Home and auto insurance bundles can be a great way to save money on your insurance costs. By purchasing both your home and auto insurance from the same company, you can often receive a significant discount on your premiums. In addition to the cost savings, bundling your insurance policies can also provide the convenience of having all your policies in one place, making it easier to manage and pay your bills.

When considering a home and auto insurance bundle, it's important to compare quotes from multiple insurers and evaluate the coverage options, discounts, and customer service offered by each company. Some of the top companies offering home and auto insurance bundles include State Farm, American Family, Nationwide, Erie Insurance, Allstate, and USAA. These companies offer a range of coverage options, competitive rates, and strong customer service, making them worth considering for your insurance needs.

Discounts and savings

Homeowners can save money on their auto insurance by bundling their home and auto insurance policies. This is called a multi-policy discount and insurance companies value customer loyalty. Progressive customers, for example, save an average of 7% when they bundle home and auto insurance. USAA offers a 10% bundling discount, while Allstate offers up to a 25% bundling discount. Bundling is not always the cheapest option, however, and it is worth shopping around and comparing quotes with and without a bundle to ensure you are getting the best deal.

There are other ways to make savings on auto insurance. Insurance companies offer discounts for safety and alarm systems, for instance. Homeowners with burglar alarms, fire alarms, automatic sprinklers, security systems, and cameras in their homes may be eligible for discounts. Similarly, features that mitigate wind and fire damage, such as impact-resistant roofs, can also result in discounted insurance premiums.

Homeowners can also save money by paying their premiums annually and in full, by paying via electronic funds transfer, and by receiving policy documents via email.

Auto Insurance for Seniors in Indiana: The Lowdown

You may want to see also

Customer service

When it comes to customer service, Auto-Owners Insurance stands out for its commitment to providing exceptional support to its policyholders. They have received numerous awards for their customer service and claims management, reflecting their dedication to meeting the needs of their customers. Auto-Owners understands that insurance can be complex, so they offer online access to make managing policies more convenient for their customers. This includes the ability to make automatic payments, request road trouble service, and easily check the status of a claim.

In addition to their digital offerings, Auto-Owners Insurance also provides personalized expertise through independent agents. These agents offer local knowledge and tailored advice to ensure that customers get the right coverage for their needs. This combination of digital tools and human expertise ensures that customers can easily access the information and support they need.

Auto-Owners Insurance is also known for its financial stability, having received an A++ (Superior) rating from AM Best Company, an insurance industry credit rating agency. This rating provides customers with peace of mind, knowing that the company has the financial strength to honour its commitments.

Furthermore, Auto-Owners Insurance demonstrates its commitment to its customers by investing in its workplace culture. The company has been certified as a Great Place to Work® for eight consecutive years, and an impressive 80% of its associates say that Auto-Owners is a great workplace. This positive work environment translates into better service for customers, as happy employees are more motivated to go the extra mile.

In terms of the claims process, Auto-Owners Insurance stands out for its fairness and transparency. They have a reputation for paying what they owe according to the policy, with no loopholes or excuses. This gives customers confidence that their claims will be handled honestly and efficiently. The company also offers a Multi-Policy Discount, making their rates even more competitive and accessible.

Overall, Auto-Owners Insurance excels in customer service by providing a range of tools and resources to support their policyholders. Their combination of digital accessibility, local expertise, and financial stability makes them a reliable choice for those seeking home and auto insurance.

Insuring Your Vehicle in AZ: The Basics

You may want to see also

Coverage options

When it comes to auto insurance, there are a variety of coverage options available to meet your specific needs and budget. Here are some of the most common types of coverage:

- Liability Coverage: This includes bodily injury liability, which covers damages for injuries or death resulting from an accident that is your fault. It also includes property damage liability, which pays for any damage to someone else's property caused by an accident that is your fault.

- Uninsured/Underinsured Motorist Coverage: This protects you from drivers who don't have insurance or don't have enough insurance to cover the damages in an accident.

- Medical Payments Coverage: This covers medical and funeral expenses for you, your family members, or passengers involved in an accident.

- Personal Injury Protection (PIP): PIP is similar to medical payments coverage but offers additional benefits and is offered in some states.

- Comprehensive Coverage: This protects your vehicle from events beyond your control, such as fire, theft, vandalism, and more.

- Collision Coverage: This pays for repairs or replacement of your vehicle if it collides with another object or vehicle.

- Additional Coverages: Other optional coverages include emergency road service, rental reimbursement, and mechanical breakdown insurance. You can also add specialised coverage for car rentals, roadside assistance, and more.

When deciding on the right amount of auto insurance coverage, consider your state's minimum requirements, your budget, the value of your vehicle, and whether you need to protect any other assets. You may also want to think about how much you can afford to pay out of pocket in the event of an accident.

Auto Insurance: Understanding the Standard Coverages You Need

You may want to see also

Pros and cons

Pros of bundling home and auto insurance:

- Discounts: Bundling home and auto insurance can lead to significant savings, with some companies advertising discounts of up to 30%.

- Convenience: Having multiple policies under one provider makes it more convenient to manage them.

- Other discounts still apply: You can combine a bundling discount with other types of discounts.

Cons of bundling home and auto insurance:

- Not always the cheapest option: In some cases, you may find cheaper rates by purchasing home and auto insurance separately from different providers.

- Limited availability: Some companies only offer insurance in certain states, so you might not be able to find a provider that offers both types of insurance in your area.

- Lack of desired coverage options: A single provider may not offer all the coverage options you want for both home and auto insurance.

- Discourages price shopping: The convenience of bundling may discourage you from regularly shopping around for better rates.

- Potential issues with "bundled" policies: Some companies act as brokers and outsource one type of insurance to a partner company, which can make managing your insurance more complicated.

Golf Cart Conundrum: Navigating Insurance Coverage for Your Ride

You may want to see also

How to buy

Buying auto and homeowners insurance is a good way to simplify your record-keeping and bill payments. Here is a step-by-step guide on how to buy auto insurance for homeowners:

- Determine what you need to insure: The main coverage on a home insurance policy is dwelling coverage, which most insurance companies have an estimation tool for. Personal property coverage is usually a percentage of your dwelling coverage amount, so it's important to know what it would cost to replace your personal belongings if you experience a total loss. Taking inventory of what you own and calculating a rough estimate of what it is worth may help you determine how much personal property coverage you will need.

- Research home insurance companies: Researching home insurance companies can give you a clear comparison of the coverage options and feature variations available from each company. You may prefer a company that offers digital claims filing, a variety of potential discounts, and endorsement options that fit your needs. It's also worth checking customer reviews to learn more about how the company handles complaints and claims.

- Explore coverage add-ons: A standard home insurance policy might not meet your needs, especially if you live in an area prone to earthquakes or flooding. Endorsement options vary by carrier, but some common ones to look out for include sewer/water backup coverage, identity theft coverage, and business property coverage.

- Get quotes: Getting quotes from different home insurance companies can help you find the lowest rate for your circumstances. To get a home insurance quote, you will likely need to provide your home's address, proximity to a fire department and fire hydrant, square footage, details about your roof type and age, the number of bathrooms, construction materials, type of garage, foundation type, and security features.

- Buy your home insurance: Once you've gathered your quotes and decided on the best home insurance company for you, it's time to buy your policy. Review the key coverage details of your policy so that you feel properly insured. A standard HO-3 homeowners policy should include dwelling coverage, other structures coverage, personal property coverage, loss of use coverage, liability coverage, and medical payments coverage.

Farm Bureau Auto Insurance: Is It Affordable?

You may want to see also

Frequently asked questions

Auto insurance for homeowners is a type of insurance that covers both your car and your home under the same policy. By bundling your home and auto insurance, you can often get a discount on your premiums and enjoy the convenience of managing both policies under one account.

The coverage offered by auto insurance for homeowners will vary depending on the insurance company and the specific policy you choose. However, typically, it will include liability coverage for both your home and your car, as well as protection against damage or loss to your property. It may also include additional perks such as accident forgiveness, new car replacement, and extended replacement cost coverage.

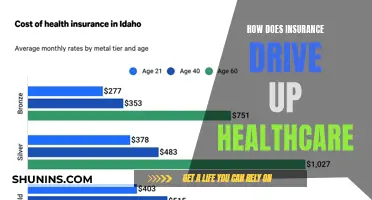

The cost of auto insurance for homeowners will depend on various factors, including the value of your home and car, the coverage limits you choose, and the insurance company you select. According to Forbes Advisor's analysis, the average annual cost of a bundled home and auto insurance policy is $2,344. However, this can vary significantly depending on the company and your individual circumstances.

To get auto insurance for homeowners, you can either contact insurance companies directly or work with an insurance broker who can help you find the best policy for your needs. It is recommended that you get quotes from multiple insurance providers and compare the coverage and rates before making a decision.

One of the main benefits of auto insurance for homeowners is the potential cost savings through bundling discounts. Additionally, having a single insurance company for both your home and auto insurance can be more convenient for managing payments, customer service, and claims. Some companies also offer perks such as a single deductible for events that damage both your home and car.