Term life insurance provides coverage for a specific period, typically 10 to 30 years. When a term life insurance policy expires, the coverage ends, and the policyholder stops paying premiums. If the policyholder passes away after the policy ends, their beneficiaries will not receive a death benefit. However, if the policy included a return-of-premium feature, the policyholder would receive a refund of the premiums paid during the term. Several options are available to individuals who still require coverage after their term life insurance policy expires, including renewing the current policy, converting to a permanent life insurance policy, or purchasing a new term life insurance policy.

| Characteristics | Values |

|---|---|

| What happens when term life insurance expires? | You might still need coverage for various reasons, including ongoing debts, dependents still needing support, or new financial obligations. |

| What happens if the policy expires? | The insurance carrier sends a notice, premiums stop, and there is no longer a death benefit. |

| Return-of-premium feature | If included in the policy, the policyholder would receive a check for the premiums paid during the term. |

| Renewal option | Some term policies offer the option to renew annually after the initial term expires, at a higher cost due to age-related risk increases. |

| Conversion rider | Many term policies include a conversion rider that allows you to change your term policy into a permanent policy without needing to go through underwriting again. |

| Coverage amount | The amount of coverage depends on factors such as age, income, mortgage, debts, and anticipated funeral expenses. |

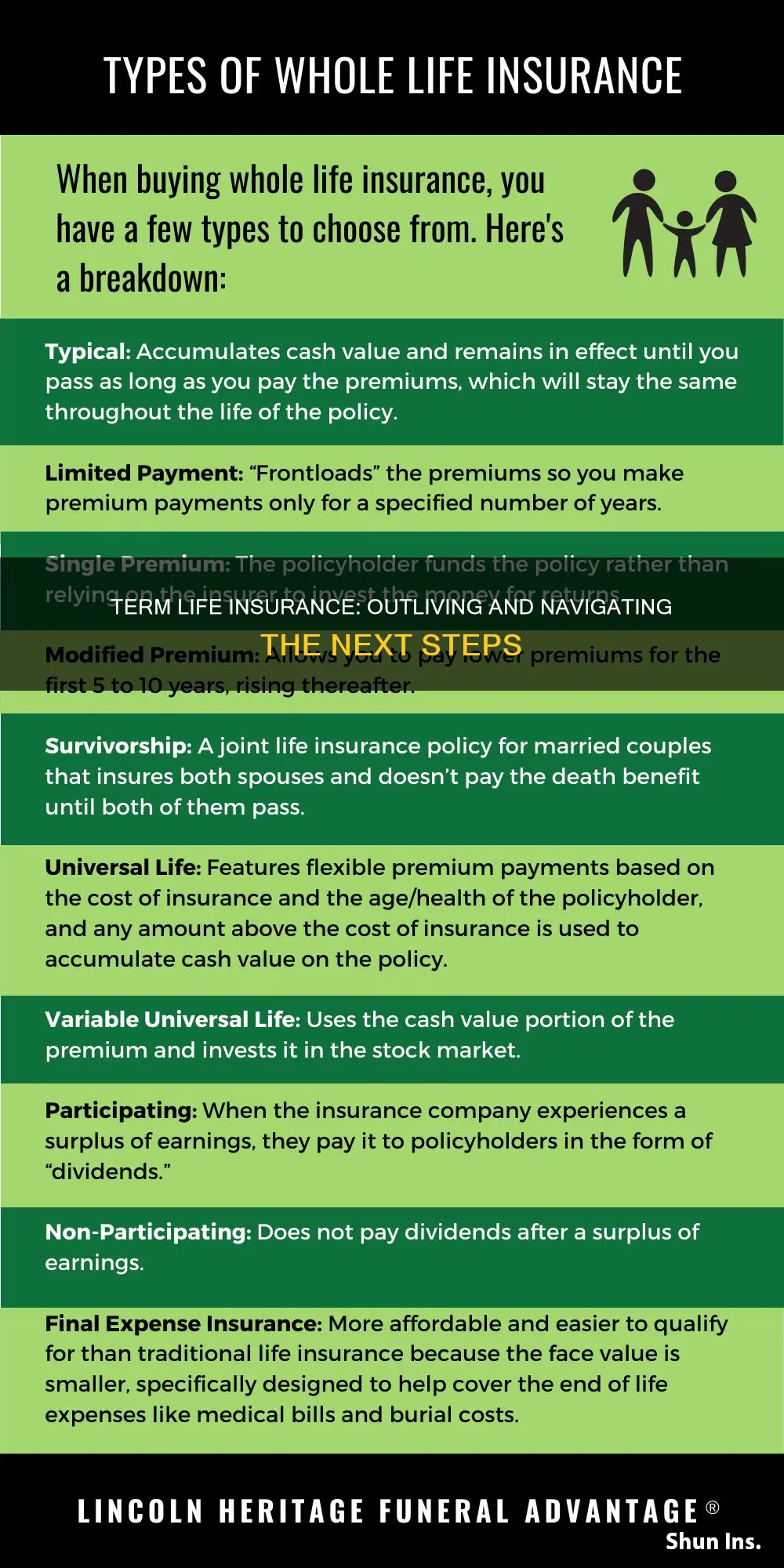

| Whole life insurance | Combines life insurance with an investment component, offering tax-deferred savings benefits. |

| Permanent life insurance | More expensive than term life insurance, with lifetime coverage and a cash value component. |

| Final expense insurance | A type of permanent insurance with low coverage limits, suitable for older adults who want to cover end-of-life expenses without a large payout. |

| Do you still need life insurance? | Assess financial independence of dependents, debt status, retirement savings, and spouse's financial stability to determine if continued coverage is needed. |

What You'll Learn

You can extend your current policy

If you outlive your term life insurance policy, you will no longer have coverage. However, you can extend your current policy, which is a good option if you need coverage for only a few more years.

Many term life insurance policies include a guaranteed renewability clause that will let you extend your coverage past its expiration date on a year-to-year basis. Your death benefit stays the same, and you won't have to reapply or undergo another life insurance medical exam. However, your premium is likely to increase each year you renew.

Some policies allow you to renew on this basis up to age 95. If you were diagnosed with a terminal illness and were unlikely to be eligible for a new policy, you could renew your term policy for a few years to ensure your beneficiaries would receive a death benefit.

While you can't get your premium dollars back from a standard term life insurance policy once it expires, if you buy a return of premium (ROP) rider, you could get some or all of your premium back if you outlive your policy.

Many term policies have a guaranteed renewability provision that allows you to keep your insurance in effect after the end of the original term as long as you continue to pay the premiums. While your premiums are likely to rise each year, you typically won't have to submit to a new physical exam.

If you need coverage for longer than a year or two, you should consider other options to avoid paying a premium that rises every year. Most term life insurance policies offer the option to renew for a limited number of years without requiring evidence of insurability. This means you can extend your coverage even if your health has changed. For instance, a 10-year term policy may be renewable each year for up to 10 additional years. During each renewal, your premium will increase based on your current age.

Strategies to Secure 100 Life Insurance Prospects

You may want to see also

You can convert to a permanent life insurance policy

If you outlive your term life insurance policy, you will no longer have coverage. However, you can convert to a permanent life insurance policy. This option is particularly useful if you are older and your health has declined, as it will be more challenging to obtain a new policy.

Term life insurance is a policy that is in effect for a specific period, such as 10, 20, or 30 years. It is more affordable than permanent life insurance, as it does not build cash value and only provides coverage for a limited time. On the other hand, permanent life insurance offers lifelong coverage and includes a cash value component that grows over time and can be used for various purposes, such as collateral for loans or withdrawals.

Converting your term life insurance policy to a permanent one can provide you with continued coverage for the rest of your life. While the premiums will be higher, you may have the option to convert to a policy with a smaller death benefit, resulting in lower premiums. Additionally, the conversion process is often straightforward, as many term policies include a term conversion rider that allows for conversion without a physical exam. This rider lets you maintain your original health classification, even if your health has worsened, which can save you money on premiums.

It is important to note that policies differ in terms of when you can make the switch to a permanent policy, and there may be age limits. Therefore, it is essential to carefully review your policy or contact your insurance company or agent to understand the specific provisions and any applicable deadlines for conversion.

Life Insurance for Children: Is It Worth It?

You may want to see also

You can buy a new term life insurance policy

If you outlive your term life insurance policy, you will no longer have coverage. However, if you still need life insurance, you can buy a new term life insurance policy. Here are some things to keep in mind when considering this option:

Cost of a new policy

The cost of a new term life insurance policy will depend on your age and health status. As you are older now, your rates will be higher than when you first purchased life insurance. Any new medical conditions that have arisen since your initial policy will also affect the cost of a new policy. Additionally, you will likely need to undergo a new medical exam as part of the application process, unless you qualify for simplified issue life insurance.

Choosing a new policy term

When purchasing a new term life insurance policy, you can choose a coverage amount and term length that fits your current needs. For example, if you have nine years left on your mortgage, you may consider a 10-year policy. You will likely need less coverage than when you first purchased life insurance, especially if you have fewer financial obligations.

Timing of purchasing a new policy

It is recommended to start looking for a new policy at least six months before your current policy expires. This will give you time to shop around and compare different options without having a coverage gap that could leave your family without financial support.

Comparing different insurers

You can choose to purchase a new term life insurance policy from your current insurer or shop around for a new provider. It is worth comparing the rates and coverage options offered by different insurers to find the best option for your needs.

In summary, buying a new term life insurance policy can be a good option if you are relatively young and in good health, as it may be the most inexpensive option for continuing your life insurance coverage. However, it is important to consider the increased cost due to your age and any changes in your health status, as well as the timing and term length of the new policy.

Life Insurance and 8938: What's the Connection?

You may want to see also

You can buy permanent life insurance

If you outlive your term life insurance, you can buy permanent life insurance, which offers lifelong protection. This type of insurance is more expensive than term life insurance, but it can be a good option for those who want to ensure their loved ones are financially protected, no matter when they die.

Permanent life insurance policies have two main types: whole life and universal life. Whole life insurance offers fixed and guaranteed premiums, a guaranteed rate of return on cash value, and a fixed death benefit. The cash value component increases over time based on the interest rate, and the policyholder may receive dividends. Universal life insurance, on the other hand, offers more flexibility, allowing the policyholder to adjust their premium payments and death benefit within certain limits. The cash value growth in a universal life policy is also tax-deferred, but the projected future guaranteed cash value may change over time.

When purchasing permanent life insurance, you can choose from several variations, including:

- Whole life insurance: Offers fixed premiums, a guaranteed death benefit, and a cash value component that grows at a guaranteed rate.

- Universal life insurance: Provides flexible premiums and death benefits, with a cash value component that earns interest based on current market rates or a fixed rate.

- Indexed universal life insurance: Similar to universal life, but the cash value component is tied to a stock market index, providing the potential for higher returns.

- Variable universal life insurance: Combines the flexible features of universal life insurance with investment options for the cash value component, allowing policyholders to invest in various sub-accounts.

It's important to note that permanent life insurance may not be suitable for everyone due to its higher cost. However, it can be beneficial for individuals who want to build cash value, leave a financial legacy for their heirs, or ensure lifelong financial protection for their dependents.

Obtaining a Non-Resident Life Insurance License: A Comprehensive Guide

You may want to see also

You can get your money back with a return of premium rider

If you outlive your term life insurance policy, you can get your money back with a return of premium (ROP) rider. This optional add-on is an endorsement that can be attached to a basic policy contract to enhance its flexibility and fit. The ROP rider provides a refund of premiums if you are still alive when your term policy ends. For example, if you purchased a 20-year term policy at age 30 and are still alive 20 years later, your money will be refunded to you.

The cost of adding an ROP rider or purchasing a policy with this built-in provision will typically be higher than that of a traditional term policy or a term policy without the rider. This is because the ROP rider provides a benefit that a traditional term policy does not: the return of your premium if you outlive the policy term. This additional benefit makes the ROP rider a fairly low-risk savings option, especially if you already want term insurance.

However, it is important to consider whether the ROP rider is worth the additional cost. You may be able to achieve a better return by saving and investing the money that would have been spent on the ROP rider. Additionally, the ROP rider may not be the best choice if you are a senior or believe you have a higher risk of dying during the policy term, as the higher quotes may reduce the total given to your beneficiary.

When deciding whether to add an ROP rider to your term life insurance policy, it is important to speak to an agent or company representative. They can help you weigh your policy options and find the best fit for your individual needs. It is also important to note that not all life insurance companies offer the same type of policy riders, and riders may be subject to underwriting and may not be available with certain health conditions or occupations.

How Life Insurance for Grandparents Works?

You may want to see also