An insurance carrier document is a record of the insurance company that provides your insurance coverage. Insurance carrier is another term for an insurance company, insurer, or insurance provider. These companies underwrite insurance policies and issue payments for claims. They are responsible for honouring the terms of the insurance policy, investigating and honouring valid insurance claims, sharing policy details, responding to customer inquiries, and reimbursing eligible claims.

| Characteristics | Values |

|---|---|

| Definition | A company that creates, manages, and sells insurance policies |

| Synonyms | Insurance company, insurer, provider |

| Responsibilities | Honor the terms of the insurance policy, investigate and honor valid insurance claims, transparently share policy details, respond to customer inquiries, accurately reimburse eligible claims |

What You'll Learn

Insurance carrier vs. insurance provider

An insurance carrier is a company that creates and manages insurance policies and is typically the financial resource behind them. They underwrite insurance plans and issue payments for claims. The terms 'insurer', 'carrier', and 'insurance company' are used interchangeably.

An insurance provider is synonymous with an insurance carrier. There is no difference between the two. Both terms describe the company that is behind an insurance policy.

While the terms are interchangeable, the word ''provider'' is sometimes used to refer to hospitals and doctors who provide healthcare services. Therefore, if you are using the term 'provider' to mean 'insurer', it is best to clarify by saying 'insurance provider'.

Insurance agencies and insurance agents sell policies. They are hired and contracted by insurance carriers to sell their insurance products. They can work for one or multiple carriers at a time, depending on the contracts. Agents work on commission, so they get a cut of whatever they sell. They have a deep understanding of the insurance coverage that the carriers they represent provide.

Insurance brokers help facilitate insurance policy sales. They collaborate with insurance carriers but do not work for them. They are third parties that work on commission and are often experts in risk management.

Contractor Insurance: What Coverages Are Essential?

You may want to see also

Insurance carrier duties

An insurance carrier is the company that provides insurance coverage. They are responsible for underwriting insurance plans and issuing payments for claims. Insurance carriers have several duties, including:

- Honouring the terms of the insurance policy

- Investigating and honouring valid insurance claims

- Sharing policy details transparently

- Responding promptly to customer inquiries

- Reimbursing eligible claims accurately

In some cases, insurance carriers may also be responsible for providing legal representation and helping pay for judgments against the insured. It is important to note that insurance carriers are not the same as insurance agencies or brokers, who sell policies and facilitate sales but do not have the same level of responsibility as carriers.

Carrie's Leg Insurance: Fact or Fiction?

You may want to see also

Types of insurance carriers

An insurance carrier is a company that creates and manages insurance policies and is typically the financial resource behind them. They are responsible for underwriting insurance plans and issuing payments for claims. Insurance carriers are also referred to as insurance companies or insurance providers.

There are two types of insurance carriers: admitted and non-admitted.

Admitted Insurance Carriers

Admitted insurance carriers are backed and approved by a state's Department of Insurance. They have met certain regulations set out by the NAIC and must continue to adhere to those standards to maintain their admitted status. If an admitted insurance carrier fails financially, the state will step in and provide assistance in covering your claims. If a claim is handled improperly, it can be appealed to the state's Department of Insurance.

Non-Admitted Insurance Carriers

Non-admitted insurance carriers are not approved by the state. This means they may not comply with insurance regulations and there is no guarantee that claims will be paid out if the company fails. Claims that are believed to have been handled improperly cannot be appealed to the state's Department of Insurance. However, non-admitted insurance companies are still regulated, and they often offer coverage for higher-risk scenarios.

Whether admitted or non-admitted, insurance carriers' credit ratings in the US are graded on a letter scale of A++ to F, with a lower rating indicating less financial reliability.

Non-Profits: Workers' Comp Insurance Necessity

You may want to see also

Admitted vs. non-admitted carriers

Admitted and non-admitted insurance carriers differ in their regulatory status. Admitted insurance companies are licensed by the State Department of Insurance or insurance commissioners where they operate, meaning they comply with state regulations. Non-admitted insurance companies, on the other hand, have not met state requirements and are not backed or approved by the state.

Admitted Carriers

Admitted insurance carriers are licensed by the State Department of Insurance or insurance commissioners in the states where they operate. This means they must comply with the regulations set by the state, including capitalization requirements, policy forms, rate approvals, and claims handling. The process of becoming an admitted carrier is lengthy and complex, as the insurance company must ensure that all rates and forms comply with state recommendations and regulations. The state also verifies the insurance company's policy forms, rates, and requirements before allowing it to sell policies in that state.

One of the main benefits of buying insurance from an admitted carrier is that policyholders don't have to pay certain fees or taxes on their policies. Additionally, if the admitted insurance company fails or becomes insolvent, the state's insurance fund will step in to make payments on claims. Admitted insurance policyholders also have the right to appeal to the state insurance department if they believe their claim was mishandled.

Non-Admitted Carriers

Non-admitted insurance carriers, also known as excess and surplus (E&S) lines carriers, have not met the regulations set by the state Department of Insurance in the areas they work. They are not backed or approved by the state, which means they are not required to comply with state insurance regulations. Non-admitted carriers operate through wholesale brokers in states where they do not have insurance licenses.

One of the benefits of non-admitted carriers is that they have more flexibility in the risks they insure. They can offer coverage for business risks that admitted carriers may not be able to provide. For example, a business located in an area prone to natural disasters may need to turn to a non-admitted carrier for property coverage. Non-admitted carriers can also be more creative with their policies, as they are not bound by state-regulated rates.

However, one of the drawbacks of non-admitted carriers is that there is no guarantee that claims will be paid if the company becomes insolvent. In this case, the state will not step in to make payments, and policyholders cannot appeal to the state insurance department.

Choosing Between Admitted and Non-Admitted Carriers

Both admitted and non-admitted insurance carriers have their benefits, and the right choice depends on the specific needs and risks of the business. Admitted carriers offer the security of state regulation and backing, while non-admitted carriers provide more flexibility in coverage options. It's important to consider the specific risks and needs of your business when choosing between admitted and non-admitted insurance carriers.

Insurance Coverage: Does It Carry Over?

You may want to see also

How to learn about your carrier

An insurance carrier is a company that sells and fulfils insurance contracts. They are responsible for underwriting insurance plans and issuing payments for claims. They are also sometimes referred to as providers or insurers.

- Understand the role of an insurance carrier: Recognise that an insurance carrier is a company that creates and manages insurance policies. They are typically the financial resource behind these policies, but in some cases, they may only serve as administrators. In such instances, the employer offering the coverage manages claims.

- Know the synonyms: The term "insurance carrier" has several synonyms, including "insurance company" and "carrier." Understanding these synonyms can help you better identify and refer to your insurance carrier.

- Review your insurance policy: Your insurance policy documents will provide detailed information about your insurance carrier, including their name and specific terms and conditions of your coverage. Review these documents to familiarise yourself with the carrier's role and responsibilities.

- Communicate directly: If you have any questions or concerns about your coverage, don't hesitate to contact your insurance carrier directly. They have a responsibility to respond promptly to customer inquiries and transparently share policy details.

- Understand the difference between carriers, agencies, and brokers: While insurance carriers create and manage policies, insurance agencies and brokers are separate entities. Agencies sell policies and can work for one or multiple carriers. Brokers, on the other hand, are third parties that facilitate policy sales and help clients explore coverage options. Understanding these distinctions can help you navigate the insurance landscape more effectively.

- Research online: Utilise online resources to learn more about your insurance carrier. Visit their website, read reviews, and compare their offerings with those of other carriers. This can help you gain a broader understanding of the carrier's reputation, services, and position in the market.

By following these steps, you can empower yourself with knowledge about your insurance carrier, enabling you to make more informed decisions regarding your insurance coverage.

Malpractice Insurance: RNs' Necessary Shield?

You may want to see also

Frequently asked questions

An insurance carrier is a company that sells and fulfils insurance contracts. They provide insurance coverage and are financially responsible for underwriting insurance plans and issuing payments for claims.

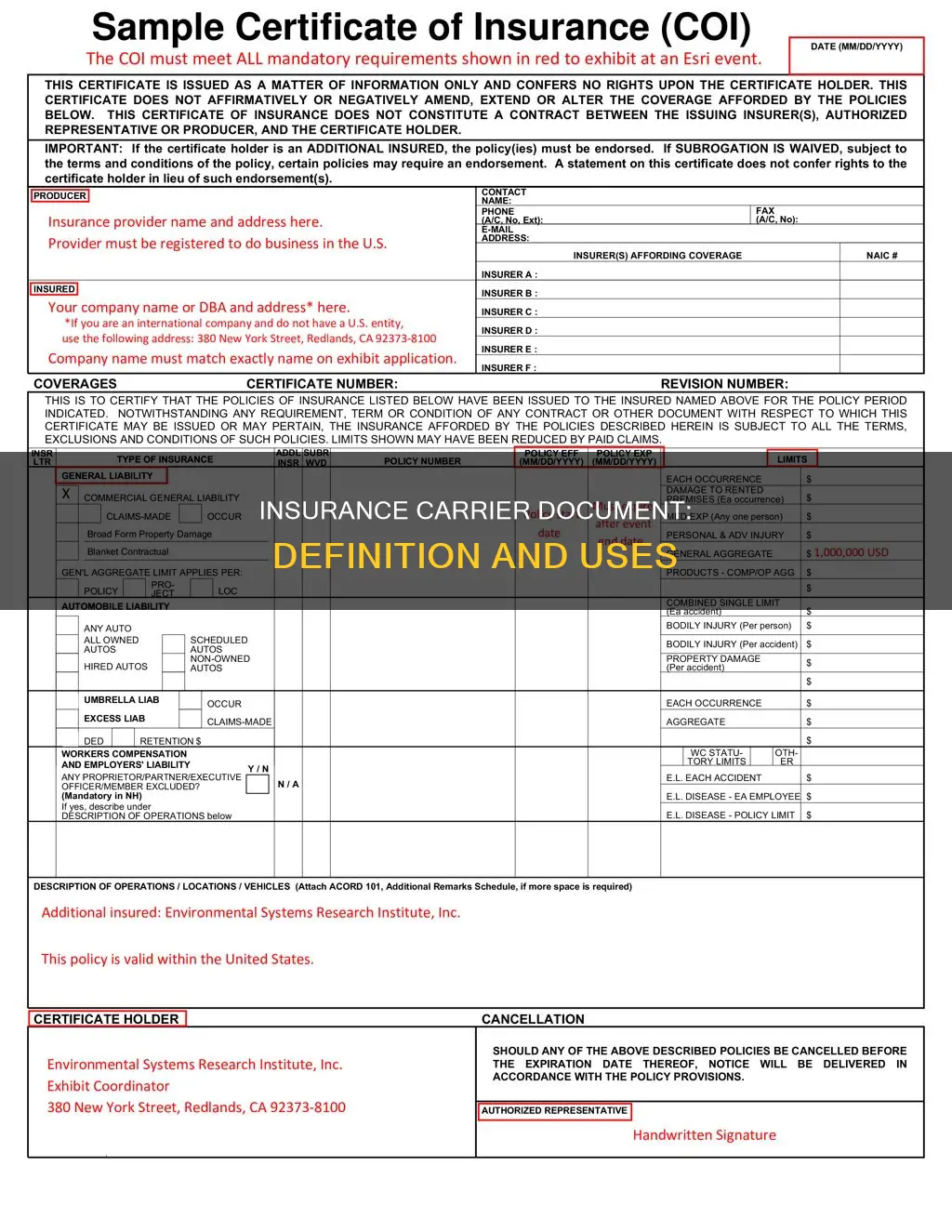

An insurance carrier document is likely to refer to the insurance policy document. This is the contract between the insurance company and the customer, outlining the terms of the insurance.

An insurance agent is an individual who is employed by an insurance carrier. They handle claims and may help set up premium payments on behalf of the carrier. Agents typically work on commission.

An insurance broker is an expert consultant who works for the insured (the customer) to get price quotes from various insurance companies. They are legally required to act in the client's best interest.