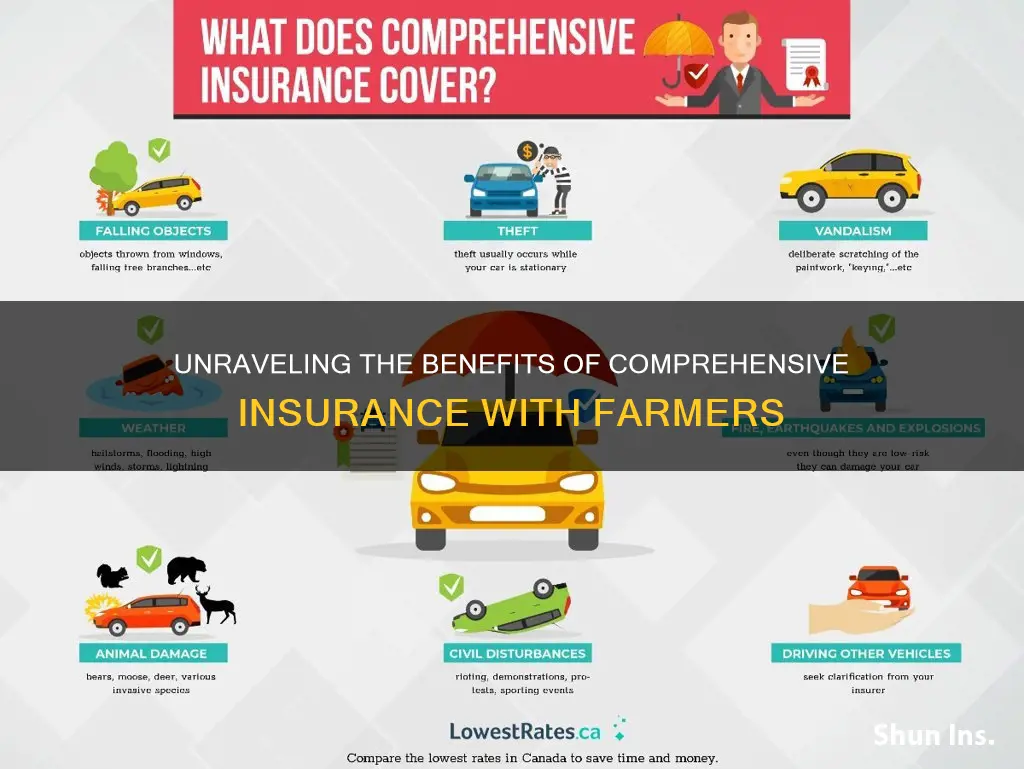

Farmers Insurance offers comprehensive coverage for damage to a policyholder's car caused by something other than a collision. This includes vandalism, natural disasters, animal damage, and damage from falling objects. Comprehensive insurance is not mandatory but is usually required by finance companies for leased or financed cars. It is often purchased together with collision insurance, which covers damage resulting from accidents.

| Characteristics | Values |

|---|---|

| What does it cover? | Damage to the policyholder’s car caused by something other than a collision, such as vandalism, theft, fire, hail, natural disasters, and falling objects. |

| What does it not cover? | Personal possessions stolen from inside a vehicle, custom parts or other equipment added by the driver. |

| Deductible | Usually $500 or $1,000. The higher the deductible, the lower the payments. |

| Mandatory? | Not mandatory in any state, but most finance companies require it for leased and financed cars. |

| Customer reviews | Positive reviews praise the company’s quick and efficient claims process and affordable rates. Negative reviews mention delays with the claims process and slow roadside assistance response times. |

What You'll Learn

- Comprehensive insurance covers damage caused by vandalism, natural disasters, and civil disturbances

- Comprehensive insurance covers damage caused by falling objects, such as trees

- Comprehensive insurance covers animal damage, including collisions with deer

- Comprehensive insurance covers glass damage not caused by a car accident

- Comprehensive insurance is not mandatory but is required by finance companies for leased and financed cars

Comprehensive insurance covers damage caused by vandalism, natural disasters, and civil disturbances

Comprehensive insurance is an optional coverage that provides protection for a wide range of events outside your control that are not caused by a collision. This includes damage caused by vandalism, natural disasters, and civil disturbances.

Vandalism

Vandalism is the intentional destruction or damage to someone else's property. Comprehensive insurance covers damage caused by vandalism, including slashed tires, broken windows, spray-painted exteriors, and keyed doors. It is important to note that vandalism intentionally caused by the owner is not covered.

Natural Disasters

Comprehensive insurance also covers damage caused by natural disasters, such as floods, hail, storms, earthquakes, and fires. This type of coverage is especially important for vehicles that are less than 10 years old.

Civil Disturbances

In addition, comprehensive insurance covers damage caused by civil disturbances, such as riots and protests. This type of coverage is particularly relevant in times of civil unrest, where vehicles may be vandalized or damaged during protests or riots.

Comprehensive insurance is a valuable option for anyone looking to protect their vehicle from damage caused by events outside their control. By choosing comprehensive coverage, individuals can have peace of mind knowing that they are protected from a wide range of potential threats to their vehicles.

Uploading Documents to Your Farmers Insurance Page: A Step-by-Step Guide

You may want to see also

Comprehensive insurance covers damage caused by falling objects, such as trees

Comprehensive insurance is an optional coverage on your car insurance policy unless you are leasing or financing your vehicle. In that case, your lender may require you to purchase comprehensive coverage. Comprehensive insurance covers damage to your vehicle from events other than a collision, including damage caused by falling objects, such as trees. Comprehensive coverage helps pay to repair or replace your vehicle if it's damaged or destroyed by falling objects like trees. It typically covers things like theft, hail damage, animal damage, and tree damage.

Comprehensive insurance covers your car if it is damaged by a falling tree. This is likely the insurance coverage you will use to get your car repaired. However, if the tree is from a neighbour's yard, it may be their responsibility to handle the damage to your car. If a tree on your neighbour's property falls and damages your car, you will still file a claim with your auto insurance company. However, if it can be proven that the tree fell due to your neighbour's negligence, their homeowners' insurance should cover your claim.

Comprehensive coverage limits come into play if your car is destroyed by a tree. If your vehicle is declared a total loss, your insurer will help pay for you to buy a new one, up to your coverage limit. The limit for comprehensive coverage is typically the depreciated value, also called the "actual cash value", of your vehicle. For example, if your totaled vehicle's actual cash value is $20,000 and your comprehensive deductible is $500, your insurer would send you a check for $19,500.

Comprehensive insurance deductibles typically range from $100 to $1,000, but they can sometimes be as high as $2,500. You choose your deductible when you purchase your policy, and the higher the deductible, the lower your premium will be.

Justin Thomas' Participation in the Farmers Insurance Open: Will He Compete?

You may want to see also

Comprehensive insurance covers animal damage, including collisions with deer

Comprehensive insurance is an optional coverage that can be added to an auto policy. It covers damage to a policyholder's car caused by something other than a collision, such as vandalism, natural disasters, falling objects, riots, storms, earthquakes, floods, and animal collisions. This includes damage caused by hitting a deer or other animals on the road. Comprehensive insurance also covers damage caused by pests, such as rats chewing through wiring.

If you swerve to avoid hitting a deer and crash into another vehicle, object, or overturn your car, you would need collision coverage to cover the damage to your vehicle. Collision coverage is for damage resulting from an accident with another vehicle or object. It is important to note that comprehensive coverage requires physical contact with the animal for the crash to be covered.

Comprehensive insurance has a deductible, typically ranging from $100 to $2,000, which is the amount the policyholder must pay out of pocket toward a covered claim. The insurance company will then reimburse the policyholder for the remaining cost of repairs or replacement.

It is worth noting that comprehensive claims, such as those for animal damage, do not typically increase car insurance rates. However, filing multiple claims within a specified period may result in higher premiums.

Farmers Insurance Golf: Unraveling the Wednesday Start Mystery

You may want to see also

Comprehensive insurance covers glass damage not caused by a car accident

Comprehensive insurance is an optional coverage that is usually purchased with collision insurance. It covers damage to your vehicle caused by events outside your control that are not caused by a collision, such as weather, vandalism, theft, civil disobedience, and natural disasters. It also covers glass damage not caused by a car accident, such as a tree branch falling on your windshield, a baseball hitting and cracking your car's windshield, or a pebble causing a crack while driving.

Farmers Insurance, which offers comprehensive insurance, provides a glass buyback optional coverage that reduces the deductible for repairable glass damage to your car's windshield. This is part of their comprehensive coverage.

Comprehensive insurance is typically purchased with collision insurance, which covers damage to your vehicle caused by a collision with another vehicle or object. While collision insurance covers damage to your windshield if it is damaged in a car accident, comprehensive insurance covers windshield damage caused by events other than a collision.

In some cases, insurers may waive the deductible for glass repairs, especially if the damage is minor and can be easily fixed. However, for glass replacement, you will likely need to pay a deductible unless you live in a "zero-deductible state" or have purchased optional no-deductible windshield replacement coverage.

It is important to note that the extent of glass and windshield coverage, including applicable deductibles, may vary across different insurance providers and states.

The Impact of Speeding Tickets on Insurance Rates: A Farmer's Dilemma

You may want to see also

Comprehensive insurance is not mandatory but is required by finance companies for leased and financed cars

Comprehensive Insurance for Leased and Financed Cars

Comprehensive insurance covers damage to the policyholder's car caused by something other than a collision, such as vandalism, theft, or a natural disaster. It also covers damage from falling objects, animal damage, and glass damage not caused by a car accident. Comprehensive insurance is usually coupled with collision insurance, which covers damage to the car resulting from a collision with another vehicle or object.

Finance companies require comprehensive insurance to protect their investment in the vehicle. If the car is damaged or destroyed, the insurance company will pay up to the actual cash value of the vehicle, minus any deductible. This ensures that the finance company can repair or replace the vehicle.

If you choose not to have comprehensive insurance on a financed car, you may be violating your contract with the finance company. This could result in legal consequences, such as the finance company cancelling your auto loan and repossessing the vehicle. Additionally, without comprehensive insurance, you would be fully responsible for any damages that occur to the vehicle.

The Impactful Reach of Crop Insurance: Empowering Farmers and Ensuring Stability

You may want to see also

Frequently asked questions

Farmers Comprehensive Insurance covers damage to the policyholder's car caused by something other than a collision, including vandalism, natural disasters, animal damage, and glass damage not caused by a car accident.

Comprehensive insurance is not mandatory in any state, but dealerships and lenders generally require it for leased and financed cars to protect their investment.

The deductible for Farmers Comprehensive Insurance is usually either $500 or $1,000, and the higher the deductible, the lower your payments. The average rate for a full-coverage policy, which includes comprehensive insurance, is $2,722 per year, but rates vary depending on factors like age, location, and driving history.

You can call Farmers customer service at 1-888-327-6335 to add comprehensive insurance to your policy.