Age reduction life insurance is a group term life insurance provision that reduces the face amount of your insurance when you reach certain ages, typically 65 or older. This type of insurance is designed to mitigate the higher costs of insuring older individuals by lowering the amount of life insurance provided. The specific age at which the reduction occurs and the extent of the reduction depend on the details of the group certificate and can vary across different plans and employers. While age reduction schedules are common, they are not universal, and some plans, such as MetLife's voluntary life plan, maintain the same benefit amount regardless of age.

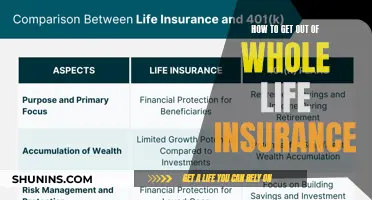

| Characteristics | Values |

|---|---|

| What | Age reduction life insurance is a group term life insurance provision. |

| --- | --- |

| Why | It exists because it is more expensive to insure older individuals than younger ones. |

| Instead of raising the premiums, insurers lower the amount of life insurance provided to older individuals. | |

| When | Age reduction schedules typically begin at age 65 or 70. |

| Reductions occur when the insured is still working and reaches these ages. | |

| Amount | The amount of reduction varies but can be calculated as a percentage of the original benefit amount. |

| For example, a 25% reduction at age 65, a 50% reduction at age 70, and a 75% reduction at age 75. | |

| Exceptions | MetLife's voluntary life insurance plan does not reduce benefits based on age. |

| This plan is portable, convertible to a whole or universal policy, and offers increased benefits without a health statement. |

What You'll Learn

- Age reduction schedules are a result of the Age Discrimination in Employment Act (ADEA)

- The cost of insuring older individuals is higher than that of younger ones

- Age reduction schedules vary across plans

- Group term life insurance is not meant to last forever

- Permanent life insurance may last your entire life

Age reduction schedules are a result of the Age Discrimination in Employment Act (ADEA)

The ADEA was created to address the challenges faced by older workers in retaining and regaining employment. It ensures that job performance takes precedence over arbitrary age considerations. The Act prohibits age preference or limitations in job specifications and denies benefits to older employees based solely on their age. It also prohibits mandatory retirement in most sectors, with some exceptions for executives over 65 in high-policy-making positions.

As originally passed, the ADEA covered employees aged 40 to 65, and it was common for plans during that time to reduce benefits or terminate basic life benefits for those over 65. These reductions were driven by employers' desires to minimize benefit expenditures for older employees. However, in 1978, the ADEA was amended to cover employees from 40 to 70, and in 1986, the age cap was removed entirely. These amendments led to the creation of the age reduction schedules we know today.

The ADEA now applies broadly to group life insurance and structures the relative cost of employer-paid benefits between older and younger workers. Section 623 of the ADEA states that the actual amount of payment or cost incurred for an older worker should be no less than that of a younger worker. The specifics of how this statute is applied are outlined in the Code of Federal Regulations, which provides guidelines for reducing benefits due to age.

Today, age reductions are often viewed as a way to manage insurer risk rather than employer costs. While mortality has improved for all, there have been significant improvements among active workers, reducing the cost of providing basic life insurance for older employees. This decline in cost has diminished employers' incentives to maintain age reductions in group life insurance plans. Additionally, major demographic shifts in the American labor force, with an increasing proportion of workers over 65, have influenced the movement away from age reductions.

Life Insurance and the IRS: What Employees Need to Know

You may want to see also

The cost of insuring older individuals is higher than that of younger ones

Age reduction life insurance is a product of the Age Discrimination in Employment Act (ADEA). The ADEA was passed in 1967 and, originally, had very little impact on basic group term life insurance as it only covered employees aged 40 to 65. In 1978, the act was amended to cover employees from 40 to 70, and, in 1986, the age cap was removed altogether.

Today, age reductions are viewed as a way to reduce insurer risk. As people age, they are at an increased risk of developing underlying health conditions, which can result in higher mortality rates and higher life insurance rates. Older people also typically need more medical care, which means higher premiums to cover the rising medical expenses. This is why the cost of insuring older individuals is higher than that of younger ones.

The older you get, the more risk you pose to health insurance companies, so your insurance premiums will likely rise as you get older. However, insurance companies must follow regulations regarding setting premiums based on a person's age. Before the Affordable Care Act (ACA), insurers were free to set their own rules regarding pricing for different age ranges, and older enrollees often paid almost five times more than younger enrollees. Now, there is a limit to how much more insurance companies can charge older adults. Federal rules state that anyone 64 or older can't pay more than three times the base rate, which is the premium for a 21-year-old.

The chances of health risks increase with age, meaning older people are more likely to need hospital care for illnesses, injuries, and other medical conditions. This places them at a higher risk of making a claim, and to offset potential claims, insurance companies will ask for higher premiums to help pay for the extra medical services that are more likely to be needed.

Older individuals are also more likely to have pre-existing health conditions, such as diabetes, high blood pressure, or asthma. While insurance companies can't use pre-existing conditions as a reason to charge higher premiums, the conditions might be more severe in older people, thus requiring more medical care and prescription drugs.

ER Visits: Life Insurance's Big Factor

You may want to see also

Age reduction schedules vary across plans

It is worth noting that age reduction schedules are a result of the Age Discrimination in Employment Act (ADEA). Before 1978, ADEA only covered employees aged 40 to 65, and it was common for plans to see reduced benefits at age 65 or the termination of basic life benefits. In 1978, ADEA was amended to cover employees up to age 70, and in 1986, the age cap was removed entirely. These changes led to the creation of the age reduction schedules we see today.

It is important to remember that term life insurance is not meant to last forever, and there is a good chance you will outlive the policy. Age reduction schedules are designed to reduce the insurer's risk, as it is more costly to insure older individuals than younger ones. While age reduction schedules vary, it is common to see a 25% reduction at age 65, a 50% reduction at age 70, and a 75% reduction at age 75.

To find the age reduction schedule for your plan, check your benefit guide or consult your employer's group certificate. Remember that insurance carriers can change, so the age reduction schedule may differ in the future. Additionally, group term life insurance plans vary from employer to employer, so be sure to check with each employer to understand their specific plan.

Drug Use and Life Insurance: What's the Connection?

You may want to see also

Group term life insurance is not meant to last forever

Group term life insurance is a type of temporary life insurance that covers multiple people under a single contract. It is typically offered by employers as part of their benefits package, with some basic coverage often provided at no cost to the employee. This basic coverage can then be supplemented by the employee, who can purchase additional coverage for themselves as well as their spouse and children. Group term life insurance is generally inexpensive, especially for younger people, and is therefore a popular option.

However, it is important to note that group term life insurance is not meant to last forever. There are several reasons for this:

- Group term life insurance is tied to employment. This means that if an individual leaves their job, they will likely lose their coverage. While some employers may allow former employees to maintain their coverage or convert their group term policy to an individual policy, this is not always the case. Additionally, the cost of an individual policy may be higher than that of the group term policy.

- Group term life insurance is temporary coverage. Unlike permanent insurance, it does not last for the entire lifetime of the insured and does not accumulate cash value. Instead, it provides coverage for a specified period, such as 10, 15, or 20 years. Once the term expires, the policyholder can either renew it, convert it to a permanent policy, or let it lapse.

- Group term life insurance rates are not locked in long-term. While individual term insurance plans typically lock in a rate for 20 to 30 years, most group plans have rate bands with incremental increases at certain ages. This means that the cost of insurance will automatically go up at certain age milestones, such as 30, 35, and 40.

- The amount of coverage offered by group term life insurance may not be sufficient for an individual's needs. Employers often limit the total coverage available based on factors such as tenure, salary, number of dependents, and employment status. As a result, individuals may need to purchase additional coverage through a separate policy to ensure they have adequate protection.

In summary, while group term life insurance can be a valuable and affordable option for individuals, it is not designed to provide permanent coverage. It is important for individuals to carefully consider their long-term needs and supplement their group term coverage with an individual policy if necessary.

Life Insurance Agents: Essential or Unnecessary?

You may want to see also

Permanent life insurance may last your entire life

Permanent life insurance is a type of insurance policy that provides coverage for the full lifetime of the insured person. It is designed to last indefinitely, or until the policyholder passes away, as long as the premiums are paid. This is in contrast to term life insurance, which only covers the policyholder for a specified period, typically 10, 20, or 30 years.

Permanent life insurance policies are more expensive than term life insurance policies due to the additional benefits they offer. One of the key advantages of permanent life insurance is that it combines a death benefit with a savings component. This savings component, or cash value, grows on a tax-deferred basis, meaning the policyholder pays no taxes on the gains as long as the money remains in the policy. The cash value can be borrowed against or withdrawn to meet various financial needs, such as medical expenses or a child's education. However, withdrawing or borrowing against the cash value will reduce the future death benefit for heirs.

There are two primary types of permanent life insurance: whole life insurance and universal life insurance. Whole life insurance policies have fixed premiums and the cash value grows at a guaranteed rate. Universal life insurance, on the other hand, offers more flexible premium options, and the cash value growth is based on market interest rates.

Permanent life insurance is a good option for individuals seeking lifelong coverage and a savings component. It can be particularly beneficial for families with young children, business owners, high-net-worth individuals, and individuals with special needs. However, it is important to consider the high costs of premiums and the risk of not being able to keep up with payments when deciding whether to purchase permanent life insurance.

In summary, permanent life insurance provides lasting coverage and offers a range of benefits, including a death benefit, a savings component, and tax advantages. It is an important tool for financial planning and can provide peace of mind for individuals and their loved ones.

Preparing for a Life Insurance Exam: Fasting and Tips

You may want to see also

Frequently asked questions

Age reduction life insurance is a type of group term life insurance that reduces the face amount of your insurance when you reach certain ages, such as 65 or 70. This type of insurance is designed to mitigate the higher costs of insuring older individuals.

Age reduction schedules vary depending on the insurance provider and the plan chosen. Typically, the benefit amount of group life insurance plans begins to decline from age 65 onwards.

An example of an age reduction schedule is as follows: at age 65, there is a 25% reduction in life insurance; at age 70, a 50% reduction; and at age 75, a 75% reduction.

Age reduction schedules are typically outlined in the group certificate provided by your employer. You can also refer to your benefit guide or consult your HR department or benefits manager.