurance rates. In Texas, a driver with a DUI will pay an average of $1,987 per year for car insurance, while a driver with a clean record will pay around $1,316 per year.

Additionally, insurance companies may increase rates for up to three years if a driver receives a traffic violation conviction. However, some companies may only apply a surcharge for the first year and remove it if the driver does not receive any subsequent citations.

To protect their driving record and manage insurance costs, drivers in Texas have the option to take a defensive driving course. Completing such a course can result in a discount of up to 10% on auto insurance rates and help keep premiums from increasing significantly after a traffic violation.

Auto Insurance for a 2006 H3 Hummer: How Much?

You may want to see also

Location and type of area

Auto insurance providers consider several location-related factors when calculating premiums. These factors include crime rates, population density, weather, state laws, and road conditions, all of which can affect the possibility of filing a claim.

Crime Rates and Population Density

High-population urban areas tend to have higher car insurance premiums due to increased accident risks and higher rates of car thefts and vandalism. Insurers may designate neighbourhoods with frequent claims as high-risk areas and quote higher premiums to offset potential costs. Texas, for instance, has a higher-than-average vehicle theft rate, impacting insurance premiums.

Weather and Natural Disasters

Harsh weather conditions and natural disasters, such as heavy rain, hail, snow, floods, hurricanes, and tornadoes, can increase the likelihood of accidents and vehicle damage. As a result, insurers may charge higher premiums in areas prone to these events to offset potential payouts. Texas, being prone to natural disasters, may have higher premiums due to the increased risk of vehicle damage.

Road Conditions and Traffic

Poor road conditions, such as potholes and inadequate signage, can increase the risk of accidents, leading to higher insurance premiums. Additionally, traffic congestion in densely populated areas can elevate the chances of accidents, influencing insurers to charge higher rates in these locations. Texas's higher-than-average highway density and long roads contribute to higher premiums.

In summary, location plays a significant role in determining auto insurance premiums in Texas. Insurers consider various factors, including crime rates, population density, weather events, and road conditions, to assess the likelihood of claims being filed. By understanding these factors, Texans can make more informed decisions regarding their auto insurance choices.

Gap Insurance: Refinance or Not?

You may want to see also

Type of car

The type of car you drive can significantly influence your auto insurance premiums in Texas. The make and model of your vehicle impact the cost of claims repair or replacement, which in turn affects your insurance rates. Here are some key points about how the type of car you drive can affect your auto insurance premiums in Texas:

- Collision and comprehensive rates are typically highest for luxury, high-performance, and sports cars. These vehicles tend to be more expensive to repair or replace, resulting in higher insurance premiums.

- The age of your car is also a factor. Older cars tend to be cheaper to insure than newer cars because car value depreciates over time.

- The presence of advanced safety features can increase your insurance rates. While these features reduce the likelihood of accidents, the technology used in these systems is often more expensive to repair or replace than traditional alternatives.

- The cost of your car also plays a role. Vehicles with a high value generally lead to higher insurance premiums since the repair or replacement costs are much higher than average.

- The presence of safety features such as anti-lock brakes and anti-theft devices can help lower your insurance rates. These features reduce the risk of accidents and theft, respectively, which insurance companies consider when calculating premiums.

- If you have a newer car with advanced technology, it may be more expensive to repair or replace certain parts, which can drive up your insurance costs.

- The type of car you drive can also impact your eligibility for certain discounts. For example, having a car with safety features like airbags may make you eligible for lower insurance rates.

Rent-a-Car Coverage: Understanding Your CA Auto Insurance Policy

You may want to see also

Credit score

When evaluating credit history, insurance companies use a credit-based insurance score, which is different from a typical credit score. While the exact calculation methods vary, common factors that contribute to this score include:

- Outstanding debt or amount owed

- Length of credit history

- Credit mix, including different types of credit accounts

- Payment history, including any past due payments

- Pursuit of new credit, including the number of hard inquiries or credit requests

It's important to note that insurance companies are prohibited from using certain factors against consumers when determining rates. For example, medical debts that went to collection, credit checks related to insurance coverage, and credit checks from businesses that the consumer did not request cannot be held against them. Additionally, if a low credit score is due to specific events such as a major illness, injury, or the death of a close family member, insurance companies must disclose this and consumers can request an exception.

While credit scores play a significant role in auto insurance premiums, it is important to remember that it is just one of many factors considered by insurance companies. Other factors include personal information, driving history, vehicle information, and insurance coverage type.

Gap Insurance: Lease Necessity?

You may want to see also

Frequently asked questions

Some factors that affect auto insurance premiums in Texas include:

- Your age, gender, and marital status.

- Your driving record and claims history.

- Where you live and how much you drive.

- The cost to replace the car you drive.

- Your credit score.

The average cost of auto insurance in Texas is $1,316 per year, which is lower than the national average of $1,424. However, rates can vary depending on individual factors such as age, driving record, and location.

Texas law requires drivers to have a minimum of $30,000 of coverage for injuries per person, up to a total of $60,000 per accident, and $25,000 of coverage for property damage. This is known as 30/60/25 coverage.