After an emergency, insurance adjusters, also known as claims adjusters, are responsible for evaluating and assessing the damage. They investigate insurance claims to determine whether the insurer should pay for the damage and how much they should pay. For example, after a car accident, an insurance adjuster will review the details of the accident, interview those involved, and go over the options with the claimant. They may also help the claimant get their vehicle inspected or set up repairs. In the case of property damage, insurance adjusters evaluate the property loss and determine the dollar amount the claim should pay out.

| Characteristics | Values |

|---|---|

| Role | To investigate an insurance claim to determine if the insurer should pay for damage or injuries, and if so, how much they should pay |

| First steps | Review claim details and policy |

| Interview those involved | |

| Go over options with the claimant | |

| Investigation | Examine police reports, video footage, and other information related to the loss |

| Examine the claimant's medical records, income-related documents, and other evidence of accident-related losses | |

| Valuation | Place a dollar value on the claimant's damages |

| Negotiation | Handle the personal injury claim settlement negotiation process with the claimant or their attorney |

What You'll Learn

Review claim details and policies

When reviewing claim details and policies, insurance adjusters will first examine the details of the incident that led to the claim, including the date of the incident, the claimant's name, date of birth, address, and contact information. They will also request authorisation to obtain accident-related medical records.

The adjuster will then investigate the incident, examining any relevant reports (such as police reports), the claimant's medical records, income-related documents, and other evidence of losses related to the incident. This process allows them to place a monetary value on the claimant's damages.

After gathering and reviewing all the necessary information, the adjuster will determine which coverages from the claimant's policy are applicable to the claim. This step is crucial in deciding whether the insurer should pay for the damages and, if so, how much.

For example, in the case of a car accident, the adjuster will verify that the claimant has the relevant coverages and that the damage is covered under their policy. They may also work with the claimant to get their vehicle inspected or set up repairs.

Overall, the review of claim details and policies is a comprehensive process that involves analysing various types of information to make informed decisions about the validity and value of the claim.

Negotiating with Your Insurance Adjuster: A Guide to Discussing Roof Leaks and Repairs

You may want to see also

Interview those involved

Interviewing those involved is a crucial step in an insurance adjuster's investigation process. It involves collecting recorded statements from people involved in the incident, such as drivers, passengers, and witnesses, and sometimes police officers and subject matter experts. Here are some detailed instructions for insurance adjusters on how to effectively interview those involved:

- Obtain recorded statements: It is important to obtain recorded statements from all individuals involved in the incident, including drivers, passengers, and witnesses. Ensure that you have their consent to record the conversation, and clearly state the purpose of the recording.

- Ask open-ended questions: When interviewing those involved, ask open-ended questions to encourage detailed responses. For example, you can ask them to "Describe what happened before, during, and after the incident." This allows them to provide a narrative account of the events, which can be helpful in understanding the context and specific details of the incident.

- Verify facts and clarify inconsistencies: During the interview, pay close attention to the information provided by the individuals. Verify facts by asking follow-up questions and cross-referencing their statements with other sources, such as police reports or video footage. If you identify any inconsistencies or discrepancies in their statements, politely ask for clarification and probe further to understand their perspective.

- Maintain a neutral and empathetic tone: It is important to remain neutral and empathetic during the interview process. Avoid making judgments or expressing personal opinions about the incident. Maintain a calm and empathetic tone, especially when interviewing individuals who may be distressed or upset due to the incident.

- Focus on relevant details: While interviewing those involved, pay attention to the information that is directly relevant to the insurance claim. This includes details such as the time and location of the incident, the extent of damage or injuries, any contributing factors, and the impact on the individuals involved.

- Handle hostile or upset individuals professionally: In some cases, individuals involved in the incident may be upset or hostile due to the circumstances. In such situations, remain calm and professional. Acknowledge their concerns, empathize with their situation, and assure them that you are there to help. Focus on active listening and provide them with an opportunity to express their concerns or ask questions.

- Conduct interviews separately: Whenever possible, conduct interviews with each individual separately to avoid influencing each other's statements. This helps in obtaining unbiased accounts of the incident and allows you to focus on the unique perspective of each person involved.

- Pay attention to non-verbal cues: In addition to what is being said, pay attention to non-verbal cues such as body language, tone of voice, and facial expressions. These can provide valuable insights into an individual's state of mind, level of distress, or potential inconsistencies in their statement.

- Ask for additional contacts: During the interview, ask the individuals involved if there are any other witnesses or individuals who may have relevant information about the incident. This helps in identifying and locating additional sources of information to support your investigation.

- Provide updates and contact information: Before concluding the interview, provide the individuals involved with updates on the claims process, expected timelines, and any relevant contact information. Let them know how they can reach out to you or the insurance company if they have further questions or concerns.

Remember, the goal of interviewing those involved is to gather factual information, clarify details, and understand the perspectives of all parties involved. By following these instructions, insurance adjusters can effectively collect the necessary information to support their investigation and claims assessment.

The Economics of Insurance Adjusting: Navigating the Claims Landscape

You may want to see also

Discuss options

After an emergency, insurance adjusters will often be sent to the affected areas to evaluate the damage and determine the financial compensation that should be paid out. There are three main types of insurance adjusters: company adjusters, independent adjusters, and public adjusters. Company adjusters are employed by insurers to evaluate claims filed by the company's policyholders. Independent adjusters work as contractors for insurance companies and are usually hired when there is a surge in demand or if their specific expertise is needed. Public adjusters are hired by individuals or businesses to help them file claims and ensure they receive the maximum payout.

If you are considering hiring a public adjuster, it is important to do your research first. Public adjusters charge a fee for their services, which is typically a percentage of the total claim amount. This fee is usually capped by local or state law. For example, in Florida, the fee for a reopened or supplemental claim cannot exceed 20% of the claim limit. When choosing a public adjuster, it is important to check their credentials and make sure they are licensed in your state. You may also want to ask for referrals or read reviews from previous clients to ensure you are hiring a reputable and experienced adjuster.

Another option to consider is hiring an independent adjuster. These adjusters work on a contract basis and can be hired directly by individuals or businesses. They may have lower dollar value authority limits and may need approval from a claims supervisor to settle a case. Independent adjusters can be a good option if you want more control over the claims process and feel that a public adjuster's fees are too high.

Finally, you may choose to work directly with a company adjuster from your insurance provider. This option may be more limited in terms of negotiating power, as company adjusters are employed by the insurance company and may have incentives to keep payouts low. However, working directly with your insurance company can streamline the claims process and may result in faster resolution of your claim.

In conclusion, there are several options to consider when working with insurance adjusters after an emergency. Public adjusters can provide personalized service and help ensure you receive a fair payout, but they come with a fee. Independent adjusters offer more flexibility and can be hired directly, but they may have lower authority limits. Company adjusters provide a direct line of communication with your insurance provider but may have conflicting interests. Ultimately, the best option for you will depend on your specific needs and circumstances.

Navigating Fire Damage Claims: The Benefits of Engaging a Public Insurance Adjuster

You may want to see also

Evaluate damage

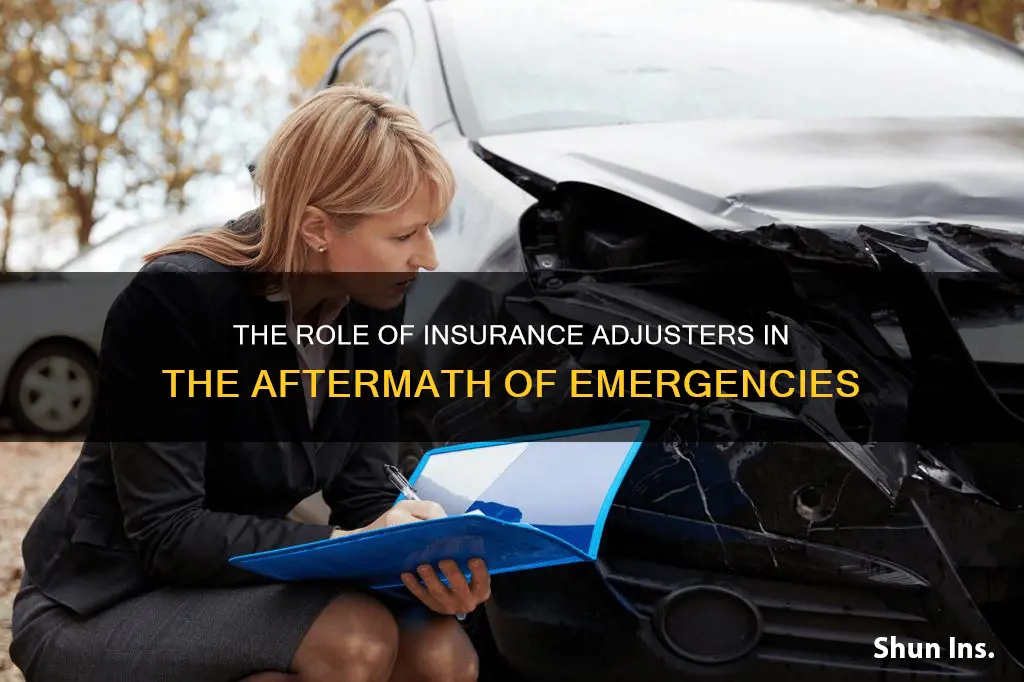

Evaluating damage is a key part of an insurance adjuster's role. After an emergency, an insurance adjuster will be responsible for assessing the damage to a property or vehicle and determining how much the insurance company should pay out in repairs.

Evaluating Damage

Insurance adjusters will conduct a thorough inspection of the damage. They will take photographs of the damage from multiple angles and look for evidence of pre-existing damage, such as rusting or previous repairs. They will also review any relevant documentation, such as police reports, medical records, income-related documents, and other evidence of losses related to the accident.

When evaluating damage to a vehicle, insurance adjusters will consider whether the cost of repairs exceeds the value of the car. If so, the vehicle will be declared a "total loss", and the insurance company will pay out the actual cash value of the vehicle, minus any deductible.

Insurance adjusters may also use specialised software to help evaluate the damage and determine repair costs. These programs take into account factors such as the severity of the damage, the type and length of medical treatment required, and the cost of necessary medications or physical therapy treatments.

Determining Payout Amount

After evaluating the damage, the insurance adjuster will determine the dollar amount that the insurance claim should pay out. This amount will be based on the coverage provided by the insurance policy, as well as the extent of the damage and any losses incurred by the claimant.

In the case of a personal injury claim, the adjuster will consider the chances of the claimant winning at trial and the potential jury award when determining the settlement amount. They may also use general rules of thumb to calculate the amount of pain and suffering to be included in the payout.

It is important to note that insurance adjusters work on behalf of the insurance company and are incentivised to resolve claims as quickly and cheaply as possible. As such, it is recommended that claimants seek legal advice when dealing with insurance adjusters to ensure they receive a fair and reasonable settlement.

Unraveling the Complexities of Expired Insurance Adjustments

You may want to see also

Investigate the incident

After an emergency, insurance adjusters are responsible for investigating insurance claims to determine the extent of the insurance company's liability. They will interview those involved, including drivers, passengers, and witnesses, and may also review the scene of the accident, police reports, video footage, and other relevant information. They will also review the claimant's medical records, income-related documents, and other evidence of losses related to the accident.

Review Official Records

The insurance adjuster will request and review official records related to the incident. This includes police reports, accident reports filed with the relevant authorities, medical records, and any other relevant documentation. It is important to note that the adjuster will typically require authorization from the claimant to access their medical records and other sensitive information.

Visit the Accident Scene

If the insurance adjuster deems it necessary, they may visit the scene of the accident to gain a better understanding of the incident. This is more common in severe accidents or when fault is not immediately apparent. By visiting the scene, the adjuster can answer questions about how the accident occurred and create a clearer picture of the events.

Interview Involved Parties and Witnesses

A crucial aspect of the investigation is interviewing all involved parties, including drivers, passengers, and witnesses. The adjuster will collect recorded statements from these individuals to gather their perspectives and accounts of the incident. This helps in verifying the facts and determining the sequence of events.

Review Claim Details and Policies

The adjuster will thoroughly review the details of the claim submitted by the claimant, including information about the incident, the extent of damage or injuries, and any relevant documentation. Additionally, they will review the insurance policies of the involved parties to determine which coverages may apply to the claim.

Evaluate Property Damage

In cases of property damage, such as damage to vehicles or structures, the insurance adjuster will inspect and evaluate the damage firsthand. They may coordinate inspections, write up repair estimates, and determine the costs of repairing or replacing the damaged property. This evaluation plays a crucial role in assessing the insurance company's liability.

Analyze Social Media Presence

In some cases, insurance adjusters may review the social media presence of the claimant. This is done to verify the information provided and ensure there are no discrepancies between the claimed injuries or losses and the individual's online activities. For example, if a claimant states they hurt their back in an accident but later posts about participating in a sports tournament without any mention of injury, it could raise skepticism about the validity of the claim.

Determine Fault and Payment

Once the insurance adjuster has gathered all the necessary information, they will make a preliminary determination of fault. They will review the applicable policies and determine if the insurance company is liable for the damages based on the circumstances of the incident. This involves assessing the extent of the company's potential liability and negotiating a settlement amount with the claimant.

Unraveling the Art of Loss Valuation: A Deep Dive into the Insurance Adjuster's World

You may want to see also

Frequently asked questions

An insurance adjuster, also known as a claims adjuster, is a person who investigates an insurance claim to determine if the insurer should pay for damage or injuries, and if so, how much they should pay.

There are three main categories of insurance adjusters: company adjusters, independent adjusters, and public adjusters. Company adjusters are employed by insurers, independent adjusters do contracted work for insurance companies, and public adjusters are hired by individuals to assist in assessing damages, filing claims, and negotiating with insurers to get the maximum payout for their claim.

After an emergency, insurance adjusters work to assess and evaluate the damage caused by the event. They may also help with filing insurance claims and negotiating with insurance companies on behalf of the policyholder. In some cases, adjusters may be temporarily licensed to work in a different state to assist with a disaster that has caused widespread damage.