Progressive Insurance is a reliable provider of auto, home, and life insurance, with a wide range of coverage options. It is the second-largest insurance company in the US and is available in all 50 states. Progressive offers a good number of add-ons with its various types of coverage, and its Snapshot® program can help drivers save on auto insurance.

Progressive's average rate for car insurance is lower than the national average, and it has the lowest rates for drivers with a DUI on their record. It also offers the fourth-lowest rates for drivers with poor credit. However, it has the third-highest rates for teen drivers.

Progressive's average full-coverage cost of $2,326 per year is about 13% cheaper than the national average of $2,681 annually. The company offers a wide range of discounts for different types of drivers, including accident forgiveness and small accident forgiveness.

Progressive also offers homeowners insurance, renters insurance, life insurance, motorcycle insurance, boat insurance, RV insurance, ATV insurance, classic car insurance, event insurance, phone insurance, travel insurance, health insurance, flood insurance, business insurance, umbrella insurance, and pet insurance.

What You'll Learn

Progressive's average rate for car insurance

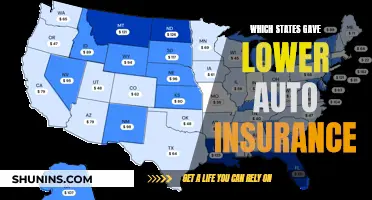

The average cost of car insurance from Progressive ranges from $79.83 to $157.27 per month for a liability-only policy. The cost varies across states, with low-cost states having an average of $79.83 per month, medium-cost states at $105.36, and high-cost states at $157.27 per month. Progressive also offers discounts for customers who pay their six-month policy upfront.

Progressive's average rate for a good driver is $1,826 per year, which is slightly lower than the national average of $2,026 per year. Progressive also offers lower rates for drivers with a DUI, with rates that are 31% cheaper than the national average.

Progressive's rates for teen drivers are more than 30% higher than the national average. However, their rates for young adult and adult drivers are slightly lower than the national average. Progressive also offers various discounts, such as multi-policy, multi-car, teen driver, and good student discounts, which can help lower the overall cost of car insurance.

Overall, Progressive's car insurance rates are competitive, especially for high-risk drivers, but they may not always be the cheapest option for those with clean driving records.

Auto Insurance and Parking Tickets: What's the Deal?

You may want to see also

Progressive's sample rates for teen drivers

Progressive's teenage car insurance is ideal for people who want to save on insurance premiums for young drivers. Standard car insurance policies for teenagers can be expensive because, as inexperienced drivers, they are more likely to be involved in accidents. Therefore, it is recommended to include your teenage driver on your current insurance policy rather than getting a new insurance policy for them.

Progressive offers a teen driver discount for drivers who are 18 years old or younger and have been insured with Progressive for at least 12 months. The discount applies after one year with Progressive.

The average cost of teen car insurance will vary based on the exact age of the driver, their ZIP code, driving history, and vehicle type. A separate car insurance policy for a 16-year-old driver who has just received their license will likely be more expensive than a policy for an 18-year-old with more driving experience. As teens get older, their rates can go down due to added driving experience, especially if they have a clean driving record. At Progressive, rates drop by an average of 9% when a driver turns 19 and another 6% at 21.

Progressive offers a variety of discounts for teens, including:

- Good student discount: A full-time student on the policy who maintains a "B" average or better may earn a 10% discount in most states.

- Multi-car discount: If your teenager has their own vehicle, Progressive will add another discount for having more than one vehicle on the policy.

- Teen driver discount: If the child driver is 18 years old or younger and has been consistently insured for at least 12 months, a discount will be added.

- Snapshot®: The Snapshot® program rewards good drivers based on how they drive. The mobile app can reveal if your teen was driving distracted.

Loss Runs: Adding a Vehicle to Insurance

You may want to see also

Progressive's rates for young adult drivers

Progressive's rates drop by an average of 9% when a driver turns 19 and another 6% at 21. As a driver becomes more experienced and avoids tickets and accidents, the price of their insurance should continue to decrease. Progressive offers a Teen Driver Discount and a Good Student Discount to help offset the costs of insuring a teen driver.

Progressive's average rate for a good driver is $1,826 per year, which is lower than the average cost of car insurance nationwide ($2,026 a year). Progressive's rates for an 18-year-old driver are 30% higher than the national average, but its rates are cheaper than the national average for all other ages analysed.

Rideshare Drivers: Auto Insurance Deductions

You may want to see also

Progressive's rates for adult drivers

Progressive's average cost of full coverage is $1,742 per year, compared to the national annual average of $1,718. Progressive's rates for adult drivers are defined as married 35-year-olds. Progressive's rates for adult drivers are lower than the national average for married 60-year-old drivers.

Progressive offers lower rates than the national average for adult drivers, defined as married 35-year-olds. Progressive's rates for adult drivers are lower than the national average for married 60-year-old drivers as well. Progressive's average rate for car insurance is also lower than the national average rate.

Auto Insurance Dividends: Taxable?

You may want to see also

Progressive's rates for senior drivers

Progressive Insurance offers a range of auto insurance policies for senior drivers, with rates depending on various factors. According to Progressive's data, car insurance for seniors typically only starts to increase at age 75, with drivers in their 50s and 60s often paying less for insurance than at any other time in their lives.

Progressive's Mature Driver Discount is a rate reduction offered to mature or older drivers who demonstrate safe driving behaviours. Eligible drivers can enjoy a reduction in their auto insurance premiums, incentivising them to maintain safe driving habits. The exact age requirement for this discount varies by state but is typically around 50 years old. To qualify, drivers must have a clean driving record with no recent at-fault accidents or major traffic violations. In some states, drivers may also be required to complete a mature driver improvement course.

Progressive offers a wide range of discounts to help lower car insurance rates, including continuous insurance, safe driver, good student, distant student, multi-policy, online quote, paperless, and pay-in-full discounts.

In addition to its standard insurance policies, Progressive provides several optional coverage types, including accident forgiveness, custom parts and equipment coverage, diminishing deductible, gap insurance, rental reimbursement, rideshare insurance, pet injury coverage, and roadside assistance insurance.

GEICO Auto Gap Insurance: Filling the Coverage Gap

You may want to see also

Frequently asked questions

Progressive's sample rates for teen drivers are more than 30% higher than the national average. Compared to the company with the cheapest rates for teens, Erie, Progressive's sample premiums are more than twice as high.

Progressive has lower rates than the national average for adult drivers, defined as married 35-year-olds. That being said, Progressive's sample rates are still approximately $500 more per year than the company with the cheapest rates in this category for both female and male motorists.

Progressive is rated No. 6 in the best car insurance companies for seniors subcategory. Its rates for female and male senior drivers are lower than the national averages.

Progressive's average rate for car insurance comes in lower than the national average rate.