Auto insurance liability coverage is divided into two parts: bodily injury liability and property damage liability. The numbers 25/50/15 on an auto insurance policy refer to the monetary limits of liability coverage. The first number, $25,000, is the maximum amount that the insurance company will pay for bodily injury liability per person. The second number, $50,000, is the maximum amount that will be paid for bodily injury liability for all persons in one accident. The third number, $15,000, is the maximum amount that will be paid for property damage liability in one accident.

| Characteristics | Values |

|---|---|

| First number | $25,000 bodily injury liability coverage per person |

| Second number | $50,000 bodily injury liability coverage per accident |

| Third number | $15,000 property damage liability coverage per accident |

What You'll Learn

- $25,000 is the maximum coverage for bodily injury liability for one person

- $50,000 is the maximum coverage for bodily injury liability for all persons

- $15,000 is the maximum coverage for property damage liability

- The policy covers medical and funeral expenses

- Liability insurance is required in almost every state

$25,000 is the maximum coverage for bodily injury liability for one person

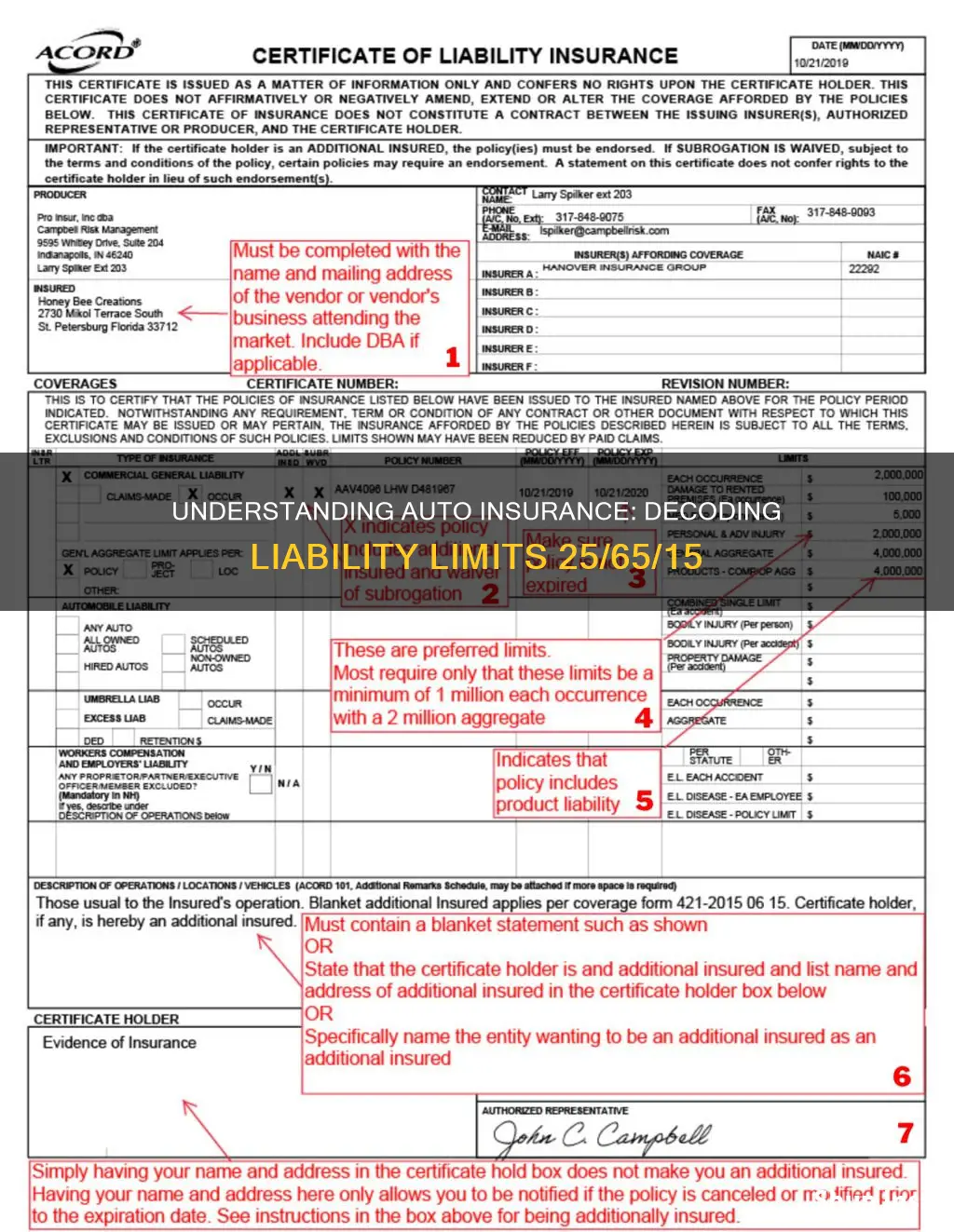

When it comes to auto insurance liability, the numbers 25/65/15 indicate the monetary limits of your liability coverage. In this case, $25,000 is the maximum coverage for bodily injury liability for one person in an accident. This means that if you are at fault in a car accident and one person is injured, your insurance company will pay up to $25,000 for their medical bills, lost wages, and funeral costs if necessary.

Bodily injury liability coverage is designed to protect you financially if you are responsible for injuring someone else in a car accident. It covers the expenses related to the injuries sustained by the other person, including medical bills, lost income if they are unable to work, and funeral expenses if the accident results in a fatality. This type of coverage is usually mandatory in most states, with minimum requirements set to ensure drivers can demonstrate financial responsibility. While the minimum requirement is often set at $25,000 per person, it's recommended to get higher coverage limits if possible to provide better financial protection in the event of an accident.

It's important to note that bodily injury liability coverage does not include your own medical expenses or property damage. If you want coverage for your own injuries and vehicle repairs, you would need to purchase additional insurance options, such as collision coverage or personal injury protection.

While having the minimum required bodily injury liability coverage is essential for legal compliance, it's worth considering higher coverage limits to protect your assets in the event of a costly accident. The recommended coverage amount is typically 100/300/100, providing up to $100,000 per person and $300,000 per incident for bodily injury liability, along with $100,000 for property damage liability.

By understanding the limits of your auto insurance liability coverage, you can make informed decisions about your policy and ensure you have adequate protection in case of an accident.

Canceling AAA Auto Insurance: A Step-by-Step Guide

You may want to see also

$50,000 is the maximum coverage for bodily injury liability for all persons

Auto insurance liability coverage is typically presented in a three-number format, such as 25/50/10 or 25/50/15. The first number refers to the maximum coverage for bodily injury liability for one person, the second number is the maximum coverage for bodily injury liability for all persons, and the third number is the maximum coverage for property damage liability. So, in the case of 25/50/15, this means that the policy provides up to $25,000 in coverage for bodily injury liability for one person, $50,000 for bodily injury liability for all persons, and $15,000 for property damage liability.

In this case, $50,000 is the maximum coverage for bodily injury liability for all persons. This means that the insurance company will pay up to $50,000 total for all individuals injured in a single accident. So, if there are multiple people injured in an accident, the $50,000 coverage limit will have to be divided among them. For example, if there are two people injured in the accident, each person's medical expenses would be covered up to $25,000. If there are three or more people injured, the $50,000 limit would have to be divided among them, with each person receiving a smaller portion of the coverage.

It's important to note that these coverage limits are typically per accident, so if there are multiple accidents, the coverage limits reset for each accident. Additionally, these coverage limits are typically the maximum that the insurance company will pay, and the policyholder may still be responsible for any expenses that exceed these limits.

The specific coverage limits can vary depending on the insurance provider and the state's requirements. Some states may have higher or lower minimum coverage requirements for bodily injury liability for all persons. It's important for drivers to understand the coverage limits and requirements in their state and to ensure they have adequate insurance coverage in case of an accident.

Owing One Company, Insuring with Another

You may want to see also

$15,000 is the maximum coverage for property damage liability

Property damage liability insurance covers damage to another person's vehicle or property. This includes damage to their car, as well as any diminished value to the vehicle as a result of the crash. It also covers damage to buildings, structures like fences and lampposts, and landscaping like trees. Additionally, property damage liability may cover legal expenses if you are sued as a result of the accident.

It is important to note that property damage liability insurance does not cover damage to your own vehicle. If you want insurance coverage for damage to your own car, you will need to purchase comprehensive and collision coverage.

Most states require drivers to carry a minimum amount of property damage liability insurance. While it is not mandatory in all states, it is still a good idea to have this coverage to protect yourself financially in case of an accident. The minimum amount of coverage required varies by state, but it is generally recommended to purchase more than the state-mandated minimum to ensure you have sufficient coverage.

When shopping for car insurance, it is important to understand the different types of coverage and their limits. In the case of 25/50/15 insurance, the first two numbers refer to bodily injury liability coverage, while the third number represents the property damage liability limit. This means that the policy will cover up to $25,000 per person and $50,000 per accident for bodily injuries, and up to $15,000 for property damage.

American Express Everyday Card: Exploring the Auto Rental Insurance Advantage

You may want to see also

The policy covers medical and funeral expenses

A 25/65/15 auto insurance policy covers up to $25,000 per person and $65,000 per accident for bodily injury liability, and $15,000 per accident for property damage liability. This means that the policy will cover medical and funeral expenses, up to the value of the relevant liability limit.

Medical Expenses

If you are injured in an accident, your insurance company will pay up to the per-person limit for your medical bills. If you have a 25/65/15 policy, your insurer will cover up to $25,000 of your medical expenses. If your bills come to more than this, you will be expected to pay the difference out of pocket.

If multiple people are injured in an accident, the insurance company will pay up to the per-accident limit for medical expenses. For a 25/65/15 policy, this means that the insurer will cover up to $65,000 in total for all injured parties. If there are multiple people injured, each person's medical expenses will be paid out of this $65,000 limit. If the total medical expenses exceed this limit, the injured parties will be expected to pay the difference.

Funeral Expenses

Certain types of auto insurance will cover funeral expenses after a fatal accident. Personal injury protection (PIP) and medical payments coverage (MedPay) are examples of policies that can cover funeral costs for you or your passengers after a fatal accident.

In some states, PIP and MedPay are mandatory, and in others, they are completely optional. PIP and MedPay policies will cover the cost of ceremonies, burial expenses, and/or cremation.

Auto Insurance: Age-Based Discounts

You may want to see also

Liability insurance is required in almost every state

Liability insurance is a type of insurance coverage that protects your business or yourself from claims of bodily injury, property damage, and reputational harm resulting from your business activities. It covers legal and settlement costs arising from lawsuits, as well as medical payments.

In the context of auto insurance, liability insurance covers the cost of damages to other people or their property in the event of an accident. The specific numbers in a policy, such as 25/50/15, refer to the monetary limits of the policy's liability coverage. In this example, the policy will cover up to $25,000 per person for bodily injury, $50,000 total for bodily injury per accident, and $15,000 for property damage.

The purpose of mandatory liability insurance is to ensure that drivers can cover the cost of damage to other people or property in the event of an accident. While it is not compulsory in all states, those who choose to drive without liability insurance may face penalties such as fines, license suspension, or even jail time. Additionally, being involved in an accident without adequate insurance coverage can result in significant financial burden, as the driver will be personally responsible for any damages exceeding their policy limits.

It is important to note that liability insurance only covers damages to third parties and not to the policyholder themselves. As such, it is recommended to purchase additional insurance coverage, such as collision coverage or comprehensive coverage, to protect yourself and your vehicle in the event of an accident.

Understanding Auto Insurance Numbers: Decoding Your Policy

You may want to see also

Frequently asked questions

The first number, 25, stands for $25,000. This is your maximum coverage for bodily injury liability for one person injured in one accident or incident.

The second number, 50, stands for $50,000. This is your maximum coverage for bodily injury liability for all persons injured in one accident.

The third number, 15, stands for $15,000. This is your maximum coverage for property damage liability in an accident.

Auto liability insurance is divided into two parts: bodily injury liability and property damage liability. These two parts work together to compensate anyone who was injured by your vehicle, protecting your financial health and assets.