In the context of insurance, an educational fund is a life insurance policy that can be used to finance the education of the insured's child. This fund can be utilised in different ways depending on the type of policy. With term life insurance, if the insured passes away, the death benefit can be used to pay for the child's college expenses, while permanent life insurance allows the insured to borrow against the policy's cash value to cover education costs without tax penalties. Permanent life insurance is often recommended by advisors for educational funding due to its flexibility and tax advantages. However, it's important to weigh the pros and cons, as permanent life insurance typically comes with higher premiums and annual fees.

What You'll Learn

- Term life insurance provides a death benefit for a specified period

- Permanent life insurance allows borrowing against the policy's cash value

- Life insurance can be used to fund a child's education

- Whole life insurance is more expensive but provides coverage for life

- Term life insurance is ideal for those on a tight budget

Term life insurance provides a death benefit for a specified period

Term life insurance is a form of insurance that provides a death benefit for a specified period of time, typically ranging from 10 to 30 years, with some policies offering terms of up to 40 years. This means that the insurance company guarantees payment of a death benefit to the insured's beneficiaries if the insured person passes away during the specified term. The death benefit is usually tax-free and can be used to cover funeral costs, mortgage payments, and ongoing living expenses for the beneficiaries.

Term life insurance is an attractive option for those seeking substantial coverage at a low cost. The premiums for term life insurance are generally more affordable than those for whole life or universal life insurance, as it offers a death benefit for a restricted time and does not accumulate cash value. The cost of term life insurance is based on the policyholder's age, health, and life expectancy, among other factors. It is important to note that term life insurance does not provide a return on investment if the policyholder outlives the specified term.

One of the benefits of term life insurance is its flexibility. Policyholders can choose the length of coverage and the amount of the death benefit to create a plan that fits their budget. Additionally, term life insurance allows for customization to meet specific needs, such as covering mortgage payments or providing income replacement for surviving family members.

Another advantage of term life insurance is its convertibility. Policyholders can convert their term policy into a permanent form of life insurance, such as whole life or universal life insurance, without undergoing additional underwriting. This provides flexibility and the option to extend coverage if needed, especially if health issues arise later in life.

When considering term life insurance, it is essential to evaluate your financial goals and needs. While term life insurance offers affordability and flexibility, it may not be suitable for those seeking lifelong coverage or looking to accumulate cash value within their policy. Permanent life insurance policies, such as whole life insurance, provide coverage for the entire life of the insured and include a cash value component that grows over time.

Key Man Life Insurance: Utilizing Proceeds Strategically

You may want to see also

Permanent life insurance allows borrowing against the policy's cash value

Permanent life insurance, which includes whole life, universal life, and variable universal life insurance, offers a cash value component that allows policyholders to borrow against the policy. This means that the policyholder can withdraw or borrow against the cash value that has accumulated in their policy over time. This can be used to cover significant expenses, such as a child's college education, without incurring tax penalties.

The cash value in a permanent life insurance policy grows over time, providing a source of funds that can be accessed through policy loans or withdrawals. This money can then be used to help pay for college costs. The flexibility of permanent life insurance policies makes them an appealing option for parents looking to secure their child's education.

One of the main advantages of permanent life insurance is its flexibility. If a child decides not to attend college, the money in the policy can be transferred to another beneficiary or withdrawn for other purposes without facing the same tax penalties as a 529 plan. Additionally, the cash value accumulated in the policy is guaranteed to be paid out by the insurance company, providing a sense of security for parents.

Permanent life insurance policies also offer tax advantages. The growth of the cash value account is tax-deferred, and any loans taken from the account are typically tax-free. Taxes are only paid on withdrawals that exceed the amount of the premiums paid. This makes permanent life insurance an attractive option for those looking to maximize their tax-deferred investment opportunities.

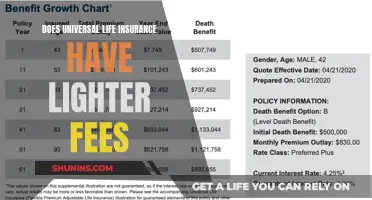

While permanent life insurance offers several benefits, it is important to consider the potential disadvantages. Premium costs for permanent life insurance are typically higher than those for term life insurance, and most policies charge high annual fees. Additionally, it may take a decade or more for the cash value account to grow beyond the amount paid in premiums. Withdrawing more money than the premiums paid will result in the withdrawal being treated as income, impacting the overall tax liability.

In conclusion, permanent life insurance allows policyholders to borrow against the policy's cash value, providing a flexible and tax-advantaged way to save for a child's education. However, it is important to carefully consider the potential disadvantages and consult with financial advisors to determine if this is the right option for an individual's specific situation.

Voluntary Life Insurance: Pre-Tax Benefits and Their Value

You may want to see also

Life insurance can be used to fund a child's education

One benefit of life insurance policies is that they can provide funds for the education of the insured's child. In the event of the policyholder's death, the beneficiary can use the tax-free death benefit to pay for the child's college expenses. This is particularly relevant for term life insurance policies, which provide coverage for a set period.

Permanent life insurance policies, on the other hand, offer more flexibility. While they are more expensive, they allow the insured to borrow against the policy's cash value without incurring tax penalties. This additional funding can help cover the child's education costs. The death benefit is designed to provide coverage for the entire life of the policyholder, rather than a set number of years. The policy also has a savings or investment account that builds cash value over time. This cash value can be withdrawn or borrowed against to cover college costs.

There are several advantages to using permanent life insurance for college savings. It offers flexibility, guaranteed payment, tax advantages, and financial aid advantages. If a child decides not to attend college, the money can be transferred to another beneficiary or, in some cases, withdrawn for other purposes without tax penalties. The cash value accumulated is guaranteed to be paid by the insurance company, and the growth of the cash value account is tax-deferred. Additionally, cash value accounts are excluded from college financial aid calculations, giving the child an opportunity to receive additional aid.

However, it is important to note that this method may not be suitable for everyone. Permanent life insurance policies typically have high premiums, annual fees, and long wait times for the cash value account to grow. Additionally, if the policyholder withdraws more money than they have paid in premiums, the withdrawal is treated as income, and cash withdrawals or unpaid loans reduce the death benefit. Therefore, it is recommended that individuals consult with financial advisors to determine the best option for their specific circumstances.

Life Insurance and Autopsies: When Are They Required?

You may want to see also

Whole life insurance is more expensive but provides coverage for life

When it comes to life insurance, there are two primary types: permanent life and term life. Term life insurance is the most popular option due to its lower premiums. However, whole life insurance, a type of permanent life insurance, offers lifelong coverage and a range of benefits that make it a valuable consideration, despite its higher cost.

Whole life insurance is more expensive than term life insurance, but it provides coverage for your entire life. While term life insurance policies expire after a set period or when you reach a maximum age limit, whole life insurance is designed to cover you for your entire life, as long as you pay the premiums and don't cancel your policy. This lifelong coverage ensures that your beneficiaries will receive a death benefit payout, no matter when you pass away.

One of the key advantages of whole life insurance is that it offers a guaranteed premium that remains fixed for the duration of the policy. With term life insurance, the fixed premium typically ends after 10, 20, or 30 years, and you may need to renew your policy at a higher rate or go without protection. In contrast, the premium you pay for whole life insurance when you take out the policy will never increase, and the younger and healthier you are when you take out the coverage, the lower your rates will generally be.

Whole life insurance also provides a tax-deferred cash value component that grows at a guaranteed rate every year. This cash value can be accessed during your lifetime through policy loans or withdrawals, providing a source of emergency funds, supplemental retirement income, or college financing. Additionally, the death benefit is guaranteed, ensuring that your beneficiaries will receive at least the face value of the policy.

Another benefit of whole life insurance is the potential to receive dividends if you purchase the policy from a mutual company. These dividends can be distributed as cash, used to pay premiums, or reinvested in your existing policy.

While whole life insurance is more expensive, it offers a range of advantages that make it a valuable option for those seeking lifelong coverage and a way to build financial assets. It is important to consider your unique goals, budget, and needs when deciding between whole life and term life insurance.

Senior Citizens: Getting Cash Value Life Insurance

You may want to see also

Term life insurance is ideal for those on a tight budget

Term life insurance is also a good option for those who want substantial coverage at a low cost. It is attractive to young people with children as it provides substantial coverage for a low cost. If the insured dies while the policy is in effect, the family can rely on the death benefit to replace lost income. It is also well-suited for people with growing families, as they can maintain the coverage needed until their children reach adulthood and become self-sufficient.

Term life insurance is also flexible, with policies lasting 10, 15, 20, or more years, and the option to renew them for an additional term. It is a straightforward product, with a fixed monthly payment and a guaranteed death benefit. In contrast, permanent life insurance policies can be more complex, with features such as cash value accumulation and potential for dividends or investment growth.

While term life insurance doesn't offer the same long-term protection as permanent life insurance, it can be a good choice for those who want to ensure their family is provided for in the event of their death, without breaking the bank. It can also be a good option for those who want to supplement their savings for their child's education, as the death benefit can be used to cover college expenses.

Get a Life Insurance License: Tennessee Requirements Guide

You may want to see also

Frequently asked questions

An education fund benefit with term life insurance allows you to use the funds from a life insurance policy to finance your child's education. This can include tuition fees, textbooks, and living costs. In the event of the policyholder's death, the tax-free death benefit can be used to pay for these expenses.

Term life insurance is more affordable and provides coverage for a specific period, whereas permanent life insurance offers lifelong protection and includes a cash value element that grows over time. This cash value can be used to supplement education funding.

Term life insurance offers flexibility and affordability. You can choose the length of coverage and the amount of the death benefit to fit your budget. It also provides peace of mind, ensuring financial support for your family in the event of your death.