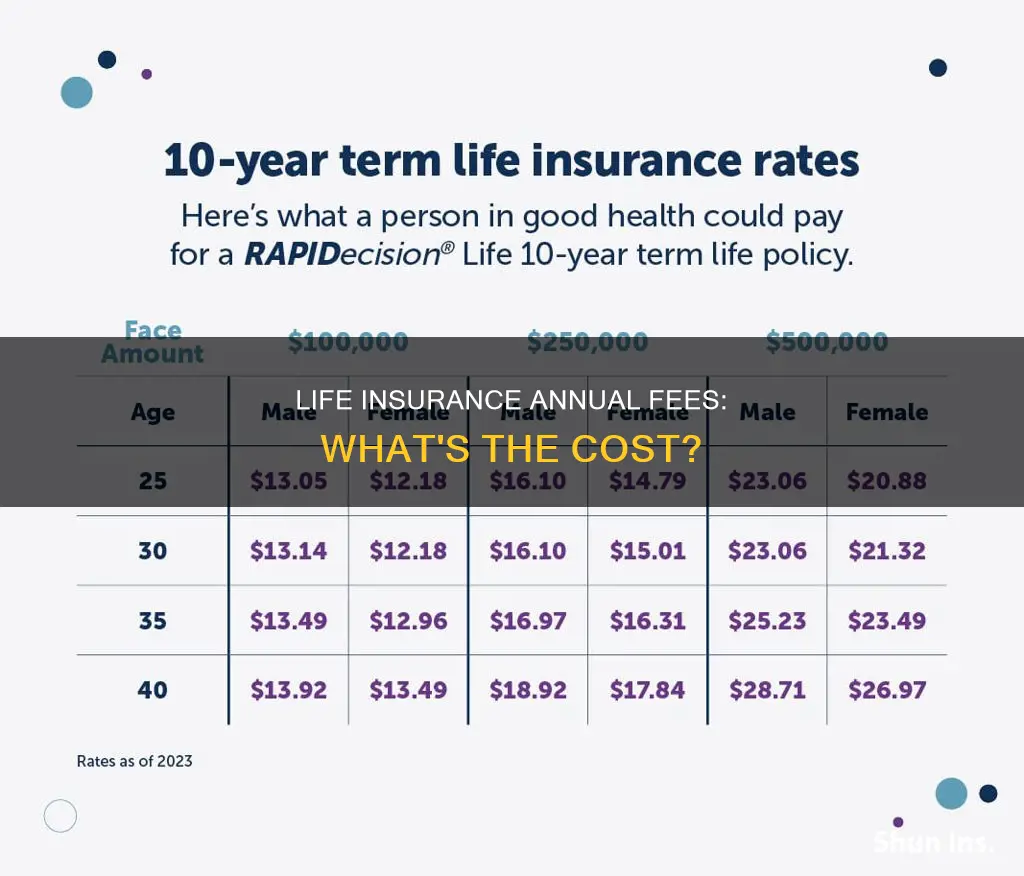

Life insurance is a contract between the policyholder and the insurance company that provides financial support to your loved ones in the event of your death. The cost of life insurance, or the premium, is influenced by various factors, including age, gender, health, and lifestyle choices. The premium is typically charged monthly, and it is important to understand the associated fees and charges before purchasing a policy. The average cost of life insurance is $26 per month, but rates can vary significantly based on individual circumstances and the type of policy chosen. Term life insurance, which covers a fixed period, is generally more affordable than whole life insurance, which offers coverage for the entirety of the policyholder's life.

| Characteristics | Values |

|---|---|

| Average cost of life insurance per month | $26 |

| Average cost of term life insurance for a 40-year-old | $200 per year |

| Factors affecting cost | Age, gender, health, smoking status, family medical history, driving record, occupation, lifestyle, type of insurance |

| Factors not affecting cost | Ethnicity, race, sexual orientation, credit score, marital status, number of policies, number of beneficiaries |

What You'll Learn

Premium loads/sales charges

These charges are applied to cover the administrative and underwriting costs incurred by the insurance company, including expenses related to policy issuance, paperwork, processing, and overall management of the insurance policy. By imposing these charges, insurance companies can recover these costs and maintain their operational efficiency.

In some cases, premium loads/sales charges may also provide additional benefits or services to the policyholder. These additional features may include enhanced coverage, higher policy limits, or added policy riders that offer extra protection or customization options. Policyholders can access these supplementary benefits by paying the premium load/sales charges.

Insurance companies assess various factors when determining the premium load/sales charges, including the risk associated with the insured individual, the type of coverage, and the potential claims experience. By adjusting these charges, insurers aim to balance the risks and ensure the profitability of their business.

The premium load/sales charge calculation involves evaluating risk factors associated with the insured individual or the coverage offered. These risk factors may include age, health condition, occupation, lifestyle choices, and previous claims history. Insurance companies use actuarial techniques and statistical data to accurately assess potential risks.

It is important for individuals seeking insurance coverage to carefully review and understand the premium load/sales charges associated with their chosen policy. These charges are disclosed by insurance companies and should be clearly mentioned in the policy documents and communicated during the application process.

Life Insurance Usage: Assisted Living Eligibility and Conditions

You may want to see also

Administration fees

When calculating the premium rates, insurance companies make several assumptions. These include the expectation that all premiums are paid in advance at the beginning of the year and that these premiums are then invested to generate interest. Additionally, it is assumed that all claims will be paid out at the end of the year.

Actuaries, or professionals who assess risk in the insurance industry, take into account various factors when determining the premium cost of a life insurance policy. One crucial factor is the mortality cost or mortality predictions, which consider the average number of deaths in a given year for individuals of a specific age. This information is typically obtained from mortality tables, allowing insurers to estimate the average life expectancy for different age groups.

In addition to mortality considerations, the insurer's expenses also play a role in setting premium rates. These expenses encompass various costs incurred by the insurance company when issuing a policy, such as licensing fees, premium taxes, administration costs, overhead, and record-keeping. The efficiency and scale of operations can lead to variations in expense loading, which represents the amount charged to cover each policy's share of operating expenses.

Another factor that influences premium rates is the investment return. This takes into account the interest generated from investing the insured's premiums in various financial instruments, such as bonds, stocks, mortgages, or real estate. Reinsurance, which involves transferring a portion of the risk to another insurance company, is also a factor that can impact the overall cost structure.

Understanding Credit Life Insurance: What, Why, and How?

You may want to see also

Monthly per-thousand charge

The monthly per-thousand charge is a key financial component of insurance policies, such as Indexed Universal Life (IUL) policies. This charge is based on the policyholder's age, gender, and underwriting classification, and it is assessed monthly. It is important to understand this charge to grasp the financial mechanics of the insurance policy and its impact on the policy's cash value.

The monthly per-thousand charge is calculated per $1,000 of the policy's face value or death benefit. For example, with a rate of $0.50 per $1,000 on a policy with a $100,000 face amount, the charge would be $50 per month. This charge helps cover the insurer's administrative expenses, including underwriting, issuance, and policy management costs.

The monthly per-thousand charge is typically deducted from the policy's cash value each month. It is important to note that this charge will be deducted from the cash value if the policyholder surrenders or terminates their policy during the surrender charge period. Therefore, it is crucial to check the length of the surrender charge period when evaluating different policies.

The monthly per-thousand charge is separate from other fees and charges associated with life insurance policies, such as premium loads/sales charges, administration fees, mortality and expense risk charges, and fund management fees. These fees and charges vary by product and insurance company, so it is essential to understand all the costs involved before purchasing a life insurance policy.

Overall, the monthly per-thousand charge is an important factor to consider when purchasing an insurance policy, especially Indexed Universal Life policies. By understanding this charge, policyholders can make more informed decisions about their financial planning and ensure they are aware of all the associated costs.

Weed and Life Insurance: What's the Deal?

You may want to see also

Mortality and expense risk charge

When you take out a life insurance policy, the insurance company will estimate how long you are likely to live based on your current age, gender, and health. A mortality and expense risk charge (or "M&E" fee) is charged by the insurance company to compensate them if you don't live to the estimated age. This charge is usually applied on a monthly basis.

The M&E fee covers the cost of death benefits (the "mortality" portion) and the expenses of other insured income guarantees included in the annuity contract. The mortality expense covers the risk of the policyholder dying while the account balance is less than the total of the premiums paid minus any withdrawals. The expense portion covers the costs of providing and administering other insured features.

M&E fees are typically charged as a percentage of the subaccount's assets, and they can vary significantly. For variable annuities, the typical M&E charge is about 1.25% of the annuity's value, although this can range from 0.40% to 1.75% per year. M&E charges for variable life policies tend to be lower, typically around 0.90%, as they also deduct the cost of insurance from premiums.

It's important for investors to be aware of the M&E charges associated with a contract before investing, as these charges can be high and may impact the overall profitability of the investment.

Life Insurance at 19: Is It Possible to Get Covered?

You may want to see also

Fund management fees

- Premium loads/sales charges: These charges compensate the insurance company for sales expenses and state and local taxes. They are deducted from the premium payment before it is applied to the policy.

- Administration fees: These fees are used to cover the costs of maintaining the policy, such as accounting and record-keeping. They are typically deducted from the policy value on a monthly basis.

- Monthly per-thousand charge: This charge is based on factors such as age, gender, and underwriting classification. It is assessed monthly.

- Surrender charge: This charge is deducted from the cash value if the policyholder surrenders or terminates their policy during the surrender charge period. The length of this period can vary, so it is important to check before purchasing a policy.

- Mortality and expense risk charge: This charge compensates the insurance company if the policyholder does not live to the estimated age. It is generally charged on a monthly basis.

It is worth noting that life insurance rates can vary significantly based on factors such as age, gender, health, smoking status, family medical history, occupation, and lifestyle choices. Additionally, the type of life insurance policy chosen, such as term life insurance or permanent life insurance, will also impact the overall cost.

Life Insurance Options for Canadians Living with Cancer

You may want to see also

Frequently asked questions

The annual fee for life insurance, also known as the premium, includes the cost of insurance protection, premium loads/sales charges, administration fees, and fund management fees. The premium rate is based on mortality and interest, with the insurance company's expense factor added on top.

The average cost of life insurance is $26 per month or $312 per year. However, this can vary depending on age, gender, health, and the type of policy. For example, a 40-year-old male buying a 20-year, $500,000 term life policy can expect to pay around $26 per month.

There are several ways to lower your life insurance annual fee:

- Maintain a healthy lifestyle: Staying within a healthy weight range, managing medical conditions, and avoiding smoking can make you less risky to insurers.

- Choose the right type of policy: Opt for term life insurance if you only need coverage for a certain number of years, as it is usually cheaper than whole life insurance.

- Compare quotes: Shop around and compare quotes from multiple insurers to find the best rate.

- Get a policy while you're young: Lock in lower premiums by purchasing life insurance at a younger age.