Amica offers a range of discounts on auto insurance, including loyalty, bundling, and good driver discounts. Amica also offers discounts for young drivers who complete an approved driver training program and full-time students with good grades. Additionally, Amica provides discounts for safety and anti-theft devices, such as airbags, adaptive headlights, car alarms, and GPS tracking systems. Furthermore, customers can save money by paying their policy premiums in full and by enrolling in paperless billing and automatic payments. Amica also offers a defensive driver discount for those who take an approved safety course.

What You'll Learn

Student discounts

Amica offers a range of discounts for students, including:

Good Student Discount

Full-time high school and college students aged 15-25 who can maintain a "B" grade average or higher are eligible for Amica's good student discount. To qualify, students must complete Amica's good student discount application form and submit it to their educational institution for eligibility verification.

Student Away at School Discount

If you have a full-time student included on your policy who is away at school without a car, you can take advantage of Amica's student away at school discount.

Legacy Discount

If you're under 30 and your parents have had an auto policy with Amica for at least five years, you may qualify for Amica's legacy discount when you take out your own auto policy.

Young Driver Training Discount

Drivers under 21 who complete an accredited driver training program are eligible for a discount.

SORN Vehicles: Do You Need Insurance?

You may want to see also

Loyalty discounts

Amica offers loyalty discounts to customers who have been with their existing auto insurance company for at least two years. The longer the relationship, the more you save. Amica also offers a legacy discount to customers under 30 whose parents have had an auto policy with the company for at least five years.

Amica also offers loyalty discounts to homeowners. If you've been with an insurer for at least two years, you can save on your home insurance. The longer you've been with your insurer, the more you'll save.

Amica also offers bundling discounts for those who have been loyal customers of their other insurance products. You can save up to 30% when you bundle your auto insurance with homeowners, condo, renters, life, flood, boat, motorcycle, small business, and umbrella policies.

Finding Auto Insurance: A Quick Guide

You may want to see also

Discounts for bundling

Amica offers a range of discounts for customers who bundle their insurance policies. One of the most significant bundling discounts is for customers who combine their auto insurance with homeowners, condo, renters, life, or umbrella policies. Amica offers savings of up to 30% when customers purchase their auto policy along with one or more of these additional policies. This discount not only provides significant savings but also the convenience of having multiple policies with a single insurer.

In addition to the standard bundling discount, Amica also offers a discount for policyholders who insure multiple cars on the same policy. This discount can provide savings of up to 25% for customers with two or more vehicles. This option is particularly advantageous for families with multiple drivers or individuals with more than one car.

Another bundling option offered by Amica is the ability to combine auto insurance with other specialized policies. For customers who have unique insurance needs, Amica provides bundling discounts for those who pair their auto insurance with policies such as flood, boat, motorcycle, small business, or other specialized coverage. This flexibility allows customers to tailor their insurance coverage while still benefiting from the savings of bundling.

Amica also recognizes loyal customers who have been with their existing auto insurance company for at least two years. The length of loyalty is taken into account, with longer relationships resulting in greater discounts. This discount is especially attractive for customers who are satisfied with their current insurer and wish to maintain their relationship while taking advantage of cost savings.

Furthermore, Amica extends its bundling discounts to homeowners. Even if a customer's home is not currently insured with Amica, owning a home may qualify them for a discount when bundling with auto insurance. This incentive encourages customers to consolidate their insurance needs and unlock savings by choosing Amica for both their auto and home insurance.

Windshield Coverage: What Auto Insurance Policies Include

You may want to see also

Discounts for safety features

Amica offers a range of discounts for safety features, helping drivers save money on their auto insurance. Here are some of the key discounts offered:

Adaptive Headlights

Private passenger vehicles equipped with adaptive headlights receive discounts on various parts of their insurance. Adaptive headlights improve visibility at night, enhancing safety. Amica recognizes this and offers a discount of up to 5% for vehicles with this feature.

Forward Collision Warning

Vehicles with a forward collision warning system alert drivers to potential accidents and receive discounts on specific parts of their insurance. Amica offers this discount to encourage the use of technology that helps prevent accidents and improve safety on the road.

Electronic Stability Control (ESC)

Cars equipped with factory-installed four-wheel electronic stability control systems will receive a discount on collision coverage and limited collision coverage. ESC helps maintain control and stability, especially in adverse conditions, making driving safer. Amica offers this discount to incentivize the use of ESC technology.

Anti-lock Brakes (ABS)

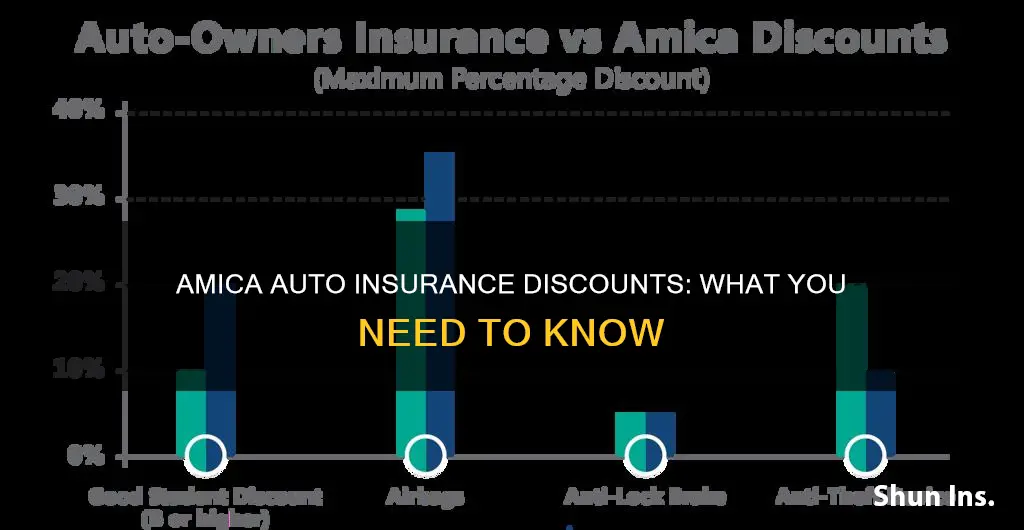

Anti-lock brakes are an advanced braking system that automatically pumps the brakes in the event of a sudden stop, helping maintain control and avoid accidents. Amica offers a discount of up to 10% for vehicles equipped with ABS, promoting safer driving.

Passive Restraint Systems

Vehicles with built-in safety features such as airbags and seat belts qualify for a passive restraint discount. These safety features are designed to protect drivers and passengers in the event of a collision, and Amica offers a discount of up to 40% on medical-related coverage for cars with these features.

Defensive Driver Discount

Amica offers a defensive driver discount for those who take an approved driver safety course. By completing this course, drivers can improve their skills, become more defensive drivers, and avoid accidents. Amica's partnership with SafetyServe.com offers an online course at a discounted price, and passing it may lead to further auto insurance discounts.

Safeco Auto Insurance: Canceling Your Policy, Step by Step

You may want to see also

Discounts for driver training

Amica offers a range of discounts for driver training, which can help you save on your auto insurance. Here are the key details:

Defensive Driver Discount Program

Amica has partnered with SafetyServe.com to offer an online defensive driver course, sponsored by the National Safety Council. This course is designed to improve your driving skills and knowledge, helping you become a more defensive driver and avoid accidents. The benefits of taking this course include:

- Cost savings: You can purchase the course at a discounted price, and you may qualify for a discount on your auto insurance upon completion.

- Convenience: The online class can be taken at a time that suits your schedule.

- Proof of completion: SafetyServe.com will send your class completion certificate directly to Amica.

- Improved skills: You'll learn valuable information to drive more defensively and avoid accidents.

Young Driver Training

Amica offers discounts for drivers under 21 who complete an accredited driver training program. This is a great way for young drivers to save on their insurance premiums and improve their driving skills.

State-Specific Defensive Driving Courses

Amica also offers discounts for drivers in several states who complete a defensive driver course. The discount amount and eligibility criteria vary by state, so be sure to check the requirements for your specific state. In some states, the defensive driver discount is only applicable to drivers over a certain age, typically 55 or older.

By taking advantage of these driver training discounts, you can not only improve your driving skills but also save on your auto insurance premiums with Amica. It's a win-win situation that promotes safer driving and provides financial benefits.

Auto and Cycle: How Car Insurance Impacts Motorcycle Coverage

You may want to see also

Frequently asked questions

Amica offers a discount of up to 30% when you bundle auto insurance with home, umbrella, and life policies. You can also save up to 25% when you insure two or more cars.

Amica offers discounts for drivers under 21 who complete an accredited driver training program. There is also a good student discount for full-time students aged 15-25 with a "B" average or higher. If you're under 30 and your parents have had an auto policy with Amica for at least five years, you may qualify for the legacy discount.

Yes, Amica offers discounts for safe driving. You can get a discount if you've been claim-free for the past three years, and for taking an approved driver safety course. You can also enrol in the StreetSmart by Amica™ app and earn up to a 20% discount by demonstrating safe driving habits.

Amica offers discounts for vehicles with safety and anti-theft features, including car alarms, GPS tracking systems, electronic stability control, airbags, adaptive headlights, and forward-collision warning systems.

Yes, you can save money by paying your premium in full upfront, by enrolling in AutoPay, and by signing up for paperless billing and receiving policy documents electronically.