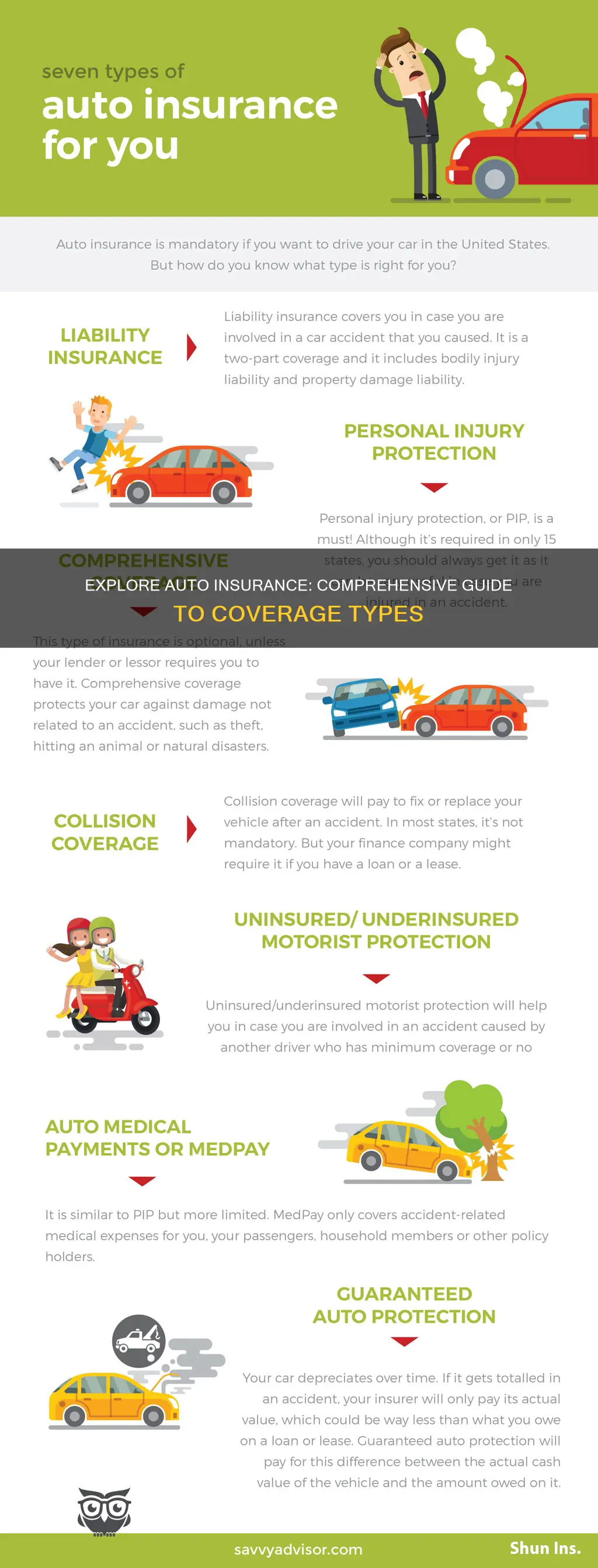

Auto insurance is a contract between the policyholder and the insurance company. The policyholder agrees to pay the premium and the insurance company agrees to pay for losses as defined in the policy. There are several types of auto insurance, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, medical payments coverage, and personal injury protection. Some of these coverages are mandatory in certain states, while others are optional. Liability coverage is required in most US states and covers the legal and financial responsibility for damage or injuries caused in an accident. Collision coverage pays for repairs to the policyholder's car after an accident, regardless of fault. Comprehensive coverage reimburses for loss, theft, or damage to the policyholder's vehicle caused by something other than a collision. Uninsured/underinsured motorist coverage protects against medical bills and vehicle repairs if the policyholder is in an accident with a driver who has insufficient or no insurance. Medical payments coverage helps pay for the policyholder's medical expenses after an accident, and personal injury protection covers medical expenses and lost wages resulting from an accident.

What You'll Learn

Liability Coverage

The amount of liability coverage required varies by state. For example, in California, the minimum liability insurance requirements are $15,000 for injury/death to one person, $30,000 for injury/death to more than one person, and $5,000 for damage to property. Most states have similar requirements, with coverage amounts ranging from $25,000 to $100,000 per person for bodily injury and $10,000 to $50,000 per accident for property damage.

Auto Insurance Agents: Worth the Hassle?

You may want to see also

Collision Coverage

If you own your vehicle outright and choose not to carry collision coverage, you will have to pay to repair or replace your vehicle out of pocket if you're involved in a single-vehicle accident or are found at-fault in an accident. If the other driver is found at-fault, their liability coverage will typically pay for the damage.

When deciding on the amount of your deductible, consider the cost of your car and its potential corresponding repairs, as well as your willingness to pay for repairs under the amount of the deductible. A higher collision deductible means lower monthly premiums, but you will cover more of the repair costs when they arise.

Insuring Teen Drivers: What You Need to Know

You may want to see also

Comprehensive Coverage

When purchasing comprehensive coverage, you will need to select a deductible, which is the amount you agree to pay before the insurance company starts paying for damages. A higher deductible typically results in lower insurance costs. Additionally, the maximum payout is based on the actual cash value of your vehicle.

Vehicle Insurance Status: Check and Verify

You may want to see also

Uninsured Motorist Coverage

In the unfortunate event of a hit-and-run accident, uninsured motorist coverage can be a valuable safeguard. You can file a claim against your uninsured motorist coverage, although it is important to note that in some states, UMPD will not cover hit-and-run incidents, and collision coverage may be necessary to cover vehicle damage.

When considering uninsured motorist coverage, it is worth noting that it may overlap with other types of insurance, such as health insurance. Therefore, it is essential to carefully review your existing coverage and understand the specifics of uninsured motorist protection to make an informed decision about its necessity.

Auto Insurance: Arizona's Requirements

You may want to see also

Medical Payments Coverage

MedPay covers the medical expenses of the policyholder and their passengers after a car accident, regardless of who is at fault. It can also cover the medical expenses of the policyholder's family members and other policyholders if they are injured in a car accident, even if they are not in the policyholder's car. This includes situations where the policyholder or their family members are pedestrians or cyclists. MedPay can also cover the medical expenses of non-relatives who are passengers in the policyholder's car.

MedPay covers a range of medical expenses, including hospital visits, nursing services, ambulance and EMT fees, surgery, X-rays, and dental procedures. It can also cover health insurance deductibles and co-pays. In the event of a fatal crash, MedPay can cover funeral costs.

The coverage limits for MedPay typically range from $1,000 to $10,000, and the policyholder can usually choose their coverage limit. It is generally recommended that policyholders carry MedPay coverage equal to their health insurance deductible so that MedPay can cover their out-of-pocket medical expenses. Policyholders with high health insurance deductibles or no health insurance coverage may want to consider higher MedPay limits.

MedPay is different from PIP, which is more extensive and can cover wage reimbursement and childcare costs in addition to medical expenses. PIP is also required in some states. MedPay, on the other hand, is usually an optional coverage and does not involve a deductible.

Insurance Coverage for 18-Wheeler Accidents: What You Need to Know

You may want to see also

Frequently asked questions

Liability coverage is required in most US states as a legal requirement to drive a car. It covers damages for injuries and property damage to others that you become legally responsible for as a result of a covered accident.

Collision insurance covers damage to your car after an accident, regardless of who is at fault. It also covers damage to your car from hitting a pothole or an object like a tree.

Comprehensive insurance covers damage to your car resulting from incidents other than collisions, such as vandalism, certain weather events, and accidents with animals.

Uninsured motorist insurance protects you and your car against uninsured drivers and hit-and-run accidents. This coverage is often paired with underinsured motorist insurance.

Personal injury protection insurance covers medical expenses and loss of income resulting from a covered accident. It may also cover funeral costs and rehabilitation expenses.