A pre-existing condition is a health issue that is known to exist before someone applies for or enrolls in a new health insurance policy. This could be an illness, injury, or condition, such as diabetes, cancer, heart disease, or asthma. Before 2014, insurance companies could deny coverage, charge higher premiums, or limit benefits to individuals with pre-existing conditions. However, the Affordable Care Act (ACA) made it illegal for insurance companies to discriminate based on pre-existing conditions. Today, health insurance companies cannot refuse coverage or charge higher rates to individuals with pre-existing conditions, and they must cover treatment for these conditions. While the ACA has improved access to health insurance for people with pre-existing conditions, it is important to note that some types of health coverage, such as short-term medical plans and fixed indemnity plans, are not regulated by the ACA and may still consider pre-existing conditions during the application process.

| Characteristics | Values |

|---|---|

| Definition of a pre-existing condition | A medical illness, injury, or health condition that existed before someone enrolls in or begins receiving health or life insurance |

| Examples of pre-existing conditions | Cancer, diabetes, lupus, depression, acne, asthma, high blood pressure, heart disease, pregnancy |

| Pre-2014 practices | Health insurers could deny coverage, charge higher premiums, or apply a waiting period for applicants with pre-existing conditions |

| Post-2014 practices | Health insurers cannot deny coverage, charge higher premiums, or apply a waiting period for applicants with pre-existing conditions |

| Exceptions | "Grandfathered" health plans purchased before March 23, 2010, are not required to cover pre-existing conditions |

What You'll Learn

- The Affordable Care Act (ACA) made it illegal for insurers to deny coverage or charge higher rates for pre-existing conditions

- Pre-existing conditions are typically chronic or long-term illnesses

- Pre-existing conditions can include anything from cancer to acne

- Grandfathered health plans do not have to cover pre-existing conditions

- Pre-existing conditions are defined differently by various UK medical insurance providers

The Affordable Care Act (ACA) made it illegal for insurers to deny coverage or charge higher rates for pre-existing conditions

Before the ACA, insurance companies could deny coverage or charge higher premiums to individuals with pre-existing conditions. A pre-existing condition is typically defined as a medical illness, injury, or health condition that a person has before they start a new health care plan. This could include chronic illnesses and medical conditions such as cancer, diabetes, lupus, epilepsy, depression, acne, asthma, anxiety, sleep apnea, and more.

The ACA, also known as Obamacare, was signed into law by President Barack Obama in 2010. The law made it illegal for health insurance companies to refuse coverage to individuals or charge them more for having a pre-existing condition. It also mandates that insurers cannot limit benefits or refuse to cover treatment for a pre-existing condition once coverage begins.

The ACA's protections apply to all Marketplace plans, which include individual and small group plans, as well as employer-sponsored plans. Medicaid and the Children's Health Insurance Program (CHIP) also cannot refuse to cover or charge more for pre-existing conditions.

It is important to note that the ACA's pre-existing condition rule does not apply to legacy health insurance policies purchased before March 23, 2010, also known as "grandfathered" plans. These plans are not required to cover pre-existing conditions. However, individuals with such plans have the option to switch to a Marketplace plan that covers pre-existing conditions during Open Enrollment.

The ACA has been popular, even among those who may not support the Act itself, as it ensures that people with long-term or chronic health conditions have access to affordable health insurance.

Obamacare's Impact: Private Insurance Losses and Gains

You may want to see also

Pre-existing conditions are typically chronic or long-term illnesses

The definition of a pre-existing condition can vary among insurance providers, and it is important to carefully review the terms of any health insurance plan before enrolling. In general, a pre-existing condition is a medical condition that an individual has before obtaining health insurance. It could be a health issue for which the individual has received treatment or even just sought advice from a medical professional. It is important to note that a formal diagnosis is not always necessary for a condition to be considered pre-existing. For example, if an individual experiences symptoms and undergoes tests, scans, or other investigations before obtaining health insurance, and a diagnosis is made after the insurance policy starts, the condition can still be considered pre-existing.

In the context of private insurance, it is worth noting that there may be exceptions to the coverage of pre-existing conditions. "Grandfathered" health plans, which are individual health insurance policies purchased before March 23, 2010, are not required to cover pre-existing conditions and may have other restrictions. These plans were sold directly by insurance companies, agents, or brokers, rather than through the Marketplace or an employer. If an individual has a grandfathered plan and wants pre-existing conditions covered, they can switch to a Marketplace plan during Open Enrollment or purchase a Marketplace plan outside of Open Enrollment and qualify for a Special Enrollment Period.

The treatment of pre-existing conditions can vary between different countries and their healthcare systems. For example, in the United Kingdom, while pre-existing conditions may not be covered by private health insurance, individuals can still obtain coverage for other health issues. Additionally, certain insurance providers in the UK may offer coverage for a limited number of pre-existing conditions, albeit with additional premiums and annual limits.

Overall, it is important for individuals with pre-existing conditions to carefully review the terms and conditions of their health insurance plans, understand their rights under applicable laws and regulations, and seek advice from a qualified broker or financial adviser if needed.

Maori and Private Insurance: Who Has Coverage?

You may want to see also

Pre-existing conditions can include anything from cancer to acne

In the United States, the Affordable Care Act (ACA) has made it illegal for health insurance companies to deny coverage or charge higher rates to those with pre-existing conditions. This means that no insurance plan can reject you, charge you more, or refuse to pay for essential health benefits for any condition you had before your coverage started. This includes both chronic and acute conditions, from cancer to acne.

A pre-existing condition is typically defined as a medical condition that you had before you took out your health insurance. This could be a health condition for which you were treated, or even something for which you sought advice from a medical professional. Importantly, you don't need to have received a diagnosis for your symptoms to be considered pre-existing by your insurer. Any condition for which you saw a doctor in the five years before the start date of your insurance can be considered pre-existing.

Chronic illnesses and medical conditions, such as cancer, diabetes, lupus, epilepsy, depression, asthma, sleep apnea, and even pregnancy, may be considered pre-existing conditions. Less severe conditions, such as acne, anxiety, and sleep apnea, may also qualify. If you have a pre-existing condition, your insurance company cannot deny you coverage or increase your rates because of that condition.

It's worth noting that "grandfathered" health plans, or individual health insurance plans purchased before March 23, 2010, are exempt from these rules and do not have to cover pre-existing conditions. These plans may also have other restrictions.

In the UK, the situation is slightly different. While you can still get health insurance with a pre-existing medical condition, you typically won't be able to get coverage for that particular health problem. Most health insurance companies in the UK will exclude all pre-existing conditions for the first two years of your policy. This is because they offer coverage based on the likelihood that you'll need medical treatment for a similar issue in the long term.

However, there are different types of underwriting available in the UK that can impact how pre-existing conditions are covered. Moratorium underwriting applies a moratorium period, meaning that any illness you had in the five years before taking out the policy will be excluded from cover but could be added if you stay symptom-free for the first two years. Full medical underwriting involves providing medical information upfront, allowing for a full assessment of your overall risk level and providing confirmation of what is and isn't covered from the outset.

Fee-for-Service Insurance: How is it Different from Private Insurance?

You may want to see also

Grandfathered health plans do not have to cover pre-existing conditions

In the United States, "grandfathered" health plans refer to individual health insurance policies purchased on or before March 23, 2010. These plans, offered by insurance companies, agents, or brokers, are exempt from certain rights and protections provided under the Affordable Care Act (ACA). Notably, these grandfathered health plans are not required to cover pre-existing conditions.

The ACA, enacted on March 23, 2010, made it illegal for health insurance companies to deny coverage or charge higher rates due to a person's pre-existing health condition. However, this legislation did not apply retroactively to plans purchased before that date. As a result, individuals with grandfathered health plans may not have the same protections as those with plans obtained after the ACA's enactment.

Pre-existing conditions refer to medical illnesses or injuries that an individual has before enrolling in a new health care plan. Examples include chronic or long-term conditions such as diabetes, cancer, sleep apnea, asthma, and pregnancy. Prior to the ACA, insurance companies could review applications and deny coverage or offer inflated rates to individuals with pre-existing conditions.

If you have a grandfathered plan and want pre-existing conditions covered, you have two main options. Firstly, you can switch to a Marketplace plan during the yearly Open Enrollment Period, which offers coverage for pre-existing conditions. Alternatively, you can purchase a Marketplace plan outside of Open Enrollment when your grandfathered plan year ends, qualifying for a Special Enrollment Period.

It is important to note that grandfathered plans may not offer the same rights and protections as Marketplace plans under the ACA. Employers and individuals must carefully consider their options and decide if maintaining grandfathered status is the best choice for their specific circumstances.

Navigating Insurance: Obamacare vs. Private Plans

You may want to see also

Pre-existing conditions are defined differently by various UK medical insurance providers

Pre-existing conditions are defined differently across various UK medical insurance providers. However, there are some commonalities in how they are generally understood. A pre-existing condition is typically defined as a medical issue, condition, or injury that existed before the start of your health insurance policy. This includes chronic conditions like diabetes, asthma, and arthritis, as well as one-off symptoms or injuries such as knee pain or a broken leg.

The impact of pre-existing conditions on your insurance coverage depends on the specific provider and the type of underwriting they offer. Full medical underwriting requires you to disclose your medical history upfront, and the insurer will then determine what is covered and what is not. On the other hand, moratorium underwriting does not require you to disclose pre-existing conditions initially, but they will review your medical history when you make a claim to determine coverage eligibility.

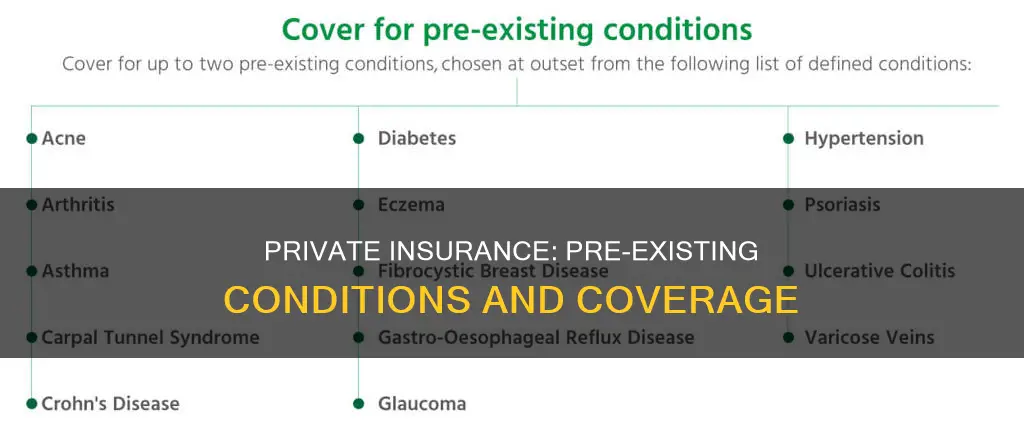

Some insurers may offer coverage for pre-existing conditions after a certain period without symptoms or treatment, typically two years. Additionally, certain providers might cover specific pre-existing conditions, such as General and Medical, which offers coverage for up to two pre-existing conditions from a defined list.

It is important to carefully review the terms and conditions of your insurance policy to understand what is and isn't covered, as well as any restrictions that may apply. While pre-existing conditions may not be covered, obtaining health insurance is still valuable as it provides access to faster treatment and peace of mind for future illnesses or injuries.

Blue Cross Blue Shield Massachusetts: Private Insurance Explained

You may want to see also

Frequently asked questions

A pre-existing condition is a known illness, injury, or health condition that a person has and has received treatment or a diagnosis for, before they enrol in a new healthcare plan.

No. Since 2014, the Affordable Care Act (ACA) has made it illegal for insurance companies to deny coverage or charge more for pre-existing conditions.

Pre-existing conditions tend to be chronic or long-term illnesses such as cancer, diabetes, lupus, epilepsy, depression, acne, asthma, anxiety, sleep apnea, and heart disease. Pregnancy before enrolment is also considered a pre-existing condition.

Private insurance companies are also bound by the ACA and cannot deny coverage or charge more for pre-existing conditions.