Concealed carry insurance, also known as CCW insurance, is a type of insurance that provides legal protection for gun owners who use their weapons in self-defence or home-defence situations. It covers the legal fees that can accrue in the case of using a firearm in self-defence, including attorney fees, bail, expert witnesses, investigators, trial exhibits, and other related expenses. CCW insurance is not mandatory, but it can provide peace of mind for gun owners who want to feel secure in their right to protect themselves and their families. The coverage varies depending on the policy and the company, with costs ranging from $10 to $50 per month.

| Characteristics | Values |

|---|---|

| Other Names | CCW insurance, self-defense insurance, firearm liability insurance, gun owner's insurance, personal firearm protection insurance |

| Purpose | To provide legal protection for gun owners who use their weapons in self-defense or home-defense situations |

| Coverage | Civil court proceedings, criminal cases, bail money, damages, legal costs, civil damages, accidental discharge, psychological support, home state coverage, etc. |

| Cost | $10-$50 per month; $11-$47 per month; $13-$69 per month |

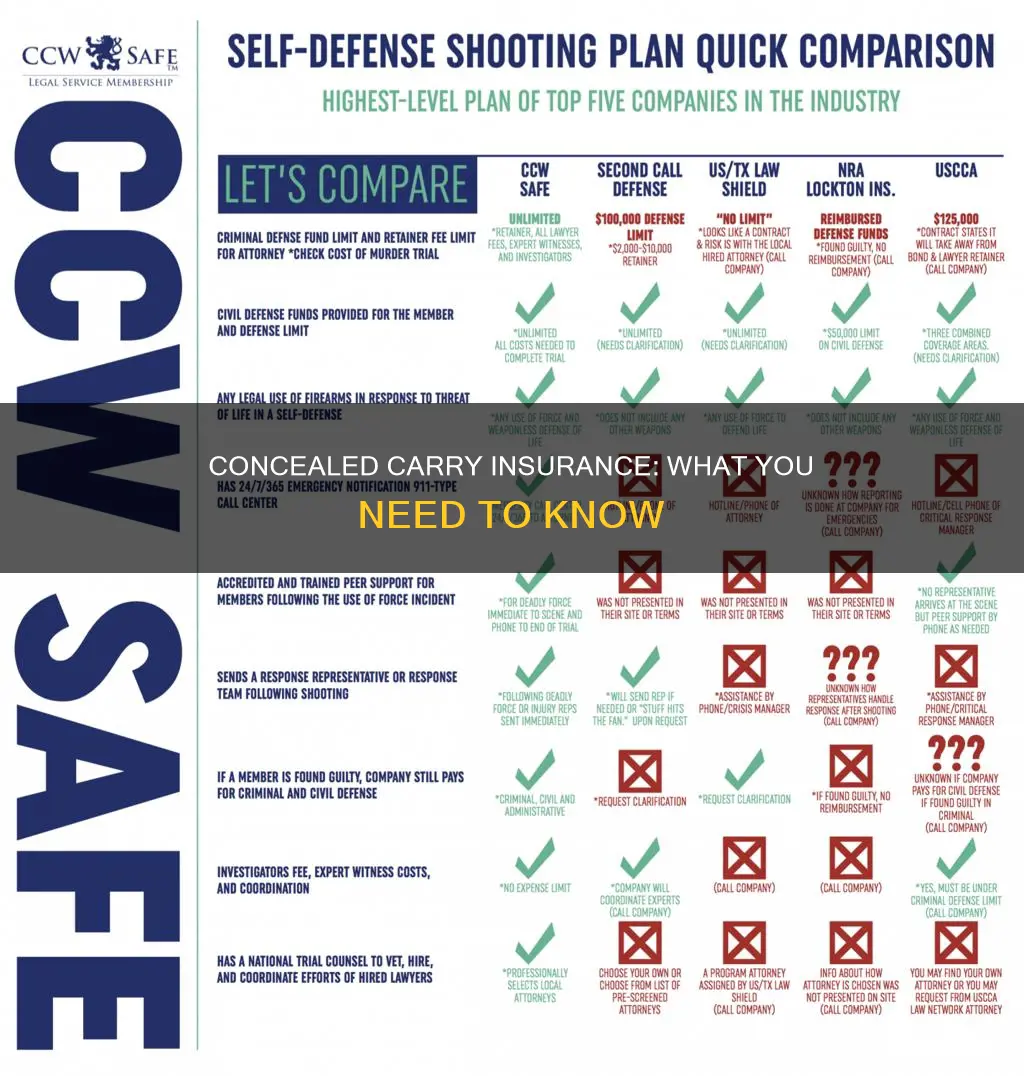

| Companies | CCW Safe, USCCA, Second Call Defense, NRA Carry Guard, US Law Shield, Right to Bear Insurance |

| Exclusions | Armed security guards, private investigators, commission of a crime, accidental discharge, law enforcement officials, active-duty military personnel, convicted felons, unregistered firearms |

| Importance | Peace of mind, protection against financial ruin, coverage of legal fees |

| Considerations | Location, current insurance policies, personality, cost, coverage amounts, provider offerings |

| State-Specific Information | Varies by state; e.g., Pennsylvania has no legal requirement for CCW insurance |

What You'll Learn

CCW insurance is not mandatory but can provide peace of mind

CCW insurance is a low-cost coverage that provides legal protection for gun owners who use their weapons in self-defence or home-defence situations. It is also known as firearm liability insurance and is beneficial for those who carry firearms to protect themselves and their families. While CCW insurance is not mandatory, it can provide peace of mind for those who carry concealed weapons.

The coverage varies from policy to policy, but many protect against civil court proceedings, such as when an involved party files a lawsuit against the gun owner. CCW insurance can also cover the costs of replacing a firearm, lost income while in custody, money required to post bail, court fees, and retaining a criminal defence lawyer.

Without CCW insurance, gun owners are at risk of shouldering these costs on their own, which can be financially devastating. With CCW insurance, individuals can rest assured that their legal costs will be covered should they face criminal charges or civil lawsuits.

In addition to financial protection, CCW insurance can also provide access to information regarding legal procedures and consultations with attorneys. This can be invaluable in navigating the complex legal system and ensuring one's rights are protected.

When considering CCW insurance, it is important to research different providers and compare costs, coverage options, and additional features. It is also crucial to understand the laws in your state regarding self-defence and concealed carry to ensure the policy adheres to these laws.

While CCW insurance is not mandatory, it can provide peace of mind and financial protection for those who carry concealed weapons. It is a valuable investment to ensure legal and financial security in the event of a self-defence situation.

Uber's Insurance: Common Carrier?

You may want to see also

CCW insurance is not traditional insurance

CCW insurance is a type of coverage that provides legal protection if you use a firearm or other weapon in a defensive situation. It is a form of liability insurance that can provide funds to pay for the expenses of experts, trial expenses, and even funds to protect you if you are sued civilly for your act of self-defence.

CCW insurance is also known as self-defence insurance and is designed to help cover the legal fees that can accrue in the case of you drawing your firearm in self-defence. The fees that arise from these kinds of situations can be large and extremely intimidating and CCW insurance can help cover attorney fees, bail, expert witnesses, investigators, trial exhibits, and other related expenses.

CCW insurance is not insurance in the traditional sense and there are no legal requirements to obtain such insurance. However, because owning and carrying a gun comes with various potential consequences, it is wise to consider the possibility of lost income while in custody, money required to post bail, paying court fees or costs, retaining a criminal defence lawyer, and dealing with any civil litigation.

Carrier Name Insurance: What's in a Name?

You may want to see also

CCW insurance is relatively new

CCW insurance is a relatively new concept, and it is not mandatory to have this type of insurance. However, it is beneficial and recommended for all responsible gun owners to have CCW insurance to cover the legal costs in case they ever need to use their firearm in self-defence.

CCW insurance is also known as firearm liability insurance and is intended to provide legal defence for gun owners who are subject to a criminal investigation, arrest, or civil litigation regarding the discharge of their firearm. CCW insurance is not insurance in the traditional sense. Unlike auto insurance, firearm coverage focuses on legal defence rather than the general protections offered by a typical insurance policy.

The coverage provided by CCW insurance varies depending on the policy and the company, but it generally includes legal fees, court costs, bail bonds, lost income, and civil damages. Some policies may also cover accidental discharge, property damage, firearms replacement, and psychological support.

The cost of CCW insurance ranges from $10 to $50 per month, with more comprehensive policies available. When considering CCW insurance, it is important to compare the different providers, plans, and coverage options to ensure you are getting the most suitable and cost-effective protection for your needs.

While CCW insurance is not mandatory, it is a valuable form of protection for gun owners. The legal fees and financial consequences of using a firearm in self-defence can be significant, and CCW insurance provides peace of mind that these costs will be covered.

Allstate: Content Insurance Coverage

You may want to see also

CCW insurance is low-cost

CCW insurance is a low-cost option for gun owners who want to be prepared for the legal aftermath of a self-defence incident. The cost of CCW insurance varies depending on the company and the level of coverage chosen, but it is generally affordable for most people.

For example, CCW Safe, one of the most popular CCW insurance providers, offers plans ranging from $209 to $599 per year. This is a reasonable price to pay for peace of mind and financial protection in the event of a self-defence incident. Other companies, such as U.S. & Texas LawShield, offer even lower rates, with their basic plan starting at just $10.95 per month. This plan includes criminal and civil defence fees upfront, which is a crucial benefit for those facing legal proceedings.

The cost of CCW insurance is a small price to pay compared to the potential legal fees and other expenses that can arise from a self-defence incident. Even a small case that is dropped without going to trial can cost over $10,000 in bail, attorney fees, and other expenses. A full-blown murder charge can easily cost over $500,000. Without CCW insurance, individuals may find themselves in financial ruin.

In addition to the financial benefits, CCW insurance also provides gun owners with critical support and resources during a traumatic and stressful time. Many companies, such as CCW Safe, offer holistic coverage that includes not only legal defence but also physical, financial, and emotional support. This can include access to experienced homicide investigators, peer support, and licensed psychologists for both the policyholder and their family.

Overall, CCW insurance is a low-cost option that provides valuable protection and support for gun owners who may find themselves in a self-defence situation. By investing in CCW insurance, individuals can protect themselves financially and legally, while also gaining access to a network of experts and resources to guide them through the aftermath of a self-defence incident.

Realtors: Are They Insured?

You may want to see also

CCW insurance is beneficial for those who carry firearms for self-defence

CCW insurance is a type of self-defence liability insurance that provides legal protection benefits to the policyholder in the event that they use their firearm in self-defence or home defence. This type of insurance is particularly useful for those who carry firearms for self-defence, as it can help cover legal fees, provide support during police investigations, and offer protection in civil court proceedings.

One of the main benefits of CCW insurance is that it can help cover legal fees associated with a self-defence incident. These fees can be extremely expensive, often costing hundreds of thousands of dollars. CCW insurance can provide funds to cover the cost of a criminal defence lawyer, as well as any court fees or costs associated with the case. This can be crucial in avoiding financial ruin, especially for those who may not have the financial means to cover these costs on their own.

Another advantage of CCW insurance is that it can provide support during a police investigation. Following a self-defence incident, it is common for the policyholder to be subject to a criminal investigation, which can be a scary and stressful experience. CCW insurance can provide access to experienced attorneys who can help guide the policyholder through the interrogation process and ensure their legal rights are protected. This can be invaluable in ensuring that the policyholder does not incriminate themselves or make any missteps that could jeopardise their defence.

CCW insurance can also offer protection in civil court proceedings. Even if a policyholder is not criminally charged or is found not guilty, they may still face civil litigation from the surviving family of the attacker. CCW insurance can provide funds to cover the costs of a civil defence lawyer and help protect the policyholder from financial liability for pain, suffering, and other damages.

Additionally, CCW insurance can provide peace of mind and confidence to those who carry firearms for self-defence. Knowing that they have a team of legal experts ready to support them in the event of a self-defence incident can reduce stress and worry. This can be especially important for individuals who may be concerned about the potential legal consequences of using their firearm.

Overall, CCW insurance offers valuable benefits to those who carry firearms for self-defence. It can help cover legal fees, provide support during police investigations, and offer protection in civil court proceedings. By having CCW insurance, individuals can feel more confident and secure in their ability to protect themselves and their loved ones.

Earthquake Insurance: Admitted Carrier?

You may want to see also

Frequently asked questions

Concealed carry insurance, also known as CCW insurance, firearm liability insurance, gun owner's insurance or self-defence insurance, is a low-cost coverage that provides legal protection for gun owners who use their weapons in self-defence or home-defence situations.

No, it is not mandatory. However, it is highly recommended to mitigate risk and protect yourself from costly legal fees.

This depends on the policy and provider. Generally, concealed carry insurance covers civil and criminal defence costs, including attorney fees, bail bonds, lost wages, and damages. Some policies may also cover accidental discharge, property damage, firearms replacement, and psychological support.

The cost varies depending on the provider and level of coverage, but it typically ranges from $10 to $50 per month.

When choosing a provider, consider the cost, coverage options, and additional features offered. Research different providers, compare plans, and read reviews to find the best option for your needs.