For young drivers under the age of 25, certain insurance policies can be restrictive. Many insurance companies impose age-based restrictions on coverage, which may limit the types of insurance available to this demographic. These restrictions often include higher premiums, limited coverage options, and specific exclusions. Understanding these limitations is crucial for young drivers to make informed decisions about their insurance coverage and explore alternative options to ensure they have adequate protection on the road.

What You'll Learn

- Age Restrictions: Many insurers deny coverage for young drivers under 25 due to higher risk

- Higher Premiums: Younger drivers often face increased insurance costs due to statistical factors

- Limited Coverage Options: Young drivers may have fewer policy choices and higher deductibles

- Driving Experience: Lack of experience is a common reason for age-based insurance exclusions

- Young Driver Discounts: Some insurers offer discounts for mature drivers, not for those under 25

Age Restrictions: Many insurers deny coverage for young drivers under 25 due to higher risk

Many insurance companies impose age restrictions on their coverage, particularly when it comes to young drivers under the age of 25. This is primarily due to the higher risk associated with this demographic group. Statistics show that younger drivers, especially those in their late teens and early twenties, are more prone to accidents and traffic violations compared to older drivers. Insurance providers often consider this increased risk when determining premiums and eligibility for coverage.

The age of 25 is a significant threshold for many insurers as it marks a transition period. During this time, young adults are typically considered less experienced and more impulsive, which can lead to riskier driving behaviors. Insurance companies may view this age group as a higher-risk category, especially for comprehensive and collision coverage, which often includes protection against accidents and damage to the insured vehicle. As a result, insurers might deny or limit coverage for young drivers under 25, making it challenging for them to obtain affordable insurance.

To address this issue, young drivers can explore alternative options. One approach is to join a parent or guardian's policy as an additional driver. This can help them access insurance coverage while potentially benefiting from the lower premiums associated with a more experienced driver. Another strategy is to consider specialized insurance programs designed for young drivers, such as those offered by some insurance companies or through government-backed initiatives. These programs often provide tailored coverage and discounts to help young drivers manage the costs of insurance.

Additionally, young drivers can take steps to improve their chances of obtaining insurance coverage. Maintaining a clean driving record by avoiding accidents and traffic violations is crucial. They can also consider taking defensive driving courses or advanced driver education programs, which can demonstrate their commitment to safe driving and potentially lead to lower insurance premiums. Building a good credit history can also be advantageous, as some insurers use credit-based insurance scoring to assess risk.

In summary, age restrictions are a common challenge for young drivers seeking insurance coverage. However, by understanding the reasons behind these restrictions and exploring alternative options, young drivers can navigate the process more effectively. Taking proactive measures to improve their driving record and financial profile can also help them secure affordable insurance coverage despite the age-related limitations imposed by insurers.

Update Your Auto Insurance: Grubhub Delivery Driver's Guide

You may want to see also

Higher Premiums: Younger drivers often face increased insurance costs due to statistical factors

Younger drivers, especially those under the age of 25, often encounter a significant challenge when it comes to obtaining affordable insurance coverage. Insurance companies typically view this demographic as high-risk drivers, and as a result, they are often subjected to higher premiums. This phenomenon can be attributed to several statistical factors that insurance providers consider when assessing risk.

One of the primary reasons for the increased costs is the higher likelihood of accidents and traffic violations among younger drivers. Statistics show that younger individuals, particularly those in their late teens and early twenties, are more prone to risky behavior on the road. This includes speeding, reckless driving, and a higher incidence of being involved in accidents. Insurance adjusters and underwriters use these statistics to calculate the potential costs of providing coverage to this age group. As a result, younger drivers may find themselves paying more for car insurance to offset these potential risks.

Another factor contributing to higher premiums is the limited driving experience of younger individuals. With less time behind the wheel, they may lack the skills and judgment required to handle various driving situations effectively. This lack of experience can lead to more frequent claims and, consequently, higher insurance rates. Insurance companies often use age and driving history as key determinants of risk, and younger drivers may find themselves in a less favorable position when it comes to securing affordable coverage.

Furthermore, the higher costs can also be attributed to the higher claim amounts associated with younger drivers. When accidents occur, younger individuals may require more extensive medical treatment or vehicle repairs, leading to increased claim payouts. Insurance providers must consider these potential costs when setting premiums, especially for younger drivers who are statistically more likely to be involved in such incidents.

In summary, younger drivers, particularly those under 25, often face higher insurance premiums due to statistical factors that insurance companies use to assess risk. These factors include accident rates, traffic violations, limited driving experience, and higher claim amounts. Understanding these reasons can help younger drivers navigate the insurance market more effectively and potentially find ways to mitigate the increased costs.

Auto Insurance Claims: Your Right to File a Lawsuit

You may want to see also

Limited Coverage Options: Young drivers may have fewer policy choices and higher deductibles

Young drivers often face limited coverage options when it comes to car insurance, which can be a significant challenge for those seeking comprehensive protection. Insurance companies typically view young drivers as high-risk individuals due to their lack of driving experience and the associated higher likelihood of accidents. As a result, they may offer fewer policy choices, making it more difficult for young drivers to find suitable coverage that meets their specific needs.

One of the primary reasons for these limited options is the higher risk associated with young drivers. Insurance providers often use age as a factor in determining premiums and coverage terms. Young drivers, especially those under 25, are statistically more prone to accidents and traffic violations. This risk factor influences the availability and cost of insurance policies.

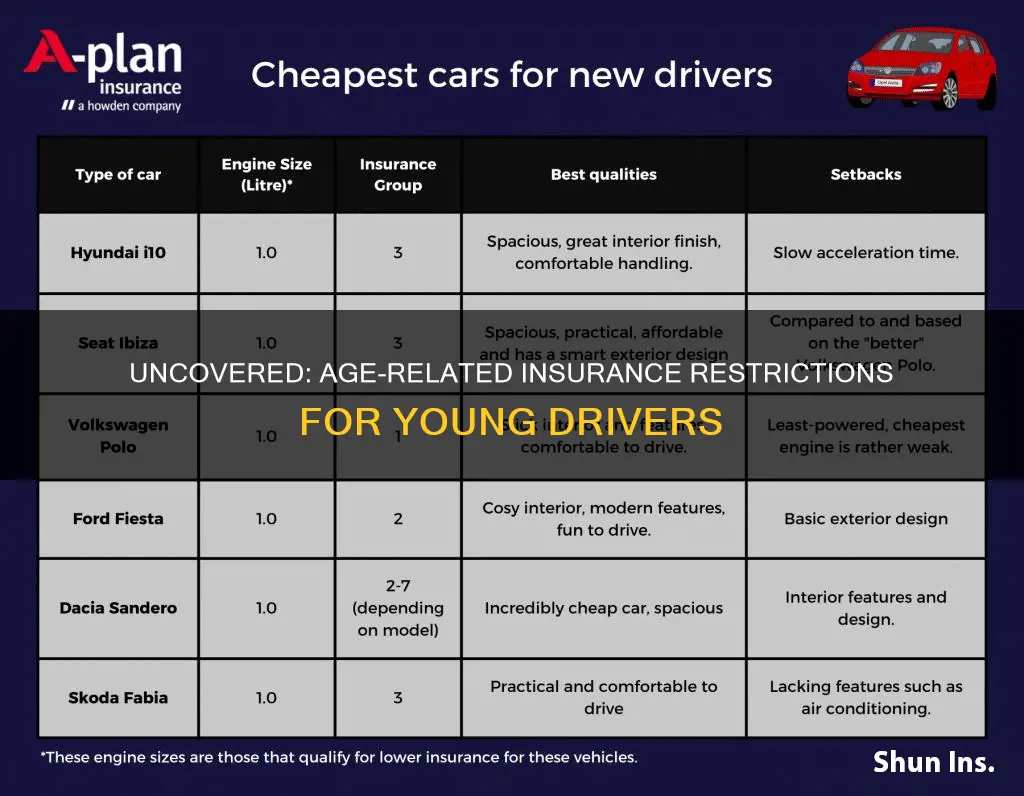

When it comes to policy choices, young drivers might find themselves with fewer options. Standard auto insurance policies may have restrictions or exclusions for drivers under 25, making it challenging to obtain comprehensive coverage. For instance, certain policies might exclude coverage for high-performance or luxury vehicles, leaving young drivers with limited choices if they desire insurance for such cars. Additionally, some insurers may offer basic liability coverage as the primary option for young drivers, which may not provide the extensive protection they require.

Higher deductibles are another consequence of limited coverage options for young drivers. Deductibles represent the amount a policyholder must pay out of pocket before the insurance coverage kicks in. Insurance companies often encourage higher deductibles for young drivers to offset the increased risk. This means that in the event of an accident, young drivers may have to pay a more substantial amount before their insurance coverage begins, potentially impacting their financial stability.

To navigate these limited coverage options, young drivers can explore alternative insurance providers or specialized programs. Some companies offer young driver policies with tailored coverage and lower deductibles. Additionally, government-backed initiatives or programs designed for young drivers can provide more affordable and comprehensive insurance solutions. By researching and comparing different insurers, young drivers can find policies that offer a balance between coverage and cost, ensuring they have the necessary protection on the road.

Stolen Vehicle: Insurance Contact?

You may want to see also

Driving Experience: Lack of experience is a common reason for age-based insurance exclusions

The insurance industry often views young drivers, especially those under the age of 25, as high-risk individuals when it comes to car insurance. One of the primary reasons for this is the lack of driving experience. Insurance companies recognize that younger drivers are generally less experienced on the road, which can lead to a higher likelihood of accidents and, consequently, more claims. This perception is a significant factor in the age-based exclusions in insurance policies.

For many insurance providers, the age of 25 is a critical threshold. During the early years of driving, individuals are more prone to making mistakes due to their limited exposure to various driving conditions and situations. This inexperience can result in a higher accident rate, which is a primary concern for insurers. As a result, insurance companies often impose higher premiums or even deny coverage for drivers under 25, especially those with limited driving history.

The lack of driving experience is a valid concern as it directly correlates with the likelihood of accidents. Younger drivers might struggle with handling high-pressure situations on the road, such as sudden stops, evasive maneuvers, or dealing with unexpected obstacles. These challenges can be more pronounced for new drivers who have not yet developed the skills and reflexes required to react effectively in various driving scenarios.

To address this issue, some insurance companies offer specialized policies designed for young drivers. These policies often include restrictions and incentives to encourage safer driving habits. For instance, they might require drivers to complete a certain number of hours of supervised practice, install telematics devices that monitor driving behavior, or offer discounts for completing defensive driving courses. By implementing these measures, insurers aim to mitigate the risks associated with inexperienced drivers and provide coverage at more affordable rates.

In summary, the lack of driving experience is a significant factor in the age-based insurance exclusions for drivers under 25. Insurance companies use this as a criterion to assess risk and determine premium rates. While it may be challenging for young drivers to access affordable insurance, there are strategies and policies in place to help them overcome these barriers and gain the necessary experience to secure better coverage in the future.

Auto Insurance: What Extra Rental Car Fees Are Covered?

You may want to see also

Young Driver Discounts: Some insurers offer discounts for mature drivers, not for those under 25

For young drivers, the insurance landscape can be particularly challenging, with many insurers imposing higher premiums due to the perceived higher risk associated with this demographic. However, it's important to note that some insurance companies recognize the need to support new drivers and offer specific discounts to mature, experienced drivers. These discounts can provide a much-needed financial incentive for those who have been driving for a significant period and have a clean driving record.

The concept of 'Young Driver Discounts' is often misunderstood. While it is true that many insurers do not offer discounts specifically for young drivers, some companies do provide incentives for mature drivers who have been on the road for several years. These discounts are designed to reward safe driving habits and long-term commitment to insurance. For instance, insurers might offer reduced rates to drivers over 25 who have maintained a good driving record, as they are considered less likely to file claims.

Mature drivers often benefit from a combination of factors that make them attractive candidates for insurance discounts. Firstly, they have a wealth of driving experience, which can translate into safer driving habits. Additionally, mature drivers are more likely to have a stable income and a consistent driving history, reducing the insurance company's risk. This stability can also mean they are less likely to make frequent changes to their insurance policies, which can further lower the insurer's costs.

To take advantage of these discounts, young drivers should consider the following steps. Firstly, research insurance companies that offer mature driver discounts. Many insurers have specific programs designed for experienced drivers, often referred to as 'senior driver discounts' or 'long-term customer discounts'. Secondly, maintain a clean driving record. This is crucial, as any traffic violations or accidents can significantly impact your insurance rates. Finally, consider taking a defensive driving course, which can sometimes lead to additional discounts.

In summary, while young drivers often face higher insurance premiums, mature drivers can benefit from specific discounts offered by some insurers. These discounts are a testament to the idea that experience on the road can lead to safer driving and reduced insurance risk. By understanding these options and taking the necessary steps, young drivers can potentially secure more affordable insurance coverage.

Auto Insurance in Colorado: What You Need to Know

You may want to see also

Frequently asked questions

Insurance companies often impose age restrictions for drivers under 25 due to higher risk factors associated with younger drivers. Statistics show that younger drivers are more likely to be involved in accidents, which can lead to increased insurance claims and higher premiums. Age restrictions are a way for insurers to manage risk and ensure fair pricing for all policyholders.

Yes, it is possible to obtain car insurance even if you are under 25. Many insurance providers offer specialized policies tailored to young drivers. These policies may include additional driver training programs, good student discounts, or usage-based insurance, which rewards safe driving habits. However, you might need to meet certain criteria, such as having a clean driving record or completing a defensive driving course.

Yes, there are alternative options available for young drivers who may struggle to find affordable insurance. One option is to consider a parent's policy, where you can be added as an additional driver. Another alternative is to look for usage-based insurance programs that track your driving behavior and provide discounts for safe driving. Some insurers also offer pay-as-you-go or per-mile insurance plans, which can be more affordable for younger drivers with limited driving experience.