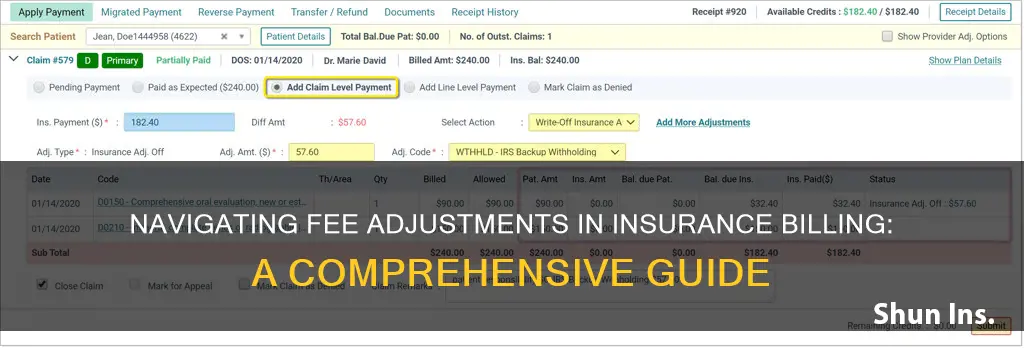

Billing insurance can be a complex process, and fee adjustments are a common occurrence. An adjustment refers to a discount on the bill, which is the portion that the hospital or doctor has agreed not to charge. This discount is specific to each insurance company and is often not transparent to the patient. When billing insurance, it is essential to understand the different types of adjustments, such as contractual adjustments, write-offs, and claim adjustments. Contractual adjustments arise when a provider is part of an insurance network and has agreed on specific rates for services. Write-offs, on the other hand, are amounts deducted by the provider that they do not expect to collect from patients or payers. Finally, claim adjustments occur when a payer denies a claim, requiring the provider to appeal or take other actions to receive reimbursement. Understanding these adjustments is crucial for accurate billing and ensuring that providers receive proper compensation for their services.

| Characteristics | Values |

|---|---|

| What is a fee adjustment? | A fee adjustment refers to the portion of a bill that a hospital or doctor has agreed not to charge. |

| Who does it apply to? | Insured persons covered by an individual or group health plan that involves a network of providers contracted by the insurer. |

| What does it mean for the insured? | The insurance company pays hospital charges at a discounted rate. The amount of the discount is specific to each insurance company. |

| What does it mean for the insurer? | The discounted amount is taken off the bill to show the true amount due from the patient (co-insurance). |

| What does it mean for the provider? | The provider's fee is reduced based on their contract with the insurer. |

| What are some reasons for adjustments? | Medical necessity, prior authorization, timely filing, bundling, coding errors. |

What You'll Learn

Fee adjustments are common when billing insurance

Contractual adjustments are common in health insurance plans involving a network of providers contracted by the insurer, such as Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO) plans. In these cases, the provider typically bills the insurer for their standard rate, and the insurer processes the claim at the agreed-upon service rate. The difference between the provider's standard rate and the contracted rate is the contractual adjustment.

Fee adjustments can also occur due to write-offs, which are amounts deducted from a medical bill that the provider does not expect to collect from patients or payers. Write-offs can occur for various reasons, including charity, small balances, no insurance, and contractual adjustments. For example, a provider may write off a small balance of $10 or $15 as uncollectible and instead try to collect it when the patient returns to the clinic.

In some cases, fee adjustments may be necessary due to claim denials. For instance, if a claim is denied for medical necessity, additional information may need to be submitted to prove that the service was medically necessary. If a claim is denied due to a lack of prior authorization, the provider can check if prior authorization was obtained and, if so, add the code and refile the claim.

Becoming an Insurance Adjuster in Missouri: A Comprehensive Guide

You may want to see also

Insurers pay hospitals at a discounted rate

The amount of the discount varies depending on the insurance company and the hospital, and it is specific to each insurance company's network of providers. The insurance company's network includes the insurer, the insured, and the providers. Each participant in the network generally benefits from the established provider network arrangement. Insurers with more market power tend to obtain lower prices from hospitals, while hospitals with more market power can obtain higher payment rates from insurers.

The discounted rate paid by the insurer is reflected in the patient's bill as an "adjustment" or "discount". This amount is subtracted from the total bill to show the true amount due from the patient, known as the co-insurance or co-pay.

The practice of insurers paying hospitals at a discounted rate has been the subject of debate and criticism. Some argue that insurers are not negotiating the best deals for their members, and that insured patients are sometimes paying higher prices than they would if they were uninsured. There is also concern about the lack of transparency in pricing, with insurers and hospitals not always disclosing their negotiated rates.

In recent years, there have been efforts to increase price transparency in the healthcare industry. The federal government has implemented rules requiring hospitals and insurers to post their negotiated rates for health care services, allowing consumers and employers to compare prices and negotiate better rates. These rules aim to reduce the wide variation in prices for similar services and empower employers and consumers to make more informed decisions about their healthcare options.

The Art of Negotiation: Mastering Insurance Adjuster Communication

You may want to see also

The discount amount is specific to each insurer

When billing insurance, the discount amount is specific to each insurer. This is because insurance companies pay hospital charges at a discounted rate, and the amount of the discount varies between insurance companies.

The "adjustment" or "contractual adjustment" on a billing statement refers to the portion of the bill that the hospital or doctor has agreed not to charge. When the insurance company pays their portion, the discounted amount is taken off to show the true amount due from the patient (co-insurance).

The discount amount is determined by the insurance company's contract with the healthcare provider. The provider usually submits the bill for their standard rate for the service, and the insurer processes the claim at the agreed-upon service rate. The reduced amount between the provider's bill and the contracted rate is the discount.

Insurers may also impose a discount off the billed price, then add the "discounted amount" and payment, and put them on one line. This makes it look like the discount off the contracted rate is part of the payment. For example, the insurer may apply a "discount" to the billed price, but not pay anything. The patient then pays the allowable or discounted price in full, thinking the insurance company paid the entire sum.

It's important to understand the billing process and the specific terms of your insurance contract to avoid confusion or unexpected costs.

The Mystery of Insurance Adjustments Unveiled: Understanding the Process and Its Impact

You may want to see also

The discount is taken off the bill, reducing the patient's payment

When billing insurance, a fee adjustment, or "discount", is taken off the bill, reducing the patient's payment. This is often due to the insurance company having negotiated a discounted rate with the healthcare provider. This is known as a contractual adjustment.

A contractual adjustment is a phrase commonly used in health insurance when an insured person is covered by an individual or group health plan that involves a network of providers contracted by the insurer. The insurance company pays hospital charges at a discounted rate, and this rate is specific to each insurance company. When the insurance company pays their portion, the discounted amount is taken off to show the true amount due from the patient (co-insurance).

The amount left after the insurance company has paid their portion is known as the patient's responsibility or patient balance. This is what the patient owes after their health insurance pays.

It's important to note that out-of-network providers set their own rates, meaning the cost of out-of-network medical bills is completely negotiable. However, with non-emergency services, it is almost always easier to negotiate medical bills before receiving the service in question.

If you are negotiating a bill, it is important to start the process early. It is also a good idea to ask for an itemized bill, which breaks down all the charges, including the cost of each procedure, medication, and service. This will allow you to see exactly what you are being billed for and identify any errors or discrepancies. You can then use this itemized bill to compare with the charges listed on your explanation of benefits (EOB).

Navigating the Claims Process: Strategies for Responding to Insurance Adjuster Questions

You may want to see also

Claim adjustments can be appealed

When a physician provides medical services, they expect to be reimbursed for that service. However, when a payer issues a denial and requires a claim adjustment, the provider may not receive their payment. In many cases, these denials can be appealed, depending on the reason for the denial.

There are two types of appeals: internal and external. If your claim is denied or your health insurance coverage is cancelled, you have the right to an internal appeal. You may ask your insurance company to conduct a full and fair review of its decision. If the case is urgent, the insurance company must expedite this process. If your internal appeal is denied, you have the right to take your appeal to an independent third party for review. This is called an external review. An external review means that the insurance company no longer has the final say over whether to pay a claim.

Appeals can be made over the telephone, through an appeal form, or with a letter of appeal from the treating physician. If a claim has been denied because it was deemed medically unnecessary, you may need to submit additional information to prove that the service was medically necessary. For example, if a person has surgery to remove excess sagging skin after significant weight loss, the claim may be denied as cosmetic surgery. However, if the physician can provide evidence that the excess skin caused chafing and irritation that led to an infection, the procedure would be deemed medically necessary.

If a claim is denied because the service is not covered by the payer, do not adjust the claim. These claims should be billed to the patient who received the service. Adjusting the claim would result in providing the service free of charge, and the responsible party for a service that isn’t covered is the patient, not the physician.

If a claim is denied due to a lack of prior authorization, the first step is to check with the office to ensure that prior authorization was not, in fact, received. If it was, simply add the code and refile the claim. If prior authorization was not obtained, find out if the payer accepts retro-authorizations.

It is important to note that only certain people and providers may submit an appeal, depending on the appeal type. For example, a TRICARE beneficiary or the parent of a minor can appeal a denied claim. Additionally, a non-network provider can appeal if they performed the service and accepted the assignment on the claim.

The Comprehensive Guide to Becoming a Roofing Insurance Adjuster

You may want to see also