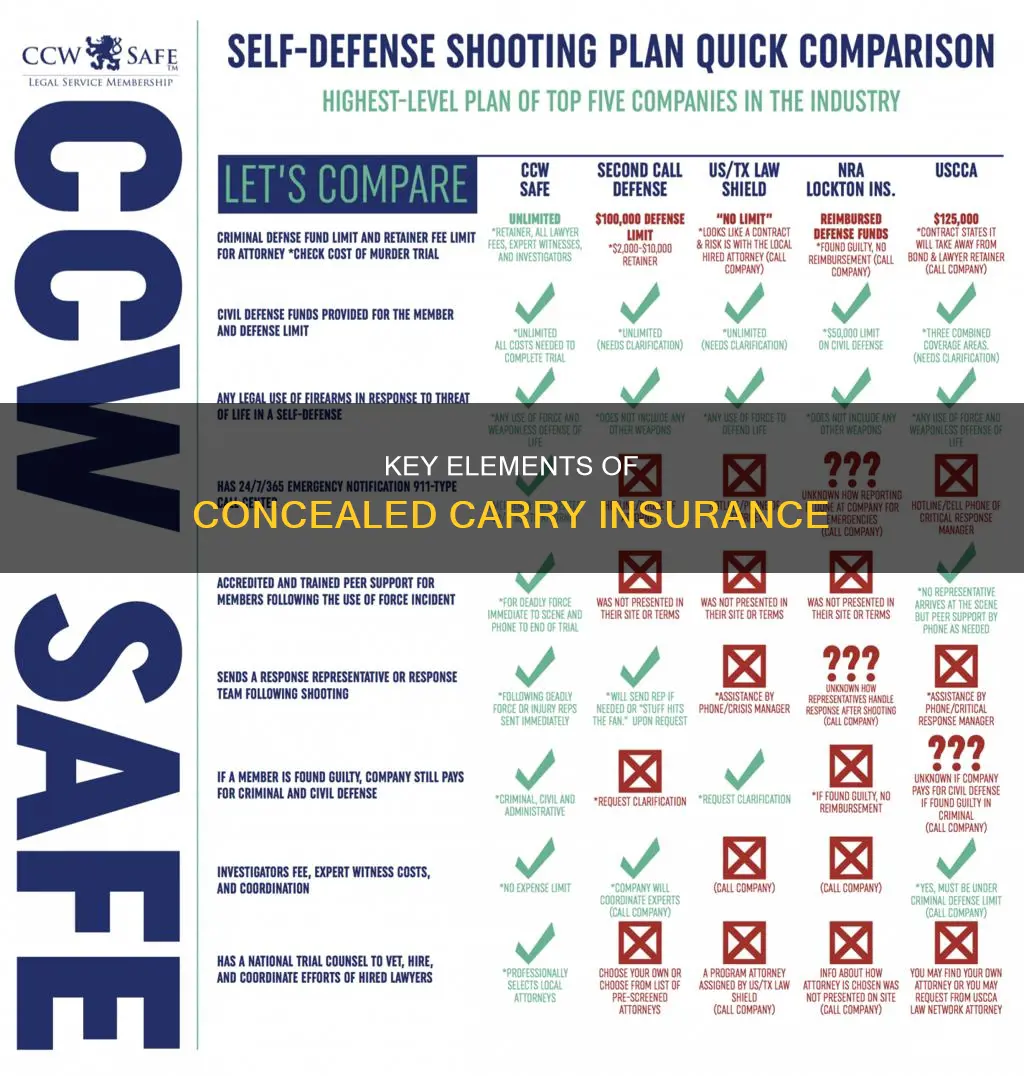

Concealed carry insurance is a type of liability insurance that provides legal protection if you use a firearm or other weapon in self-defence. It's important to note that concealed carry insurance is for self-defence purposes only and should not be used in cases of violent assault or other crimes.

When choosing a concealed carry insurance plan, it's essential to consider the following:

- Criminal defence assistance

- Civil defence assistance

- Upfront or deferred compensation

- Exclusions and disqualifications

- Deductibles or caps on coverage

- Customer service availability

- The option to choose your lawyer versus drawing from a pool

- Coast-to-coast coverage

Additionally, here are three crucial things to look for in CCW insurance:

1. The ability to pick your attorney: You should have the right to choose the best attorney for your defence.

2. Money upfront: Getting your legal coverage money upfront is crucial, as covering hundreds of thousands of dollars in legal expenses while awaiting reimbursement can be challenging for most people.

3. Daily allowance/per diem: In addition to legal expenses, you may need financial support to cover your daily expenses if you cannot work during the trial.

| Characteristics | Values |

|---|---|

| Ability to choose your own attorney | Yes/No |

| Money upfront | Yes/No |

| Daily allowance/per diem | Yes/No |

| Criminal defense coverage limit | $100,000/Unlimited |

| Civil defense coverage limit | $1,250,000/Unlimited |

| Civil damages coverage limit | $0/$2,000,000 |

| Bail coverage | Yes/No |

What You'll Learn

Civil and criminal liability insurance

In the context of concealed carry insurance, civil liability refers to the legal responsibility to pay damages to a third party who has suffered injury or loss as a result of the policyholder's actions. This can include monetary compensation for medical expenses, property damage, pain and suffering, and other economic or non-economic losses. Civil liability cases are typically brought by private individuals against another private individual, rather than by the government. The burden of proof in civil cases is lower than in criminal cases, often requiring only a "preponderance of the evidence" to establish liability.

On the other hand, criminal liability refers to violations of criminal law, which can result in penalties such as incarceration, fines, or other terms imposed by the state. While concealed carry insurance cannot protect against incarceration or other criminal penalties, it can provide crucial financial support for legal defence in criminal cases. This includes coverage for attorney fees, expert witnesses, private investigators, and bail bond premiums, among other expenses.

When considering civil and criminal liability insurance, it is essential to review the specific terms and conditions of different insurance providers. Some companies offer unlimited coverage for criminal and civil defence expenses, while others have monetary caps or exclusions that may impact the extent of protection. Additionally, it is important to understand the reimbursement policies of the insurance provider, as some companies may require the policyholder to cover expenses upfront and seek reimbursement later.

Overall, civil and criminal liability insurance is a critical component of concealed carry insurance, offering financial peace of mind and ensuring that individuals can mount an effective legal defence in the event of a self-defence incident. By understanding the scope and limitations of their insurance coverage, individuals can make informed decisions about their level of protection and choose a plan that best suits their needs.

LA Skyscrapers: Earthquake Insurance Essential?

You may want to see also

Choosing your own attorney

You Don't Want Just Any Attorney

You don't want just any attorney defending you in a criminal defense case. You want an attorney that you have confidence in and one that you never have to wonder if they are doing what is best for you vs what is cheapest for the insurance company.

You Want to Be Able to Fire Your Attorney

You want the right to fire your attorney if they aren't competent or if you don't agree on your defense.

You Want to Choose an Attorney You Can Trust

When choosing your own attorney, you can select one that you trust and feel is good for you.

You Want an Attorney with Experience

When choosing your own attorney, you can select one with experience in firearm defense or civil defense for a CCW holder.

You Want an Attorney Who Can Get to the Scene Quickly

You want an attorney who can get to the scene quickly, without having to file a claim first.

You Want to Be Able to Pick Your Attorney in Advance

You want to be able to pick your attorney in advance, rather than having one chosen for you by the insurance company.

Cell Phone Insurance: Worth the Cost?

You may want to see also

Upfront or deferred compensation

Some companies offer upfront payments, meaning they will cover legal fees and other associated costs as they arise during the legal process. This can be crucial in helping to alleviate the financial burden on the policyholder, who may already be dealing with the stress and uncertainty of a legal case.

However, not all companies offer upfront compensation. Some may provide reimbursement only after the case has been settled, which means the policyholder would need to cover legal fees out of pocket during the case and then seek reimbursement from the insurance company later. This can be a significant financial strain, especially if the case is prolonged or involves multiple trials.

It is important to carefully review the terms and conditions of the insurance policy to understand their approach to compensation and whether it aligns with your needs and preferences. Some companies may also have different tiers of coverage, with varying levels of upfront or deferred compensation.

When considering concealed carry insurance, it is essential to weigh the benefits of upfront compensation against the potential drawbacks of higher premiums or limited coverage options. Ultimately, the decision comes down to your personal financial situation and risk tolerance, as well as your assessment of the likelihood of needing to utilise the insurance policy.

It is also worth noting that some companies do not offer financial assistance at all but instead provide access to a network of on-call lawyers who specialise in self-defence or firearms litigation. While this may not provide direct financial support, it can still offer valuable assistance in navigating the legal process.

Kentucky: No Insurance, Criminal Offense?

You may want to see also

Exclusions and disqualifications

- Intentional Acts: Homeowner's insurance policies typically exclude coverage for intentional acts. This means that if you intentionally shoot someone, your homeowner's insurance may not provide coverage.

- Criminal Acts: Homeowner's insurance policies also exclude coverage for criminal acts. This means that if you are charged with a crime related to the use of your firearm, your homeowner's insurance may not cover you.

- Self-Defense Scenarios: Some concealed carry insurance policies may have specific exclusions or limitations for certain self-defense scenarios. For example, some policies may not cover you if you use your firearm in a "gun-free zone" or if you are under the influence of alcohol or certain prescription medications.

- Unintentional Discharges: Not all concealed carry insurance policies cover unintentional discharges, which are the most common type of gun-related incident that results in legal charges.

- Family and Domestic Incidents: Some policies may exclude coverage for incidents involving family members or people you invite into your home.

- Animal Attacks: Some policies may not cover you if you use your firearm in self-defense against a vicious animal.

- Geographic Limitations: Some policies may only provide coverage in certain states or regions. Make sure to check the geographic coverage of the policy before purchasing.

- Permit Requirements: Some policies may require you to have a concealed carry permit or live in a constitutional carry state to be eligible for coverage.

- Reimbursement: Some policies may require you to pay for legal expenses upfront and seek reimbursement later, while others provide funds upfront.

- Clawback Clauses: Some policies may include clawback clauses, which means that if you are found guilty or plead guilty to a lesser charge, you may have to repay the insurance company for any legal expenses they covered.

- Negligence: If your actions are found to be negligent or reckless, you may not be covered by your insurance policy.

It is important to carefully review the exclusions and disqualifications section of any concealed carry insurance policy before purchasing to ensure that you understand what is and is not covered.

Contractors: Insurance Must-Haves

You may want to see also

Deductibles or caps on coverage

When choosing a concealed carry insurance company, it is important to consider whether there are deductibles or caps on coverage. This refers to the amount of money that the insurance company will pay out for a claim, and whether there is a limit on how much they will pay.

In general, insurance policies have caps on coverage. This means that there is a set amount of money that the policy will cover, after which the policyholder is responsible for any additional costs. For example, while CCW Safe offers no limit on attorney fees for criminal and civil defence, its basic plan offers no lost wages compensation and additional charges for bail coverage.

Some companies, such as CCW Safe, offer multiple plans with different levels of coverage. For example, CCW Safe's Defender plan offers $1 million in bail coverage, while its Ultimate plan offers $2 million.

It is important to carefully review the terms and conditions of any insurance policy to understand what is and is not covered, as well as any limits or exclusions that may apply. For example, while some policies may cover accidental discharges, others may not.

Additionally, it is worth noting that some companies, such as CCW Safe, do not seek reimbursement of defence costs if the policyholder is found guilty or pleads to a lesser offence. This can provide added peace of mind and financial protection in the event of a self-defence incident.

When considering deductibles or caps on coverage, it is also worth considering the reputation and financial stability of the insurance company. A company with deep financial pockets may be more likely to fulfil claims, whereas a smaller company may have more limited resources.

Ultimately, the decision of whether to opt for a policy with deductibles or caps on coverage will depend on an individual's budget and specific needs. However, it is important to carefully weigh the risks and potential costs associated with a self-defence incident when making this decision.

Farmers' Snowmobile Insurance: What's Covered?

You may want to see also

Frequently asked questions

Concealed carry insurance, also known as CCW insurance or self-defense insurance, is a type of insurance policy or membership that helps cover legal fees and other related expenses in the event that you need to use your firearm or weapon in self-defense.

Legal fees and court-related expenses can quickly add up, often costing hundreds of thousands of dollars. Even if you are acting in self-defense, you may still be arrested, charged, or sued. Concealed carry insurance provides financial protection and assistance in navigating the legal system.

The coverage varies by provider and plan, but it typically includes legal defense costs, bail, civil and criminal liability, and access to attorneys or legal resources. Some policies may also cover incidental expenses, lost wages, and expert witness fees.

When choosing a concealed carry insurance plan, consider factors such as coverage limits, bail amounts, attorney selection, and whether the plan is available in your state. Compare multiple providers and plans to find one that best suits your needs and budget.

The decision to purchase concealed carry insurance depends on your individual circumstances and preferences. Consider factors such as the likelihood of needing to use your weapon in self-defense, the potential financial impact of legal fees, and the availability of alternative resources. Remember that insurance provides an added layer of protection and peace of mind.