Short-term car insurance is hard to come by in Michigan. Most major car insurers don’t offer contract terms for periods shorter than six months. The good news is that car insurance contracts typically last for just six months, allowing insurance companies to re-rate or re-price your premium using your up-to-date driving history and personal info. The six-month mark is also a good time to reset your situation by exploring other companies. Comparing prices online is quick and easy, and there isn't a penalty for changing auto insurance companies between policy terms or even in the middle of your policy term, as long as you don't let your insurance lapse.

| Characteristics | Values |

|---|---|

| Average cost of minimum coverage car insurance in Michigan | $856 per year |

| Average cost of full coverage car insurance in Michigan | $1,924 per year |

| Average monthly cost of minimum coverage car insurance in Michigan | $71 |

| Average monthly cost of full coverage car insurance in Michigan | $160 |

| Average cost of minimum coverage car insurance in Michigan for teens | $940 per year |

| Average cost of full coverage car insurance in Michigan for teens | $12,921 per year |

| Cheapest car insurance in Michigan | USAA |

What You'll Learn

The average cost of car insurance in Michigan

The cost of car insurance in Michigan varies depending on factors such as age, driving record, credit score, and location. Age is a significant factor, with younger drivers paying higher premiums. The average annual cost for a 16-year-old driver in Michigan is $12,921, while it decreases to $1,924 for drivers in their thirties and reaches the lowest rates for those aged 60 and above.

The driving record also plays a crucial role in determining insurance rates. A clean driving record can lead to lower premiums, while accidents, tickets, and violations will result in higher costs. For example, a single speeding ticket can increase the average annual premium to $5,606.

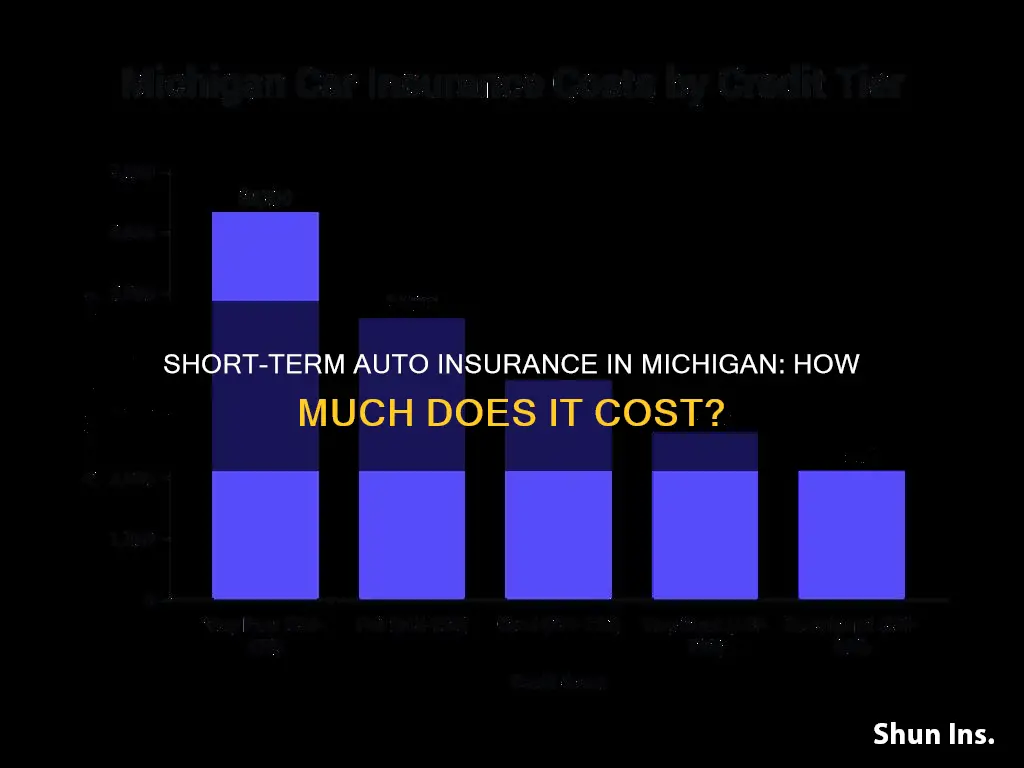

When it comes to credit scores, Michigan allows insurers to use credit scores to determine rates, with higher scores generally leading to more favorable premiums. A good credit score is typically considered to be between 670 and 739.

The cost of car insurance in Michigan also varies by location, with Ann Arbor offering the most affordable full coverage at $1,361 per year, while Detroit has the highest rates at $3,987 per year.

Switching Auto Insurance: The Money-Saving Move?

You may want to see also

Car insurance costs in Michigan by age

The cost of car insurance in Michigan varies depending on factors such as age, driving record, vehicle type, and location. On average, drivers in Michigan pay $1,924 per year for full coverage car insurance, while state minimum coverage costs around $856 annually.

Age is a significant factor in determining car insurance rates in Michigan. Younger drivers tend to pay higher premiums due to their lack of experience on the road. The data shows that drivers aged 22 to 29 pay the most, with an average annual premium of $2,203. As drivers mature and gain more experience, rates become more affordable, with those in their thirties paying around $1,924 per year. Seniors aged 60 and above benefit from the lowest rates, with an average annual premium of $1,763.

In addition to age, gender can also impact car insurance rates in Michigan. For example, a 16-year-old male driver in Michigan may face higher premiums than a female driver of the same age. Adding a male teen driver to a family policy can result in an average annual premium of $5,205, while choosing an individual policy for the same driver could cost approximately $9,053.

Other Factors Affecting Car Insurance Costs in Michigan

Aside from age, several other factors influence car insurance rates in Michigan:

- Driving Record: A clean driving record can lead to lower insurance rates, while accidents, tickets, and violations will increase costs. For example, a single speeding ticket can raise premiums by up to 39%, and a DUI conviction can increase rates by 156%.

- Vehicle Type: The make, model, and age of your vehicle can impact your insurance rates. Certain cars, such as luxury vehicles and EVs, may be more expensive to repair, resulting in higher insurance costs.

- Location: Urban areas with higher traffic congestion and theft rates tend to have pricier car insurance. Michigan cities like Detroit and Hamtramck have higher average insurance rates than less congested areas.

- Credit Score: Insurance companies use credit scores as an indicator of a driver's reliability. Higher credit scores often lead to lower insurance premiums.

- Coverage Level: Opting for higher coverage limits or adding comprehensive and collision insurance will increase your premium.

Root Insurance: Gap Coverage Explained

You may want to see also

Car insurance costs in Michigan for high-risk drivers

High-risk drivers in Michigan pay more for car insurance than other drivers as they are considered a greater risk. Factors like prior accident history, traffic violations and poor credit scores influence how much the policyholder will pay for insurance coverage. Luckily, there are ways for high-risk drivers to reduce the amount they must pay for premiums.

Average Costs

The average cost of car insurance in Michigan is $1,924 per year for full coverage, which is about $160 per month. The average monthly cost for a state minimum coverage car insurance policy is about $71, while a full coverage policy averages around $160 per month.

Factors Affecting Costs

The cost of car insurance in Michigan is influenced by various factors, including age, chosen coverage, location, driving record and credit history.

Driving Record

The more severe the driving violation, the higher the premiums you can expect to pay for car insurance in Michigan. These violations will continue to impact your premiums as long as they remain on your record, with durations differing by state.

Credit Score

Credit scores are pivotal in determining your car insurance rates in Michigan. Insurance companies consider credit scores as indicators of a driver's reliability and the likelihood of filing a claim. A higher score often correlates with lower risks, leading to more affordable premiums.

Location

Urban areas with higher traffic congestion and theft rates typically lead to pricier car insurance due to the increased risk of accidents and claims.

Age

Age significantly influences car insurance costs in Michigan. Drivers aged 22 to 29 pay the most, with costs decreasing as drivers age, reflecting the trend that experience on the road may lead to lower premiums.

Vehicle Type

Cars that are more expensive to repair or are frequent targets for theft may have higher insurance costs.

Coverage Level

Opting for higher coverage limits or additional policies such as collision insurance and comprehensive insurance will impact your rate.

Ways to Save Money

- Shop around for options by comparing rates from multiple insurers.

- Maintain a good driving record.

- Bundle insurance policies, such as bundling car insurance with homeowners insurance.

- Increase your deductibles.

- Check for discounts you're eligible for, such as for safe driving or having a car alarm.

Huntington Bank's Auto Insurance: What You Need to Know

You may want to see also

Car insurance costs in Michigan by vehicle type

The cost of car insurance in Michigan depends on various factors, including the type of vehicle, age, driving record, and location. Here is a breakdown of the average car insurance costs in Michigan by vehicle type:

Average Car Insurance Costs in Michigan by Vehicle Type:

- For a BMW 330i, the average annual cost is 43% higher than the state average, amounting to $3,520.

- For a Ford F-150, the average annual cost is $2,450, which is slightly below the state average.

- For a Honda CR-V, the average annual cost is $2,267, which is slightly lower than the state average.

- For a Toyota RAV4, the average annual cost is $2,302, which is slightly below the state average.

- For a Tesla Model 3, the average annual cost is $3,041, which is 22% higher than the state average.

It's important to note that these averages may not include all vehicle types and that the cost of insurance can vary significantly depending on other factors such as age, driving record, and location within Michigan. It's always a good idea to shop around and compare quotes from multiple insurance providers to find the best rates for your specific situation.

Vehicle Occupant Insurance: Who and What is Covered?

You may want to see also

How to save on car insurance in Michigan

Michigan's auto insurance rates are higher than the national average, but there are ways to save money on your car insurance. Here are some tips to help you get started:

Comparison shop for the best premiums

Using an independent insurance agency that works with multiple insurance companies is the best way to get the lowest rates. Working with an independent agency ensures you will get the best prices.

Ask for the latest PIP coverage options

Lawmakers in Michigan have created new PIP coverage options that allow drivers to choose less coverage at greater discounts. If you select this option, you may have to pay medical fees in case of an accident from your pocket.

Ask for higher deductibles

Higher deductibles can decrease your car insurance premium rates. Insurance companies consider drivers with higher deductibles to be more responsible, and they have fewer claims. Ask your car insurance company to increase the amount of your deductibles.

Get low mileage discounts

If you drive your car less and have a lower annual mileage, you may be eligible for low mileage discounts. This is also applicable to drivers who carpool to work, school, or college.

Maintain a good credit score

Insurance companies say they don't consider credit score when calculating premiums, but drivers with good credit scores tend to get lower insurance rates than those with poor credit scores.

Drop collision/comprehensive insurance on older cars

Collision and comprehensive insurance are expensive for older cars. If you are paying a higher premium for comprehensive or collision insurance than the actual cash value of your car, it is better to drop this extra coverage.

Get group insurance

If you are part of any alumni, business, or professional group, you may be able to get a discount on your car insurance. Ask your employer to add you to any group or club that can help you get a less expensive car insurance policy.

Take a defensive driving course

Completing a defensive driving course can lower your car insurance rates. These courses teach safe and responsible driving, and insurance companies often offer discounts to drivers who have completed them.

Club your other insurances

If you need other types of insurance, such as home or renters insurance, try to buy them from the same company. Buying multiple insurances from one company makes you a valuable customer, and you will likely get lower insurance rates.

Add your family members to your policy

You can often get a lower insurance rate by adding your spouse or children to your policy.

By combining multiple cost-saving strategies, you can significantly reduce your car insurance expenses in Michigan.

The Auto Insurance Conundrum: Affordability for Young Adults

You may want to see also

Frequently asked questions

In Michigan, the average cost of car insurance is around $1,924 per year for full coverage and $856 per year for state minimum coverage.

The minimum car insurance requirements in Michigan include $50,000 for bodily injury per person, $100,000 for bodily injury per accident, $10,000 for property damage and unlimited personal injury protection (PIP) per person.

The average cost of full coverage auto insurance in Michigan is $1,924 per year or $160 per month. For state minimum coverage, the average annual cost is about $856, or $71 per month.

The average annual cost of car insurance for a 22-year-old in Michigan with 100/300/100 full coverage and a $1,000 deductible is $2,203 or $184 per month.

Michigan is a no-fault state that requires drivers to carry personal injury protection (PIP) coverage. Other factors, such as high collision rates and auto theft statistics, also contribute to the elevated insurance premiums in Michigan.