Guaranteed asset protection (GAP) insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the difference between the amount owed on a vehicle lease and the vehicle's actual cash value (ACV) if the latter is lower. GAP insurance is typically required by lessors as an extra layer of financial security when a car depreciates and is worth less than the amount owed on the vehicle. It can also be purchased directly from auto insurers or dealerships.

| Characteristics | Values |

|---|---|

| Type of insurance | Auto insurance |

| Purpose | Covers the difference between the vehicle's value and the amount owed on the lease |

| Activation | When the car is deemed a total loss or stolen |

| Requirements | Must be the original loan/lease holder, the car must be less than 2-3 years old, and the driver must have comprehensive and collision coverage |

| Cost | $400-$700 flat rate from dealerships; $200 from credit unions; $20 increase in annual premium on average from insurers |

| Coverage exclusions | Carryover balances, lease penalties, overdue payments, extended warranties, repairs, personal injuries, other accident-related expenses |

What You'll Learn

When is auto lease gap insurance required?

Auto lease gap insurance is required in a few specific situations. Firstly, if you lease a vehicle, your lender or lessor may mandate it as a condition of the lease agreement. This is because gap insurance protects both you and the lender/lessor financially in the event of the car being written off or stolen. Gap insurance is designed for people who finance or lease their vehicles and don't own them outright.

Secondly, if you owe more on your vehicle than it is currently worth, gap insurance is a sensible option. This situation is sometimes called being "upside down" or "underwater". This commonly occurs when you finance a new vehicle, especially if you make a smaller down payment or choose a longer loan repayment period. In this case, your loan balance will decrease more slowly than the car's depreciation.

Thirdly, if you have rolled over negative equity from an old car loan into a new loan, gap insurance is a good idea. This is because you will already be starting with a loan amount that is higher than the value of the vehicle.

Finally, if you lease or buy a vehicle that depreciates quickly, such as some luxury vehicles or sports cars, gap insurance is recommended. This is because there is a higher risk of the car being written off or stolen while you still owe more than its value.

In summary, auto lease gap insurance is required when your lease or loan agreement mandates it, or when your financial situation puts you at significant financial risk if the vehicle is written off or stolen.

Mechanical Breakdown Coverage: Is It Part of Auto Insurance?

You may want to see also

What does auto lease gap insurance cover?

Auto lease gap insurance is an optional coverage that applies if your leased car is stolen or deemed a total loss. It covers the difference between the actual cash value (ACV) of the vehicle and the outstanding balance on the lease. This type of insurance is especially useful if you made a low down payment, have a long lease term, or are leasing a luxury car.

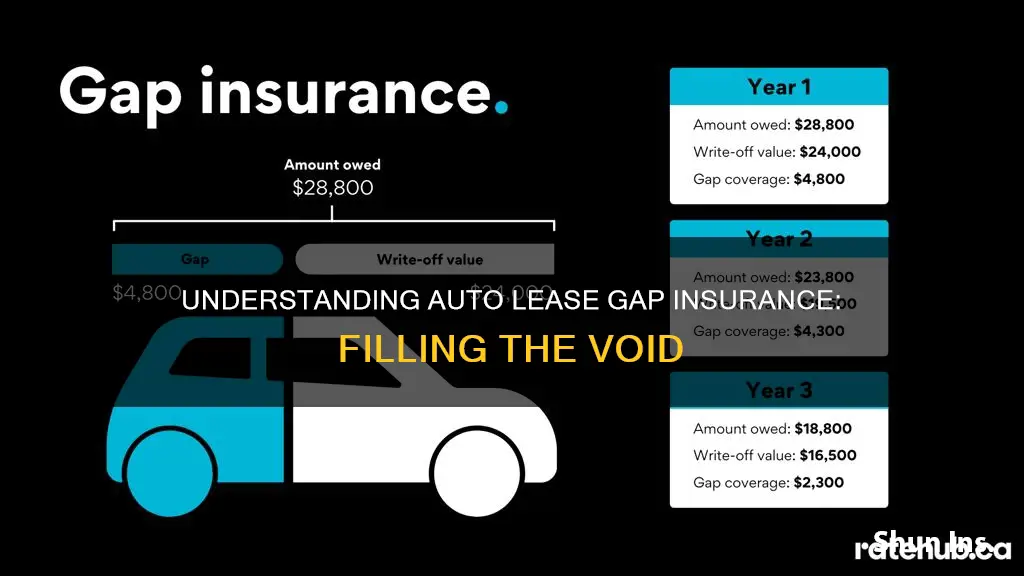

Here's an example to illustrate how auto lease gap insurance works: Let's say you lease a car with a sticker price of $28,000 and make a 10% down payment, resulting in a loan cost of $25,200. With a five-year lease and a 0% financing deal, your monthly payment is $420. After a year, you've paid $5,040 and still owe $20,160. Unfortunately, the car is totaled in an accident.

Without gap insurance, your standard comprehensive or collision coverage will pay out the ACV of the vehicle, which is typically calculated based on depreciation. In this case, the insurance company determines that your car has depreciated by 20%, so the ACV is $22,400. This leaves you with a gap of $2,240 that you still owe on the lease, even after the insurance payout.

However, with auto lease gap insurance, this gap would be covered. Gap insurance would pay the difference between the ACV and the outstanding lease balance, ensuring that you don't have any out-of-pocket expenses related to the total loss of your leased vehicle.

It's important to note that gap insurance doesn't cover other property damage or injuries resulting from an accident, nor does it cover engine failure or other repairs. Additionally, gap insurance may not cover additional charges related to your lease, such as excess mileage fees. Be sure to review the specific terms and conditions of your gap insurance policy to understand the scope of its coverage.

Auto Collision Insurance: Understanding the Coverage and its Cost

You may want to see also

What does auto lease gap insurance not cover?

Auto lease gap insurance does not cover additional charges related to your loan, such as finance or excess mileage charges. It also does not cover other property or injuries as a result of an accident, nor does it cover engine failure or other repairs.

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the difference between the amount paid out by your comprehensive or collision coverage and the balance left over on your vehicle loan or lease. It is important to note that gap insurance does not cover every scenario where there is a gap between the amount owed and the value of the vehicle.

For example, if you owe money on a car loan and the car is totalled in an accident, gap insurance will not cover the difference if the gap is due to repairs or improvements made to the vehicle that increased its value beyond the original loan amount. In this case, the gap insurance would only cover the difference up to the original value of the vehicle.

Additionally, gap insurance does not cover any outstanding loan balance if the car is returned to the leasing company at the end of the lease term. In this case, the lessee would be responsible for paying off the remaining balance.

Uber's Commercial Auto Insurance Costs

You may want to see also

Where can you buy auto lease gap insurance?

Gap insurance is available from a variety of sources, including insurance companies, car dealerships, and auto loan lenders. You may also be able to purchase it from a bank, credit union, or specialised provider.

Many major auto insurers, including State Farm, Nationwide, Progressive, Allstate, USAA, AAA, and Esurance, offer stand-alone gap insurance or coverage as an add-on to an existing policy. However, not all insurers offer this, so you may need to shop around.

You can also buy gap insurance from the dealership where you purchased your vehicle, which offers the convenience of one-stop shopping. However, this option will likely be more expensive than adding it to an existing insurance policy.

Additionally, you can purchase gap coverage from a car loan lender or finance company. Similar to buying through a dealership, this option may be more costly than purchasing coverage from your current auto insurance provider.

It is recommended to get quotes from multiple providers and compare prices to find the best option for your needs.

Marital Status and Auto Insurance: Exploring the Connection

You may want to see also

When should you drop auto lease gap insurance?

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the difference between the depreciated value of the car and the loan amount owed. This type of insurance is particularly useful if you have a long lease term, made a low down payment, or are leasing a luxury car.

You should drop auto lease gap insurance when the remainder of your loan drops below the value of the vehicle. This usually happens within the first few years of the loan. You can request that your car insurance company drops the coverage at this point. However, if you financed gap insurance through a dealer, you'll be paying for it for the remainder of the loan unless you refinance.

Gap insurance only makes sense for the period when the current value of a vehicle is less than the balance of a loan or lease. You can use resources like the National Automobile Dealers Association (NADA) guide or Kelley Blue Book to determine your car's value and compare it to your loan balance. If your loan balance is less than the car's value, you no longer have a gap to worry about and can drop the insurance.

Additionally, gap insurance is not necessary if you made a large down payment on your car, as the amount you owe in car payments is less likely to exceed your car's value. It's also worth noting that gap insurance is only available for newer vehicles, typically those less than three model years old. Older vehicles are usually not eligible for gap insurance coverage.

Amex Blue Bonus: Auto Insurance Coverage?

You may want to see also

Frequently asked questions

Auto lease gap insurance, or guaranteed asset protection insurance, is a type of auto insurance coverage that covers the difference between what you owe on your auto loan and the actual cash value (ACV) of the car if there is an accident where the car is deemed a total loss.

Gap insurance is not required by law, but it is often required by lenders or lessors as a condition of a loan or lease. It can also help you save money if your car is in an accident or is stolen by covering the difference between the value of the vehicle and the remainder of the loan.

If your leased vehicle is in an accident, your comprehensive or collision coverage will pay out an amount equal to the vehicle's ACV. If that amount isn't enough to cover your remaining lease payments, then your gap insurance may cover the difference.