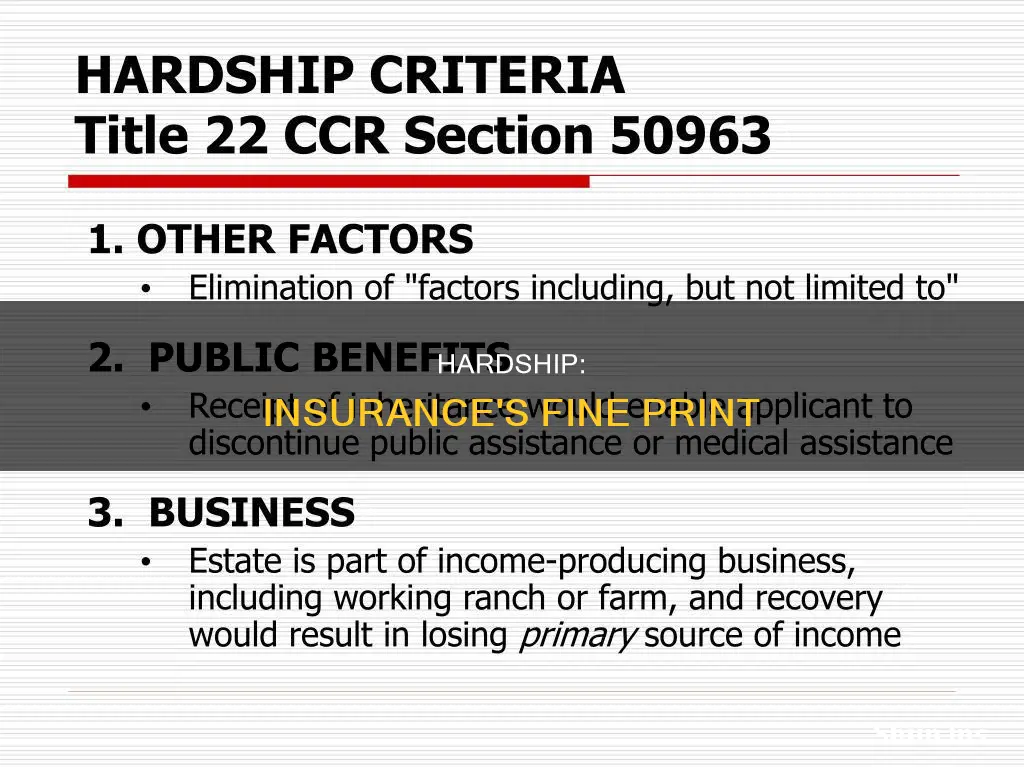

A hardship exemption is an exception granted to individuals who are unable to afford health insurance due to personal or financial circumstances. From 2014 to 2018, the Affordable Care Act (ACA) required nearly all Americans to maintain minimum essential health coverage. Those who couldn't comply were charged a shared responsibility payment fee on their tax returns. However, individuals could avoid this fee by applying for a hardship exemption. Notable reasons for a hardship exemption include eviction, domestic violence, death of a family member, natural disasters, bankruptcy, and unexpected medical expenses.

| Characteristics | Values |

|---|---|

| Age | 30 or older |

| Type of insurance | Catastrophic coverage |

| Circumstances | Evicted or facing eviction, shut-off notice from a utility company, victim of domestic violence, death of a family member, natural or human-caused disaster, bankruptcy, substantial debt due to medical expenses, unexpected increases in necessary expenses due to caring for an ill, disabled or aging family member, child denied coverage for Medicaid or CHIP, ineligible for Medicaid, other legitimate hardships |

What You'll Learn

Homelessness or eviction

In the United States, the Affordable Care Act (ACA) previously required nearly all Americans to maintain minimum essential health coverage. Failure to do so would result in a penalty tax called a "shared responsibility payment". However, individuals facing financial hardship could apply for an exemption from this tax. While the federal tax penalty was eliminated in 2019, exemptions are still important for two reasons: providing access to marketplace catastrophic plans for individuals aged 30 and older, and avoiding state-levied penalties for failure to have ACA-compliant health insurance.

Homelessness and eviction are considered a financial hardship for insurance purposes. Individuals facing or experiencing homelessness or eviction can apply for a hardship exemption to gain access to a catastrophic health plan. This is a specific type of coverage available on the individual/family market, but it requires a hardship exemption for those aged 30 and older.

To qualify for a hardship exemption, individuals must provide evidence of their circumstances, such as facing or experiencing eviction or foreclosure. The exemption typically covers the month before, the month of, and the month after the hardship, but it may be granted for a full calendar year in certain cases. For example, if an individual is facing homelessness due to eviction, they can apply for a hardship exemption to access a catastrophic health plan.

It is important to note that each state's Medicaid program is unique and has different eligibility criteria. While Medicaid is a means-tested program, applicants must also meet categorical criteria, such as age, disability, or pregnancy. Individuals experiencing homelessness can apply for Medicaid and may benefit from third-party assistance in securing and maintaining eligibility.

Marriage: Insurance Status Update?

You may want to see also

Notice from a utility company about disconnecting supply

A shut-off notice from a utility company is considered a hardship for insurance purposes. This notice is a notification that your utility services will be disconnected due to non-payment or other reasons. It is important to note that this only applies if you are 30 years or older and are seeking to purchase a catastrophic health plan.

Receiving a disconnect notice from your utility company can be a stressful situation. Here are some detailed instructions on what to do if you receive such a notice:

Understand Your Rights and Options:

Each state has its own utility disconnection policies, and utility companies are required to follow these policies before taking any action. You can find information about your state's policies by contacting your Public Service Commission or Public Utilities Commission. These commissions regulate public utility rates and services.

Contact the Utility Company:

Call the utility company as soon as possible. Sometimes, a simple phone call can help resolve the issue promptly. Ask about any available payment plans or assistance programs that may help you maintain your utility services.

File a Complaint:

If you feel that the utility company has not followed the proper procedures or has violated your consumer rights, you can file a complaint with your state's Public Service Commission or Public Utilities Commission. They are responsible for regulating utility companies and ensuring they provide services at reasonable prices.

Seek Legal Assistance:

Consider contacting a local attorney who can advocate for your consumer rights, especially if you are in a dispute with the utility company. They can explain your state's laws and help you navigate the process.

Special Protections:

Remember that special protections exist for certain individuals, such as those with serious illnesses, disabilities, infants, or elderly household members. These protections may provide temporary relief from water shutoff. However, you must take active steps to qualify, such as filing the necessary paperwork and providing proof from a medical professional.

Alternative Payment Options:

If you are facing financial hardship, know that some utility companies offer alternative payment options. These may include lenient payment schedules, deferred payment plans, income-based payments, or installments for past-due bills. Contact your utility provider to discuss these options and find a solution that works for you.

In conclusion, receiving a notice from a utility company about disconnecting your supply can be a qualifying hardship for insurance purposes. It is important to understand your rights, contact the company, and seek assistance or alternative options to maintain your utility services.

Understanding Insurable Interest: Unraveling the Intricacies of Insurance Eligibility

You may want to see also

Death of a family member

The death of a family member is a difficult and challenging time for those left behind. It can also be a period of financial hardship, particularly if the deceased was a primary earner. Managing insurance policies and coverage during this time can be complex and stressful. Here are some key considerations and actions to take when dealing with insurance after the death of a family member.

Life Insurance

Life insurance is designed to provide financial support to those who were dependent on the deceased. If the deceased had a life insurance policy, the beneficiaries named in the policy will receive a payout. This death benefit can help cover end-of-life expenses, such as funeral costs, as well as ongoing expenses like mortgage payments or tuition fees. It is important to locate the policy documents and contact the insurance company to initiate the claims process. The policyholder or beneficiaries may need to provide documentation, such as a death certificate, to receive the benefit.

Health Insurance

The death of a family member can impact health insurance coverage for the deceased's spouse and dependent children. If the deceased was the policyholder, the surviving family members may need to explore their options for continued coverage. In some cases, they may be eligible to special enroll in the employer-sponsored health plan of the spouse's employer or through the Marketplace. They may also be able to continue their existing health coverage for a certain period, typically up to 36 months, under COBRA (Consolidated Omnibus Budget Reconciliation Act). It is important to act promptly, as there are often time limits for making these changes.

Retirement Plans

The death of a family member can also affect retirement plans and savings. It is important to review and update beneficiary designations for any retirement plans, IRAs, or other retirement accounts. Additionally, checking the Social Security statement can help determine the benefits that surviving children may be entitled to receive.

Other Insurance Considerations

The death of a family member may also require updates to other insurance policies, such as auto or home insurance, if the deceased was listed on those policies. It is important to review all insurance coverage and make the necessary adjustments to ensure continued protection.

Dealing with insurance matters during a time of grief can be overwhelming. It is advisable to seek guidance from a trusted financial advisor or insurance professional, who can help navigate the complex world of insurance and ensure that the surviving family members receive the coverage and benefits they are entitled to.

Federal Insurance Reform: Navigating the Path to Change

You may want to see also

Natural or human-caused disasters

Natural disasters can be extremely costly, and insurance is often necessary to help people recover. However, it's important to note that not all disasters are covered by standard insurance policies, and some may require separate coverage.

Standard homeowners insurance policies typically cover disasters such as tornadoes, lightning strikes, windstorms, hail, fires, and volcanic eruptions. They may also cover damage caused by aircraft, vehicles, vandalism, and civil unrest. However, there are notable exclusions. For example, damage caused by flooding and earthquakes is usually not covered by standard policies. If you live in an area prone to these types of disasters, you may need to purchase separate flood or earthquake insurance. Similarly, damage caused by mudslides, landslides, and sinkholes is often excluded from coverage, and separate insurance may be necessary.

In the United States, the National Flood Insurance Program (NFIP) provides flood insurance through private insurers. There is usually a 30-day waiting period for this type of coverage, so it's important to plan ahead if you live in a flood-prone area. Earthquake insurance is available from most insurance companies as a separate policy or endorsement to your existing homeowners or renters insurance.

When it comes to wildfires, homes in high-risk areas may require a separate endorsement, a stand-alone deductible, or wildfire coverage excluded from their policy. Similarly, homes in areas with a high risk of wind and hail damage from tornadoes or hurricanes may have a separate deductible or require additional endorsements.

In addition to natural disasters, human-caused disasters can also have a significant financial impact. Homeowners insurance may cover certain types of human-caused disasters, such as damage caused by aircraft, vehicles, or vandalism. However, it's important to carefully review your policy to understand the specific perils covered and any exclusions.

In the context of health insurance, a hardship exemption may be granted if an individual experiences a fire, flood, or another disaster (natural or human-caused) that results in substantial damage to their property. This exemption allows individuals who cannot afford health insurance due to personal or financial circumstances to avoid paying a penalty for not having coverage.

Family Pact: Insurance or Not?

You may want to see also

Unexpected expenses due to a family member's illness

To qualify for a Special Enrollment Period with ObamaCare, you must have experienced certain life events, such as getting married, having or adopting a baby, losing health coverage, or a change in income that affects your ability to pay for health coverage.

Document: 33

Url: https://www.healthinsurance.org/medicaid-spend-down/

34

Url: https://www.healthinsurance.org/medicaid-spend-up/

35

Url: https://www.healthinsurance.org/medicaid-medicaid-spend-up/

36

Url: https://www.healthinsurance.org/

37

Url: https://www.healthinsurance.org/medicaid-spend-up/#:~:text=Medicaid%20spend%20down%2C%20also%20known

38

Url: https://www.healthinsurance.org/medicaid-spend-up/what-is-medicaid-spend-up/

39

Url: https://www

Updating Your Insurance PCP: A Guide

You may want to see also