Auto insurance is a contract between you and your insurance company. By applying for coverage, you agree to pay a premium to the insurance company, and they agree to pay for covered costs associated with an auto accident once the deductible has been met under the policy terms. Auto insurance terms can be confusing, and it's important to understand what these terms mean to ensure you have the right coverage for your needs. This paragraph aims to introduce the topic of auto insurance terms and their meanings, as well as highlight the importance of familiarizing yourself with these terms before purchasing a policy.

Liability Insurance

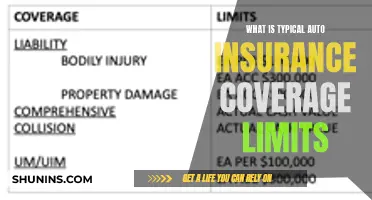

In the context of vehicle insurance, liability insurance covers injuries or death caused to another person in an accident where you are at fault. It also covers damage to other vehicles and property, such as mailboxes or street signs. Additionally, it provides financial protection for legal expenses arising from accident-related lawsuits. When selecting a vehicle insurance policy, you will need to choose a liability coverage limit, which is the maximum amount your policy will pay for injuries or property damage caused by you. It is recommended to select a limit that matches or exceeds your total net worth to ensure your assets are adequately protected.

Business owners can also purchase liability insurance, often called general liability insurance, to protect their businesses from claims related to bodily injury, property damage, and other situations. This type of insurance is usually purchased separately from personal vehicle or property insurance.

Autoimmune Disorders and Insurance Coverage: Unraveling the Blood Work Mystery

You may want to see also

Comprehensive Coverage

The cost of comprehensive coverage is usually based on the actual cash value of your vehicle. This means that the insurance company will consider the age, mileage, make, model, and overall condition of your vehicle when determining the cost of coverage. In some cases, lenders may require you to carry comprehensive coverage if you are financing or leasing a vehicle.

Auto Insurance: Is Comprehensive Coverage Mandatory?

You may want to see also

Collision Coverage

The cost of collision coverage depends on the current market value of the vehicle and the deductible you select. The deductible is the amount you will have to pay out of pocket before the insurance company covers the rest. A higher deductible will lower the cost of the insurance. For example, common deductible levels for collision insurance in California are $100, $200, or $500.

When deciding whether to purchase collision coverage, it is worth considering the value of your vehicle. If you drive an older car, it may not be worth the cost of collision coverage. However, if your vehicle still maintains a good value relative to your deductible and monthly rate, collision coverage could be a good option.

In summary, collision coverage is an important form of auto insurance that can provide financial protection in the event of a collision with another vehicle or object. While it is not legally required, it can offer valuable peace of mind and help you avoid costly repairs.

Insuring Mom: Adding a Parent to Your Auto Policy

You may want to see also

Claim

A claim is a request for payment from your car insurance company to cover vehicle repairs, injury treatment, or other costs. The process of making a claim involves contacting your insurance company to inform them of an incident that may be covered under your policy. The insurance company will then evaluate the damage and determine the amount to be paid out, if applicable.

When making a claim, it is important to provide as much information as possible about the incident, including details such as the date, time, location, and any relevant circumstances. It is also essential to have all the necessary documentation, such as police reports, medical records, and repair estimates.

The claims process can vary depending on the insurance company and the type of claim being made. In some cases, an insurance adjuster may be assigned to evaluate the damage and determine the appropriate compensation. It is important to review your insurance policy carefully to understand the specific claims process and requirements.

It is worth noting that there are different types of claims that can be made, depending on the nature of the incident. These may include collision claims, comprehensive claims, medical payment claims, and more. Each type of claim has its own specific coverage and limitations, so it is important to understand what is included in your policy.

Additionally, there may be time limits for filing a claim, and certain steps that need to be taken promptly after an incident occurs. It is always recommended to contact your insurance company as soon as possible after an incident to initiate the claims process and ensure compliance with any necessary requirements.

Auto Insurance Statements: How Long to Keep?

You may want to see also

Deductible

A deductible is the amount of money you have to pay out of pocket for a covered loss before your insurance company pays the rest. For example, if you file a claim for $1,500 and you have a deductible of $500, you will have to pay the $500 deductible before your insurer will cover the remaining $1,000 balance.

The average car insurance deductible is $500, but deductibles can range from $100 to over $2,000. The most common deductible amount is $500, but companies usually offer deductibles ranging from $100 to $2,500. The deductible amount that you choose should be based on what you can afford to pay if your vehicle is unexpectedly damaged.

There are two types of auto coverage that have deductibles: collision and comprehensive. Collision coverage pays for damage to your car if you hit another vehicle or a stationary object. Comprehensive coverage, on the other hand, covers damage from things other than collision, such as theft, weather, and wild animals.

When choosing a deductible, it's important to consider your income, budget, savings, and available credit. A higher deductible will reduce your premium, but it's crucial to choose an amount that you can comfortably afford in case of an accident or unexpected event.

Additionally, it's worth noting that not every type of car insurance uses a deductible. Liability insurance, for example, never uses a deductible as it covers damages caused to another person or their property in an accident.

Mastercard Auto Insurance: What You Need to Know

You may want to see also

Frequently asked questions

An estimate of how much a company will charge you for car insurance.

The amount of the loss that the policyholder is responsible for paying upfront before covered benefits from the insurance company are payable.

Pays for others' injury treatment and property damage if you cause a crash, as well as your legal defence costs if you're sued.

Pays to repair your car after animal collisions and also covers a specific list of non-collision issues, including car theft, falling objects, and fire, among others.

A request for payment from your car insurer to cover vehicle repairs, injury treatment, or other costs.