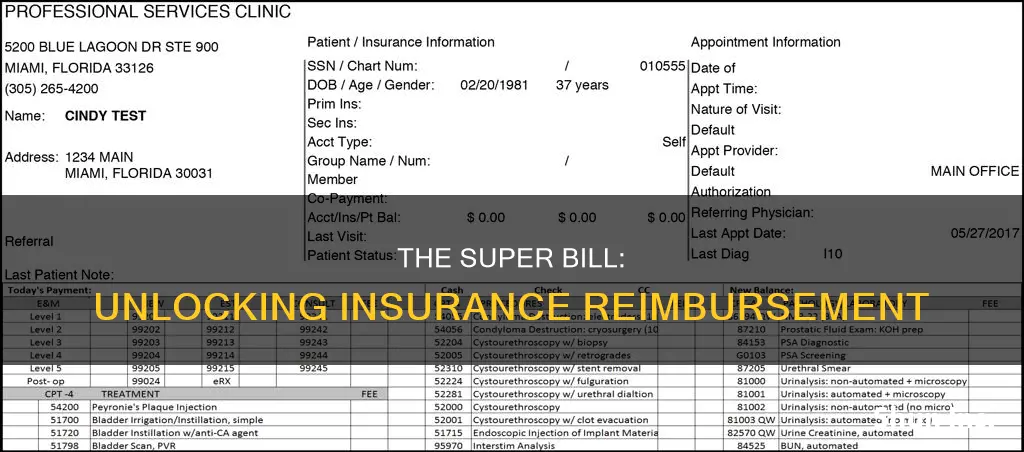

A superbill is a document that outlines the services provided to a client by a healthcare professional. It is used by healthcare providers as a primary source of data for creating claims for reimbursement from insurance companies. Superbills are typically used for out-of-network services, where the client pays upfront and then seeks reimbursement from their insurance provider. The superbill serves as a detailed receipt or invoice, including medical billing codes for the services rendered. It contains important patient demographic information, practice details, and treatment information.

| Characteristics | Values |

|---|---|

| Purpose | Used by healthcare providers to create claims for reimbursement |

| Used by patients to get reimbursed for services | |

| Other names | Charge slips, encounter forms, fee tickets |

| Requirements | Patient contact information |

| Provider information | |

| Diagnostic code (DX) | |

| Procedure codes and descriptions (CPT) | |

| Diagnosis codes and descriptions (ICD-10) | |

| Modifiers | |

| Fee for each service date | |

| Referrer identification | |

| Units or minutes for services rendered | |

| Fees charged for services rendered |

What You'll Learn

- A superbill is a detailed invoice/receipt of services provided to a client

- It includes basic client information, such as name, date of birth, and address

- It also includes provider information, such as name, location, and license number

- Superbills are used by out-of-network providers to help clients get reimbursed by their insurance company

- They are also known as charge slips, encounter forms, or fee tickets

A superbill is a detailed invoice/receipt of services provided to a client

A superbill is a detailed invoice or receipt of services provided to a client. It is a document that lists the services rendered to a client by a healthcare provider. It is used by healthcare providers as the primary source of data for creating claims for reimbursement from insurance companies.

A superbill is different from a simple receipt or ordinary invoice as it contains additional information regarding the services provided, such as diagnostic and procedure codes. It is also different in that it is not a request for payment but rather a tool for the client to seek reimbursement from their insurance provider.

A superbill typically includes the following information:

- Client contact information, including name, address, date of birth, phone number, and any other identifiers requested by the insurer.

- Provider information, such as the provider's name, location of practice, phone number, email address, and National Provider Identification (NPI) number.

- Diagnosis codes, which show what the client is being treated for and help the insurance company validate that the treatment is medically necessary.

- Procedure codes, which describe the medical procedures or services performed by the provider.

- Dates of service, including all dates the provider worked with the client.

- An itemized list of costs, including the service amount for each procedure code and any out-of-pocket costs paid by the client.

Superbills are usually provided to clients and insurance companies that are out of network. They allow clients to seek reimbursement for services provided by an out-of-network provider. The superbill enables the provider to collect upfront payment from the client, while the client can then submit the superbill to their insurance company to seek reimbursement for some of the out-of-pocket costs.

Exploring the Maximum Limit of Term Insurance: Unraveling the Mystery of Coverage Caps

You may want to see also

It includes basic client information, such as name, date of birth, and address

A superbill is a document that outlines the services provided to a client or patient. It is used by healthcare providers as a primary source of data for creating claims, which are then submitted to insurance companies for reimbursement. Superbills are typically used for out-of-network billing, meaning the healthcare provider is not within the client's insurance network.

Superbills include basic client information, such as:

- Name

- Date of birth

- Address

- Phone number

- Any other information the insurer may request

They also include the provider's information, such as:

- Name

- Practice name and address

- Phone number

- Email address

- National Provider Identifier (NPI) or Employer Identification Number (EIN)

- License number

The superbill will also include details about the services provided, such as the date of service, procedure codes, diagnosis codes, and the total cost.

Superbills are important because they allow clients to seek reimbursement from their insurance company for out-of-pocket expenses. They are typically provided to clients after they have paid for the services upfront. The client can then submit the superbill to their insurance company, who will review the claim and reimburse the client accordingly.

Comprehensive Guide to Purchasing 1 Cr Term Insurance

You may want to see also

It also includes provider information, such as name, location, and license number

A superbill is a document that outlines the services provided to a client by a healthcare professional. It is used by the client to seek reimbursement from their insurance company for any out-of-pocket expenses.

Provider information is a crucial component of a superbill. This includes the following:

- Provider's full name

- Provider's National Provider Identifier (NPI) number, a 10-digit identification code issued to all US healthcare providers by the Centers for Medicare and Medicaid Services (CMS)

- Address where the service was provided

- Provider's contact information, including phone number and email address

- Referring provider's name and NPI number (if applicable)

The provider information section of a superbill is important as it allows the insurance company to identify the healthcare provider and their practice. This information is necessary for the insurance company to process the client's reimbursement claim. It is also used to verify that the provider is qualified to offer the services listed on the superbill.

In addition to provider information, a superbill typically includes the client's contact information, diagnosis, procedure codes, and a list of services provided, along with the associated costs.

The Surprising Link Between Cavities and Insurance: Understanding the Unexpected Connection

You may want to see also

Superbills are used by out-of-network providers to help clients get reimbursed by their insurance company

A superbill is a document that lists the services provided to a client by an out-of-network healthcare provider. It is used by the client to seek reimbursement from their insurance company for the services they received. The superbill contains detailed information about the services provided, including CPT codes, ICD-10 codes, pricing, and practice information. It is essentially an itemized invoice that allows the insurance company to evaluate the client's claim and determine reimbursement eligibility and rates.

Superbills are typically used by out-of-network providers who do not have a contract with the client's insurance company. By providing a superbill, these providers can help their clients seek reimbursement for their services. The superbill serves as proof of the services rendered and includes all the necessary information for the insurance company to process the claim.

The process of receiving and submitting a superbill should be discussed with the insurance company beforehand. The client may need to submit the superbill through the insurance company's portal, mail it in, or use other methods as per the insurance provider's instructions. It is important to note that Medicare recipients do not have out-of-network benefits, so superbills would not apply in such cases.

Creating a superbill can be beneficial for both the provider and the client. The provider gets paid upfront by the client, avoiding the need to wait for claim reimbursement from insurance providers. The client has the opportunity to be reimbursed for their out-of-pocket expenses, potentially reducing the overall cost of care.

Superbills are commonly used in specialty medical fields, such as behavioral health, where therapists and psychologists often opt for superbills instead of becoming in-network providers. It provides a simpler and quicker alternative to joining an insurance panel, allowing out-of-network providers to collect payments directly from clients while still giving clients the option to seek reimbursement.

Nature's Fury: Understanding Tornadoes and Their Impact on Home Insurance Policies

You may want to see also

They are also known as charge slips, encounter forms, or fee tickets

A superbill is a document that contains a detailed list of services provided to a client by a healthcare provider. It is used by the client to seek reimbursement from their insurance company for out-of-network services. Superbills are also known as charge slips, encounter forms, or fee tickets. These terms refer to pre-printed documents that record the fees associated with a patient's visit through procedure codes and supporting data such as diagnostic codes.

Charge slips, encounter forms, or fee tickets are used by healthcare providers to outline the services provided to a client or patient. This includes detailed information such as CPT codes, ICD-10 codes, pricing, and practice information. By providing this information, the superbill enables the insurer to decide whether to provide reimbursement. It also allows patients to understand the costs associated with their treatment.

When creating a superbill, or charge slip, it is important to include the patient's demographic and contact information, such as their name, phone number, and date of birth. Additionally, the provider's information, including their name, practice address, phone number, email address, and National Provider Identification (NPI) number, should be included. The NPI is a 10-digit identification number issued by the Centers for Medicare and Medicaid Services.

The superbill, or encounter form, should also include information about the treatment provided. This includes the date of service, diagnosis codes from the Diagnostic and Statistical Manual of Mental Disorders (DSM) or International Statistical Classification of Diseases (ICD-10), and Common Procedure Terminology (CPT) codes. CPT codes describe the medical procedures performed on a patient and are maintained by the American Medical Association.

Fee tickets also include information about the fees charged for each service, as well as any out-of-pocket costs paid by the patient. This allows the insurance company to calculate reimbursement for the patient. Overall, superbills, or charge slips, encounter forms, or fee tickets, are essential for patients seeking reimbursement for out-of-network healthcare services.

Weighing the Benefits: Exploring Term Insurance for Your Children's Future

You may want to see also

Frequently asked questions

A superbill is a document that lists the services provided by a healthcare provider to a patient. It is used by healthcare providers as a primary source of data for creating claims for reimbursement.

The superbill allows patients to seek reimbursement from their insurance company for services provided by an out-of-network healthcare provider.

A superbill typically includes the patient's name, phone number, date of birth, and insurance information, as well as the healthcare provider's name, location, phone number, email address, and National Provider Identification (NPI) number. It also includes a list of services provided, with corresponding procedure codes, diagnosis codes, and fees.

The method of submitting a superbill may vary depending on the insurance provider. Some common methods include uploading it through the insurance company's portal, mailing it, or faxing it. It is recommended to discuss the process with the insurance company beforehand.