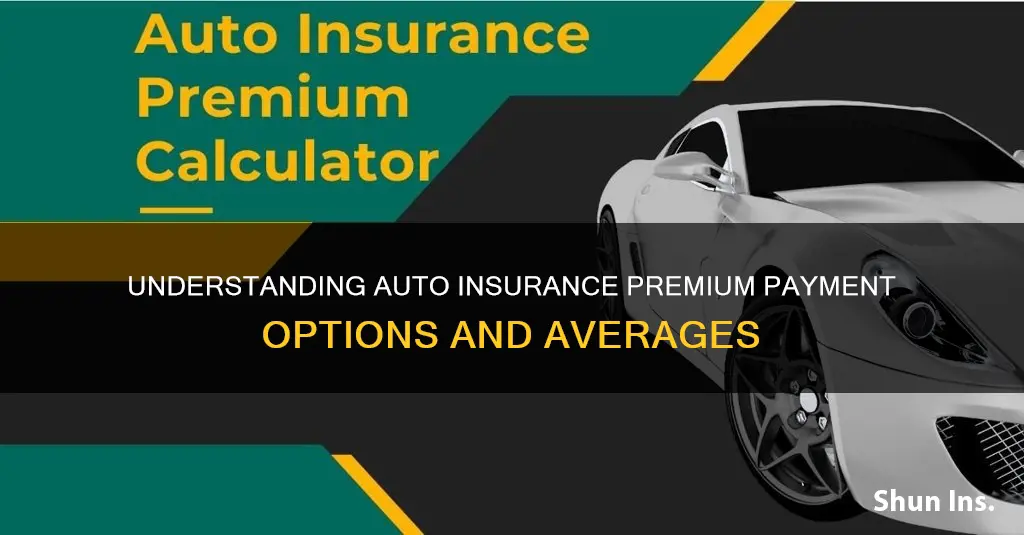

The average cost of car insurance in the U.S. varies depending on the type of coverage, driver profile, location, vehicle, and provider. The national average cost of car insurance is $2,026 per year or $169 per month for full coverage, and $638 per year or $53 per month for minimum coverage. However, these costs can differ based on various factors. For example, the average cost of car insurance for a 35-year-old driver with good credit and no driving violations is $2,681 per year or $223 per month for full coverage, and $869 per year or $72 per month for minimum coverage. The provider you choose also has a significant impact on your car insurance rates, with national providers generally being more expensive than regional and local providers. Additionally, your age, gender, driving record, credit score, and vehicle type can all influence your car insurance premium.

| Characteristics | Values |

|---|---|

| National average annual cost of car insurance | $2,026 |

| National average annual cost of car insurance (Forbes Advisor) | $2,348 |

| National average annual cost of car insurance (MarketWatch) | $2,681 |

| National average annual cost of car insurance (US News) | $2,068 |

| Average cost of car insurance per month | $169 |

| Average cost of car insurance per month (Forbes Advisor) | $196 |

| Average cost of car insurance per month (MarketWatch) | $223 |

| Average cost of car insurance per month (US News) | $172 |

What You'll Learn

The average cost of car insurance varies by state

The cost of car insurance varies by state, and there are several reasons for this. Firstly, each state has different regulations, and the number of claims in a state, as well as the cost of those claims, will affect the price of insurance. For example, states with a high number of natural disasters, such as severe storms or flooding, will likely have higher insurance costs. Similarly, states with more congested cities and higher traffic density will also have higher insurance costs, as there is a greater chance of accidents occurring. The cost of living in a state will also impact insurance prices, as states with a higher cost of living tend to have more expensive insurance.

Another factor that affects the cost of insurance by state is the minimum coverage requirements. Some states require additional coverage types, such as uninsured motorist coverage and personal injury protection, which can raise the cost of a minimum coverage policy. States that mandate more coverage types generally have higher insurance costs. For example, Florida, Michigan, New Jersey, New York, and Delaware are the five most expensive states for insurance, and they all mandate PIP (Personal Injury Protection) coverage.

Additionally, the frequency of lawsuits in a state can impact insurance prices. States with a higher rate of lawsuits over auto insurance accidents tend to have larger claim settlements, which results in higher insurance costs for all drivers in that state. Louisiana, for instance, is known for its litigious nature, and it has the third most expensive average annual full-coverage car insurance cost.

The cost of car repairs and medical care also varies by state, and this will affect insurance prices. States with higher repair and medical costs will generally have higher insurance prices, as insurance companies will need to pay out more for claims.

Finally, the competitiveness of the auto insurance market in a state will impact prices. States with a larger number of national and regional insurance companies selling insurance will generally have cheaper insurance, as customers can shop around and compare prices more easily.

Progressive Auto Insurance: Everything You Need to Know

You may want to see also

The average cost of car insurance varies by company

On average, car insurance from some of the top insurance carriers in the nation ranges from around $1,300 to $2,800 per year for full coverage. The national average for full coverage car insurance is $2,026 per year, or $169 per month, while the national average for state minimum coverage is $638 per year, or $53 per month.

USAA, Auto-Owners, and Geico offer some of the cheapest full coverage car insurance but are not all available to all drivers. USAA, for example, is only available to drivers with a military affiliation.

The average cost of car insurance also depends on factors such as age, gender, driving record, credit score, and vehicle type.

Charging Insurance Companies for Auto Glass: What's a Fair Price?

You may want to see also

The average cost of car insurance varies by age and gender

The cost of car insurance varies by age and gender, with younger drivers and males generally paying more. This is because insurance companies adjust the cost of auto insurance based on the amount of risk a driver poses. People who are more likely to get into accidents and make claims on their insurance are riskier to insure and therefore pay higher rates.

Age

The average cost of car insurance is $6,045 a year for an 18-year-old driver, $2,204 a year for a 30-year-old, and $1,847 a year for a 60-year-old. Car insurance costs start high for teens due to their lack of experience and higher statistical risk of accidents but begin to decrease as drivers get older and gain more experience. Seniors may see their insurance premiums increase again as reaction times tend to decrease with age.

Gender

Gender also plays a role in determining car insurance rates, although not as significantly as age. Car insurance for younger females is generally cheaper than for males of the same age. For example, a 16-year-old female pays $495 less per year than a 16-year-old male. However, when they turn 25, the difference in their annual rates narrows to only $33.

Combined Impact of Age and Gender

The combined impact of age and gender has the most marked influence on car insurance premiums. The gap between insurance premiums for men and women under 20 is an average of 14%. This is because young men aged 16 to 19 are more than twice as likely to cause a fatal car accident than females of the same age. The gender gap between insurance prices narrows once drivers reach middle age to just 1%.

Lost Wages and Auto Insurance Tax

You may want to see also

The average cost of car insurance varies by driving record

The average cost of car insurance varies depending on your driving record. A recent blemish on your driving record can cause your auto insurance rates to increase, as insurers will view you as a riskier driver compared to someone with a clean record. Traffic violations and car accidents can remain on your record for up to five years.

Average car insurance costs after an at-fault accident

After an accident, the average car insurance costs for an at-fault driver are:

- $2,614 per year for full coverage.

- $744 per year for minimum coverage.

On average, car insurance costs for full coverage are about 48% higher for a driver who has caused an accident than for one who hasn't, according to NerdWallet's analysis.

Average car insurance costs after a speeding ticket

Speeding not only contributes to more traffic deaths but may also result in higher insurance premiums for those who are ticketed. On average, a driver with a recent speeding ticket pays 27% more for full coverage than a driver with a clean record, according to NerdWallet's analysis.

Average car insurance costs after a DUI

Being caught drinking and driving will result in significantly higher insurance rates. On average, auto insurance costs for full coverage increase by about 83% for a driver with a recent DUI, translating to an average increase of about $1,467 per year for full coverage car insurance after a DUI, according to NerdWallet's analysis.

Lowering Auto Insurance in Ontario: Tips and Tricks

You may want to see also

The average cost of car insurance varies by credit score

In the US, drivers with an excellent credit score of 800 or above pay an average annual rate of $2,031 for full coverage car insurance. On the other hand, those with a poor credit score may pay an average of $4,366 or more.

In California, Hawaii, Massachusetts, and Michigan, credit scores are prohibited or limited as a factor in determining auto insurance rates.

Improving your credit score can take time, but it is worth doing to ensure you are earning the lowest possible rate for your policy.

Bonded Insurance: What Auto Insurers Offer This and Why

You may want to see also

Frequently asked questions

The average cost of car insurance is $2,026 per year or $169 per month for full coverage, and $638 per year or $53 per month for minimum coverage.

The average cost of car insurance varies by state. For example, the average annual cost of full coverage car insurance in Vermont is $1,158, while in Florida, it is $3,865.

The average cost of car insurance also depends on the company. For example, USAA offers the cheapest rates for full coverage, at $1,335 per year, while Erie offers the second-cheapest rates, at $1,532 per year.

The average cost of car insurance varies by age. For example, the average annual cost of full coverage car insurance for an 18-year-old driver is $6,045, while for a 30-year-old driver, it is $2,204.

The average cost of car insurance also depends on your driving record. For example, the average annual cost of full coverage car insurance for a driver with a clean record is $2,069, while for a driver with a DUI, it is $3,413.