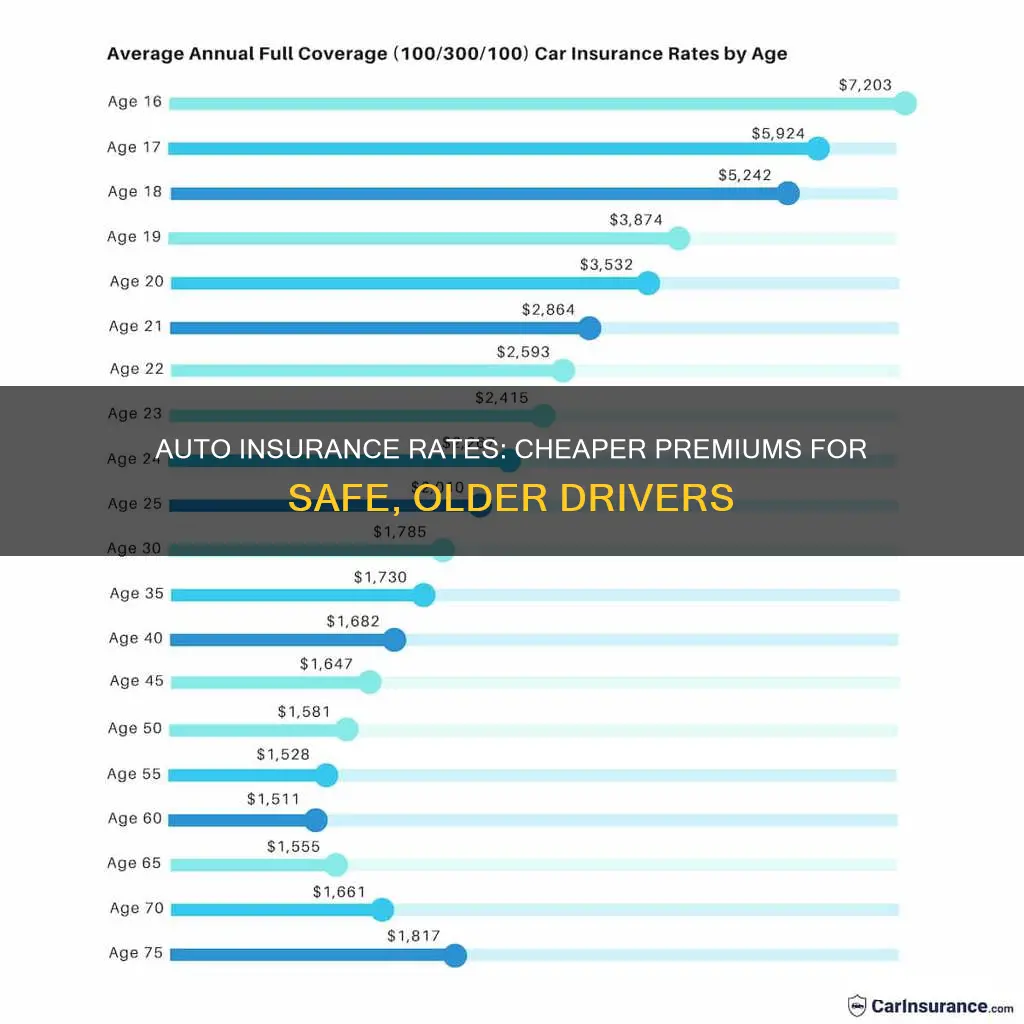

Auto insurance rates are highest for young and inexperienced drivers, who are statistically more likely to get into accidents and exhibit unsafe driving behaviours. As drivers age, insurance rates decrease, with the most significant drops occurring at ages 19 and 21. Rates continue to lower until drivers turn 30, after which they stabilise until drivers reach their senior years, when rates begin to increase again due to factors such as slowed response times and impaired vision and hearing. While age is a significant factor in determining insurance rates, other factors such as driving history, credit score, and location also play a role in the cost of auto insurance.

| Characteristics | Values |

|---|---|

| Age when insurance rates go down | 18-19, 21, 25, 30 |

| Reasons | Inexperience, risk factors, gender, location, driving record, credit score, insurance history |

| Insurance companies with cheaper rates for young drivers | GEICO, American Family, USAA, Nationwide, Progressive |

What You'll Learn

Auto insurance rates decrease the most at ages 19 and 21

Auto insurance rates are primarily determined by the level of risk a driver poses. Young drivers are considered to be high-risk due to their inexperience, increased likelihood of exhibiting unsafe driving behaviours, and higher accident rates. As a result, they pay the most for auto insurance.

As drivers age and gain experience, their risk profile improves, leading to a decrease in insurance rates. The most significant drops in auto insurance rates occur at ages 19 and 21, with a 25% decrease in premiums at age 19 and a 20% decrease at age 21. This decrease in rates continues throughout a driver's twenties and stabilises around age 30 to 34.

The difference in insurance rates between men and women also narrows as they get older. Men, who are generally considered riskier to insure due to higher accident rates and a greater propensity for risky driving, experience a more substantial decrease in rates at age 25, with a 12% drop compared to a 9% drop for women.

While age is a significant factor in determining insurance rates, other factors such as driving history, credit score, and location can also impact a driver's insurance premiums. Maintaining a clean driving record, improving credit scores, and living in a low-crime area can help lower insurance costs.

It is worth noting that insurance rates may vary depending on the insurance company, and it is always a good idea to shop around and compare quotes to find the best rates. Additionally, taking advantage of discounts offered by insurance companies, such as good student discounts, driver training discounts, and telematics programs, can further reduce insurance costs for young drivers.

Auto Insurance Payouts: Understanding the Legalities of Judgment Attachments

You may want to see also

Rates are highest for teens and young adults

Auto insurance rates are highest for teens and young adults, with rates decreasing as drivers age and gain more experience. This is due to the increased statistical likelihood of these drivers being involved in accidents because of their inexperience.

Young drivers are considered high-risk by insurance companies due to their lack of experience behind the wheel, making them more expensive to insure. This is reflected in the data, which shows that the cost of auto insurance is highest for teenagers, especially those aged 16 and 17. The risk associated with young drivers is further supported by statistics, which indicate that drivers aged 16 to 19 are involved in almost three times as many fatal car accidents per mile driven as any other age group.

As drivers age and gain experience, insurance rates gradually decrease. The cost of auto insurance coverage typically begins to drop by the time a driver reaches their early 20s and can see a significant reduction in premiums by age 25. This reduction in rates can be attributed to the decreased risk of insuring more experienced drivers, as they are less likely to be involved in accidents.

The difference in insurance rates between males and females also narrows as drivers age. Younger male drivers tend to have higher insurance rates due to a greater propensity for risky driving behaviour. However, as drivers age, the difference in rates between genders decreases, with males and females paying roughly the same rates by their mid-to-late 20s.

While auto insurance rates generally follow this downward trend as drivers gain experience, other factors can also influence insurance rates. These factors include driving history, credit score, and location, among others. Additionally, insurance rates may increase again for senior drivers due to factors such as vision or hearing loss and slowed response time.

DVLA: How to Check Your Car Insurance Status

You may want to see also

Men pay more than women, especially at younger ages

Men are generally considered riskier to insure than women, especially at younger ages. This is because, statistically, more male drivers under the age of 25 are involved in car accidents than female drivers. Men in this age range are also more likely to drink and drive, and those who do are more likely to be involved in fatal crashes. As a result, younger men can expect to pay around 10% more for auto insurance than their female counterparts.

For example, the average car insurance cost for a 21-year-old male is $240 per month, while female drivers pay $216 per month. Similarly, 20-year-old males pay around $300 per month for full coverage, while females of the same age pay approximately $265 per month. The discrepancy in rates between genders narrows as drivers age, with males and females paying roughly the same rates by the time they reach their 30s.

In addition to age and gender, other factors that can influence auto insurance rates include driving history, credit score, vehicle type, and location. It's worth noting that some states in the US, such as California, Hawaii, and Massachusetts, prohibit the use of gender as a factor in determining insurance rates.

Collectibles: Cheaper Insurance?

You may want to see also

Insurance rates increase again for seniors

Insurance rates for seniors increase due to several factors, and it is important to understand these factors to make informed decisions regarding auto insurance. Here are some key points to consider:

Increased Risk of Accidents: As drivers age, there is a higher risk of being involved in car accidents. The Centers for Disease Control and Prevention (CDC) finds that the likelihood of being injured or killed in a traffic accident increases with age. This is often due to age-related factors such as declining vision, cognitive abilities, and physical fitness, as well as the side effects of medications. As a result, insurance companies view seniors as a higher-risk group, leading to increased rates.

Higher Claims and Medical Expenses: Older drivers are more susceptible to severe injuries in the event of a car accident. This results in costly medical expenses and insurance claims, which, in turn, contribute to higher insurance rates for seniors. The Insurance Institute for Highway Safety reports a notable increase in fatal crashes among drivers aged 70 to 74, with the highest rates in drivers aged 85 and older.

State Laws and Company Guidelines: The increase in insurance rates for seniors can also depend on state laws and insurance company guidelines. In some states, such as California, Hawaii, and Massachusetts, age is not a factor in determining insurance rates due to legal restrictions. However, in other states, insurance companies may raise rates for drivers as they reach a certain age, typically around 65 or 70.

Frequency of Accidents: Insurance companies base their rates on statistical data, and seniors as a demographic group tend to have a higher frequency of accidents. This is often due to the factors mentioned above, such as age-related changes and increased susceptibility to injuries. As a result, insurance companies may view seniors as a higher-risk group, leading to increased rates.

Underwriting Guidelines: Insurance companies use underwriting guidelines to assess risk and set rates accordingly. These guidelines consider various factors, including age, driving record, and health status. As seniors may have a higher risk profile, insurance companies may adjust their rates to account for potential claims and expenses.

While insurance rates may increase for seniors, it is important to note that there are ways to mitigate these increases. Shopping around for insurance providers, taking advantage of senior discounts, maintaining a safe driving record, and considering pay-per-mile insurance programs can all help reduce the financial burden of higher insurance rates. Additionally, comparing rates from different insurers and taking advantage of discounts specifically for seniors can help seniors find more affordable coverage options.

Auto Insurance and Employment Perks: Unlocking Discounts and Benefits

You may want to see also

The cheapest auto insurance companies for young drivers

Young drivers are considered a high risk to insure due to their lack of driving experience and a higher likelihood of reckless driving and accidents. As a result, they often face some of the highest car insurance rates. However, there are still ways to find cheaper insurance as a young driver.

Staying on a Parent's or Guardian's Policy

The best way to get the cheapest car insurance for young drivers is often to add them to a parent's or guardian's policy. Young drivers are seen as risky to insure, and policies can cost thousands of dollars a year. It is usually much cheaper to add a young driver to a parent's or guardian's auto insurance policy than it is for them to purchase a separate one.

Comparing Quotes from Multiple Companies

Another way to save money on car insurance as a young driver is to shop around and get quotes from multiple companies. Carriers use proprietary rating algorithms, so you may see significantly lower rates with one carrier compared to another. Most insurance experts recommend comparing at least three quotes to see where you could get the cheapest car insurance.

Taking Advantage of Discounts

Many car insurance companies offer discounts that can help lower the cost of insurance for young drivers. These include:

- Good student discounts: Young drivers who are still in college and maintain high grades may be able to qualify for this discount.

- Safe driving course discounts: By completing an approved safe driving course, young drivers may be able to apply this discount to their car insurance policy.

- Affiliation discounts: Young adults who are in the military, part of a certain profession, or members of a particular organisation or alumni group may be able to get a special discount.

- Loyalty discounts: Certain insurance carriers offer discounted rates to young adult drivers who start their own policy after being insured on a parent's policy.

Other Ways to Save

There are also other ways to save on car insurance as a young driver:

- Evaluate your annual mileage: If you don't drive much, consider whether you need low mileage car insurance.

- Use a telematics program: Telematics programs track real-time driving behaviour and can lead to car insurance discounts.

- Avoid tickets and accidents: Car insurance companies typically raise rates after speeding tickets and accidents, so maintaining a clean driving record may help you save on your premium.

- Build your credit: In most states, insurance companies charge higher rates for customers with fair to poor credit scores. Building credit quickly can help you find more affordable rates.

The Cheapest Companies for Young Drivers

According to various sources, the cheapest companies for young drivers include:

- GEICO

- USAA

- State Farm

- Progressive

- Travelers

- Nationwide

- Auto-Owners

- American Family

Insurance Company: Hail Damage Auto Repair Rip-Off?

You may want to see also

Frequently asked questions

Auto insurance rates start to go down when drivers reach their early 20s. The most significant drops happen at ages 19 and 21, and rates continue to decline throughout a person's twenties.

Younger drivers are generally more likely to have accidents or take risks on the road due to their inexperience. Older, more experienced drivers are less likely to have accidents and are therefore cheaper to insure.

Yes, men tend to pay more than women for car insurance, especially at younger ages. This is because men are statistically more likely to engage in risky driving behaviour and be involved in fatal accidents.

Several factors can influence auto insurance rates, including driving experience, driving history (e.g. accidents or speeding tickets), credit score, marital status, education level, and location.