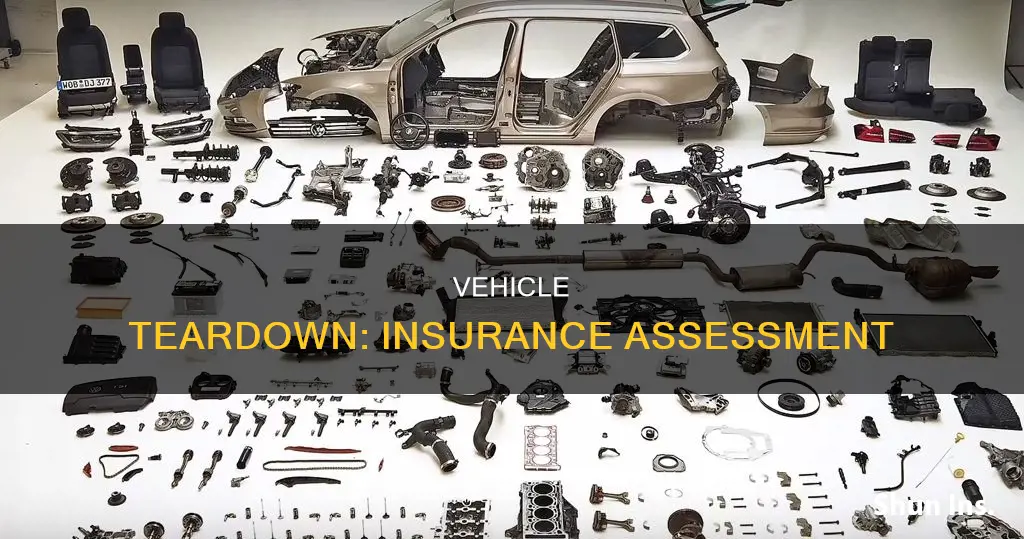

A vehicle teardown for insurance purposes is a process where a damaged vehicle is disassembled to identify the extent of the damage and determine the necessary repairs. This is typically done when there is a high potential for hidden damage that cannot be seen through a visual inspection alone. A teardown can help reduce supplemental estimate revisions and provide a more accurate timeframe for the repair process. It also helps to avoid a vehicle being deemed a total loss after extensive repairs are carried out, only for hidden damage to be discovered later.

| Characteristics | Values |

|---|---|

| Purpose | To identify the extent of damage to a vehicle and generate an itemized estimate for restoring the vehicle to its pre-loss condition |

| Initiated by | The insurance company or the vehicle owner |

| Benefits | Significant reduction in supplemental estimate revisions, faster repair times, providing consumers with a realistic timeframe for the repair process, avoiding a vehicle being deemed a total loss after performing extensive repairs due to later discovery of hidden damage |

| Estimate Requirements | The cost of reassembling the vehicle, the cost of parts and labor necessary to replace items normally destroyed by teardown, notification that teardown might prevent restoration to the condition in which it was provided, the maximum time it will take to reassemble the vehicle if the customer does not want to proceed with repairs |

| Authorization | The customer, not the insurance company, is responsible for authorizing repairs, including teardowns |

What You'll Learn

A teardown can help avoid a vehicle being deemed a total loss

A teardown can be a useful way to avoid a vehicle being deemed a total loss. A teardown estimate involves the disassembly of a vehicle to identify the extent of the damage and generate an itemised estimate for repairs. This process can benefit both the automotive repair dealer (ARD) and the customer by reducing the number of supplemental estimate revisions and providing a more realistic timeframe for the repair process.

In the context of insurance, a teardown can help to determine whether the cost of repairing a vehicle exceeds its value, which is a key factor in determining whether a vehicle is deemed a total loss. By identifying all necessary repairs upfront, a teardown can help to ensure that extensive collision repairs are not performed on a vehicle that may ultimately be deemed a total loss due to hidden damage.

It is important to note that the customer, not the insurance company, is responsible for authorising repairs, including the teardown process. Therefore, it is essential for the ARD to keep the customer informed throughout the estimating, teardown, and repair process. By performing a teardown, providing a detailed estimate, and maintaining open communication, an ARD can help to avoid a vehicle being deemed a total loss and ensure a positive customer experience.

Luxury Cars: Higher Insurance Costs?

You may want to see also

A teardown can help identify hidden damage

A teardown estimate is a written estimate that is required before disassembling a vehicle to identify necessary repairs. It includes the cost of reassembling the vehicle, the cost of parts and labor, and notification that the teardown might prevent the vehicle from being restored to its original condition.

Performing a teardown can help avoid a vehicle being deemed a total loss after extensive repairs are carried out, only for hidden damage to be discovered later. It can also reduce supplemental estimate revisions, resulting in faster repair times and providing consumers with a more realistic timeframe for the repair process.

In the case of insurance claims, a teardown may be necessary to determine the cause of failure and whether the claim is covered by the insurance company. This can be a time-consuming process, and the customer is responsible for authorizing and paying for the teardown, even if the insurance company does not cover the claim.

No-Fault Insurance: Optional or Essential?

You may want to see also

A teardown requires a written estimate

A teardown estimate is a written estimate that is required before disassembling a vehicle or vehicle component to identify the necessary repairs. This is particularly important in collision repairs, where a vehicle has sustained considerable damage. A teardown estimate will usually require the disassembly of a collision-damaged vehicle to a point where the automotive repair dealer (ARD) can identify the extent of the damage and generate an itemised estimate for restoring the vehicle to its pre-loss condition.

The teardown estimate must contain the same information as a standard estimate, with some additional requirements. This includes the cost of reassembling the vehicle or component, the cost of parts and labour necessary to replace items typically destroyed by teardown, and notification that the teardown might prevent the restoration of the vehicle to its original condition. The ARD is required to inform their customer of this risk.

The teardown process is beneficial for the ARD, the customer, and the insurer. It results in fewer supplemental estimate revisions, faster repair times, and provides a more realistic timeframe for the repair process. It also helps to avoid a vehicle being deemed a total loss after extensive repairs due to the later discovery of hidden damage.

It is important to note that the customer, not the insurance company, is responsible for authorising repairs, including the teardown. The ARD should keep the customer informed throughout the entire process, from estimating to teardown and repairs, to avoid potential complaints.

Gap Insurance: Is My Vehicle Covered?

You may want to see also

A teardown requires customer authorisation

A teardown is a process that occurs when a vehicle has been in a collision and requires a detailed inspection to identify the extent of the damage. This process involves disassembling the vehicle to determine the necessary repairs and estimate the cost of restoring the vehicle to its pre-loss condition.

While a teardown can provide valuable information, it is important to note that it requires customer authorisation. This is because the customer, not the insurance company, is responsible for authorising repairs, as outlined in the Business and Professions Code section 9880.1(f). The automotive repair dealer (ARD) must inform their customer that the teardown might prevent the vehicle from being restored to its original condition.

In the case of insurance claims, the insurance company may request a teardown to determine the cause of failure or the extent of damage. However, it is the customer's responsibility to provide authorisation for this process. This means that the customer should be aware of the potential risks and costs associated with the teardown.

During a teardown, the body shop will take apart the vehicle to inspect for hidden damage that may not be visible during a standard inspection. This process can be time-consuming and labour-intensive, which is why it requires customer approval. By performing a teardown, the ARD can provide a more accurate estimate of the repairs needed and help avoid the vehicle being deemed a total loss after extensive repairs have been made.

It is essential for the ARD to keep the customer informed throughout the entire process, from estimating to teardown and repairs. This open and consistent communication can help set realistic expectations and avoid potential complaints.

Insuring a Vehicle: Ownership Flexibility

You may want to see also

A teardown can help avoid consumer complaints

A teardown can be a useful tool to help avoid consumer complaints. A teardown estimate is a process where a damaged vehicle is disassembled to identify the extent of the damage and to generate an itemized estimate for restoring the vehicle to its pre-loss condition. This process is particularly beneficial when there is a high potential for hidden damage that cannot be seen by visual inspection alone.

By performing a teardown, an automotive repair dealer (ARD) can provide a detailed and accurate estimate of the necessary repairs, which helps to set clear expectations for the customer. This can lead to faster repair times and reduced supplemental estimate revisions, as well as providing consumers with a more realistic timeframe for the repair process.

Additionally, a teardown can help to avoid a vehicle being deemed a total loss after extensive repairs are carried out, only for hidden damage to be discovered later. This can be a costly and time-consuming outcome for both the customer and the insurer. By identifying all the necessary repairs upfront, a teardown can help to streamline the repair process and reduce the likelihood of consumer complaints.

It is important to note that the customer, not the insurance company, is responsible for authorizing repairs, including the teardown. Therefore, clear and consistent communication between the ARD and the customer is essential throughout the entire process, from estimating and teardown to repairs. Keeping the customer informed ensures that they understand the extent of the damage and the repairs needed, reducing the likelihood of complaints arising from misunderstandings or unexpected issues.

Furthermore, a teardown can help to identify and address any safety concerns that may not be apparent from a visual inspection. This is especially important as it ensures that the repaired vehicle is safe to drive and can provide peace of mind for the customer. By prioritizing safety and transparency, ARDs can build trust with their customers and reduce the likelihood of complaints.

In summary, a teardown can be a valuable tool for ARDs to provide accurate estimates, streamline repairs, and maintain good customer relationships. By keeping customers informed and involved in the process, ARDs can help set realistic expectations and reduce the potential for consumer complaints.

Auto Insurance Grace Periods: Do They Exist?

You may want to see also

Frequently asked questions

A vehicle teardown for insurance involves a damaged vehicle being disassembled so that the extent of the damage can be identified and an estimate for repairs can be generated. This process can help to avoid a vehicle being deemed a total loss after extensive repairs are carried out, only for more hidden damage to be discovered later.

The customer is the party responsible for authorizing a teardown, not the insurance company. However, the insurance company will usually have the client sign a repair authorization before any teardown is completed.

A teardown can provide a more accurate estimate of the cost of repairs and reduce the need for supplemental estimate revisions, resulting in faster repair times. It can also help to avoid a vehicle being deemed a total loss after repairs are carried out due to the discovery of hidden damage.