Term life insurance is a type of life insurance policy that provides coverage for a certain period of time, typically between 5 and 40 years. It is a more affordable option compared to other types of life insurance and offers financial protection for a set period. If the insured person dies during the specified term, the beneficiaries will receive a lump-sum, tax-free payment known as the death benefit. This benefit can be used by the beneficiaries to cover expenses such as healthcare, funeral costs, consumer debt, and mortgage debt. The death benefit may also be issued as annuities. Term life insurance policies have level premiums, which means that the premiums remain the same throughout the duration of the policy. These policies do not accumulate cash value and are designed to provide coverage for a specific need or period, such as covering a mortgage or business loan.

| Characteristics | Values |

|---|---|

| Type of insurance | Life insurance |

| Coverage period | A specified period of time or a "term" of years, e.g. 5-40 years |

| Coverage renewal | Possible after term ends, but at a higher premium based on the person's age at the time of renewal |

| Payout | A death benefit is paid to the insured's beneficiaries if the insured dies during the specified term |

| Payout amount | Varies, e.g. $250,000, $500,000, $1,000,000 |

| Premium | Relatively low compared to permanent life insurance; based on the insured's age, health, and life expectancy; typically fixed for the duration of the policy |

| Cash value | No cash value |

| Convertibility | Can be converted to permanent life insurance, e.g. whole life or universal life insurance |

| Add-ons | Riders can be purchased to enhance the policy, e.g. accelerated benefit, accidental death benefit, guaranteed insurability |

| Ideal for | People who want substantial coverage at a low cost, e.g. young people with children, people with growing families |

What You'll Learn

Term insurance vs. whole life insurance

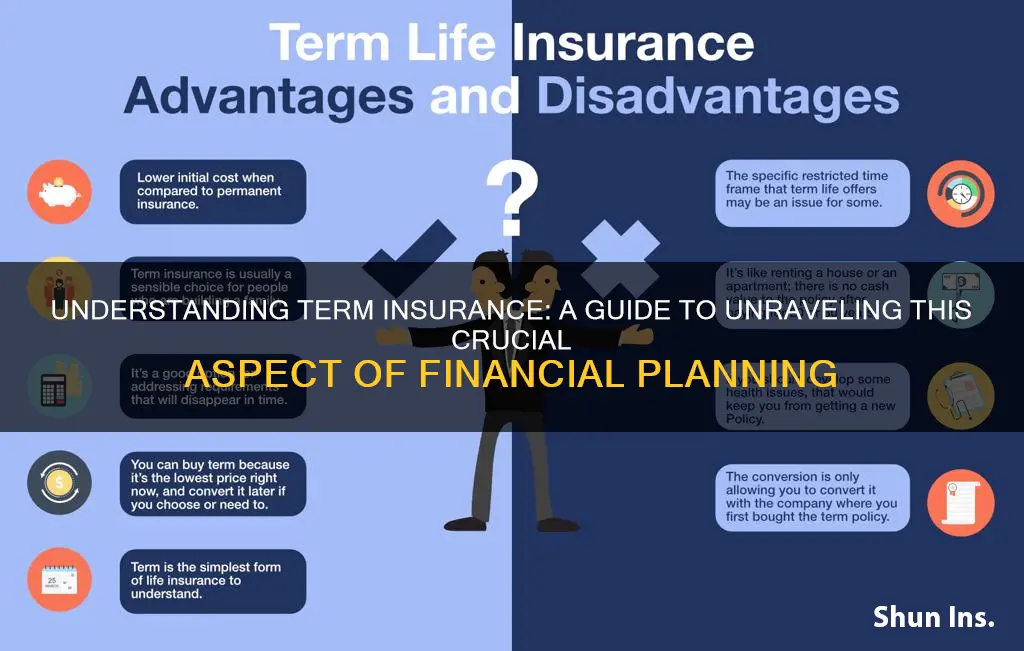

Term insurance and whole life insurance are two of the most common types of life insurance. They differ in terms of cost, length of coverage, cash value, and complexity.

Term Insurance

Term life insurance offers simple and affordable coverage for a specific period, usually between 10 and 30 years. If the policyholder dies within the set term, their beneficiaries receive the policy's payout. Term life insurance tends to be cheaper than whole life insurance because it offers temporary coverage and doesn't build cash value. The premiums for term life insurance are generally lower and remain level throughout the term. It is also easier to understand and apply for term life insurance compared to whole life insurance.

However, one of the drawbacks of term life insurance is that it expires after the set term, and if the policyholder outlives the term, their coverage ends and they don't receive any benefits. Term life insurance also doesn't offer a cash value component, which means it cannot be used as a wealth-building or tax-planning strategy.

Whole Life Insurance

Whole life insurance, on the other hand, provides coverage for the entire life of the policyholder, as long as they keep paying the premiums. It also includes a cash value component, which grows tax-free over time and can be withdrawn or borrowed against. The premiums for whole life insurance are much higher than those for term life insurance because the coverage lasts a lifetime, and the policy accumulates cash value. Whole life insurance is also more complex than term life insurance due to the additional features it offers.

One of the main advantages of whole life insurance is that it provides lifelong protection, and the death benefit is guaranteed as long as the premiums are paid. The cash value component also offers financial flexibility, as it can be used to pay for expenses or invest in other financial needs.

Both term and whole life insurance have their pros and cons, and the choice between the two depends on individual needs and financial circumstances. Term life insurance is generally sufficient for most people due to its affordability and simplicity. However, whole life insurance may be preferred for those who need permanent coverage and the additional benefits provided by the cash value component.

The Unseen Hand: Understanding the Role of Insurance Producers

You may want to see also

Term insurance premiums

Term insurance is a type of life insurance that provides coverage for a certain period of time, typically ranging from 1 to 30 years. It is designed to offer financial protection to the insured's family or loved ones in the event of their untimely death. The key feature of term insurance is that it offers a death benefit, which is a lump-sum payment made to the beneficiaries upon the insured's death. This benefit is intended to help cover expenses such as funeral costs, mortgage payments, education fees, and everyday expenses.

There are two main types of term insurance premiums: level term and decreasing term. Level term premiums remain the same throughout the policy period, while decreasing term premiums gradually decrease over time. Additionally, some term insurance policies offer the option of convertible premiums, which allow the policy to be converted into a permanent life insurance policy, such as whole or universal life insurance. However, this conversion usually results in higher premiums.

It is important to note that term insurance premiums are generally non-refundable, even if the insured person outlives the policy term. Moreover, failing to pay the premiums may result in the cancellation of the policy and a loss of coverage. Therefore, it is crucial for policyholders to carefully consider their options, compare different insurance providers, and choose a plan that best suits their needs and budget.

Unraveling the MIB Mystery: Understanding Insurance Industry Acronyms

You may want to see also

Convertible term life insurance

Term insurance is a type of life insurance that provides coverage for a certain period of time, such as 10, 20, or 30 years. It is more affordable than other types of life insurance and is a good option for those who cannot afford the high premiums of permanent life insurance. However, term insurance does not accumulate cash value and has no cash value if the insured outlives the policy.

When converting a term policy to a permanent policy, the premiums will increase as permanent insurance is more expensive than term insurance. Additionally, the permanent policy will have the same value as the term policy, but the premiums will be higher. It is important to note that convertible term life insurance policies usually have a conversion deadline, after which the policy cannot be converted.

Some insurance companies offer partial conversions, which allow the policyholder to convert only a portion of their term life policy to permanent coverage while retaining the rest as term life insurance. This can be a good option for those who want the benefits of both types of policies.

Understanding Personal Injury: Exploring the Insurance Definition and Its Legal Implications

You may want to see also

Level-premium term insurance

Permanent insurance, such as whole life insurance with level premiums, will typically see the death benefit increase over time, even as the premiums remain the same. This is because permanent life insurance accrues a cash value that adds to the death benefit amount.

Term life policies will not see increasing coverage and are usually set at 10, 15, 20, or 30 years. Level-premium term insurance is often the most common type of term insurance. The policy pays a benefit if the policyholder passes away during a fixed period, and if death occurs outside of this term, there is no payout.

Term Insurance: Understanding the Wait for Coverage

You may want to see also

Yearly renewable term insurance

Term life insurance is a type of insurance that provides a financial benefit in the event of terminal illness or death. It is typically offered as a one-year renewable term (YRT) or level premium term (LPT) policy.

A yearly renewable term insurance policy is a one-year temporary life insurance policy that automatically continues each year at the same death benefit. When someone buys a YRT insurance policy, the premium quoted is for one year of coverage based on the insured's current age. The premium then increases annually to cover the increased risk of death as the insured person ages. The policy can be extended into future years without additional underwriting, but the premium will increase each year.

Actuaries at insurance companies determine the premium for a renewable term policy, using specific formulas that consider age, health, and other factors to predict the likelihood of a policyholder dying at a given age. Renewable term policies allow policyholders to renew coverage each year without additional medical underwriting, up to a certain age.

YRT policies tend to appeal to young insurance seekers who want to start with a low-cost, flexible premium. They also fill niche short-term demands, such as for those awaiting insurance coverage while changing jobs, people who recently quit smoking, or those with short-term medical conditions.

However, the main drawback of a YRT policy is that if a policyholder renews for many years, they could end up paying more in premiums than if they had bought a level term life or permanent life insurance policy.

In contrast to YRT, LPT policies have uniform premiums that remain the same, regardless of the age of the policyholder. While LPT policies are generally preferred due to their lower cost over time, YRT policies offer the benefit of not requiring policyholders to re-qualify at renewal, even if they become terminally ill.

Understanding Solvency Ratios: The Key to Evaluating Term Insurance Stability

You may want to see also

Frequently asked questions

Term insurance is a type of life insurance policy that provides coverage for a certain period of time, typically between 5 and 40 years.

If the insured person dies during the specified time period and the policy is active, a death benefit will be paid to their beneficiaries. The beneficiaries can use this money for any purpose, such as settling healthcare and funeral costs or consumer debt.

Term insurance is initially much less expensive compared to permanent life insurance. It is ideal for people who want substantial coverage at a low cost. It also offers guaranteed renewability and convertibility options.

The cost of term insurance depends on various factors, including age, gender, health, and lifestyle habits. For example, a healthy 30-year-old non-smoking man can get a 30-year term policy with a $500,000 death benefit for around $30 per month.

If you outlive your term insurance policy, you will not receive any money back. The policy will expire, and your beneficiaries will not be eligible for the death benefit. However, some policies offer renewability or convertibility options that allow you to extend the coverage.