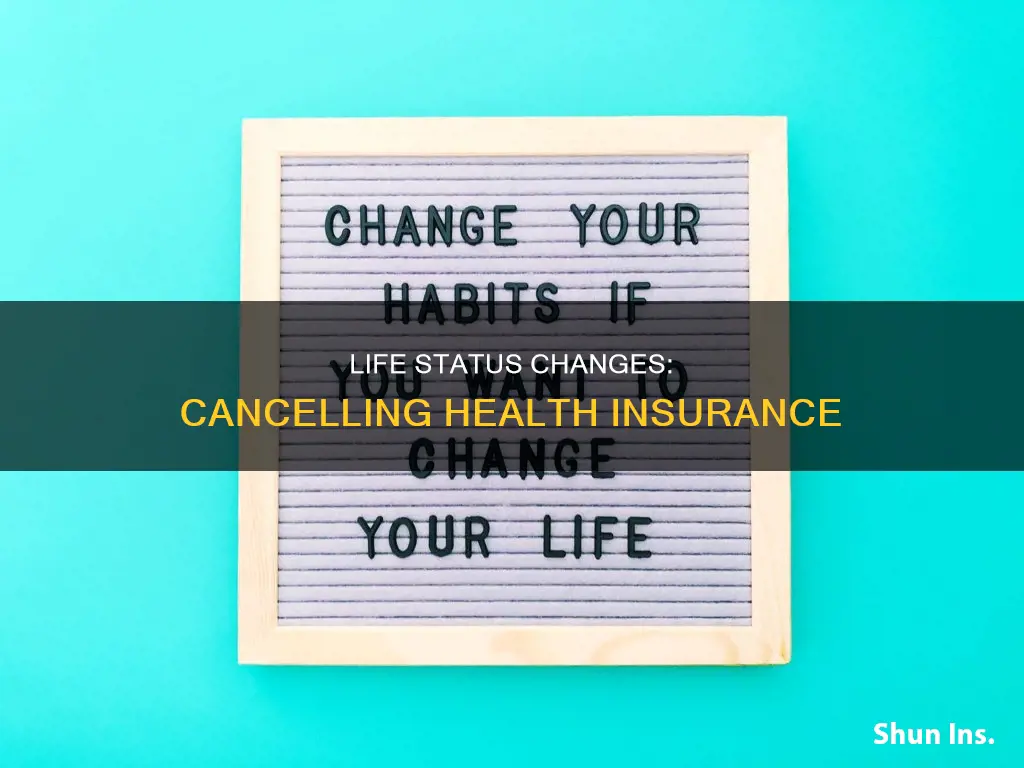

A life status change is a term used to describe a significant event in a person's life that can impact their health insurance coverage. These events are considered Qualifying Life Events (QLEs) and allow individuals to make changes to their insurance policy outside of the usual Open Enrollment Period. QLEs include changes in family status, such as the birth or adoption of a child, marriage, divorce, or the death of a spouse. They also include changes in employment status, such as starting or losing a job, or a change in income that affects the ability to pay premiums. Other events like moving to a new location, gaining or losing dependent status, or a change in citizenship status can also qualify. These life status changes enable individuals to adjust their health insurance plans accordingly, ensuring they have the necessary coverage during life's unpredictable shifts.

| Characteristics | Values |

|---|---|

| Qualifying Life Events | Gaining a dependent, becoming a dependent, losing minimum essential coverage, death of the insured, divorce, birth or adoption of a child, change in employment status, loss of coverage, becoming a US citizen, leaving incarceration |

| Open Enrollment Period | Late fall to early winter, typically November 1 to December 15 |

| Special Enrollment Period | 60 days from the qualifying life event |

| Cancellation | Contact the insurance provider or the health insurance marketplace, fill out forms |

What You'll Learn

Marriage, divorce, or a change in family status

Marriage

If you are getting married or remarried, you may enroll in a new health insurance plan, change from "Self Only" to "Self and Family", or switch from one plan to another. You must submit your enrollment change from 31 days before to 60 days after the change in family status. If you already have a "Self and Family" enrollment, you should contact your health plan provider to inform them of your new family member(s).

Divorce

In the case of divorce or annulment, your ex-spouse is eligible for continued coverage under your "Self and Family" enrollment while you are legally separated or in the process of getting a divorce. Once the divorce or annulment is finalised, your ex-spouse loses coverage, although there may be a 31-day extension of coverage. After the divorce, your ex-spouse may be eligible to enrol under Spouse Equity, Temporary Continuation of Coverage (TCC), or convert to an individual policy.

If you have a "Self Plus One" enrollment with no other eligible family members, the divorce is considered a Qualifying Life Event, and you can change to a "Self Only" enrollment within 60 days of the date of your divorce. You can also change plans or options at this time. If you have a "Self and Family" enrollment with no other eligible family members, you can decrease your enrollment to "Self Only". If there is only one eligible family member remaining, you may change to a "Self Plus One" enrollment.

Change in Family Status

Changes in family status can include events such as having a baby, adopting a child, or a child turning 26 and losing coverage through a parent's plan. These events are considered Qualifying Life Events, allowing you to make changes to your health insurance plan outside of the usual Open Enrollment Period.

Life Insurance: Adding to Your Net Worth?

You may want to see also

Employment status changes

A change in employment status is a qualifying life event (QLE) that allows you to cancel your health insurance plan outside of the usual open enrollment period. This includes:

- Reemployment after a break in service of more than three days

- Returning to pay status after your coverage terminated during leave without pay status, or because you were in leave without pay status for more than 365 days

- A pay increase that allows for premiums to be withheld

- Being restored to a civilian position after serving in the uniformed services

- Changing from a temporary appointment to an appointment that entitles you to a government contribution

- Changing to or from part-time career employment

In addition, losing your current health insurance coverage due to termination or a change in employment status is also considered a qualifying life event.

It's important to note that you usually have a limited time, often 60 days, to make changes to your insurance policy after experiencing a qualifying life event.

Juvenile Diabetes: Life Insurance Options for Patients

You may want to see also

Loss of coverage

Qualifying Life Events

Certain life events are considered "qualifying life events" or "qualified status changes," which allow individuals to make changes to their health insurance outside of the Open Enrollment Period. These events typically involve a change in household size, residence, income, or access to health insurance. For example, losing employer-sponsored health insurance due to job loss or leaving a spouse's insurance plan after a divorce are both considered qualifying life events.

It's important to note that voluntarily dropping your coverage, such as choosing to leave a parent's insurance plan or failing to pay premiums, does not qualify for a Special Enrollment Period.

Special Enrollment Period (SEP)

A Special Enrollment Period (SEP) is a window of time when individuals can enroll in or make changes to their health insurance outside of the standard Open Enrollment Period. This period is triggered by a qualifying life event and usually lasts for 60 days from the date of the event. During this time, individuals can adjust their coverage to reflect their changed circumstances.

For example, if an individual loses their job and their employer-sponsored health insurance, they are eligible for an SEP. They can use this period to enroll in a new health plan, either through the exchange/marketplace in their state or directly through an insurer.

Medicaid and Other Programs

Planning for the Future

When facing a loss of coverage, it's crucial to act promptly during the Special Enrollment Period to ensure continuous coverage. Additionally, it's important to carefully review the details of potential insurance plans, including costs, services covered, and whether your preferred healthcare providers accept the insurance.

By understanding the options available during a loss of coverage, individuals can make informed decisions to secure the health insurance that best fits their evolving needs and circumstances.

Primerica Life Insurance: Borrowing Money from Your Policy?

You may want to see also

Moving to a new location

Moving within the same state:

If you are relocating to a new address within the same state, you may be able to retain your current health insurance plan. Contact your insurance provider to confirm if your new location is still within their coverage network. It is important to report your change of address to your insurance company and update your application, even if your plan remains the same.

Moving to a different state:

When moving to a new state, it is essential to understand that health insurance plans are regulated at the state level, meaning you will likely need to enrol in a new plan. Your previous health insurance provider may not offer coverage in your new state, so it is crucial to review your options and select a suitable plan.

Special Enrollment Period (SEP):

Moving to a new state or zip code qualifies you for a Special Enrollment Period, allowing you to make changes to your health insurance outside of the standard open enrollment period. This period typically lasts for 60 days, giving you a limited window to adjust your insurance coverage.

Steps to take when moving to a different state:

- Research and compare health insurance plans available in your new state. Consider factors such as coverage, provider networks, and cost.

- Start a new application on your new state's Marketplace website or HealthCare.gov, depending on which platform your state uses.

- Enrol in a new plan: Pick a plan that suits your needs and pay your first month's premium to finalise your enrolment.

- Terminate your previous plan: Contact your previous insurance provider to cancel your old plan, preferably aligning the termination date with the start of your new coverage to avoid gaps in insurance.

Additional considerations:

- Timing your move: If you are transitioning from one insurance plan to another, consider timing your move to minimise any gaps in coverage. Aim to move towards the end of the month so that your previous plan can cover you for most of that month, and your new plan begins at the start of the following month.

- Short-term plans: If you anticipate a gap in coverage, consider enrolling in a short-term plan to bridge the period until your new plan takes effect. However, keep in mind that short-term plans may not cover pre-existing conditions.

- Medicaid considerations: If you are transitioning from one state's Medicaid program to another, be aware that each state operates its own program with different rules and eligibility requirements. Research and plan ahead to ensure a smooth transition and avoid coverage lapses.

Remember to review your health insurance options thoroughly when moving to a new location to ensure you have the coverage you need in your new area.

Aflac Life Insurance Loan: Online Application Process

You may want to see also

Death of a family member

The death of a family member is a life status change that can impact your health insurance coverage and may require you to make adjustments to your policy. Here are some important considerations and steps to take if you experience the loss of a loved one:

Impact on Coverage

If you were covered under your deceased loved one's insurance plan, your coverage will likely be affected. In the case of employer-sponsored insurance, dependent coverage typically ends after a grace period. Contact the human resources department of the deceased's employer to understand how long your coverage will continue and explore any available options.

COBRA Coverage

With most employer-sponsored plans in the US, surviving dependents have the option of COBRA (Consolidated Omnibus Budget Reconciliation Act) medical insurance. COBRA allows you to extend your current coverage for up to 36 months, but you will need to pay the full premium cost, which can be expensive. You usually have 60 days from the date of your loved one's death to sign up for COBRA.

Special Enrollment Period

The loss of a spouse or family member is often considered a "Qualifying Life Event" or "Qualifying Life Change," which can trigger a special enrollment period for exchange-based plans under the Affordable Care Act. This allows you to sign up for a new plan or change your existing coverage outside of the regular open enrollment period.

Notify Relevant Parties

If the deceased was covered under your insurance plan, notify your employer's human resources department or your health insurer as soon as possible. Your premium and other costs may change due to losing a dependent on the plan.

Claim Settlement

If the deceased was the policyholder, promptly notify the insurance company to initiate the claim settlement process and prevent any delays. Gather essential documents, including the original policy document, death certificate, medical records (if applicable), and identification proof of the nominee or legal heir. Submit the claim form with the required documents to the insurance company.

Cancellation Process

To cancel the policy of the deceased policyholder, inform the health insurance provider as soon as possible. Provide the insurance company with the required documents, such as a copy of the death certificate. Request written confirmation of the cancellation to formally close the policy and have proof of termination. If premiums were prepaid, contact the insurer to inquire about potential refunds for unused months.

Remember that the specific steps and options available to you may vary depending on your location and the type of insurance plan you have. It is always best to consult with the relevant government websites, insurance providers, and human resources departments for detailed information on your specific situation.

Life Insurance: Shopping Frequency and the Ramsey Way

You may want to see also

Frequently asked questions

A life status change is a significant event in a person's life that can impact their health insurance coverage. These events can include changes in marital status, the birth or adoption of a child, employment status, or the loss of current health insurance coverage.

Some examples of life status changes that may qualify you for a Special Enrollment Period include getting married, divorced, or legally separated; giving birth to or adopting a child; starting, ending, or losing a job; losing your current health insurance coverage; moving to a new ZIP code, county, or country; and becoming a U.S. citizen or leaving incarceration.

You typically have 60 days from the life event to enroll in a new plan or make changes to your existing plan. However, it is important to report your change as soon as possible.

To cancel your health insurance plan, you will need to contact your insurance provider or the health insurance marketplace. You may need to fill out forms to make the cancellation official, and it is important to ensure you have alternative coverage in place before cancelling your current plan.