Term insurance is a type of insurance plan that offers a death benefit to beneficiaries when the policyholder passes away. The intention of term insurance is to leave a sufficient amount of money for your family in case you die before fulfilling all your financial obligations. An increasing term insurance plan is a type of term plan where the base sum assured increases over time. This is designed to keep up with inflation and other changing circumstances, such as an increase in financial responsibilities due to marriage or starting a family. The sum assured increases by a predefined amount each year until it reaches the maximum limit. The rate of increase is specified beforehand and remains the same throughout the plan tenure. While the coverage increases over time, the premiums usually remain constant.

| Characteristics | Values |

|---|---|

| Type of insurance plan | Term insurance with an increasing cover feature |

| Coverage amount | Increases automatically until it reaches the maximum limit |

| Modes to increase cover | Percentage increase, maximum cover aimed for, or end-age |

| Premium | Same throughout the policy tenure but higher than the pure term plan |

| Documentation and medical tests | No need to be done again |

| Riders | Accidental death and disability benefit rider, Critical Illness Rider, Waiver of premium rider |

What You'll Learn

Increasing cover option

An increasing cover option in term insurance is a type of term plan where the base sum assured increases. This is particularly useful if your financial situation changes over time, as the sum assured you choose at the beginning of the plan may not be adequate in the future due to inflation.

With an increasing cover option, the sum assured will increase by a predefined amount every year until the policy term ends or a maximum limit is reached. This helps you stay protected and aligned with your financial goals.

- One premium: With a manual upgrade, you would need to purchase a fresh policy by paying an additional premium. Throughout the term, you will continue to pay two premiums. With an increasing cover option, on the other hand, you will only have a single policy and a single premium for life.

- Automatic increase: When you manually upgrade your policy, you will need to submit documents, sign new declarations, and undergo new medical tests. With an increasing cover option, no new forms, documents, declarations, or medical tests are required.

- No risk of rejection: If you manually upgrade your policy when you're older, there is a chance that you will have to pay higher premiums due to age and health conditions. There is also the risk of the proposal being rejected due to age or poor health. With an increasing cover option, you won't have to worry about paying additional premiums or the policy getting rejected.

- Increase of 5%, 8%, or 10% per year until the cover becomes 2x.

- Increase of 5% or 10% every year until the policy term ends.

- Increase of 5% every year until the policyholder reaches the age of 55.

When considering an increasing cover option, it is important to calculate the right amount of coverage needed based on your income, expenses, liabilities, and future financial goals. It is also essential to consider the impact of inflation, as the cost of living tends to increase over time.

Understanding the Combined Ratio: A Key Metric in Insurance Performance Evaluation

You may want to see also

Inflation and upgrades

The primary reason people opt for term insurance plans is to provide financial security to their loved ones in their absence. When buying the policy, several factors are taken into consideration, such as current income, expenses incurred, liabilities, assets, and future financial objectives. The financial objectives tend to change as one grows older. Financial needs may increase with rising comfortable lifestyles and medical expenses.

An increasing term insurance plan ensures that the sum assured increases annually by a predetermined amount. The increase is done after adjusting for inflation and financial goals at the given time. With the increasing term insurance plan, the policyholder has the liberty to increase the sum assured amount during the tenure. The premiums of the policy may or may not change depending on the insurer. Ideally, increasing term plans are useful when accomplishing financial objectives at different life stages. For instance, this plan allows the policyholder to increase the term insurance coverage amount during important milestones of their life, such as marriage, the birth of a child, and the child's education. Here, the policyholder can increase a certain percentage of the sum assured amount to meet their rising/changing financial demands and responsibilities.

There are different modes to increase the cover based on the percentage increase, the maximum cover aimed for, or an end age. The premium is the same throughout the policy tenure but is higher than the pure term plan because of the increasing cover. There is no need for new documentation or medical tests to be done again.

The sum assured increases every year till the policy matures. However, it can only go up to a certain percentage of the original sum assured and not more than that. For example, the limit might be 2X the first cover amount. So, if the policyholder takes a 1 Crore cover, and the maximum limit is 2X, then, by the end of the term, the cover will increase to 2 crores and not more.

The benefits of an increasing term insurance plan include:

- Effectively helps to fight inflation

- Meets changing financial goals

- Premiums are low and affordable

- Saves tax under Section 80C of the Income Tax Act

- No additional underwriting

Smoking Relapse: Impact on Term Insurance and Your Health

You may want to see also

Premium throughout policy tenure

Term insurance is a type of life insurance that provides coverage for a specific period, known as the "term". This type of insurance is typically much cheaper than permanent life insurance and does not accumulate cash value. The premium for term insurance is usually fixed and paid for the length of the term. If the insured person dies within the term, the insurance company pays out a death benefit to their beneficiaries. However, if the term expires and the person dies afterward, there is no coverage or payout.

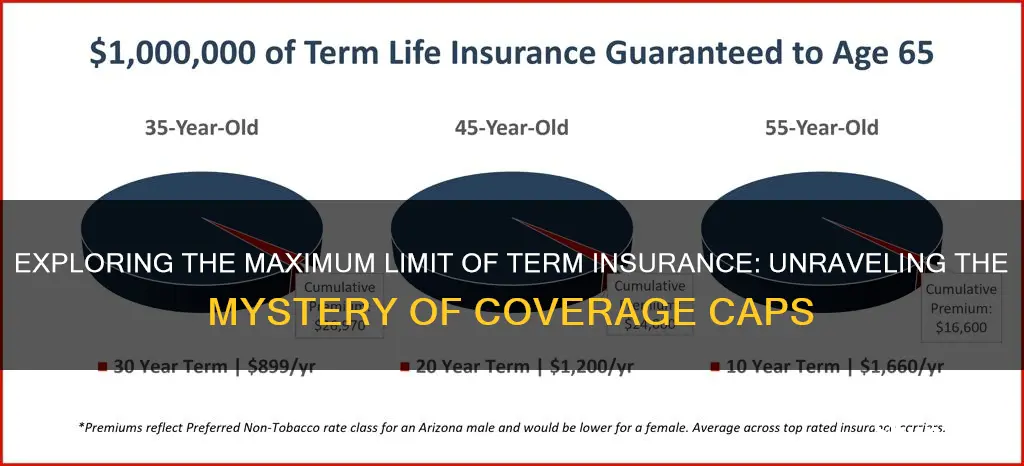

When considering the premium throughout the policy tenure of term insurance, it is important to understand the factors that determine the premium amount. The insurance company calculates premiums based on health, age, gender, lifestyle, and life expectancy. The younger and healthier a person is, the lower their premium will be. Additionally, premiums are typically higher for those engaged in risky activities or occupations.

Term insurance policies offer flexibility in premium payments. Policyholders can choose to pay annually, semi-annually, quarterly, or monthly. There is also the option of a one-time, lump-sum premium payment or a limited pay option, where premiums are paid within the initial few years of the policy. The life cover remains active for the entire term, even if premium payments are completed earlier.

It is worth noting that term insurance premiums may increase significantly if the policy is renewed after the initial term expires. This is because the premium is based on the person's age at the time of renewal, and life insurance premiums tend to be more expensive at older ages.

When deciding on the policy tenure of term insurance, it is crucial to consider your financial obligations, dependents, and affordability. The policy tenure should be long enough to cover any outstanding debts and provide financial support to dependents until they become financially independent. However, it should also be affordable, as longer policy tenures come with higher premiums.

In conclusion, when considering the premium throughout the policy tenure of term insurance, it is important to assess your financial situation, health, age, and the length of coverage needed. Term insurance offers flexibility in premium payments, but it is important to be mindful of potential increases in premiums upon renewal.

The Fronting Phenomenon: Unraveling the Complexities of Insurance Fronting

You may want to see also

No new documentation

Term insurance is a type of life insurance that financially secures your loved ones in the event of your death. It is a pure protection plan that offers a death benefit to the beneficiaries when the policyholder passes away. The sum assured is the amount that the family receives on the demise of the policyholder.

There are two options to increase your term insurance cover amount: buying a new term policy or choosing the increasing cover option with your existing insurer. The increasing cover option is a type of term insurance plan where the base sum assured increases over time. This type of plan does not require any new documentation or medical tests. The policy will systematically upgrade without the policyholder needing to intervene each time.

The increasing cover option offers several benefits, including:

- One premium: With a manual upgrade, you purchase a fresh policy by paying an additional premium. With an increasing cover, on the other hand, you will only have a single policy and a single premium for life.

- Automatic increase: When you manually upgrade, you need to submit documents and undergo new medical tests. With increasing covers, there are no new forms, documents, declarations, or medical tests required.

- No risk of rejection: There is a chance that a manual upgrade could be rejected due to age or health-related reasons. With increasing covers, there is no risk of rejection.

When purchasing a term insurance plan, the standard set of documents required includes income proof, identity proof, medical report, and proof of residence. These documents help the insurance company evaluate your financial situation and establish your insurability.

Understanding the Insurance Coverage of Short-Term Bonds

You may want to see also

Riders for additional coverage

Riders are add-ons to a term insurance policy that provide additional coverage and benefits. They allow customisation of the policy to meet specific needs and offer enhanced protection. While some riders are included within the term plan, others need to be purchased separately by paying an additional premium. Here are some common riders for additional coverage:

- Accidental Death Rider: This rider provides an additional payout on top of the base sum assured if the policyholder dies due to an accident. It ensures that the policyholder's family receives extra financial support.

- Terminal Illness Rider: This rider provides a cash benefit if the policyholder is diagnosed with a terminal illness, as certified by a medical practitioner. The benefit can be used for medical treatments or to secure the financial future of loved ones.

- Critical Illness Rider: This rider provides a lump-sum payout if the policyholder is diagnosed with a critical illness specified in the policy, such as cancer, heart attack, stroke, etc. It helps cover expenses related to the illness or lost income during treatment.

- Waiver of Premium Rider: This rider waives future premiums if the policyholder becomes permanently disabled or loses their income due to injury or illness before a specified age. It ensures that the policy remains active even if the policyholder is unable to pay premiums due to disability or income loss.

- Long-Term Care Rider: This rider provides monthly payments if the insured person needs to stay in a nursing home or receive home care. It covers the costs of long-term care, which can be expensive.

- Return of Premium Rider: This rider refunds the premiums paid by the policyholder at the end of the policy term if they survive. It provides a benefit to the policyholder for outliving the policy term.

These riders provide additional peace of mind and financial security by addressing specific situations and needs that may arise during the policy term. They are a cost-effective way to enhance the coverage of a term insurance policy.

Understanding the Role of Pre-Existing Conditions in Short-Term Insurance Plans

You may want to see also

Frequently asked questions

Term insurance is a contract between the insurance company and you. In the case of your death, your family will receive a large cover amount. This amount is decided based on the yearly premium you pay and other factors.

An increasing term insurance plan is a type of term plan where the base sum assured increases. The sum assured, chosen on plan commencement, increases every year by a specified amount.

The benefit of an increasing term insurance plan is that it helps you fight inflation. The sum assured amount effective today may not be adequate tomorrow.

You can opt for an increasing cover term insurance plan that will allow you to increase the cover amount. If you have a spouse and that is the reason you want an increased cover, you can add them under the same policy.

The maximum limit of an increasing term insurance plan depends on the insurer. The maximum limit can be based on the percentage increase, the maximum cover aimed for, or an end age.