Insurance policies are often filled with legal jargon and complicated language, making them difficult to understand. However, it is crucial to read and comprehend your insurance contract to ensure you know what you are agreeing to and what your coverage includes. The policy is a legal contract between you and the insurance company, and understanding it can help you avoid costly coverage gaps or frustration with your insurer after an accident.

The first page of your insurance policy is typically the Declarations page or the Dec page. This section summarises essential information about your policy, including coverage types, limits of liability, premiums, deductibles, and contact information. It is important to review this page periodically to ensure accuracy.

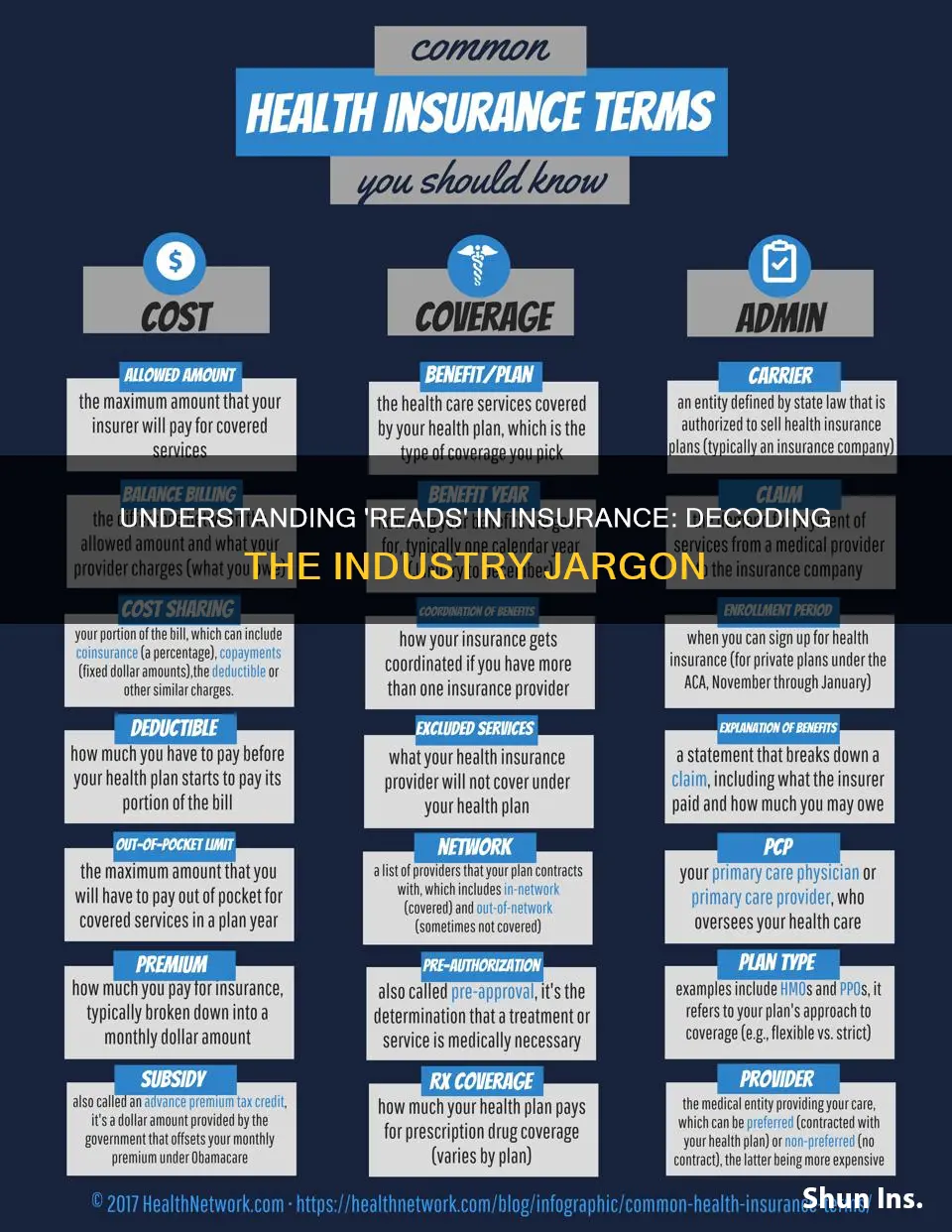

The rest of your policy will include sections such as the insurance agreement, definitions, coverage sections, exclusions, endorsements, cancellation terms, and contact information. The insurance agreement outlines the terms, conditions, and exclusions of your coverage. The definitions section explains any key terms used in the policy, while the coverage sections go into more detail about the specific types of coverage you've purchased. It is crucial to understand the exclusions, as they outline what is not covered by your policy. Endorsements outline any optional additions to your policy, while the cancellation terms explain the conditions under which your policy can be cancelled.

While insurance policies can be challenging to navigate, taking the time to understand your coverage and asking for help when needed will ensure you know what you are paying for and what protection you can expect.

| Characteristics | Values |

|---|---|

| Purpose | To outline the terms of your insurance policy, including what is covered and what is not, as well as what you'll pay. |

| Readability | Insurance policies are often dense and complicated, with lots of legalese and specialized terms. However, insurance companies strive to make their policies as clear as possible, as ambiguity in the language will be interpreted in favour of the insured in the event of a legal challenge. |

| Key Sections | Declarations page, insurance agreement, definitions, coverage sections, exclusions, endorsements, cancellation terms, contact information. |

| Understanding the Policy | Learn insurance terminology, read the fine print, ask questions, seek help from agents and attorneys if needed. |

What You'll Learn

- Insurance policies are often dense and confusing, filled with legal jargon

- Understanding your insurance policy can help avoid costly coverage gaps

- The declarations page summarises your coverages, limits, premiums and deductibles

- Insurers must notify you before cancelling or not renewing your policy

- Insurance contracts are based on the principle of utmost good faith

Insurance policies are often dense and confusing, filled with legal jargon

- Legal Validity: Insurance policies are legal contracts that need to hold up in court. As a result, they contain a lot of legal jargon and specialized terms to reduce ambiguity and protect the insurance company.

- Complexity of Coverage: Insurance policies need to cover a wide range of scenarios, risks, and exclusions, making them inherently complex. They often include multiple sections that cross-reference each other, making them difficult to navigate.

- Industry Regulations: The insurance industry is highly regulated, and carriers must comply with various laws and regulations. This results in denser policies as companies try to spell out all the terms, conditions, and exclusions to protect themselves legally.

- Protection Against Lawsuits: Insurance companies want to reduce their liability and protect themselves from potential lawsuits. By making the policies dense and complicated, they can deny coverage more easily and profit from policyholders' confusion.

- Dynamic Nature of Contracts: Insurance contracts evolve over time due to new laws, regulations, court cases, and differing opinions. This can lead to increased complexity and difficulty in understanding the policies.

- Team of Lawyers: Insurance companies typically have a team of lawyers drafting the terms and conditions, resulting in policies that are challenging to understand for the average person.

- Length and Detail: Insurance policies can be lengthy, often ranging from 150 to 200 pages. They contain detailed information, exceptions, and exclusions, making them hard to navigate and understand for regular consumers.

To navigate these dense and confusing insurance policies, it is essential to seek help from agents, brokers, or attorneys who are trained to decipher complex insurance contracts. Additionally, paying close attention to capitalized or bolded words, which often have specific meanings, can help clarify the coverage provided. Reading and understanding insurance policies before purchasing them is crucial to ensure you know what you are paying for and what coverage you can expect.

Short-Term Insurance Scams: Unraveling the Truth Behind Temporary Coverage

You may want to see also

Understanding your insurance policy can help avoid costly coverage gaps

Insurance policies are often filled with legal jargon, making them confusing to understand. However, it is important to read through your insurance contract carefully to ensure you know what you are agreeing to and what is covered and what is not. Understanding your insurance policy can help you avoid costly coverage gaps and frustration with your insurer after an accident.

- Start with the declarations page: This page summarizes your coverage, insured drivers, vehicles, coverage limits, deductibles, and other important information. Review this page periodically to ensure accuracy and that it reflects any changes you have made to your policy.

- Understand key terms: Insurance policies often have a definitions section that clarifies who and what is covered. Pay attention to capitalized, bolded, or italicized words as these are usually defined terms with specific meanings relevant to the policy.

- Be aware of exclusions: Exclusions are situations or circumstances that are not covered by your policy. Understanding exclusions can help you identify any gaps in your coverage and determine if you need additional coverage.

- Review the insuring agreement: This section outlines what is covered and how it is covered. It is important to read this section carefully to know exactly what your insurer has agreed to cover.

- Ask for help: If you are unsure about any part of your insurance policy, don't hesitate to contact your insurance agent or a legal expert for clarification. They can help you understand the complex terms and conditions and ensure you have the coverage you need.

- Regularly review your policy: It is important to review your insurance policy periodically, especially after any major changes that could impact your coverage. This will help you identify any gaps or areas where you may be underinsured.

- Compare insurance providers: Shopping around and comparing different insurance providers can help you find the best coverage for your needs at a competitive price.

Understanding the Fine Print: Navigating Insurance Policies and Their Terms and Conditions

You may want to see also

The declarations page summarises your coverages, limits, premiums and deductibles

The declarations page, often referred to as the 'dec page', is a summary of your insurance policy. It is a snapshot of your coverages, limits, premiums and deductibles, providing an overview of your policy details. This document is typically the first page of your insurance policy and serves as a quick reference guide to your coverage.

The dec page outlines the specific coverages provided by your insurance policy. It details the types of risks and perils insured against, as well as any exclusions or limitations. This section helps you understand what is covered by your policy and what falls outside its scope.

Limits refer to the maximum amount your insurance company will pay for a covered loss. On the declarations page, you will find the limits for each type of coverage provided by your policy. These limits represent the cap on the insurance company's financial responsibility in the event of a claim.

Premiums are the amount you pay for your insurance coverage. The declarations page outlines the cost of your policy, including any applicable fees and surcharges. This section breaks down the total premium, showing the amounts attributed to each type of coverage and providing a clear picture of the financial commitment associated with your policy.

Deductibles are the amount you must pay out of pocket before your insurance coverage begins. The dec page specifies the deductibles for the various coverages under your policy. Understanding your deductibles is crucial, as they directly impact your financial responsibility when making a claim. A higher deductible usually results in lower premiums, while a lower deductible leads to higher premiums.

The declarations page is a vital document that provides a concise and accessible summary of your insurance policy. It serves as a convenient reference point for understanding your coverage, premiums, and financial obligations in the event of a claim. By reviewing the dec page, you can be confident that you know the essential details of your policy and can make informed decisions regarding your insurance protection.

The Surprising Benefits of Term Insurance: Unlocking Peace of Mind

You may want to see also

Insurers must notify you before cancelling or not renewing your policy

An insurance policy is a legal document that outlines the terms and conditions of your coverage. It is essential to understand the terms of your policy to know what is covered and what is not. While insurance policies can be complex and challenging to understand, it is your responsibility to review and comprehend the contract.

In most states, insurers are required to notify policyholders in writing of any cancellation at least 30 days before the effective date. This notification is crucial as it gives you time to address the issue, negotiate with the insurance company, or find alternative coverage. The specific reasons for cancellation vary but often include non-payment of premiums, fraud, or significant changes in risk.

It is important to note that non-renewal is different from cancellation. Non-renewal occurs when either the insurance company or the policyholder chooses not to renew the policy upon its expiration. In this case, the insurance company must also provide notice, typically 45 days, and explain the reason for non-renewal. The exact timeframe and requirements may vary depending on the state you live in.

If you receive a cancellation or non-renewal notice, it is essential to take prompt action. Contact your insurance agent or company to discuss the issue and explore possible solutions. You can also reach out to your state's insurance department for further assistance and clarification.

Cigna's Individual Term Insurance Plans: Exploring Personalized Coverage Options

You may want to see also

Insurance contracts are based on the principle of utmost good faith

The doctrine of utmost good faith requires all parties to a contract to act honestly and not mislead or withhold critical information from one another. This means that insurance agents must reveal critical details about the contract and its terms, while applicants are required to provide honest answers to all questions asked.

In the context of insurance contracts, the doctrine of utmost good faith requires the full and accurate disclosure of relevant information. Insurance agents must honestly provide premium figures and coverage limitations, while applicants must truthfully disclose all requested pertinent personal information. This includes details such as health background, family history, any prior accidents or traffic tickets, residence, income, and education level.

Violations of the doctrine of good faith can result in contracts being voided and sometimes even legal action. For example, if an applicant intentionally withholds or misrepresents material information, the insurance company can reject any claim arising from the policy.

The doctrine of utmost good faith is necessary to ensure fairness, encourage trust, and provide a basis for legal action if one party breaches the contract. It is an important principle that promotes honest and fair behaviour between all parties involved in a contract.

Understanding the Art of Calculating Sum Assured in Term Insurance

You may want to see also

Frequently asked questions

The first step is to read the overview on your declarations page, which summarises your policy number, coverage period, types, limits, deductibles, premium, and agent's contact information.

The second step is to familiarise yourself with insurance terminology. Many everyday words take on legal meanings in insurance policies. Refer to the definitions section or glossary for clarification.

The third step is to carefully read the fine print. Reading insurance policies takes patience and focus, but it is important to understand the contract between you and your insurer.

The fourth step is to ask yourself questions to test your understanding. For example, "Do I know my policy number?", "When does my policy expire?", "What are my deductibles?", and "What are my coverage limits?".

The fifth step is to refer to the insuring agreement to see what is covered and the exclusions section to see what is not covered by your policy.