An insurance carrier is a company that creates, manages, and sells insurance policies. They are typically the financial resource behind the policies and are responsible for underwriting insurance plans and issuing payments for claims. Insurance carriers offer a wide variety of coverage types and policies to fit the unique needs of consumers. When a consumer files an insurance claim, the insurance carrier reviews, investigates, and processes it. If the claim is approved, the insurance carrier pays out their share of the agreed-upon reimbursement benefits.

| Characteristics | Values |

|---|---|

| Definition | A company that creates, manages, sells and fulfills insurance policies |

| Synonyms | Insurance company, insurance provider, insurer |

| Responsibility | Underwriting insurance plans and issuing payments for claims |

| Agent's Responsibility | Handling claims and setting up payments |

| Research | Research a carrier's reputation and financial health before signing up for a policy |

| Types | Direct insurance carriers, reinsurance carriers, captive insurance carriers, admitted carriers, non-admitted carriers |

What You'll Learn

- A PEO (Professional Employer Organization) offers co-employees access to health coverage at affordable rates that are usually only available to large corporations

- PEOs often offer a more well-rounded benefits package, including wellness and mental health perks, 401(k) options, and a variety of health insurance plan options

- PEOs also provide solutions for payroll, HR tools and resources, and compliance support

- PEOs can offer a scalable and affordable solution for providing access to health coverage, along with helping businesses in a number of other ways

- When a company joins a PEO, the networks are better, the plans are better, and the premiums are less expensive?

A PEO (Professional Employer Organization) offers co-employees access to health coverage at affordable rates that are usually only available to large corporations

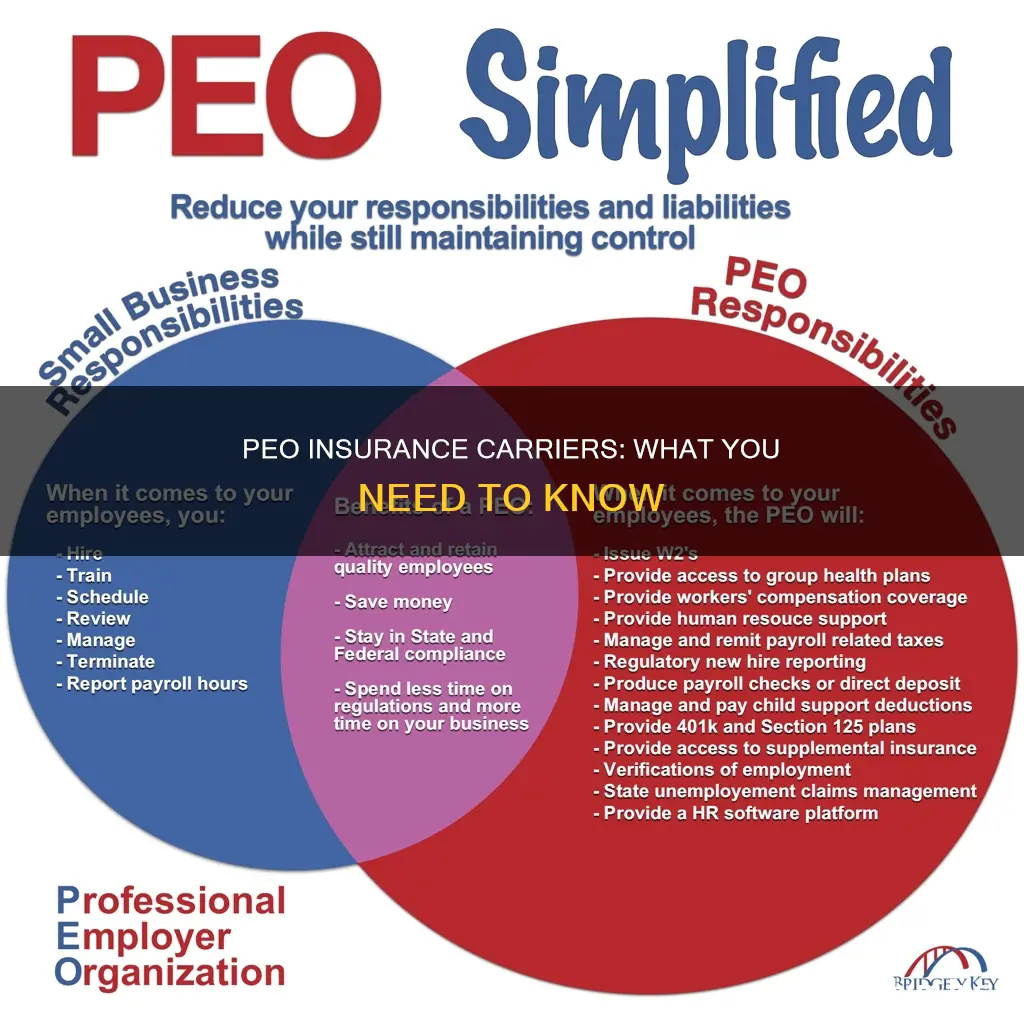

A PEO, or Professional Employer Organization, is a type of full-service human resource outsourcing known as co-employment. In this arrangement, the PEO performs employee administration tasks such as payroll and benefits administration on behalf of a business.

A PEO offers co-employees access to health coverage at affordable rates that are usually only available to large corporations. This is because the employees of all the PEO's customers are grouped together, forming one large group. This means that the PEO can offer employees access to health coverage and rates comparable to those of a large corporation, even though they work for much smaller companies.

PEOs often offer a more comprehensive benefits package, which may include wellness and mental health perks, 401(k) options, and a wide range of health insurance plan options. In addition, many PEOs provide solutions for payroll, HR tools and resources, and compliance support.

Small businesses often find that buying health insurance directly is the least viable option, as navigating health insurance options can be complicated and time-consuming. By using a PEO, small businesses can access affordable health coverage for their employees and benefit from the PEO's expertise in HR and compliance issues.

It is important to note that a PEO is different from an insurance carrier, which is a company that creates and manages insurance policies and is typically financially responsible for them. While a PEO acts as a co-employer and provides access to health coverage through specific insurance providers, an insurance carrier underwrites insurance plans and issues payments for claims.

Non-Profit Insurance: What Large Organizations Need

You may want to see also

PEOs often offer a more well-rounded benefits package, including wellness and mental health perks, 401(k) options, and a variety of health insurance plan options

A Professional Employer Organization (PEO) is a third-party company that manages human resources functions for small businesses, including payroll processing and benefits administration. PEOs can also manage the onboarding of new hires, ensuring that all the appropriate paperwork and training is completed.

For example, Justworks offers access to wellness and mental health perks, 401(k) options, and a rich variety of health insurance plan options.

PEOs can also provide solutions for payroll, HR tools and resources, and compliance support. They can help small businesses save time and money by offloading the administrative burden, allowing them to focus on growing their business.

Overall, PEOs offer a more comprehensive and affordable benefits package compared to what small businesses could typically access on their own.

Lease Co-Owner Without Insurance: Now What?

You may want to see also

PEOs also provide solutions for payroll, HR tools and resources, and compliance support

A PEO, or Professional Employer Organization, is a type of full-service human resource outsourcing known as co-employment. PEOs provide solutions for payroll, HR tools and resources, and compliance support.

Payroll Solutions

PEOs can process payroll and pay local, state, and federal employment taxes. They can also integrate payroll with time and attendance, reducing duplicate data entry and errors. This saves businesses time and money and streamlines the process. PEOs can also offer workers' compensation payment services, allowing businesses to pay premiums based on actual wages rather than estimates, improving cash flow.

HR Tools and Resources

PEOs offer access to high-quality, cost-effective health insurance, dental care, retirement benefits, and other employee perks. They handle employee enrollment and process claims. PEOs can also provide HR professionals who give HR services and support. These experts can help businesses protect themselves from fines and penalties and ensure compliance with federal and state employment laws. They may also assist with talent management, including recruiting, training, and performance management.

Compliance Support

Compliance experts from PEOs can help businesses navigate complex employment laws and regulations. They can offer guidance on payroll tax law, reporting requirements, unemployment insurance, workers' compensation, and hiring and HR compliance. This helps businesses reduce their risk and maintain compliance, avoiding costly fines.

By outsourcing these functions to a PEO, businesses can save time and resources, allowing them to focus on their core operations and strategic growth.

Red Cross: Workers' Comp Covered?

You may want to see also

PEOs can offer a scalable and affordable solution for providing access to health coverage, along with helping businesses in a number of other ways

A Professional Employer Organization (PEO) is an excellent resource for businesses that want to save time and money on health insurance and other HR functions. Small businesses often find that buying health insurance directly is the least viable option. This is because navigating health insurance options can be complicated and time-consuming.

A PEO can offer a scalable and affordable solution for providing access to health coverage, along with helping businesses in a number of other ways.

Access to Affordable Health Coverage

Firstly, a PEO can provide employees with access to health coverage at affordable rates. This is because a PEO acts as a co-employer, grouping all its clients' employees together to form one large group. This means that insurance companies will offer the same rates that they would to a large corporation. In contrast, small businesses that purchase health insurance independently are often charged higher premiums by insurance companies to offset the potential risk.

A More Well-Rounded Benefits Package

Secondly, PEOs often offer a more well-rounded benefits package. For example, Justworks offers access to wellness and mental health perks, 401(k) options, and a variety of health insurance plan options.

Streamlined Business Operations

Thirdly, a PEO can streamline business operations by providing all-in-one solutions that integrate payroll, employee benefits, and compliance support into one system. This saves employers time and reduces the risk of costly fines for failing to comply with employment regulations.

Compliance Support

Finally, a PEO can offer compliance support on both federal and state levels. This includes helping businesses navigate complex employment regulations, such as hiring employees in multiple states and filing payroll taxes. A PEO can also take on some of the compliance risks for the business.

In summary, a PEO can be a valuable partner for small businesses, offering scalable and affordable solutions for providing access to health coverage, as well as a range of other benefits and support.

Handyman Insurance: What You Need to Carry

You may want to see also

When a company joins a PEO, the networks are better, the plans are better, and the premiums are less expensive

A PEO, or Professional Employer Organization, is a type of full-service human resource outsourcing that acts as a co-employer. In this arrangement, the PEO performs employee administration tasks such as payroll, withholdings, W-2s, garnishments, and benefits administration on behalf of a business.

When a company joins a PEO, they gain access to better networks, improved plans, and more affordable premiums. This is because, in a PEO, all plans are large group plans, meaning that the coverages are better than what's available in the small group open market for small companies. For example, the choices with Aetna in the small group market are limited, but in a PEO, Aetna offers amazing plans that are only available in PEO or large group plans for large employers.

By joining a PEO, companies can offer their employees access to a comprehensive benefits package, including medical, dental, vision, life, and disability benefits, as well as retirement savings programs such as 401(k) plans. The PEO will also handle the related administrative tasks, such as negotiating with carriers, enrolling employees, and providing legal notices.

In addition to improved benefits, companies that join a PEO can also benefit from streamlined payroll processing, compliance support, and HR services. The PEO can also provide support with talent management, recruitment, and compliance with employment laws and regulations, helping to avoid costly fines and penalties.

Overall, joining a PEO can provide companies with better networks, improved plans, and more affordable premiums, as well as a range of additional benefits and support services.

Nonprofit Insurance: What's Needed?

You may want to see also

Frequently asked questions

PEO stands for Professional Employer Organization. It is an organization that offers co-employees access to health coverage at affordable rates.

An insurance carrier is a company that sells and fulfills insurance contracts. They are also known as insurance providers or insurers.

A health insurance broker is an expert at insurance, whereas a PEO can provide expertise in HR and compliance issues, in addition to providing access to health coverage.

PEOs offer a more well-rounded benefits package, including wellness and mental health perks, 401(k) options, and a variety of health insurance plan options. They also provide solutions for payroll, HR tools, resources, and compliance support.

It depends on your specific needs. If you require assistance with compliance and HR issues in addition to health coverage, a PEO may be a better option. If you are primarily focused on health insurance, a broker may be more suitable.