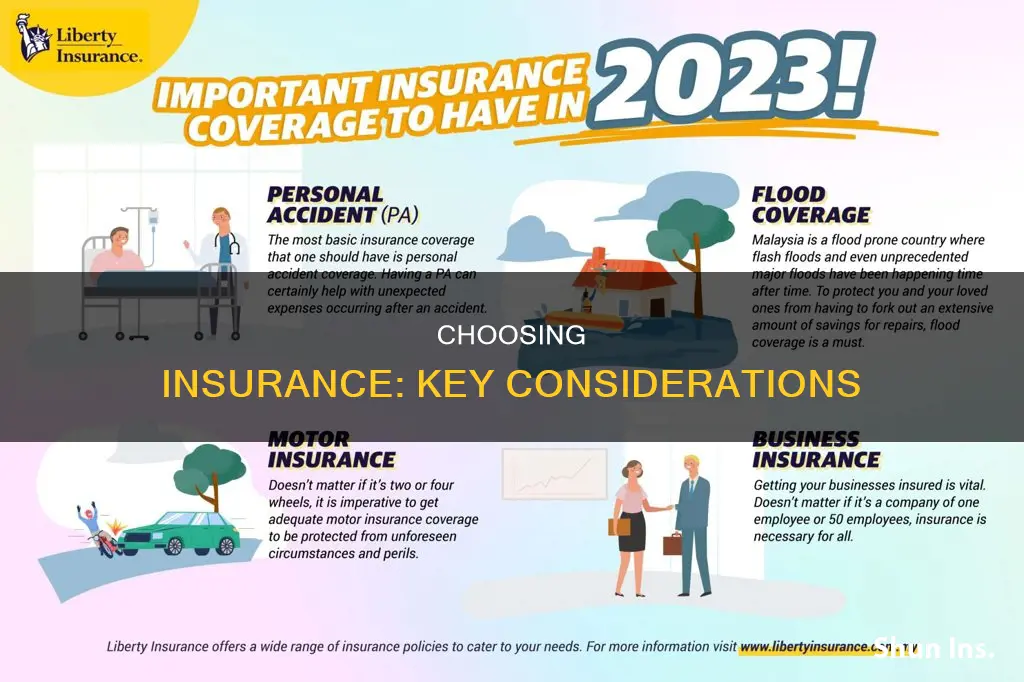

Picking an insurance plan can be a daunting task, but it doesn't have to be. There are several factors to consider when choosing an insurance plan that fits your needs. Firstly, it's important to understand the different types of plans available, such as HMOs, PPOs, EPOs, and POS plans, each with its own benefits and limitations. You should also evaluate your healthcare needs and determine if you prefer a plan with higher premiums and more coverage or lower premiums and higher out-of-pocket costs.

When selecting an insurance plan, consider whether your preferred healthcare providers, hospitals, and pharmacies are within the plan's network. In-network services are typically covered, while out-of-network services may incur additional costs. Additionally, review the prescription drug coverage offered by the plan and ensure that your regular prescriptions are included.

It is also essential to compare estimated yearly costs, including deductibles, copays, and coinsurance, rather than focusing solely on monthly premiums. Think about how much healthcare you typically use and choose a plan that aligns with your needs.

Lastly, remember to review plan options annually, as costs and coverage can change. By considering these factors, you can make an informed decision when selecting an insurance plan that best suits your healthcare requirements and budget.

| Characteristics | Values |

|---|---|

| Type of insurance | Health insurance, car insurance |

| Type of plan | HMO, PPO, EPO, POS, HDHP |

| Cost of premiums | Higher premiums for more coverage, lower premiums for higher out-of-pocket costs |

| Cost of out-of-pocket expenses | Copays, coinsurance, deductibles, out-of-pocket maximum |

| Cost of prescriptions | Covered by some plans, not covered by others |

| Network of providers | In-network providers are cheaper, out-of-network providers may be covered for an additional cost |

| Customer service | Claims service, responsiveness |

| Additional benefits | Gym membership discounts, grocery discounts, virtual clinic access |

What You'll Learn

Type of plan and provider network

When considering the type of insurance plan and provider network, it is important to understand the different types of plans available and how they can meet your specific needs.

Health Maintenance Organization (HMO)

HMOs usually limit coverage to doctors and hospitals that are part of their network or have a contract with the HMO. They typically do not cover out-of-network care unless it is an emergency. HMOs often require individuals to live or work within their service area to be eligible for coverage. This type of plan generally offers lower out-of-pocket costs and provides a primary care physician who coordinates your care. However, it may offer less freedom in choosing providers. HMOs often focus on prevention and wellness, providing integrated care.

Preferred Provider Organization (PPO)

PPOs offer more flexibility in choosing medical providers, allowing individuals to use doctors, hospitals, and providers outside of the network without a referral. However, using in-network providers will result in lower costs, as they have negotiated lower rates with the insurance company. Out-of-network care will generally be more expensive. PPOs typically have higher out-of-pocket costs compared to HMOs.

Exclusive Provider Organization (EPO)

EPOs are managed care plans that provide coverage only when using in-network doctors, specialists, or hospitals, except in emergency situations. EPOs generally offer lower out-of-pocket costs and may not require referrals to specialists. However, they provide less freedom in choosing providers outside of their network.

Point of Service (POS)

POS plans offer a combination of features from both HMOs and PPOs. They encourage the use of in-network providers by offering lower costs when using doctors, hospitals, and healthcare providers within the plan's network. Similar to HMOs, POS plans require referrals from a primary care physician to see a specialist. POS plans may offer more provider options than HMOs, but they may have higher out-of-pocket costs compared to EPOs.

When considering the type of plan and provider network, it is important to evaluate your specific needs and preferences. Factors to consider include the availability of preferred doctors or specialists within the network, the size and convenience of the network, the referral requirements, and the balance between premiums and out-of-pocket costs. Understanding these factors will help you make an informed decision when choosing an insurance plan that best suits your healthcare needs and budget.

Navigating the Insurance Billing Maze: Unraveling the 'Which Insurance to Bill' Conundrum

You may want to see also

Monthly premiums

When considering insurance options, monthly premiums are a key factor. A premium is the amount you pay for your insurance policy each month. It is important to note that premiums are not the only costs associated with insurance, and you may have to pay additional charges such as taxes or service fees.

The price of the premium depends on various factors, including the type of insurance coverage, the area in which you live, any claims filed in the past, and moral hazard and adverse selection. For example, the premium for auto insurance will be influenced by factors such as the age and location of the driver, with higher-risk factors leading to more expensive premiums. Similarly, for life insurance, the premium is determined by the age at which coverage begins, with younger individuals generally paying lower premiums.

When choosing a health insurance plan, it is important to consider not only the monthly premium but also the deductible, copayments, and coinsurance. The deductible is the amount you must pay for covered health services before your insurance company starts contributing. Copayments and coinsurance are payments made for each instance of receiving healthcare services, such as a doctor's visit or hospital charges. Out-of-pocket costs refer to all expenses other than the monthly premium, including deductibles, copayments, and coinsurance.

When comparing health insurance plans, it is essential to evaluate the total costs, including the premium and out-of-pocket expenses. While a plan with a lower monthly premium may seem attractive, it could result in higher overall costs if the out-of-pocket expenses are significant. On the other hand, a plan with a higher premium may offer more comprehensive coverage and lower out-of-pocket costs, which could be more cost-effective if you anticipate frequent healthcare needs.

Additionally, consider the quality of care and the network of providers associated with the insurance plan. Some plans may offer a wider range of benefits, better coverage for specific types of treatments, or a larger network of doctors and healthcare facilities. It is also worth investigating whether your preferred doctors and medical providers are included in the plan's network, as using out-of-network providers can result in higher costs.

Maximizing Vision Insurance Benefits for Eyeglasses

You may want to see also

Out-of-pocket costs

- Definition and Examples: Out-of-pocket costs refer to the portion of covered medical expenses that you are responsible for during a plan year. This typically includes costs such as deductibles, copays, and coinsurance. For example, if your insurance covers 80% of a procedure, you will be responsible for paying the remaining 20% out-of-pocket. Non-covered services, such as cosmetic surgery or non-prescription drugs, will also need to be paid for out-of-pocket.

- Maximum Out-of-Pocket Costs: Most health insurance plans have a limit on how much you will pay out-of-pocket. These maximum out-of-pocket costs represent the maximum amount you can pay before your insurance starts covering all costs. In the US, for 2023, the maximum out-of-pocket cost for an individual is $9,100, and for a family, it's $18,200. These amounts will increase in 2024 to $9,450 and $18,900, respectively.

- In-Network vs Out-of-Network: Out-of-pocket costs typically refer only to in-network costs for essential health benefits. If you use out-of-network providers, your out-of-pocket expenses can be significantly higher or even unlimited, depending on the plan. Some plans, like HMOs and EPOs, generally do not cover out-of-network care unless it's an emergency.

- Choosing a Plan: When selecting an insurance plan, consider your expected out-of-pocket expenses based on your health needs and the plan's coverage. If you anticipate high medical costs, a plan with a lower out-of-pocket maximum might be preferable, even if the monthly premiums are higher. On the other hand, if you're generally healthy and don't expect to incur many medical expenses, a plan with lower premiums and higher out-of-pocket costs may be more suitable.

- Understanding Your Plan: It's essential to understand the specifics of your insurance plan. Know the definitions of key terms like copay, coinsurance, deductible, and out-of-pocket maximum. Additionally, be aware of any non-covered services, as these will be your responsibility to pay for entirely.

By carefully considering the out-of-pocket costs associated with different insurance plans, you can make an informed decision about which plan best suits your healthcare needs and financial situation.

Navigating Insurance Changes with CVS Caremark: A Step-by-Step Guide

You may want to see also

Co-pay and coinsurance

When choosing an insurance plan, it's important to understand the costs you may incur when using the plan. Two key concepts to understand are copay and coinsurance.

A copay, or copayment, is a set rate or fixed amount you pay for prescriptions, doctor visits, and other types of care. The amount of the copay varies based on the service you receive. For example, you might pay a $15 copay for a generic prescription drug, $30 to visit your primary care doctor, or $50 to see a specialist. Copays typically start at $10 and go up from there, depending on the type of care received. Copays are usually paid before you have met your deductible for the year.

Coinsurance, on the other hand, is the percentage of covered medical expenses you pay after you've met your deductible. Your health insurance plan pays the remaining amount. For example, if you have an "80/20" plan, it means your plan covers 80% and you pay 20% until you reach your maximum out-of-pocket limit. The amount you pay in coinsurance for a healthcare service is a percentage of what your plan pays the doctor or medical provider. For instance, if the plan's allowed amount for a treatment is $100 and your coinsurance payment is 20%, you will pay $20 and your plan will cover the remaining $80.

In general, plans with lower premiums have higher coinsurance and/or deductibles, while plans with higher monthly premiums tend to have lower coinsurance and lower deductibles. It's important to review the details of your insurance policy to understand your obligations for various healthcare services.

When choosing an insurance plan, consider whether you want a plan with higher premiums and more coverage, or lower premiums and higher out-of-pocket costs. If you frequently visit the doctor, need regular medications, or have a chronic condition, a plan with higher premiums and more coverage may be a better option. On the other hand, if you're generally healthy and don't require frequent medical care, a plan with lower premiums and higher out-of-pocket costs might be more suitable.

Understanding Veterans Insurance: Decoding Insurance Payment on Your Bill

You may want to see also

Coverage of medicines

When considering insurance, it is important to assess the coverage of medicines provided by the plan. Here are some key points to consider:

Prescription Drug Coverage:

It is crucial to understand the extent to which your insurance plan covers prescription medications. Most plans will help cover the cost of certain prescribed medications, but it is important to review the specific details. Check your insurer's website or contact them directly to find out which prescriptions are covered. Additionally, review the plan's "formulary" or approved list of medications, as these will typically be more affordable. Some insurers may only cover the cheapest version of a drug, so it is worth confirming if you require a specific brand.

In-Network Pharmacies:

Different insurance plans have contracts with specific pharmacies, known as "in-network pharmacies." It is important to find out if your regular pharmacy is considered in-network under your plan. If not, you may need to use a different pharmacy or explore options for medication delivery.

Out-of-Pocket Costs:

Understand the out-of-pocket expenses associated with your prescription medications. This includes copays, coinsurance, and deductibles. Copays are flat fees that you pay each time you fill a prescription, while coinsurance is the percentage of the total cost that you pay. The deductible refers to the amount you must pay before your insurance starts contributing.

Health Plan Categories:

In some countries, health insurance plans are categorized into different "metal" tiers, such as Bronze, Silver, Gold, and Platinum. These categories indicate how costs are shared between you and your plan. Higher-tier plans generally offer more comprehensive coverage but may come with higher premiums.

Referrals and Prior Approvals:

Some insurance plans may require prior approval or a referral from your primary care physician before covering certain medications. This is particularly common for more specialized or expensive drugs. Check with your insurance provider to understand their specific requirements and processes.

Alternative Therapies:

If you are interested in alternative therapies, such as chiropractic care or acupuncture, review your plan's coverage for these services. Some plans may cover these therapies, while others may offer limited or no coverage.

International Coverage:

If you plan to travel internationally, understand how your insurance plan covers medical expenses incurred during your trip. This includes prescription medications as well as other medical services.

By carefully reviewing the coverage of medicines offered by different insurance plans, you can make an informed decision that aligns with your specific needs and budget.

Perils: What's Covered and What's Not

You may want to see also

Frequently asked questions

The most common types of health insurance policies are HMOs, PPOs, EPOs and POS plans. These plans differ in terms of their provider networks, referral requirements, and out-of-pocket costs.

Check the provider directory and formulary (drug list) of the plan to see if your doctors and prescriptions are included. You can also directly contact your doctors and ask about the insurance plans they accept.

Out-of-pocket costs include premiums, deductibles, copays, and coinsurance. Premiums are monthly payments made to the insurance company, while deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. Copays are flat fees for covered services, and coinsurance is the percentage of costs you pay for a service.

You should consider the amount of coverage you need, what you can afford, and the reputation of the insurance company. It's important to understand how the policy would protect you in different scenarios and choose a company with good customer service and financial stability.

Liability coverage is essential and includes bodily injury liability and property damage liability. You may also want to add uninsured and underinsured motorist coverage, personal injury protection, and comprehensive and collision coverage.