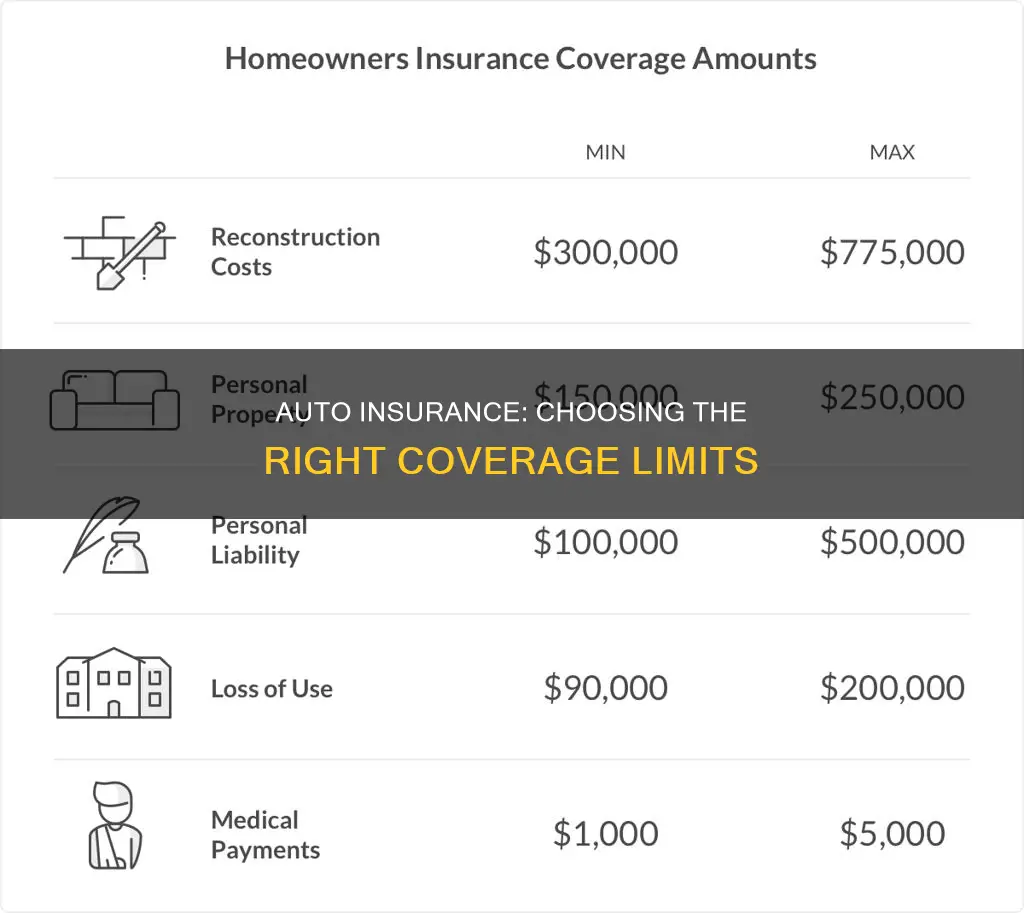

Auto insurance coverage limits refer to the maximum amount your insurance company will pay out after an accident. The minimum amount of car insurance you’ll typically need is state-required liability coverage, which covers damage and injuries you cause to others in an accident. However, individual state requirements vary widely, and your state may mandate higher or lower limits than the most common minimum limits of $25,000 per person and $50,000 per accident for bodily injury and $25,000 for property damage.

While state-minimum insurance is a legal requirement, it may not be enough to cover all the costs of an accident. Therefore, it is recommended that drivers carry the highest amount of liability coverage they can afford, with $100,000 per person, $300,000 per accident in bodily injury liability, and $100,000 per accident in property damage liability being considered the best coverage level for most drivers.

| Characteristics | Values |

|---|---|

| Minimum liability insurance | $500,000 |

| Bodily injury liability per person | $25,000 |

| Bodily injury liability per accident | $50,000 |

| Property damage liability per accident | $25,000 |

| Comprehensive coverage | Theft, fire, storm, natural disaster, animal collision |

| Collision coverage | Collision with another vehicle or object |

| Medical payments coverage (MedPay) | $1,000-$10,000 per person |

| Personal injury protection (PIP) | $10,000 |

| Uninsured motorist coverage (UM) | Varies by state |

| Underinsured motorist coverage (UIM) | Varies by state |

What You'll Learn

State-by-state requirements

The best auto insurance coverage limits depend on the state in which you live. Each state has different minimum requirements for auto insurance coverage, so it is important to review the specific requirements for your state. Here is an overview of the state-by-state requirements for auto insurance coverage in the United States:

Alabama

Alabama has minimum auto insurance requirements that include bodily injury liability coverage of $25,000 per person and $50,000 per accident, as well as property damage liability coverage of $25,000. Alabama does not require personal injury protection (PIP) or uninsured/underinsured motorist coverage.

Alaska

Alaska also has similar minimum requirements to Alabama, with bodily injury liability coverage of $25,000 per person and $50,000 per accident, and property damage liability coverage of $25,000. PIP and uninsured/underinsured motorist coverage are not mandatory in Alaska.

Arizona

In Arizona, the minimum auto insurance requirements include bodily injury liability coverage of $25,000 per person and $50,000 per accident, as well as property damage liability coverage of $15,000. Arizona does not require PIP coverage, but it does mandate uninsured/underinsured motorist coverage.

Arkansas

Arkansas has the same minimum requirements as Alabama and Alaska, with bodily injury liability coverage of $25,000 per person and $50,000 per accident, and property damage liability coverage of $25,000. PIP coverage is not mandatory, but uninsured/underinsured motorist coverage is required in Arkansas.

California

California has slightly different minimum requirements, with bodily injury liability coverage of $15,000 per person and $30,000 per accident, while property damage liability coverage is set at $5,000. California does not require PIP coverage, but it does mandate uninsured/underinsured motorist coverage.

Colorado

Colorado's minimum auto insurance requirements include bodily injury liability coverage of $25,000 per person and $50,000 per accident, as well as property damage liability coverage of $15,000. Colorado does not require PIP coverage, but it does mandate uninsured/underinsured motorist coverage.

The requirements vary across different states, and it is essential to review the specific mandates for your state. It is also important to note that collision and comprehensive coverage are optional in all states but highly recommended for added protection.

Auto Insurance: A Guide to Buying

You may want to see also

Liability insurance

When purchasing liability insurance, you will typically see coverage limits presented as three numbers, such as 25/50/25 or 100/300/100. The first number represents the maximum amount your insurance will pay for bodily injury claims per person, the second number is the maximum for bodily injury claims per accident, and the third number is the limit for property damage claims per accident.

While state minimum coverage limits may be sufficient to meet legal requirements, they might not provide adequate protection in the event of a serious accident. It is generally recommended to get liability coverage of at least $500,000, with higher limits being preferable if you can afford them. This will help ensure that you have enough coverage to pay for medical bills, vehicle repairs, and other expenses resulting from an accident.

Pemco Claim Auto Insurance: Understanding the Process

You may want to see also

Full coverage

"Full coverage" is a somewhat misleading term used by lenders to refer to a combination of comprehensive and collision insurance, plus any other coverages mandated by the state. While there is no consensus on what constitutes "full coverage", it typically includes liability, uninsured/underinsured motorist, and personal injury protection, in addition to comprehensive and collision.

Liability insurance is mandated in almost every state and covers bodily injury and property damage. It is important to note that state minimums for liability insurance may not be sufficient in the event of a serious accident, and it is recommended to purchase higher limits if possible. For example, a policy with coverage limits of $100,000 per person, $300,000 per accident in bodily injury liability, and $100,000 per accident in property damage liability is considered a good level of protection.

Comprehensive insurance covers damage to your vehicle from events outside your control, such as theft, vandalism, fire, collisions with animals, and weather damage. While it is not required by any state, comprehensive insurance is typically required by lenders if you are leasing or financing your vehicle. Even if you own your car outright, comprehensive insurance can provide valuable protection if your car is worth more than a few thousand dollars or if you cannot afford repairs or a new vehicle in the event of damage.

Collision insurance covers repairs to your vehicle if it is damaged in a collision with another vehicle or object, regardless of fault. Like comprehensive insurance, collision coverage is typically required by lenders for leased or financed vehicles. Collision insurance can provide peace of mind and financial protection if your vehicle is new or expensive, or if you cannot afford repairs or a replacement vehicle.

In addition to the core coverages mentioned above, there are several optional coverages that can further enhance your "full coverage" policy. These include roadside assistance, rental car reimbursement, accident forgiveness, and gap insurance, among others.

When determining the appropriate level of "full coverage" for your needs, it is essential to consider factors such as the value of your vehicle, your budget, and your personal preferences. While "full coverage" can provide comprehensive protection, it is important to remember that no single policy can offer 100% coverage in all situations.

Gap Insurance: Refinancing Transfer

You may want to see also

Comprehensive insurance

When deciding on the level of comprehensive coverage, it's important to choose a deductible that you can afford. The deductible is the amount you'll need to pay out of pocket before your insurance company covers the rest. A higher deductible can lower your premiums, but it also means you'll pay more if you need to file a claim. For example, if you have a $1,000 deductible and your car sustains $5,000 worth of damage, you'll need to pay the first $1,000, and your insurance will cover the remaining $4,000.

When deciding on the limits and deductibles for your comprehensive insurance, it's essential to consider your vehicle's value, your budget, and your tolerance for risk. If your car is worth a significant amount, you'll want to ensure your coverage limits are high enough to cover the cost of repairs or replacement. Your budget will also play a role in determining how much coverage you can afford and how high of a deductible you're comfortable with.

In conclusion, comprehensive insurance is a valuable addition to your auto insurance policy. It offers protection against a wide range of risks and can provide financial peace of mind. By choosing appropriate coverage limits and deductibles, you can ensure that you're prepared for unexpected events without breaking the bank. Remember to review your policy regularly and make adjustments as needed to ensure you have the best coverage for your situation.

Mastercard Auto Insurance: What You Need to Know

You may want to see also

Collision insurance

Collision coverage is particularly suitable for vehicle owners who lease or finance their vehicles, have newer or more expensive cars, or older vehicles that still maintain good value relative to the deductible and monthly rate. When deciding on the amount of deductible, it is essential to consider the cost of the car and its potential repair costs, as well as your willingness to pay for repairs under the deductible amount. A higher collision deductible can lower your monthly premium but may put you at risk in times of need.

In addition to collision insurance, comprehensive insurance is another type of coverage that protects against events outside of the driver's control, such as theft, vandalism, or natural disasters. While collision insurance covers events within the motorist's control, comprehensive insurance typically falls under "acts of God or nature." It is important to note that collision insurance does not cover damage due to theft or vandalism and does not cover damage paid from another driver's policy if they were at fault.

The main difference between collision and comprehensive coverage lies in what is within and outside the driver's control. Collision insurance will cover events within a motorist's control or when another vehicle collides with the insured car. On the other hand, comprehensive insurance covers events typically outside the driver's control, such as a spooked deer, a heavy hailstorm, or a carjacking.

When considering the best auto insurance coverage limits, it is recommended to have enough liability coverage to protect your assets in case of an accident. This includes having a higher total bodily injury limit than your net worth to ensure that your insurance can cover medical bills resulting from an accident. Additionally, your property damage liability limit should also be sufficient to cover any potential losses.

Calculating Auto Insurance: A Quick Guide to the 10% Rule

You may want to see also

Frequently asked questions

The best auto insurance coverage limits are those that meet your state's legal requirements and offer you sufficient protection. The recommended coverage limits for liability insurance are $100,000 per person for bodily injury, $300,000 per accident for bodily injury, and $100,000 for property damage.

When choosing your auto insurance coverage limits, consider your state's minimum requirements, the value of your car, your budget, and your personal preferences. You should also think about the level of risk you are comfortable with and whether you want additional coverages beyond the state minimum.

If you don't purchase the minimum required auto insurance coverage, you may face legal consequences, including fines, suspension of your driver's license, and even jail time in some states. You may also be held financially liable for any damages or injuries you cause in an accident.