Texas law requires all drivers to carry proof of liability insurance with them when driving. This can be shown on a driver's phone or as a physical copy. The minimum insurance coverage in Texas is $30,000 per injured person, up to $60,000 per accident, and $25,000 for property damage, often referred to as 30/60/25 coverage. If you are unable to provide proof of insurance when pulled over by a police officer, you may face fines, impoundment of your vehicle, and suspension of your driving privileges.

| Characteristics | Values |

|---|---|

| Is proof of insurance required in Texas? | Yes |

| What are the minimum insurance coverages? | $30,000 per injured person, $60,000 per accident, and $25,000 for property damage |

| What is the shorthand for the above coverages? | 30/60/25 coverage |

| What are the penalties for driving without insurance in Texas? | Fine of up to $1,000, vehicle impoundment for up to 180 days, and suspension of driving privileges for up to two years |

| How can you provide proof of insurance? | Physical copy or electronic copy on a cellphone |

What You'll Learn

Minimum insurance coverage in Texas

Texas law requires all drivers to have adequate car insurance. The minimum insurance coverage required in Texas is $30,000 per injured person, up to a total of $60,000 per accident, and $25,000 for property damage per accident. This basic coverage is referred to as 30/60/25.

The minimum coverage includes liability insurance, which pays for the other driver's car repair and medical bills if you cause an accident. It is important to note that liability coverage only pays for the other driver's expenses and not for your own injuries or damage to your vehicle.

While the minimum insurance coverage is $30,000 per injured person, it is recommended to consider purchasing higher limits as medical costs can be high. Additionally, you may want to include other types of coverage in your policy for added protection.

- Collision coverage: This pays for damage to your car in an accident with another vehicle or object.

- Comprehensive coverage: This covers the cost of repairing or replacing your car in non-collision incidents, such as theft, fire, or vandalism.

- Uninsured/Underinsured Motorist coverage: This protects you if you are in an accident caused by a driver who doesn't have insurance or doesn't have enough coverage.

- Personal Injury Protection (PIP) coverage: This is similar to medical payments coverage and is included in all auto policies in Texas. PIP covers medical bills, lost wages, and other non-medical costs for you and your passengers.

- Towing and labor coverage: This pays for towing your car if it can't be driven and for labour costs, such as changing a flat tire.

- Rental reimbursement coverage: This covers the cost of renting a car if yours is stolen or being repaired after an accident.

Remember, the minimum insurance coverage requirements in Texas are just the basics. You may want to consider your specific needs and choose additional coverages to ensure you are adequately protected in the event of an accident.

PMI Insurance: Who Needs It?

You may want to see also

Texas's penalties for driving without insurance

Texas law requires all drivers to have adequate car insurance. The minimum insurance coverages in Texas are $30,000 per injured person, $60,000 per accident, and $25,000 for property damage. These requirements are known as 30/60/25 coverage.

Texas has strict penalties for driving without insurance. If you are caught driving without insurance in Texas, you could face a fine of up to $1,000 for a second or subsequent offence. For a first offence, the fine is between $175 and $350. You will also have to pay a license renewal surcharge of $250 per year for three years and your insurance premiums are likely to increase when you do get insurance because you will be considered a high-risk driver. You may also have to file an SR-22 form, which is a document connecting your insurance provider with the DMV to certify that you have the minimum liability coverage.

If you are caught driving without insurance for a second or subsequent time, Texas law imposes even stricter penalties. In addition to the fine and surcharge, you may face the suspension of your vehicle registration and/or driver's license, and your vehicle may be impounded for up to 180 days. You will also have to pay a daily storage fee for your vehicle, which can add up to more than $3,800 over 180 days. In total, you could owe more than $4,800 for second and subsequent convictions of driving without insurance.

If you are in an accident and do not have insurance, the consequences can be even more severe. If you are responsible for a collision that results in serious injuries or death, you face a fine of up to $4,000 and up to one year in jail. Your vehicle registration and license will be suspended for up to two years, and you will be required to file an SR-22 form for three years. You will also be 100% liable for any physical injuries and property damage resulting from the accident.

CNMs: Malpractice Insurance — Necessary?

You may want to see also

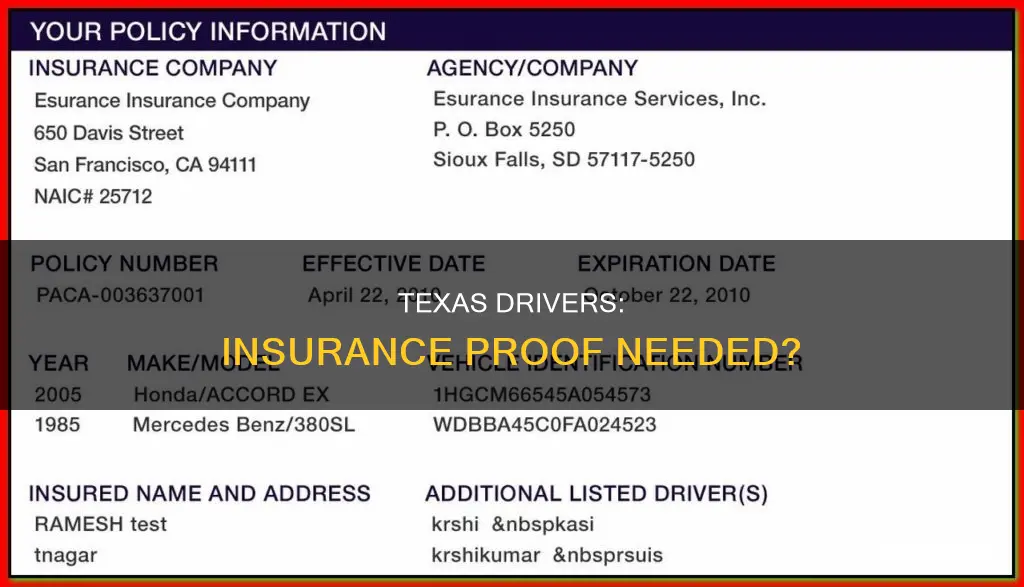

Acceptable ways to show proof of insurance

Texas law requires all drivers to have adequate car insurance. This means that drivers need to have a minimum insurance coverage of $30,000 per injured person, up to $60,000 per accident, and $25,000 for property damage. This is known as 30/60/25 coverage.

Drivers must also carry proof of this coverage at all times, which must be shown at the request of any law enforcement official. This can be done by showing an ID card from your insurance company, which you should keep in your glove compartment.

Texas also allows drivers to show proof of insurance by phone, making electronic proof a viable and convenient option. This is especially useful when conducting business with the DMV, renting a vehicle, or when requested by police.

Insurance ID Card:

When you purchase an insurance policy, your insurance company will send you ID cards that you can keep in your vehicle. These cards provide essential information about your policy, including coverage limits and effective dates. It is a good idea to keep these cards in your glove compartment so that they are easily accessible if needed.

Electronic Proof:

Texas is one of the states that allow electronic proof of insurance, which can be accessed on your phone. This is a convenient option, especially if you don't have your physical insurance card with you. However, it is important to note that not all states accept electronic proof, so if you are travelling outside of Texas, it is advisable to have your physical insurance card as well.

Declaration Page of Your Policy:

The declaration page of your insurance policy serves as a summary and includes important details such as your coverage limits, dollar limits, and deductibles. While it may not be as convenient as an insurance card or electronic proof, having a copy of this page in your vehicle can serve as proof of insurance if needed.

Insurance Company Confirmation:

If you have recently purchased insurance or made changes to your policy, your insurance company can provide confirmation of your coverage. This could be in the form of an email, letter, or other documentation that outlines your policy details, including effective dates and coverage limits.

DMV Verification:

When you register your vehicle or renew your registration in Texas, the DMV will verify your insurance information. This means that the DMV has a record of your insurance coverage, which can serve as proof if needed. However, it is still important to have your insurance card or electronic proof readily available.

Rental Car Agreement:

If you are renting a vehicle, the rental car agreement can sometimes serve as proof of insurance. This is because rental car companies often offer their own insurance coverage as part of the rental agreement. However, it is important to carefully review the terms and conditions of the rental agreement to understand the extent of the coverage provided.

It is important to remember that Texas law requires drivers to have a minimum level of insurance coverage, and failure to provide proof of insurance can result in penalties, including fines, impoundment of your vehicle, and suspension of your vehicle's registration.

Contractors: Insurance Must-Haves

You may want to see also

What to do if you're pulled over without proof of insurance

In Texas, it is illegal to drive without insurance, and you are required by law to carry proof of insurance when driving. If you are pulled over without proof of insurance, you could face a fine of up to $1,000, your vehicle may be impounded for up to 180 days, and your driving privileges may be suspended for up to two years. Here is what you should do if you are pulled over without proof of insurance:

- Stay calm and be polite to the officer. Explain your situation honestly and provide any relevant information, such as the fact that you do have insurance but were unable to show proof at the time.

- If you have your insurance card or policy documents in your vehicle, you can try to locate them and provide them to the officer.

- If you have an electronic copy of your insurance card or policy, you can show it to the officer.

- If you have recently purchased insurance, you may be able to contact your insurance company and ask them to verify your coverage to the officer through TexasSure, a state-funded electronic database.

- If you are unable to provide proof of insurance at the time, you may be able to appeal the ticket and provide proof later.

- If you are given a ticket, be sure to pay it on time to avoid additional penalties.

- Contact your insurance company and inform them of the situation. They may be able to provide guidance or assistance.

- If you are facing legal consequences, consider consulting an attorney for assistance.

It is important to remember that driving without insurance is a serious offense and can result in significant penalties. It is always best to ensure that you have proof of insurance with you when driving and to keep your insurance coverage up to date.

CPAs: Errors and Omissions Insurance

You may want to see also

What happens if you cause an accident without insurance

In Texas, it is a legal requirement for all drivers to carry car insurance. The minimum insurance coverages are $30,000 per injured person, $60,000 per accident, and $25,000 for property damage. This is often referred to as 30/60/25 coverage.

If you are in an accident and do not have insurance, there are several consequences you may face. Firstly, the police officer at the scene might issue you a ticket and have your car towed and impounded, for which you will have to pay a fee and show proof of insurance to get your car back. You may also be fined between $175 and $350 for a first offense, and up to $1,000 for subsequent offenses. Furthermore, your driver's license may be suspended, and you may be required to file an SR-22 form for three years after the accident. Your vehicle registration and license will be automatically suspended for up to two years.

If you are found to be at fault for the accident, you will be liable for any and all physical injuries and property damage resulting from the accident. This means that you could be sued by the other party for expenses associated with personal injury, such as medical bills and lost income due to an inability to work. If their lawsuit is successful, you will have to pay these expenses out of pocket. Additionally, if the accident resulted in serious injuries or death, you may face criminal penalties, including a fine of up to $4,000 and up to one year in jail.

Even if you are not at fault for the accident, driving without insurance can still result in penalties and fines. It is important to note that Texas has a fault-based auto insurance system, which means that the person who caused the accident is liable for the losses. If the other driver is at fault, their insurance company will typically cover your accident-related damages. However, you may still face penalties for driving without insurance, as mentioned earlier.

To avoid these consequences, it is important to always carry proof of insurance when driving in Texas. This proof of insurance, along with your driver's license and vehicle registration, must be presented to a police officer when pulled over for a traffic violation.

Geico Insurance: Always on Your Person?

You may want to see also

Frequently asked questions

Yes, Texas law requires all drivers to carry proof of insurance when driving. You will need to show proof of insurance if a police officer requests it, when you are involved in an accident, and to register your car.

If you are caught driving without insurance in Texas, you could face a fine of up to $1,000, have your vehicle impounded, and your driving privileges suspended for up to two years.

The minimum insurance coverage required in Texas is $30,000 per injured person, up to a total of $60,000 per accident, and $25,000 for property damage. This is known as 30/60/25 coverage.

You can show proof of insurance by providing a physical copy of your insurance card or displaying it electronically on your cell phone.