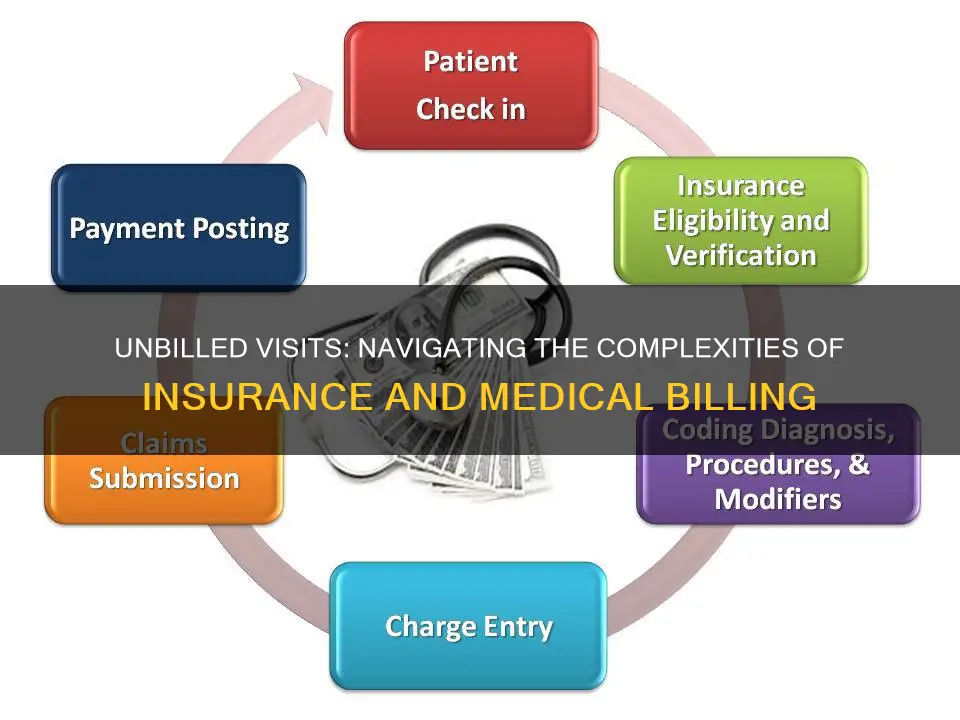

If your doctor doesn't bill your insurance, it could be for a number of reasons. Firstly, not all doctors accept health insurance, and some are cash-only. Secondly, your doctor may be out-of-network, which means that they will bill your insurance company, but then charge you for the remaining balance. In this case, you may be able to get out-of-network coverage or find an in-network provider instead. If you do receive a bill, it's important to check that the charges are correct and that your insurance company hasn't made an error. You can also try negotiating with the doctor to reduce the bill or set up a payment plan.

| Characteristics | Values |

|---|---|

| Reasons for doctors not accepting insurance | Doctors may stop working with insurance plans if they believe the health insurance company isn't paying enough. |

| What to do if your doctor doesn't accept your insurance | You can try to get out-of-network coverage or find an in-network provider instead. You can also ask if the doctor will take a reduced fee or provide flexible payment terms. |

| What to do if you can't pay a medical bill | You can negotiate with the medical provider, asking for a discount or offering proof of income or expenses that prevent you from working. You can also work with a medical advocacy agency that works with clients for free. |

| What to do if your medical bill has mistakes | You can get an itemized copy of your bill and talk to your medical provider and your insurance company. You can also dispute the bill with a collection agency. |

| What to do if your health insurance won't pay for a medical service | You can negotiate with your insurance company and healthcare providers to work out a payment plan or a discount. You can also work with a medical billing advocate to reduce your costs by looking for erroneous billing practices. |

What You'll Learn

You will be responsible for the medical bills

If your doctor doesn't accept your insurance, you will be responsible for the medical bills. This situation can arise if your doctor is out-of-network or does not accept insurance at all. In such cases, you will need to pay the medical bills yourself, and it is important to be aware of this before your appointment to avoid unexpected costs.

When facing medical bills that are not covered by insurance, there are several steps you can take to manage the financial burden:

- Understand your bill: Request an itemized bill to ensure that all charges are accurate and reflect the services you received. Compare it with your insurance plan to determine what charges you are responsible for and if there are any discrepancies.

- Communicate with your medical provider: Contact your medical provider to discuss any concerns or discrepancies in the bill. They may be able to review and correct any mistakes, or provide a letter explaining their disagreement with your insurer's denial decision.

- Review your insurance plan and appeal: Carefully review your insurance plan and reach out to your insurance company to understand their coverage and appeal processes. If you believe they should cover the bill or reimburse you, file an appeal within the specified timeframe, providing relevant medical records and letters from your doctor.

- Dispute the bill with a collection agency: If the bill goes to a collection agency during the appeal process, send a letter within 30 days disputing the bill and requesting them not to send it to court. Communicate with your doctor or hospital about the dispute and provide necessary information.

- Seek financial assistance: Explore financial assistance programs, sometimes called "charity care," which provide free or discounted healthcare for those struggling to pay medical bills. Nonprofit organizations may also offer help with paying for medical bills, prescription drugs, and other expenses.

- Negotiate with your medical provider: If all else fails and you are still responsible for the bill, negotiate with your medical provider. Ask for discounts, offer proof of financial difficulties, and explore interest-free repayment plans.

It is important to act promptly when dealing with medical bills to avoid late fees, interest charges, and potential damage to your credit score. Staying organized, keeping detailed records, and seeking help when needed can make navigating this complex process more manageable.

Weighing the Benefits: Exploring Term Insurance for Your Children's Future

You may want to see also

You can try to get out-of-network coverage

If your doctor doesn't accept your insurance, you can try to get out-of-network coverage. Out-of-network charges refer to the costs incurred when you seek care from a provider outside of your insurance company's group of affiliated providers. This can be expensive, especially if you have a health maintenance organization (HMO) plan.

To avoid unexpected costs, it's important to review your insurance plan and understand what is and isn't covered. Your "summary of benefits and coverage" (SBC) will give you a snapshot of your plan's benefits, including what services are covered, cost-sharing, and any exceptions. If you've misplaced your SBC, you can request a new copy from your insurer or employer.

If you know you'll be needing to seek care from an out-of-network provider, you may be able to negotiate with your insurer to get a network exception. This could be the case if there are no in-network providers within a reasonable distance or if the out-of-network provider has a level of expertise that's superior to the available in-network providers for a particular procedure.

If you know you'll be paying for out-of-network care yourself, you can try to negotiate a lower price directly with the medical provider. They may offer you a discounted rate in exchange for paying cash or agreeing to a short payment time frame. When negotiating, it's important to remain calm and polite, and to keep a paper trail of your conversations.

Even if you do your best to choose in-network providers, you may still receive a surprise out-of-network bill. This could be because you were treated at the nearest hospital in an emergency, or because an in-network hospital used an out-of-network anesthesiologist or assistant surgeon. In these cases, you could be left with a bill for the difference between what the provider charges and what your insurance pays, known as "balance billing".

To avoid this, you can ask your insurer to cover your care at the in-network rate. This may be possible if you or a family member has a rare, serious illness or health problem, and there is no provider in your network with the training or experience to treat it properly. In this case, with prior approval from your insurer, you may be able to go out of the network while still paying the lower, in-network rate.

If your insurer agrees to this, be sure to work out the details in advance. Usually, your out-of-network referral will be to a specific doctor, but any doctor managing your care will work with other providers who perform related procedures. Claims from these other providers may be processed as out-of-network, and you will have to appeal the insurer's decision.

The Economics of Insurance: Unraveling the Affordability Paradox

You may want to see also

You can find an in-network provider

If your doctor doesn't accept your insurance, you can find an in-network provider instead. This can save you money, as out-of-network providers can leave you with unexpected medical bills. In-network providers have agreed to accept payment from your health plan at agreed-upon rates.

There are several ways to check whether a doctor is in your network:

- Check your insurance company's website for an updated network list.

- Call your insurance company. You can usually find their phone number on your health insurance member ID card.

- Ask your care provider. They may be able to tell you if they take your insurance plan by looking at your health insurance card.

- Check the provider's website.

It's important to note that provider networks can change, so it's a good idea to verify that your doctor is in your network before scheduling an appointment or switching plans.

Understanding Sub-Limits: Unraveling the Intricacies of Insurance Policies

You may want to see also

Your doctor may be cash-only

If your doctor doesn't accept your insurance, it could be because they are cash-only. This means that they require cash payments from patients and don't work with insurance carriers at all. This can result in unexpected medical bills for patients, who are responsible for the full amount of their treatment.

Doctors may choose to operate on a cash-only basis due to the difficulties of working with insurance companies, including extensive paperwork and low reimbursement rates. By cutting ties with insurance carriers, doctors can reduce their administrative burden and focus on patient care.

If your doctor is cash-only, you have several options to explore:

- Out-of-network coverage: Contact your insurance company to discuss your options for out-of-network coverage. They may be able to negotiate with your doctor or provide alternative solutions.

- Find an in-network provider: Switch to a different doctor who is part of your insurance network. This way, your treatment will be at least partially covered by your insurance plan.

- Request a reduced fee: Ask your doctor if they are willing to accept a reduced fee or provide flexible payment terms. Some doctors may offer discounts for upfront payments or have financing options available.

- Concierge medicine: Inquire about concierge medicine options, where you pay a prepaid fee for a predetermined number of services or visits. This can provide you with more predictable costs.

- Switch insurance plans: Consider changing your insurance plan or carrier to one that your doctor accepts. Confirm with your doctor which insurance plans they work with.

- Payment assistance: Check if your doctor's office offers any financial assistance programs or payment plans to help reduce your out-of-pocket expenses.

- Urgent care clinics: Walk-in clinics that provide non-emergency services may charge less than private practices. This can be a more affordable option for basic medical needs.

Remember that it is important to understand the billing practices of your doctor and your insurance coverage before receiving treatment. Navigating medical billing can be complex, so don't hesitate to ask questions and explore your options to minimize unexpected costs.

The Mystery of RFD Insurance: Unraveling the Acronym's Meaning and Its Role in Financial Protection

You may want to see also

You can ask your doctor to submit an out-of-network claim

If your doctor doesn't accept your insurance, you can ask them to submit an out-of-network claim as a courtesy. This is a good option if you don't want to switch doctors or find an in-network provider. However, it's important to note that even if your doctor submits an out-of-network claim, you may still be responsible for some of the costs that your insurance company doesn't cover.

To avoid unexpected medical bills, it's always a good idea to understand what your insurance will and will not pay for before visiting a healthcare provider. Ask your insurance company to confirm which healthcare providers and facilities are in-network. If you visit an out-of-network provider, your insurance company will pay them the set rates, and then the provider will bill you for the remaining amount.

If your doctor doesn't accept your insurance and refuses to submit an out-of-network claim, you will be responsible for the full amount of the bill. In this case, you can try negotiating with the doctor to see if they will accept a reduced fee or provide flexible payment terms. You can also look into financial assistance programs or "charity care" that may help cover the cost of your medical bills.

Securing Short-Term Rental Insurance: Navigating the Path to Comprehensive Coverage

You may want to see also

Frequently asked questions

When a doctor doesn't take insurance, they are considered a cash-only, direct pay, or direct primary care doctor.

If your doctor doesn't accept your insurance, you can try to get out-of-network coverage or find an in-network provider. You can also ask the doctor if they will take a reduced fee or provide flexible payment terms.

The No Surprises Act is a federal law that went into effect on January 1, 2022. It protects you from unexpected out-of-network medical bills for emergency room visits and related non-emergency care.

If you receive a surprise medical bill, you can submit a complaint and dispute the bill if it's at least $400 more than the good faith estimate provided by your provider.

If you can't pay a medical bill, you can try to negotiate with the medical provider, ask for financial assistance, or set up a repayment plan. You may also be able to dispute the bill if there are any errors or if it's not covered by your insurance.