When a marriage ends in divorce, it is important to address life insurance policies to provide financial safeguards and protect dependents. In many divorces that include provisions for alimony or child support, it is common practice to include a stipulation that the supporting spouse should carry a life insurance policy. This ensures that support payments continue even if the supporting spouse dies before fulfilling their obligations. An ex-spouse generally isn't allowed to remain on the other spouse's life insurance policy unless they have an insurable interest or if the divorce decree requires it.

| Characteristics | Values |

|---|---|

| Reasons for stipulating spouse to carry insurance decree | To ensure continued financial support for the dependent spouse and/or children in case of the supporting spouse's death |

| Type of insurance | Life insurance, health insurance, disability insurance, car insurance, homeowner's insurance |

| Factors influencing the decision | Presence of alimony or child support obligations, insurable interest, state laws, policy ownership, beneficiary designations |

| Options for the dependent spouse | COBRA coverage, employer-provided insurance, state health insurance marketplace, Medicare, Medicaid |

| Considerations | Cost of insurance, impact on divorce settlement, financial implications, protection of child support payments |

What You'll Learn

- Health insurance: Spouses can remain on each other's health insurance plans during divorce proceedings but not after the divorce is finalised

- Life insurance: Life insurance policies can be used to secure alimony and child support

- Medicare: Former spouses can obtain Medicare benefits if the marriage lasted at least ten years and other conditions are met

- Medicaid: Divorcees who cannot afford health insurance premiums can apply for Medicaid benefits

- Disability insurance: Earning divorcees should purchase their own disability insurance

Health insurance: Spouses can remain on each other's health insurance plans during divorce proceedings but not after the divorce is finalised

When it comes to employer health insurance plans, only eligible dependents are typically covered. This means that if your spouse has health insurance through your employer, they will no longer be covered once your divorce is finalised. While your children will continue to receive coverage, your ex-spouse will likely not meet the requirements.

That being said, there are a few options for spouses to remain on each other's health insurance plans during divorce proceedings. In many states, courts will automatically issue temporary restraining orders when someone files for divorce. These orders are meant to maintain the financial status quo during the divorce process and prohibit either spouse from taking certain actions, such as changing or cancelling health insurance policies. If you live in a state that doesn't automatically issue these orders, you can request that a judge issue one that addresses health insurance and any other relevant issues. These orders typically last until the divorce is finalised.

Additionally, the Consolidated Omnibus Budget Reconciliation Act (COBRA) requires employers to keep providing health insurance for an employee's ex-spouse for up to 36 months after a divorce. COBRA is a federal program that applies to employers with 20 or more employees, and it allows workers and their families to maintain health coverage after divorce and other qualifying events. However, COBRA can be expensive, as you have to pay the entire monthly premium of the employer's plan plus an additional 2% administrative fee.

It's important to note that health insurance companies generally do not permit divorced spouses to remain on each other's health insurance policies. If you believe health insurance will be a major issue in your divorce, it is recommended that you consult with an experienced attorney as soon as possible.

Hazard Insurance: Is It Mandatory?

You may want to see also

Life insurance: Life insurance policies can be used to secure alimony and child support

Life insurance policies can be used to ensure financial stability for ex-spouses and children in the event of the supporting spouse's death. This is especially important in cases where the children are very young at the time of the divorce, as child support payments may continue for many years, and a lot can happen in that time.

In many divorces that include provisions for alimony or child support, it is common practice to include a stipulation that the supporting spouse should carry a life insurance policy. This ensures that those support payments continue even if the supporting spouse dies before fulfilling their obligations.

The amount of the policy should be calculated based on the amount of support that is awarded. Child support generally terminates once the child reaches the age of majority, but alimony payments may continue for much longer, depending on the length and conditions of the marriage.

There are two main types of life insurance policies to consider: term life and whole life. Term life insurance is usually available in 10-year, 20-year, and 30-year terms, and is best if you only want coverage until your child is old enough to live on their own. Whole life insurance is more permanent and lasts until death, but it is also more expensive. Most single parents don't need whole life coverage.

When setting up a life insurance policy, it is important to designate who will be the owner of the policy. The owner controls the policy and has the right to name the beneficiaries. One way to ensure that the policy is maintained as stipulated in the divorce settlement is to name the custodial parent as the owner of the policy.

Additionally, if the dependent children or former spouse receiving alimony are named as beneficiaries, they have what is called an "insurable interest" in the supporting spouse's life. This means they have a financial stake in the life of the supporting spouse. An ex-spouse generally isn't allowed to remain on the other spouse's life insurance policy unless they have an insurable interest or if the divorce decree requires it.

It is also important to consider who will fund the policy. Will the supporting spouse fund it entirely, or will the supported spouse contribute? Will the cost be shared? If the supporting spouse is funding the policy, will support payments be calculated based on their income before or after payment of the premiums?

Overall, life insurance policies can provide financial security for ex-spouses and children in the event of the supporting spouse's death, ensuring that alimony and child support payments continue as intended.

Loading Insurance: Carrier 411 Guide

You may want to see also

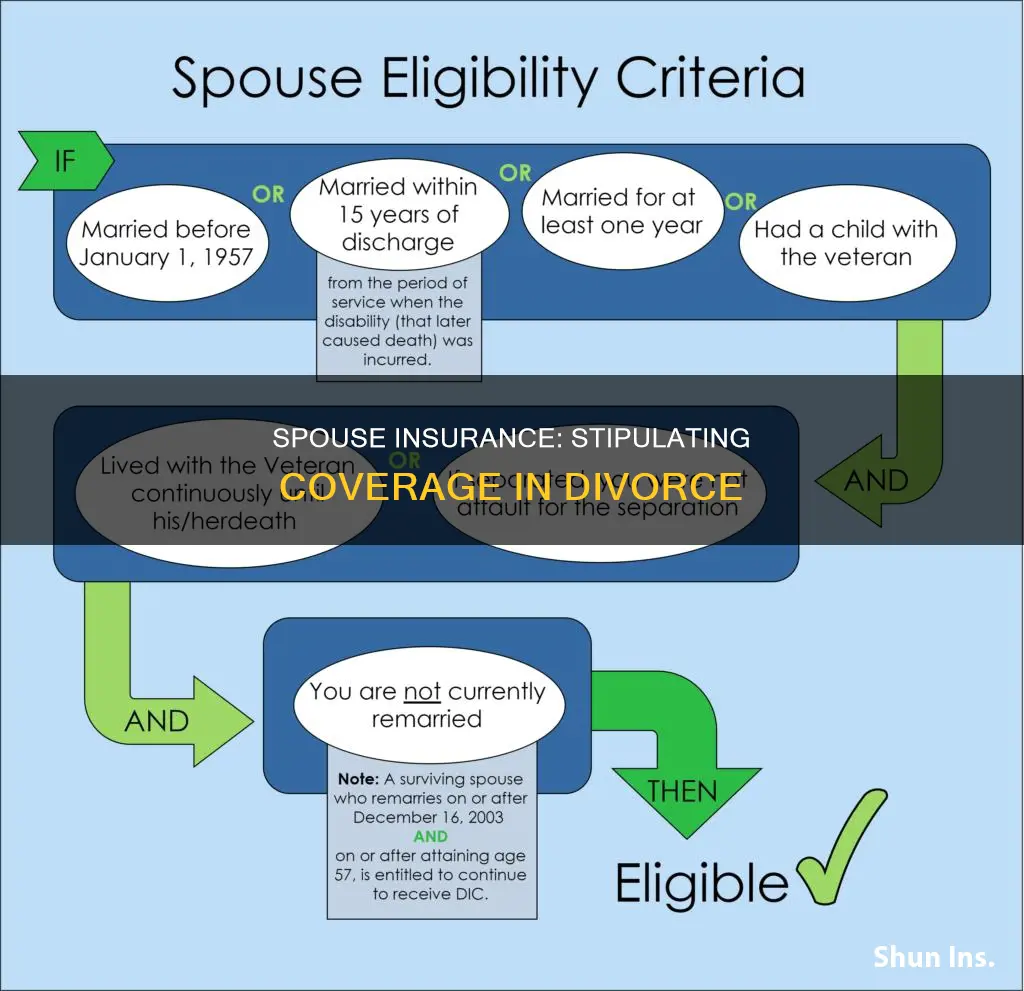

Medicare: Former spouses can obtain Medicare benefits if the marriage lasted at least ten years and other conditions are met

When it comes to health insurance, a divorce is a life-changing event that can have a significant impact on your coverage. If you were previously covered under your spouse's employer-provided insurance, that coverage will typically end once the divorce is finalized. However, there are a few options available for former spouses to maintain their health insurance coverage.

One option is COBRA insurance, which allows an ex-spouse who loses coverage due to divorce to continue their coverage for up to 36 months. While COBRA policies can be expensive, they are often more affordable than paying for medical expenses out of pocket. Additionally, if your marriage lasted at least ten years, you have reached the age of 62, you are currently unmarried, and your ex-spouse qualifies for Social Security Retirement benefits, you may be eligible for Medicare benefits based on their employment history.

Another option for maintaining health insurance coverage after a divorce is to include a stipulation in the divorce settlement that requires your spouse to continue providing coverage for you and your children. This option may be particularly relevant if you are unable to afford health insurance premiums on your own. In such cases, you may need to go to court and seek a modification to the initial terms of the divorce settlement.

It is also important to consider life insurance policies during divorce proceedings. Life insurance can provide financial protection for dependents, such as children, in the event of an unexpected death. To ensure that your former spouse can continue to make child support payments, even after their death, you may need to be named as a beneficiary on their life insurance policy.

In summary, while a divorce can have significant implications for your insurance coverage, there are several options available to help you maintain the coverage you need. These options include COBRA insurance, Medicare benefits based on your former spouse's employment history, and stipulations in the divorce settlement. Additionally, updating your life insurance policy to reflect your new circumstances can help protect your dependents financially.

Church Molestation Insurance: Who's Covered?

You may want to see also

Medicaid: Divorcees who cannot afford health insurance premiums can apply for Medicaid benefits

Divorce is a life-changing event that impacts many aspects of a person's life, including their insurance coverage. It is important to understand the nuances of insurance when it comes to divorce, especially for those who cannot afford health insurance premiums.

In the United States, the majority of people receive health insurance through their employer. Once a divorce is finalised, a spouse will no longer be eligible for benefits through their ex-spouse's employer-provided insurance. However, they may still be temporarily eligible for COBRA benefits. COBRA insurance, named after the Consolidated Omnibus Budget Reconciliation Act, allows an ex-spouse who loses coverage due to divorce to pay for COBRA coverage for up to 36 months. While COBRA policies are expensive, they are a more affordable option than paying for medical expenses out of pocket.

Alternatively, divorcees who cannot afford health insurance premiums may apply for Medicaid benefits. In a "Medicaid divorce", one spouse offers all their assets to the other during divorce proceedings, allowing the recipient spouse to apply for Medicaid without reporting assets. To be eligible for Medicaid in this scenario, the marriage must have lasted at least ten years, the applicant must be at least 62 years old, unmarried, and the ex-spouse must qualify for Social Security Retirement benefits.

Additionally, health insurance coverage may be included in divorce settlements. For example, a spouse who has been receiving coverage through their partner's plan may request that the divorce settlement stipulate the continuation of said coverage. Courts recognise the potential financial implications of health insurance coverage and may modify the initial terms of a divorce settlement if an ex-spouse cannot afford to carry insurance for their former spouse.

It is important to note that federal law mandates that health insurance coverage ends as soon as a divorce is finalised. Therefore, it is crucial for divorcees to explore their options, such as COBRA coverage, Medicaid, or purchasing insurance through the state's health insurance marketplace or their own employer, if applicable. Consulting with a divorce attorney can help individuals navigate the complex matters of insurance during this emotionally turbulent time.

Uship Carriers: Insured or Not?

You may want to see also

Disability insurance: Earning divorcees should purchase their own disability insurance

Divorce is a difficult process, and it's important to understand your rights and the potential financial implications. Divorce settlements cover a lot of ground, from the division of property to child custody and spousal support. One important aspect that should not be overlooked is insurance.

During divorce proceedings, it is common for the supporting spouse to be required to carry a life insurance policy to ensure that alimony and child support payments are protected in the event of their death. However, it is also crucial to consider disability income insurance, especially if one spouse is the primary breadwinner.

The potential for disablement and its financial consequences are often overlooked in divorce settlements. If the breadwinning spouse loses their job due to a long-term or permanent disability, this could lead to a loss of income and potentially impact their ability to fulfil their financial obligations. Disability income insurance can help mitigate this risk by replacing a portion of their income if they are unable to work due to an illness or injury.

According to Chad Tourin, an attorney and associate managing director, "The biggest problem when ignoring the full economic value of a divorcée is that many of the agreements in the divorce would fall apart if income were to suddenly stop due to illness or injury. Orders for alimony, child support, etc. would become meaningless because it would be impossible for the divorcée to make those payments."

Therefore, it is advisable for earning divorcees to purchase their own disability income insurance to protect their income stream and ensure they can continue making agreed-upon payments to their ex-spouse and/or children. While group disability income insurance through an employer may be an option, it might not provide the necessary protection. A private disability income policy can be customised to include the specific protection needed.

Additionally, during divorce negotiations, it is essential to designate who will be the owner of any insurance policies. The owner controls the policy and has the right to name the beneficiaries. By naming the custodial parent as the owner of the policy, there is added assurance that the policy will be maintained as stipulated in the divorce settlement.

In conclusion, earning divorcees should strongly consider purchasing their own disability income insurance to safeguard their income and ensure they can uphold their financial commitments post-divorce. This important step can help provide financial security and peace of mind during a challenging life transition.

Churches: Insured or Uninsured?

You may want to see also

Frequently asked questions

No, you cannot remove your spouse from your health insurance plan without a court order permitting you to do so. If your spouse obtains their own insurance, you should obtain a written and signed stipulation that can be submitted to the Court to be approved as a Court Order.

Yes, as part of the child support aspect of your case, the court can order your spouse to provide life insurance with your child as the beneficiary.

Yes, you can push for this, especially if you have been married for a long time. It is common for divorce agreements to include provisions for alimony or child support, and it is standard practice to include a stipulation that the supporting spouse should carry a life insurance policy.

Health insurance coverage may be included in divorce settlements. For example, a spouse who has been receiving health insurance coverage through their partner's plan may request that the divorce settlement stipulate that coverage should continue.