The monthly average cost of car insurance varies depending on factors such as location, age, gender, driving history, and vehicle type. In the US, the average monthly cost of car insurance is $196 for full coverage and $53 for minimum coverage. However, these rates can differ across states, with Florida being the most expensive state for car insurance, and Ohio being the cheapest. The cost of car insurance also depends on the insurance company, with USAA, State Farm, and GEICO offering some of the lowest rates. Additionally, factors such as age and driving history can significantly impact insurance costs, with younger and less experienced drivers paying higher premiums.

| Characteristics | Values |

|---|---|

| Average monthly cost of full coverage car insurance | $158 |

| Average monthly cost of full coverage car insurance (Bankrate) | $196 |

| Average monthly cost of full coverage car insurance (MarketWatch) | $223 |

| Average monthly cost of full coverage car insurance (NerdWallet) | $147 |

| Average monthly cost of full coverage car insurance (Policygenius) | $136 |

| Average monthly cost of minimum coverage car insurance | $42 |

| Average monthly cost of minimum coverage car insurance (Bankrate) | $53 |

| Average monthly cost of minimum coverage car insurance (MarketWatch) | $72 |

| Average monthly cost of minimum coverage car insurance (NerdWallet) | $41 |

| Average monthly cost of minimum coverage car insurance (Policygenius) | $51 |

What You'll Learn

The average cost of car insurance in the US

Average Cost of Car Insurance by Coverage Type

The type of coverage you choose has a significant impact on the cost of car insurance. Full coverage car insurance, which includes collision and comprehensive coverage in addition to liability insurance, is typically more expensive than minimum coverage. According to recent data from September 2024, the national average annual cost of car insurance is $2,348 for full coverage and $639 for minimum coverage, according to Bankrate. On a monthly basis, full coverage averages $196, while minimum coverage averages $53 per month.

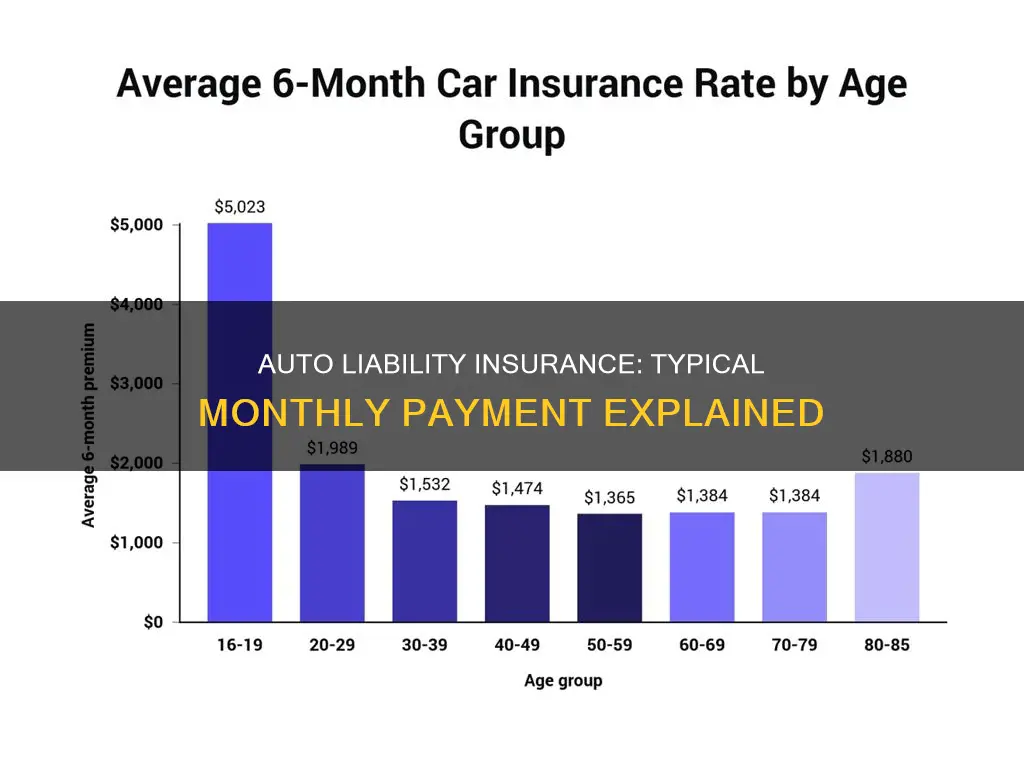

Average Cost of Car Insurance by Age

Age is a crucial factor in determining car insurance rates, with younger drivers often paying higher premiums. Rates tend to decrease as drivers gain more experience, with the lowest rates typically seen for drivers in their 50s. As drivers enter their 70s, rates may start to creep up again due to factors such as decreased reaction time and poorer eyesight.

Average Cost of Car Insurance by Driving Record

Your driving record also plays a significant role in determining car insurance costs. Drivers with a clean driving record generally pay lower premiums compared to those with accidents, speeding tickets, or DUIs on their record. An at-fault accident, for example, can increase your annual premium by around 44% on average. A DUI conviction can result in even higher increases, with rates staying on your record for 10 years or more.

Average Cost of Car Insurance by Location

Location is the second most influential factor affecting car insurance rates. Rates can vary significantly from state to state, with Idaho, Vermont, Ohio, Maine, and Hawaii being the cheapest for full coverage, while New York, Louisiana, Florida, Nevada, and Colorado are the most expensive, according to Bankrate. Within each state, rates can also vary between cities and even zip codes, with larger cities tending to have higher insurance costs.

Average Cost of Car Insurance by Provider

The insurance provider you choose can also significantly impact your car insurance rates. National providers, such as Auto-Owners, Erie, and Geico, tend to offer competitive rates, but regional and local providers may also provide more affordable options. It's essential to shop around and compare quotes from multiple providers to find the best rates.

In summary, the average cost of car insurance in the US depends on various factors, including coverage type, age, driving record, location, and provider. By understanding these factors and comparing rates, you can make informed decisions and find the most suitable coverage for your needs at a reasonable price.

U.S. Auto Insurance: Understanding Automatic Renewal

You may want to see also

Car insurance costs by state

The cost of car insurance varies between states for many reasons, including accident and claim frequency, the cost of labour and vehicle parts, vehicle theft frequency, and road conditions. The coverage level chosen also plays a significant role. For example, drivers with leases or loans on their vehicles tend to have comprehensive and collision coverage, along with higher liability limits, while drivers of older cars tend to have liability-only limits at the state-required minimums.

According to MarketWatch, the state with the highest average car insurance rates is New York, at $8,232 per year for full coverage and $2,490 per year for minimum coverage. The state with the lowest average full-coverage car insurance rates is Maine, at $1,460 per year.

Bankrate's research found that the five states with the cheapest annual full-coverage car insurance rates are Idaho ($1,326 per year), Vermont ($1,396 per year), Ohio ($1,492 per year), Maine ($1,528 per year), and Hawaii ($1,548 per year). The five states with the highest average annual full-coverage car insurance costs are New York ($3,757 per year), Louisiana ($3,683 per year), Florida ($3,450 per year), Nevada ($3,111 per year), and Colorado ($3,022 per year).

Auto Depreciation: Can You Sue Your Insurer?

You may want to see also

Car insurance costs by company

The cost of car insurance varies depending on the company you choose. The average cost of car insurance in the US is $2,348 per year, or $196 per month, for full coverage, and $639 per year, or $53 per month, for minimum coverage.

Some of the cheapest rates for full coverage are offered by Auto-Owners, Erie and Geico. However, car insurance companies have their own methods for calculating rates, so the cost of car insurance for each individual will vary from carrier to carrier.

USAA, Erie, Auto-Owners, Geico and Westfield are among the cheapest for state minimum car insurance.

The average annual cost of full coverage car insurance from large companies is as follows:

- Auto Club Enterprises: $1,300

- National General Insurance: $1,500

- USAA: $1,600

- Geico: $1,600

- Farmers: $1,700

- Progressive: $1,700

- State Farm: $1,800

- Allstate: $2,000

- Travelers: $2,000

- Nationwide: $2,100

Texas Auto Insurance Recognition: Out-of-State Policies Explained

You may want to see also

Car insurance costs by age

The cost of car insurance is influenced by a variety of factors, including age, location, provider, driving history, and credit score. While location is the second most influential factor, age is the most significant determinant, with rates decreasing from $3,192 per year for 16-year-old drivers to $671 per year for 45-year-old drivers, on average. Younger drivers are considered high-risk due to their increased likelihood of accidents and expensive claims, resulting in higher insurance rates.

In the United States, the average annual cost of car insurance is $869 for minimum coverage and $2,681 for full coverage. However, these costs are based on a 35-year-old driver with good credit and no driving violations. The cost of car insurance for a 16-year-old driver is significantly higher, averaging $3,192 per year for minimum coverage and $5,669 per year for full coverage.

Age affects car insurance rates more than other factors such as location, vehicle type, gender, and credit score. Male drivers under the age of 18 pay the most among all demographics, nearly 50% more than teenage female drivers. The cost of car insurance gradually decreases as drivers age, with rates typically decreasing each year until the age of 25, when rates begin to level off. At age 55, car insurance is cheapest, on average, as middle-aged drivers have the lowest accident and claim rates.

In addition to age, driving history also has a significant impact on car insurance rates. An at-fault accident, a DUI, or a speeding ticket can increase rates by up to 44% on average. Poor credit is another factor that increases rates, with drivers with poor credit paying nearly 85% more for full coverage, on average.

Auto and General Insurance: Is It Worth the Hype?

You may want to see also

Car insurance costs by gender

The monthly average cost of car insurance for drivers in the US is $196 for full coverage and $53 for minimum coverage. However, this cost can vary depending on several factors, including age, gender, driving history, and location.

In most states, car insurance companies are allowed to consider gender when setting car insurance rates. On average, men pay slightly more for car insurance than women. This is because men are generally considered to be riskier drivers and are more likely to engage in dangerous driving behaviours. The difference in rates between men and women is typically larger for younger drivers and decreases as drivers get older.

According to data, women aged 16 to 24 pay around $140 to $784 less per year for car insurance than men in the same age group. The gender gap in insurance rates narrows as drivers age, with men and women paying similar rates by their 30s.

It is important to note that some states, such as California, Hawaii, Massachusetts, Michigan, North Carolina, and Pennsylvania, have banned the use of gender as a factor in determining insurance rates. In these states, insurance companies are not allowed to consider gender when setting premiums.

Factors Affecting Car Insurance Costs

In addition to gender, other factors that can influence car insurance rates include age, driving history, location, credit score, vehicle type, and insurance company. Younger and less experienced drivers typically pay higher insurance rates due to an increased risk of accidents. Drivers with a history of accidents, speeding tickets, or DUIs will also pay more for insurance.

Location plays a significant role in insurance costs, with rates varying by state, city, and even ZIP code. Insurance companies also consider the make and model of your vehicle, with certain types of vehicles, such as sports cars and luxury cars, being more expensive to insure.

Your choice of insurance company can also have a substantial impact on your rates, as each company uses its own methods to determine premiums. It is always a good idea to shop around and compare quotes from multiple insurance providers to find the best rate for your specific situation.

Strategies for Becoming an Auto Insurance Sales Agent

You may want to see also

Frequently asked questions

The average monthly payment for auto liability insurance is around $50, with some sources giving a figure of $53 and others around $70.

The cost of auto liability insurance is influenced by factors such as location, age, gender, marital status, vehicle type, driving history, and credit score.

Auto liability insurance for a young driver can cost several hundred dollars per month, depending on age, gender, and driving history.

You can get a discount on your auto liability insurance by bundling policies, maintaining a clean driving record, and comparing rates from different insurance providers.

Full coverage auto insurance includes comprehensive and collision coverage, in addition to liability coverage. Minimum coverage auto insurance only includes the state-mandated minimum liability coverage.