Treaty reinsurance is one of the two main types of reinsurance, the other being facultative reinsurance. Reinsurance is when an insurance company purchases insurance from another company to share some or all of the risk of a policy or group of policies. Treaty reinsurance covers an entire group or book of business held by an insurance company, while facultative reinsurance deals with a single policy in a single transaction. Treaty reinsurance is a long-term relationship between the ceding company (the insurer that is transferring its risk) and the reinsurer (the company accepting the risk). The reinsurer assumes the insurance liability and is obligated to accept all policies that fall within the agreed-upon category of business. The ceding company benefits from treaty reinsurance by freeing up capital, increasing solvency, and achieving greater financial stability.

What You'll Learn

Treaty reinsurance vs facultative reinsurance

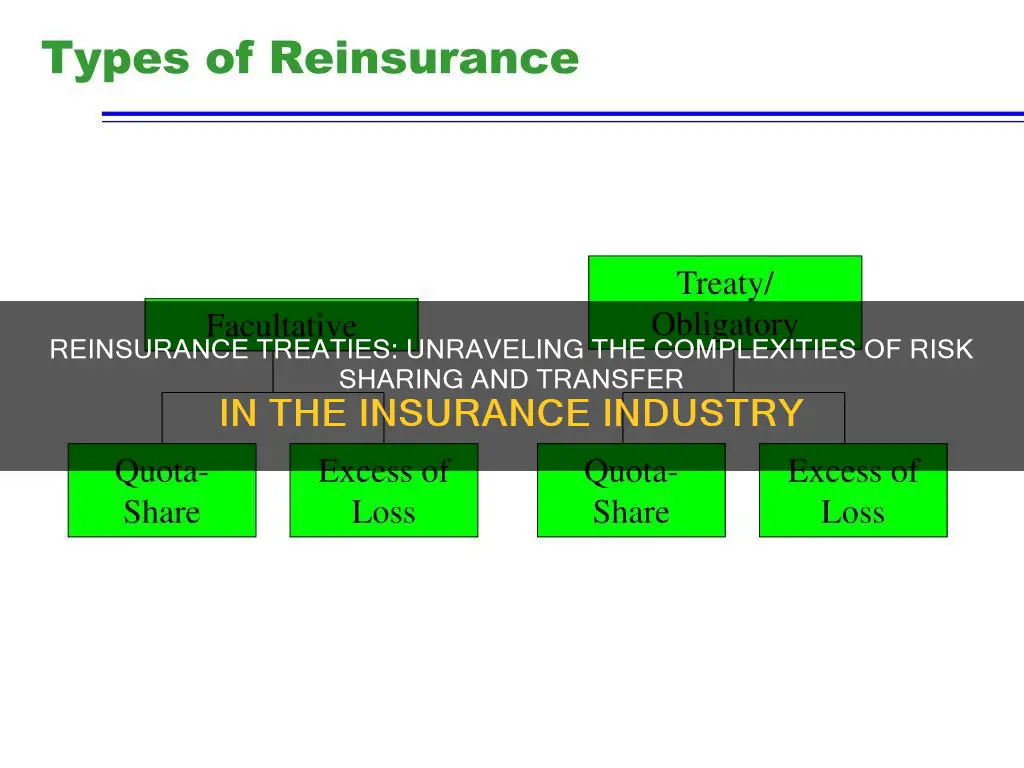

Reinsurance is a way for insurance companies to transfer some of the financial risks they assume when issuing insurance policies. This is done by ceding some of their risk to another insurance company, known as the reinsurer. There are two basic types of reinsurance arrangements: facultative reinsurance and treaty reinsurance.

Facultative Reinsurance

Facultative reinsurance is designed to cover single risks or a defined package of risks. The ceding company can offer an individual risk or a defined package of risks to a reinsurer, who has the right to accept or reject the risk. The reinsurer will perform its own underwriting for some or all of the policies to be reinsured, and each policy is considered a single transaction.

Facultative reinsurance is typically used for high-value or hazardous risks because the policies can be tailored to specific circumstances. It can be less attractive to the ceding company, as the reinsurer may insist that the ceding company retains some of the liability on the riskiest policies.

Treaty Reinsurance

Treaty reinsurance, on the other hand, covers a ceding company's entire book of business, such as a primary insurer's homeowners' insurance book. In treaty reinsurance transactions, the ceding company transfers all risks within a book of business to the reinsurer. For example, a primary insurer might transfer its entire book of commercial auto insurance. The two parties enter into an agreement, known as the treaty, in which the reinsurer is obliged to accept all covered business.

Treaty reinsurance arrangements are typically long-term, and they will accept policies that the ceding company has not yet written, as long as they fit the pre-agreed risk class. The reinsurer generally expects to make a profit, and these expectations are measured and adjusted over time.

The main difference between treaty reinsurance and facultative reinsurance is the scope of the transaction. Treaty reinsurance involves many policies or an entire book of risk held by the ceding insurance company, while facultative reinsurance generally deals with one policy in a single transaction. Treaty reinsurance can be more cost-effective as there is no need to negotiate the terms of the agreement before underwriting each policy. It also represents a long-term, ongoing relationship between the ceding company and the reinsurer.

However, treaty reinsurance has the potential to be unprofitable for both parties. The ceding insurer may negotiate terms that are disadvantageous and limit its flexibility, while the reinsurer must rely on the ceding insurer's underwriting experience and may lack detailed information about individual loss exposures.

Facultative reinsurance, on the other hand, provides the reinsurer with the ability to accept or reject each application based on its own underwriting principles. However, this can create uncertainty for the ceding insurer, as they cannot predict in advance whether a reinsurer will agree to accept a risk.

Supplemental Insurance: Understanding the Added Layer of Protection

You may want to see also

The role of the ceding company

The ceding company, also known as the cedent, is the insurance company that purchases the reinsurance policy. The ceding company's main role in a treaty reinsurance agreement is to identify and delineate the classes of business it seeks to reinsure and manage the claims efficiently.

The ceding company passes on ("cedes") some part of its own insurance liabilities to the other insurance company, the reinsurer. The ceding company can cede a portion or all of the risk associated with an insurance policy to another insurer. Ceding helps the ceding company to hedge against undesired exposure to losses and free up capital to use in writing new insurance contracts.

The ceding company must carefully select its reinsurer partner based on financial strength, reputation, and the reinsurer's expertise in handling specific types of risks. The ceding company retains liability for the reinsured policies, so although claims should be reimbursed by the reinsurance firm, if the reinsurance company defaults, the ceding company may still have to make a payout on reinsured policy risks.

The ceding company achieves risk diversification and capital relief through treaty reinsurance, while the reinsurer receives premium income and opportunities for profitable engagement with a range of insurance risks.

Term Insurance: Exploring the Minimum Duration for Coverage

You may want to see also

The role of the reinsurer

The reinsurer is the purchasing company in a treaty reinsurance agreement. It assumes the risks that are specified in the contract in return for a premium. The reinsurer is obligated to accept all policies that fall within the agreed-upon category of business. It may require the ceding company to enact certain underwriting processes when the two parties enter into the agreement, but it cannot deny coverage to a policy that meets the contractual terms.

The reinsurer's role is crucial in providing necessary reinsurance capacity to the ceding company, enabling it to pursue growth strategies or enter new markets. The reinsurer also receives premium income and opportunities for profitable engagement with a range of insurance risks.

The two types of treaty reinsurance contracts are proportional and non-proportional. With proportional contracts, the reinsurer agrees to take a share of insurance policies and pay a specific percentage if a claim is then filed. In return, the reinsurer receives a corresponding proportion of premiums. For example, a reinsurer may agree to accept the risk of 20% of an insurance company's policies and pay out 20% of all claims on those policies, in exchange for 20% of the ceded premiums on those policies.

Non-proportional contracts, on the other hand, are where the reinsurer will agree to pay out claims only if they exceed a certain amount during a period. For example, a reinsurer may agree to pay out 40% of claims on an insurer's cyber insurance policy if the claims exceed $200,000 in the first three years.

Treaty reinsurance agreements are typically long-term relationships. This is because the reinsurer has agreed to assume the risks for a swathe of policies and not simply a specific risk. The long-term nature of the agreement allows the reinsurer to plan out how to achieve a profit because it knows the type of risk it is taking on and is familiar with the ceding company.

Advantages of Treaty Reinsurance for the Reinsurer

Treaty reinsurance can be advantageous for the reinsurer in several ways. Firstly, it allows the reinsurer to profit by taking on a portion of the ceding company's liabilities in exchange for a premium. Secondly, it provides the reinsurer with opportunities for profitable engagement with a range of insurance risks. Additionally, treaty reinsurance is less transactional and less likely to involve risks that can be rejected.

Disadvantages of Treaty Reinsurance for the Reinsurer

One potential disadvantage of treaty reinsurance for the reinsurer is that it may be exposed to bad business that is automatically reinsured, which could lead to unprofitable outcomes. This is because the reinsurer must rely on the ceding insurer's underwriting experience and may lack detailed information about individual loss exposures.

Understanding Term Life Insurance: A Guide to This Essential Coverage

You may want to see also

Types of treaty reinsurance

Treaty reinsurance is one of the three main types of reinsurance contracts, the other two being facultative reinsurance and excess of loss reinsurance. Treaty reinsurance is further divided into two types: proportional and non-proportional.

Proportional Treaty Reinsurance

Proportional treaty reinsurance, also known as Pro Rata reinsurance, involves a predetermined proportion of policies being reinsured by the reinsurer, up to a specified limit. The most common type of proportional treaty is the quota-share treaty, where the insurer cedes a proportion of premium and losses to the reinsurer in return for a reinsurance commission. The quota-share treaty is often used to launch new lines of business or new insurance companies.

Another type of proportional treaty is the surplus treaty, where the proportional rate is estimated in excess of a retention line and depends on the risk sum insured. This allows the insurer to write larger risks and diversify its portfolio without fully retaining the risk.

Non-Proportional Treaty Reinsurance

Non-proportional treaty reinsurance, also known as Excess of Loss reinsurance, does not have a proportional relationship between the premium paid by the insurer and the losses ceded. The reinsurer compensates for losses exceeding a retention amount, up to a specified limit. This type of treaty is defined "per risk" (e.g. fire, motor) or "per event" (e.g. windstorm, hail). Non-proportional treaties are used by insurers to protect against major events, such as natural catastrophes.

Another type of non-proportional treaty is the stop-loss treaty, which aggregates all the losses for a given line of business during a year. It is an annual treaty with deductibles and limits given as a percentage of the loss ratio. Stop-loss treaties protect insurers in the event of a poor year in terms of event frequency or intensity.

The Intricacies of Self-Insurance: Exploring the Viable Alternative to Traditional Insurance

You may want to see also

Advantages and disadvantages of treaty reinsurance

Advantages of Treaty Reinsurance

Treaty reinsurance is a vital tool for insurance companies to manage their risk and protect against large losses. It is a form of "insurance for insurance companies", allowing them to take on more risks and expand their business. Here are some advantages of treaty reinsurance:

- Comprehensive Coverage: It provides an all-encompassing safety net for insurers, shielding them from a wide range of potential perils.

- Risk Distribution: Insurers can distribute their risk exposure across multiple reinsurers, spreading the financial burden and enhancing stability.

- Consistent Protection: It offers consistent protection over a predefined period, providing peace of mind for insurers.

- Reduced Risk Assessment Overhead: Treaty reinsurance streamlines the risk assessment process by reducing the need for individual risk assessments.

- Opportunity to Grow: It allows insurance companies to expand their operations by increasing their book of business and offering more policies to customers.

- Greater Stability: Treaty reinsurance helps insurance companies limit their claims volatility, especially in the event of major events or catastrophes.

- Control of Underwriting: Unlike facultative reinsurance, treaty reinsurance gives the ceding company more control over their policy underwriting.

- Cost-Effectiveness: It is generally more affordable than other forms of reinsurance, such as facultative reinsurance.

- Long-term Relationship: Treaty reinsurance fosters a long-term relationship between the insurance company and the reinsurer, who can better understand the insurer's business and help navigate future challenges.

Disadvantages of Treaty Reinsurance

While treaty reinsurance offers significant benefits, there are also some drawbacks to consider:

- Limited Control: The ceding company gives up some control over the management of risks and the claims handling process.

- Limited Flexibility: The pre-agreed-upon terms of the treaty may hinder the ability to adapt to unexpected events or changing market conditions.

- Cost Considerations: Premiums are often dictated by the terms of the agreement, which can result in higher costs for the insurer than expected.

- Risk Coverage Limitations: Treaty reinsurance may not cover all types of risks, leaving insurers exposed in certain areas.

- Potential for Unprofitability: The ceding insurer may negotiate terms that limit flexibility and expose the reinsurer to bad business, leading to unprofitable outcomes for both parties.

Short-Term Health Insurance Options in New York: Understanding the Alternatives

You may want to see also

Frequently asked questions

What is treaty reinsurance?

How does treaty reinsurance work?

What is the difference between treaty reinsurance and facultative reinsurance?

What are the benefits of treaty reinsurance?

What are the disadvantages of treaty reinsurance?