Speeding tickets can have a significant impact on car insurance premiums, with some companies penalising policyholders for minor speeding convictions. If you are married, any speeding tickets you have may affect your husband's insurance, as most insurance companies require that any household members of driving age be listed on the policy. While the impact of your speeding tickets on your husband's insurance may depend on whether you are listed as a driver on his policy, insurance companies can access your driving record and take this into account when calculating his premiums.

What You'll Learn

How much does insurance increase?

The amount by which insurance rates increase due to speeding tickets depends on several factors. These include the driver's location, driving history, and insurer.

According to a 2024 Forbes Advisor analysis, the average car insurance rate increase for drivers who get a speeding ticket is 26%, or nearly $507 more per year. However, this amount varies across states due to differences in state insurance regulations. For example, Texas drivers experience the lowest average rate increase of 13%, while Michigan drivers face the highest average increase of 54%.

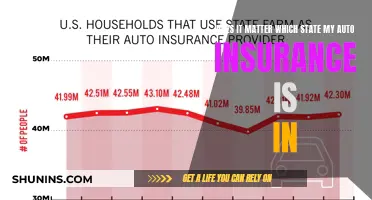

Additionally, some insurers may not increase rates after a single speeding violation. For instance, State Farm had the smallest average rate hike of around $22 more per month. On the other hand, Mercury had the highest rate increase of 39%.

It's worth noting that speeding tickets may remain on a driving record for three to five years, depending on the state. During this period, a driver's insurance rates may continue to be affected.

Auto Insurance Scores: Accessible Without SSN?

You may want to see also

Does the state matter?

Yes, the state you live in matters when it comes to how much a speeding ticket will affect your insurance premium. The average car insurance rate increase for drivers who get a speeding ticket is 26%, or nearly $507 more per year, but this varies by state. For example, Texas drivers get the lowest average rate increase with only a 13% hike, while Michigan drivers get the highest average increase at 54%.

Some states don't put minor tickets on your DMV record. For example, Colorado and Pennsylvania do not record the violation if it is considered a minor offense, like a speeding ticket. Other states, like Maryland and Nevada, record the violation but do not assign points for out-of-state tickets. In these states, an out-of-state ticket may not impact your insurance premium. On the other hand, states such as Florida and Texas place both the violation and points on your driving record for all out-of-state convictions, which will likely increase your car insurance premium.

Additionally, each state has different laws regarding how long a speeding ticket stays on your record. For example, New Jersey and Texas allow car insurers to apply surcharges for three years, while Massachusetts allows up to five years.

It's important to note that even if you receive a speeding ticket in another state, your home state will likely be made aware of the infraction, and your insurance company will eventually find out. However, not all states treat out-of-state tickets the same as local tickets, and some states prohibit insurance companies from raising rates after just one moving violation conviction.

Temporary Auto Insurance for Oregon: Where to Get Covered

You may want to see also

Does the type of violation matter?

The type of violation certainly matters when it comes to insurance increases. The more serious the violation, the more you can expect to pay for insurance. For example, a DUI conviction will increase your insurance premium by as much as 102% on average, whereas a speeding ticket will typically increase your insurance rate by 25% to 27%.

However, the impact of a violation on your insurance rate depends on how your state and insurer treat the violation. Some states outright ban insurance companies from using certain types of violations when determining their rates. For example, non-moving violations, such as parking tickets, typically do not affect your insurance rate, whereas moving violations, such as speeding tickets, will. Within the category of moving violations, more severe violations will result in higher rate increases. For example, a DUI conviction will result in a higher rate increase than a speeding ticket.

The number of violations you have will also affect your insurance rate. If you accumulate a significant number of violations, your insurance rate is likely to increase. For example, insurers will typically increase your rate if you get two or more speeding tickets in three years.

Smart Ways to Reduce Auto Insurance for Teen Drivers

You may want to see also

How does driving history affect insurance?

A person's driving history can have a significant impact on their insurance rates. While a single speeding ticket may not affect insurance costs, multiple violations will likely result in higher premiums. The increase in insurance rates depends on several factors, including the driver's location, insurer, and driving record. For example, a North Carolina driver could pay 50% more for insurance after a speeding ticket, while a Pennsylvania driver might only see a 15% increase for the same offense. The length of time that a speeding ticket stays on a driving record also varies by state, typically between three and five years.

In addition to speeding tickets, other types of moving violations, such as running a red light or texting while driving, can also increase insurance rates. These violations are often considered "surchargeable" incidents, which means they can lead to higher rates. The number of points added to a driver's license for each violation varies by state, and accumulating a significant number of points can result in higher insurance rates due to the increased risk of filing an insurance claim.

The impact of a speeding ticket on insurance rates can vary depending on the insurer and the state. Some insurers may not raise rates after a single speeding violation, while others may significantly increase premiums. It is essential to compare insurance quotes from multiple companies to find the most affordable policy after receiving a speeding ticket. Additionally, taking a state-approved driving course can help reduce points on a driving record and potentially keep insurance rates lower.

Overall, a person's driving history, including speeding tickets and other moving violations, can significantly affect their insurance rates. The increase in premiums depends on various factors, and it is important to consider the potential financial implications of speeding tickets beyond the initial fine.

Auto Insurance: Is Comprehensive Coverage Mandatory?

You may want to see also

What are the alternatives to increased insurance?

The cost of car insurance typically goes up about 25% after a speeding ticket. However, there are several alternatives to increased insurance costs due to speeding tickets. Here are some options to consider:

Shop Around for a New Policy

If your current insurer increases your premium after a speeding ticket, you can explore other insurance providers who may not penalize you for a single violation. Different insurers have varying criteria for assessing risk, and some may be more lenient than others. Comparing quotes from multiple companies can help you find a more affordable policy.

State-Approved Driving Course

Enrolling in and completing a state-approved driving course can be beneficial. This may help reduce points on your driving record or even keep the speeding offense off your record entirely, resulting in no increase in your insurance rates.

Explore Discount Opportunities

Even with a speeding ticket, you may still be eligible for certain insurance discounts. Look into potential discounts offered by different insurance companies, as they may have programs that reward safe driving habits or the installation of safety features in your vehicle.

Review Your Policy Coverage

Consider reviewing your current insurance policy to identify areas where you can adjust your coverage. By carefully evaluating your needs and selecting the appropriate coverage limits and deductibles, you may be able to offset the potential increase in insurance costs due to the speeding ticket.

Improve Your Driving Record

Focus on improving your driving behavior and maintaining a clean driving record going forward. Over time, as the speeding ticket ages and falls off your record, your insurance rates may decrease again, especially if you avoid any further violations.

It's important to remember that insurance rates are influenced by various factors, including your driving history, location, and individual insurer policies. By being proactive and exploring these alternatives, you may be able to mitigate the impact of a speeding ticket on your insurance costs.

Auto Insurance Settlement: Sue After Accepting?

You may want to see also

Frequently asked questions

Yes, your husband's insurance could increase if you get a speeding ticket. If you are listed on each other's insurance policies, your speeding ticket will be visible on your driving record, which can cause your insurance company to increase your premiums.

You can exclude yourself from your husband's insurance policy, which may prevent his insurance from increasing due to your speeding ticket. However, this also means that you will not be covered under his policy. You could also shop around for a lower rate from another insurance company or take a defensive driving course, which may lower your premiums.

Not necessarily. While speeding tickets can cause insurance rates to increase, this is not always the case. It depends on the insurance company and their policies.

Most insurance companies require that any household members of driving age be listed on the policy. However, in some states, you may be able to exclude your spouse from your policy if they do not drive the vehicle.