There are many apps available that allow users to compare auto insurance policies, loans, and repair costs. These apps can help users save time and money by providing a platform to compare multiple insurance quotes and choose the best option for their needs. Some popular apps in this category include Jerry: The AllCar™ App, Insurify, Compare.com, and Way.com. These apps offer various features such as digital insurance cards, rewards for safe driving, and the ability to bundle policies for additional savings. When choosing an app, it is important to consider factors such as the number of insurance companies included, the ease of use, and the availability of real-time quotes.

| Characteristics | Values |

|---|---|

| Name of the app | Insurify |

| Availability | Apple App Store and Google Play |

| Number of downloads | 50,000+ |

| Ratings | 3.8 stars in the App Store and 3.5 stars on Google Play |

| Quotes | Customized, real-time quotes from multiple companies |

| Purchase | Ability to complete the purchase online or by speaking with an agent |

What You'll Learn

Compare car insurance policies, loans, and repair costs

Comparing car insurance policies, loans, and repair costs can help you make informed decisions and save money. Here's how you can compare each of these aspects:

Car Insurance Policies:

Comparing car insurance policies is an effective way to find the best coverage at the most affordable rate. By using comparison websites or apps, you can get real-time quotes from multiple insurance providers without the risk of spam. These platforms allow you to input your information, such as your age, location, driving record, and vehicle details, to receive personalized quotes. It's important to compare the same types of coverage, including liability-only or full coverage, across different insurers. Additionally, consider the quality, reputation, and financial strength of the insurance company, especially in the event of a claim. Comparing rates regularly, such as every six months, is a good idea as the marketplace changes quickly.

Car Loans:

When comparing car loans, it's essential to understand the loan terms, interest rates, and your credit score. Online auto loan comparison calculators can help you input different loan scenarios to find the best option. Generally, a higher credit score can lead to lower interest rates. Getting pre-approved for a loan from a financial institution, such as a credit union, may result in a lower interest rate, and their exclusivity can work in your favour. It's worth noting that there is usually no minimum credit score requirement for a car loan.

Repair Costs:

Estimating repair costs in advance can help you make informed decisions and avoid unexpected expenses. If your vehicle is under warranty, some repairs may be covered at no additional cost. For older vehicles or repairs not covered by the warranty, you can use auto repair pricing tools to get an estimate. These tools provide a range of fair repair prices in your local area, including parts and labour. It is recommended to get multiple quotes from different repair shops and dealerships to find the most competitive pricing. Additionally, some repair shops and dealerships offer financing or payment plans for more expensive repairs.

Understanding Auto Insurance Reimbursement: Your Guide to Getting Covered

You may want to see also

Find the best insurance rates

There are many apps and websites that allow you to compare insurance rates from different providers. These include Jerry, Gabi, The Zebra, WalletHub, Compare.com, Policygenius, Insurify, NerdWallet, and QuoteWizard.

When comparing insurance rates, it's important to know what you're looking for. Insurance rates are determined by a number of factors, including your age, gender, vehicle, location, credit history, driving record, and claims history. Knowing your state's insurance requirements is also important.

- Prepare by gathering basic information such as driver's license numbers, vehicle identification numbers, and previous policy coverage limits.

- Decide on the level of coverage you need. For example, if you lease or finance your car, you'll need comprehensive and collision coverage.

- Choose a reputable comparison platform that provides real-time quotes and doesn't sell your data.

- Explore discounts offered by insurance providers, such as good driver discounts or student discounts.

- Manage your payments by being prepared to make a down payment and set up a payment plan.

By comparing insurance rates and considering these tips, you can find the best insurance rates that meet your needs.

Auto Repair Insurance: Worth the Cost?

You may want to see also

Get quotes from multiple insurance companies

Getting quotes from multiple insurance companies is a great way to ensure you're getting the best deal on your car insurance. Here are some tips on how to get quotes and find the right policy for you:

Research Insurer Reputation

It's important to know how insurance companies treat their customers. Look for things like claims satisfaction and customer complaints. Check out reviews and ratings from organizations like the Better Business Bureau and J.D. Power. This will help you narrow down your options and choose companies with a good reputation.

Choose Your Preferred Method

You have a few options for getting insurance quotes: local captive agents, independent agents or brokers, or online comparison sites. Captive agents work for a specific insurance company, while independent agents and brokers offer policies from multiple companies. Online comparison sites, such as The Zebra, allow you to compare quotes from multiple companies at once.

Consider Your Coverage Needs

Think about the type of coverage you need. While minimum liability coverage is required in most states, it may not be sufficient for your needs. Consider factors such as the value of your vehicle, your driving history, and the level of protection you want.

Evaluate Your Budget

Determine how much you can afford to spend on car insurance. Keep in mind that the cheapest option may not always be the best. Compare the coverage and benefits offered by different insurers to find the best value for your money.

Choose Your Policy

Once you've gathered quotes and considered your coverage needs and budget, it's time to choose a policy. Compare the quotes based on price, coverage limits, and deductibles to find the one that best suits your needs.

Provide Necessary Information

When getting quotes, you'll need to provide some basic information, such as your name, address, driver's license information, vehicle details, and driving history. This information will help insurance companies assess your risk and provide an accurate quote.

By following these steps and comparing quotes from multiple insurance companies, you can find the right car insurance policy that offers the coverage you need at a price that fits your budget.

Canceling Travelers Auto and Home Insurance

You may want to see also

View and compare insurance coverage

When comparing insurance coverage, it's important to consider a few key factors to ensure you're getting the best value for your money. Here are some tips to help you view and compare insurance coverage:

- Know Your State's Requirements: Understand the minimum insurance requirements in your state. This will ensure that you comply with the law and avoid any penalties or fines.

- Assess Your Needs: Determine the level of coverage you need based on your vehicle, driving habits, and personal preferences. Consider factors such as the age and value of your car, how often you drive, and whether you need comprehensive or collision coverage.

- Compare Multiple Quotes: Don't settle for the first quote you receive. Use comparison websites or apps to get quotes from multiple insurance providers. This will help you find the most competitive rates and coverage options.

- Consider Your Budget: Decide how much you can afford to spend on insurance. Compare the premiums, deductibles, and coverage limits offered by different insurers to find a plan that fits your budget.

- Research the Insurance Company: Look into the reputation, financial stability, and customer service of the insurance companies you're considering. Check reviews and ratings to ensure they have a good track record of handling claims and providing satisfactory service.

- Understand the Policy Details: Carefully review the coverage limits, exclusions, and any additional benefits offered by each insurance policy. Make sure you know exactly what is and isn't covered before making a decision.

- Seek Discounts: Ask about potential discounts such as good driver discounts, multi-policy discounts, or loyalty programs. These can help lower your premium and make your chosen policy more affordable.

- Review the Fine Print: Pay attention to the terms and conditions of the insurance policy. Understand the renewal process, cancellation policy, and any other relevant details to avoid surprises later on.

- Consult a Licensed Agent: If you have questions or need guidance, don't hesitate to reach out to a licensed insurance agent. They can provide personalized advice and help you navigate the complexities of insurance coverage.

Auto Insurance Negotiation: Tips to Lower Your Rates

You may want to see also

Bundle insurance policies

Bundling insurance policies is a great way to save money and simplify your insurance management. By purchasing multiple types of insurance policies from the same provider, you can take advantage of discounts and manage all your policies in one place. Here are some things to keep in mind when considering bundling insurance policies:

Benefits of Bundling Insurance Policies:

- Discounts and Savings: One of the biggest advantages of bundling insurance policies is the potential for significant discounts and savings on your premiums. Most insurance companies offer bundling discounts, also known as multi-policy or multi-line discounts, when you purchase multiple types of policies from them. These discounts can range from 7% to 25% or more on your total insurance cost.

- Convenience and Streamlined Management: With bundling, you only have to deal with one insurance company, which simplifies the management of your policies. You can often use a single app or online account to manage multiple insurance products, view and download policy documents, pay and manage bills, and file and track claims. This streamlined approach saves you time and effort.

- Single Deductible: In some cases, bundling insurance policies can lead to having a single deductible for multiple policies. For example, if your vehicle and home are damaged in the same covered event, you may only need to pay one deductible instead of two, making the claims process more straightforward.

Things to Consider:

- Availability of Bundling: Not all insurance companies offer both home and auto policies, or other specific types of insurance you may need. Before deciding on bundling, ensure that your chosen insurer provides all the necessary coverage options.

- Limited Coverage and Discount Options: When bundling, you might find it challenging to find a carrier that offers all the specific coverage types and endorsements you require. Some specialized discounts may also be difficult to find across multiple policies with the same company.

- Cost Comparison: While bundling can offer significant savings, it's important to compare costs with other insurers. In some cases, you might find lower rates for the same coverage by purchasing separate policies from different companies, even without a bundling discount. Shop around and get quotes from multiple insurers to find the best deal.

Examples of Insurance Bundling:

- Home and Auto Insurance: This is one of the most common types of insurance bundles. By insuring your home and vehicle with the same company, you can often take advantage of substantial bundling discounts. Companies like Liberty Mutual, Allstate, Farmers, Nationwide, State Farm, and Progressive offer bundling options for home and auto insurance.

- Auto and Renters Insurance: If you're renting a home, bundling your auto and renters insurance can be a great way to save money. Many insurance companies, such as Liberty Mutual and Progressive, offer discounts for combining these policies.

- Other Bundling Options: In addition to home and auto, you can often bundle other types of insurance policies, such as RV, boat, motorcycle, life insurance, and more. The availability of bundling options and discounts may vary depending on your chosen insurance company and your specific needs.

Remember to carefully review the coverage options, discounts, and customer service ratings of the insurance companies you're considering for bundling. While bundling can offer convenience and savings, it's important to ensure that you're getting the right coverage for your needs at a competitive price.

Home and Auto Insurance: Best Companies for Peace of Mind

You may want to see also

Frequently asked questions

Comparing car insurance quotes from multiple providers is the best way to ensure you're getting the best deal. You can do this by using a car insurance comparison site or app.

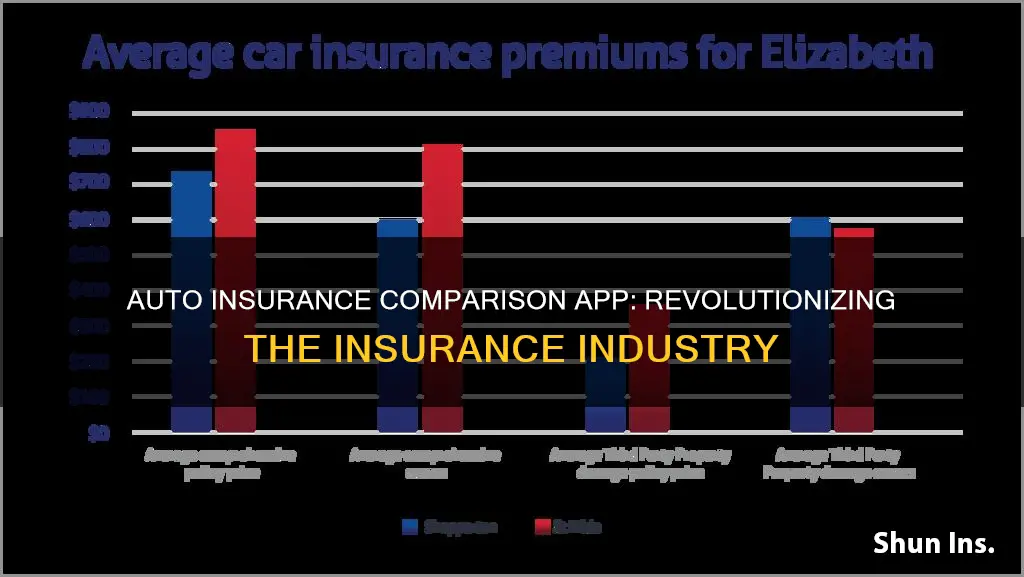

The cost of car insurance varies depending on several factors, including age, location, driving record, and type of car. The national average for full-coverage car insurance is $211 per month, while liability insurance averages $104 per month.

It's a good idea to compare car insurance rates every six months to a year, as the marketplace changes quickly. This is especially important if you've had any recent life changes, such as getting married or adding a new driver to your policy.

To compare car insurance rates, you'll need some basic information about yourself and your vehicle, including your age, address, driving record, and vehicle make and model.

Yes, there are several apps that allow you to compare car insurance rates, including Jerry, Gabi, The Way, and WalletHub. Many major insurance companies, such as Geico, Progressive, and Allstate, also have apps that allow you to get quotes directly from them.