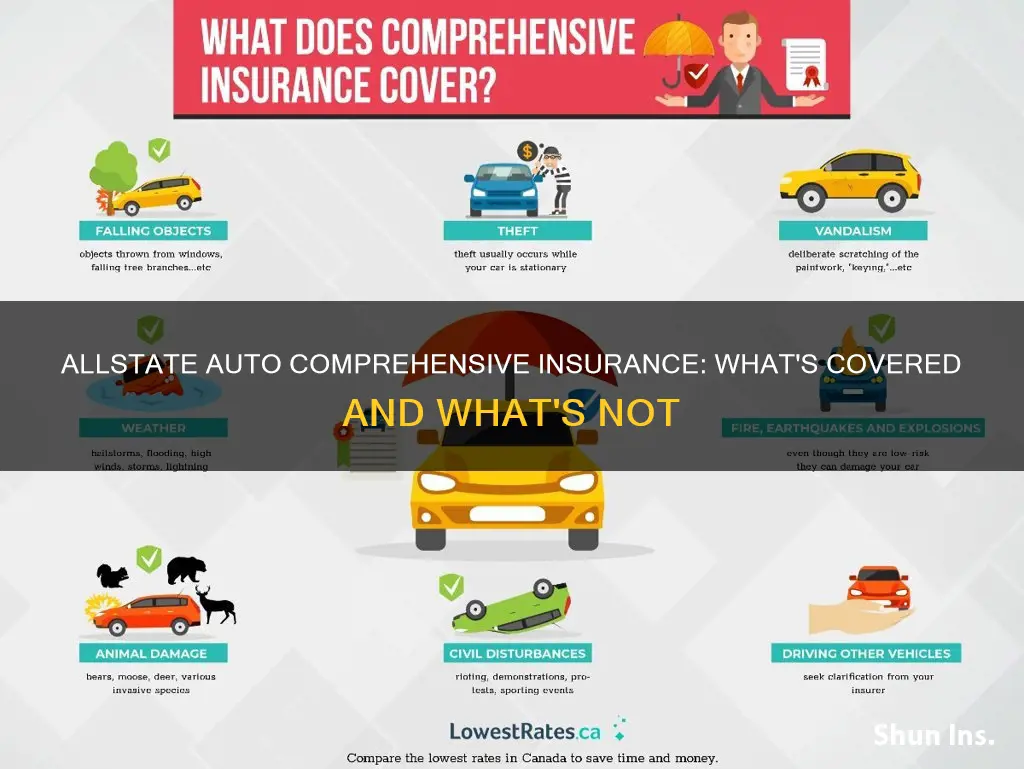

Allstate's comprehensive insurance covers damage to a policyholder's car caused by something other than a collision, including vandalism, civil disturbances, falling objects, animal damage, natural disasters, and glass damage. Comprehensive coverage is not mandatory but is often required for leased and financed cars. It is typically purchased alongside collision insurance, which covers repairs or replacements after an accident, regardless of fault. Together with the state's minimum coverage requirements, these policies are often referred to as full coverage.

What You'll Learn

Vandalism and civil disturbances

Comprehensive insurance covers damage to your car from vandalism. This includes damage to the car body, such as spray painting or scratches, as well as broken windows and lights, and slashed or stolen tires. If your car has been vandalised, you should begin the claims process as soon as possible. You will need to file a police report and contact your insurer. You will also need to meet with a claims adjuster and take your car to a repair shop.

Comprehensive insurance will not cover any personal items within the car if they were stolen during the vandalism incident. Coverage for personal belongings would come under your renters or homeowners insurance.

Comprehensive insurance is optional, but it is recommended for drivers with cars less than 10 years old and/or worth more than $3,000. It can be purchased for $50–$100 per year, depending on your insurer.

In the context of civil disturbances, comprehensive insurance will cover damage to your car caused by riots, civil commotions, and vandalism. This is because comprehensive auto coverage protects against damage by things like fire, falling objects, and vandalism, which can accompany a riot.

Njm Auto Insurance: Is It Worth the Hype?

You may want to see also

Falling objects

Comprehensive insurance is an optional add-on to your auto insurance policy that covers damage to your car that isn't caused by a collision. This includes damage from falling objects.

It's important to note that falling objects coverage typically applies when the object makes a hole in the exterior of your vehicle or causes significant damage. Smaller objects that may fall into your car, such as rocks or hail, are usually covered under a separate policy, such as collision or glass damage insurance.

In addition to natural falling objects, comprehensive insurance coverage for falling objects can also include protection against man-made objects falling from the sky. This can include satellite debris, space debris, or even falling aircraft parts. While these events are extremely rare, the financial protection provided by this type of insurance coverage can be invaluable if your vehicle is damaged by one of these falling objects.

Comprehensive insurance for falling objects provides peace of mind and financial security in the event of unexpected incidents. It ensures that you are covered for repairs or replacements needed due to damage caused by falling objects, helping to alleviate the financial burden associated with these unforeseen circumstances.

Salvage Title Insurance: Is It Possible?

You may want to see also

Animal damage

When it comes to animal-related damage to your vehicle, comprehensive insurance from Allstate has you covered. Animal damage is an unexpected but common occurrence and can leave you with costly repair bills. This is when comprehensive insurance comes to your aid, covering a range of animal-related incidents.

Comprehensive insurance covers damage caused by a range of animals, including deer, which are responsible for a significant number of animal-related car insurance claims each year. Deer-related accidents often result in substantial damage to the front end of a vehicle, including broken headlights, a shattered windshield, and body damage. Hitting a deer, or any large animal for that matter, is considered an animal collision and is covered under your comprehensive insurance policy. Smaller animals, such as birds, rabbits, or squirrels, can also cause damage, and comprehensive insurance covers these incidents as well. For example, a bird dropping a hard object onto your windshield, causing it to crack, would be covered.

It's important to note that comprehensive insurance covers damage caused by animals to your vehicle, but not any injuries sustained by the animal itself. If you collide with an animal and it is injured or killed, you are not covered for the cost of veterinary care or any other related expenses. In addition, while comprehensive insurance covers damage caused by animals, it does not cover any damage caused by your own pets. For example, if your dog chews the upholstery or scratches the paint, you would need to file a claim under your homeowners or renters insurance policy, not your auto insurance.

To file a claim for animal damage, you will need to provide evidence of the incident, such as photographs of the damage and the animal, if possible. You may also need a police report, especially if the damage is significant or if the animal was injured and had to be put down. It's always a good idea to contact your insurance provider as soon as possible after the incident to understand the specific requirements for filing a claim and to ensure a smooth claims process.

Comprehensive insurance provides valuable peace of mind for drivers, knowing that they are covered for a wide range of unexpected events, including animal-related damage. By understanding what is covered, you can feel confident that you are protected financially should an encounter with wildlife leave your vehicle damaged.

Loyalty Discounts: Do They Apply to Auto Insurance?

You may want to see also

Natural disasters and weather events

Natural disasters and extreme weather events can pose a significant threat to your vehicle. In the event of damage caused by such occurrences, comprehensive car insurance coverage can provide financial protection.

Comprehensive insurance covers vehicle damage caused by various weather-related events and natural disasters, including:

- Hail storms

- Floods

- Wildfires

- Hurricanes

- Tornadoes

For instance, if a hail storm damages your car, comprehensive insurance can cover the costs of repairs or a new windshield without you having to pay a deductible. Similarly, if your vehicle is damaged by a tornado, comprehensive insurance will typically cover the necessary repairs for damage caused by flying debris, large hail, or strong winds.

It is important to note that comprehensive coverage also extends to other types of natural disasters, such as earthquakes. While separate earthquake insurance may be needed for your home, a comprehensive auto insurance policy will cover your vehicle in the event of earthquake damage.

Comprehensive coverage is designed to protect against events outside the driver's control. Therefore, it is crucial to have this coverage in place before any damage occurs. Insurance companies may impose binding restrictions on policy changes once a natural disaster, such as a flood or wildfire, has been forecasted.

The cost of comprehensive coverage, also known as "Act of God" coverage, averages $184.14 annually. While filing a claim under this coverage will typically increase your premiums, the rate increase is generally lower than that of at-fault claims.

Choosing Auto Insurance: Coverage Basics

You may want to see also

Glass damage

Allstate's comprehensive insurance coverage includes glass damage repair or replacement. This means that if your vehicle's windshield, side mirrors, or other glass components are damaged or broken, you can file a claim with Allstate to have them repaired or replaced. Glass damage can occur due to a variety of reasons, such as flying debris, vandalism, or even extreme temperature changes. Comprehensive coverage is designed to protect you from these unexpected events.

When it comes to glass damage, Allstate's comprehensive insurance typically covers the full cost of repair or replacement. This includes the cost of the glass itself, as well as the labor and materials required for a secure installation. It is important to note that the coverage is subject to your policy's comprehensive deductible. This means that you will need to pay the deductible amount before Allstate covers the remaining costs. Be sure to review your policy documents to understand the specific details of your comprehensive coverage and deductible amount.

Allstate works with a network of trusted glass repair and replacement shops to ensure quality service for its customers. When filing a claim for glass damage, you can choose to go through this network or select your own repair facility. If you opt for a facility outside of Allstate's network, be sure to verify their reputation and quality of work beforehand. It is also recommended to request an itemized invoice after the repairs are completed, detailing the work performed and the parts used.

In some cases, glass damage may be covered by your liability insurance if it occurs as a result of a collision that was deemed your fault. However, comprehensive coverage specifically covers events that are not collisions, such as vandalism or weather-related incidents. It is always a good idea to review your insurance policy and understand the specifics of your coverage, including any exclusions or limitations, to ensure you are fully protected in the event of glass damage or any other unexpected incidents.

When dealing with glass damage, it is important to act promptly and contact Allstate as soon as possible. The longer you wait, the more likely the damage could spread or worsen. For example, a small chip in your windshield could turn into a large crack, requiring a more costly repair or even a full replacement. Taking immediate action can help ensure your safety, maintain the integrity of your vehicle, and may even prevent the need for more extensive (and expensive) repairs down the line.

Overall, comprehensive insurance coverage from Allstate provides valuable protection against glass damage. Whether it's a cracked windshield or a broken side mirror, you can rest assured that the costs of repair or replacement will be covered. By understanding your policy, acting promptly, and choosing a reputable repair facility, you can confidently navigate the claims process and get back on the road safely. Remember to always drive with caution and be prepared for unexpected events with comprehensive insurance coverage.

Insuring Old Vehicles: Is It Worth It?

You may want to see also

Frequently asked questions

Allstate comprehensive insurance covers damage to the policyholder's car caused by something other than a collision, including vandalism, civil disturbances, falling objects, animal damage, natural disasters, and glass damage. It also covers theft, including the replacement of a stolen car or stolen parts.

No, Allstate comprehensive insurance is not mandatory in any state. However, dealerships and lenders typically require it for leased and financed cars to protect their investment.

You can add comprehensive insurance to your Allstate policy by logging into your online account on the Allstate website or by calling their customer service at 1-800-255-7828.