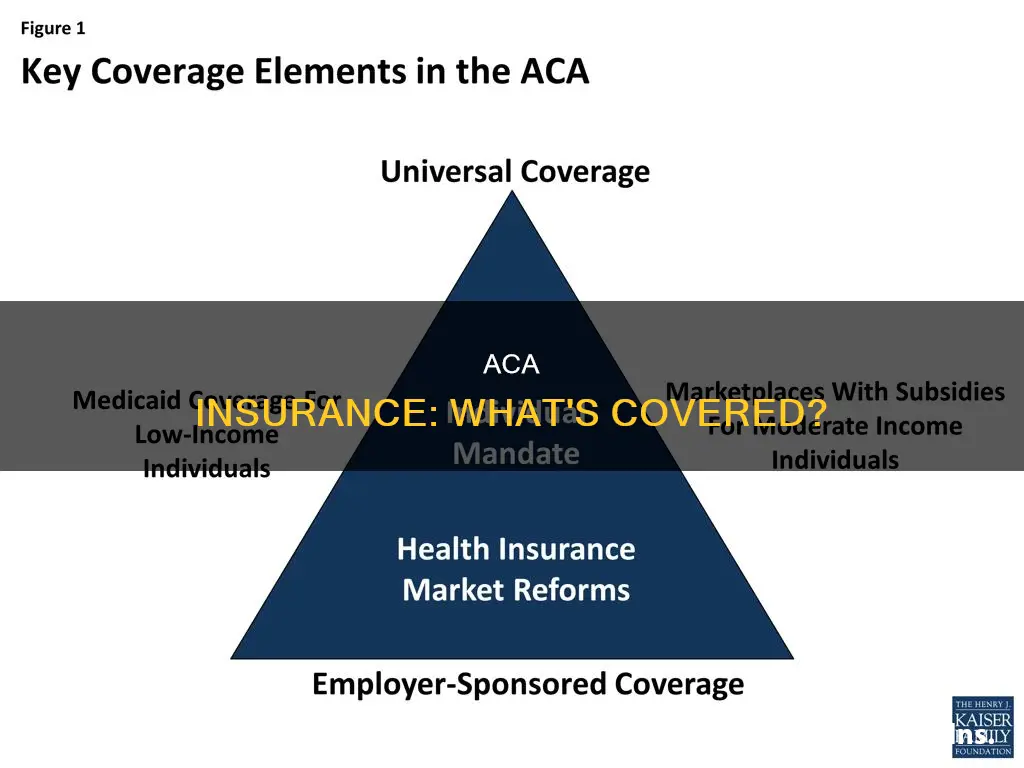

The Affordable Care Act (ACA), also known as Obamacare, introduced several new health insurance regulations. ACA compliance is required for most types of health coverage, but the specifics vary from one type of health plan to another. ACA-compliant individual and small-group policies must include coverage for ten essential health benefits with no annual or lifetime coverage maximums. These plans are guaranteed issue during open enrolment, so pre-existing conditions are not a factor in eligibility. ACA-compliant policies cannot be rescinded except in cases of fraud or intentional misrepresentation, and carriers must comply with the medical loss ratio (MLR) rules that require them to spend at least 80% of premiums (85% for large-group plans) on medical expenses.

What You'll Learn

Metal Levels

The Affordable Care Act (ACA) categorizes health insurance plans into four metal tiers: Bronze, Silver, Gold, and Platinum. These tiers are based on how much the individual pays for their insurance and how much the plan covers when they need particular services. The metal level system helps individuals choose a health insurance plan that suits their needs and budget.

Bronze

Bronze plans offer the lowest monthly premiums. However, individuals will have to pay higher out-of-pocket costs when they need health or medical services. These plans typically have higher deductibles, meaning individuals may have to pay thousands of dollars before the insurance company starts contributing. On average, the individual pays 40% of the costs, while the plan pays 60%. Bronze plans are ideal for those who are generally healthy, do not require regular doctor visits, and are looking for low monthly premiums.

Silver

Silver plans offer slightly higher monthly premiums than Bronze plans but lower deductibles and out-of-pocket costs. With a Silver plan, individuals will pay around 30% of the costs, while the plan covers 70%. Silver plans are the only tier that considers cost-sharing reductions. Individuals eligible for cost-sharing subsidies can apply them to their Silver plan, significantly reducing their out-of-pocket maximum. Silver plans are a good option for those who qualify for cost-sharing reductions or those who want more coverage for routine care at a moderate cost.

Gold

Gold plans have high monthly premiums but low out-of-pocket costs and deductibles. These plans offer quick access to coverage, as individuals can meet their deductibles faster. On average, the individual pays 20% of the costs, while the plan pays 80%. Gold plans are suitable for those who require regular doctor visits or healthcare services and don't mind paying higher premiums.

Platinum

Platinum plans have the highest monthly premiums but offer the lowest out-of-pocket costs and deductibles. These plans cover 90% of medical expenses, leaving individuals to pay only 10%. Platinum plans are ideal for those who require regular medical care and are willing to pay high premiums to keep other healthcare costs low.

It is important to note that the metal tiers do not indicate the quality of care or the number of services covered. All plans, regardless of the metal level, must include a core set of benefits called Essential Health Benefits (EHB), such as emergency room care, hospital stays, maternity and newborn care, prescription drugs, and preventive care.

Cardiologist: Specialist or Not?

You may want to see also

Essential Health Benefits

The Affordable Care Act (ACA), also known as Obamacare, introduced several new health insurance regulations. Most types of health coverage are required to be ACA-compliant, but the specifics vary from one type of health plan to another.

ACA-compliant health plans must follow rules established by the ACA, which vary by group size (individual, small group, and large group). Self-insured plans follow the large group rules.

The ACA requires non-grandfathered health plans in the individual and small group markets to cover EHBs. These fall into 10 categories:

- Ambulatory patient services: Outpatient services, such as doctors' visits.

- Emergency services: This includes urgent care.

- Hospitalization: Inpatient hospital care.

- Maternity and newborn care: Pregnancy, childbirth, and postnatal care.

- Mental health and substance use disorder services: Including behavioral health treatment.

- Prescription drugs: Medication coverage.

- Rehabilitative and habilitative services and devices: Services that help patients acquire, maintain, or improve skills necessary for daily functioning.

- Laboratory services: Medical testing.

- Preventive and wellness services and chronic disease management: Preventative care and management of ongoing health conditions.

- Pediatric services: Including oral and vision care for children. Dental benefits for adults are optional.

The ACA's requirement that these EHBs be covered without annual dollar caps provides patients with more health benefits and reduces their financial burden.

Individual/Family Coverage

Individual/family health plans are policies that people purchase on their own, rather than obtaining them from an employer. These plans can be purchased in the health insurance exchange or directly from a health insurance company.

Small Group Coverage

In most states, a "small group" is an employer with up to 50 employees. However, California, Colorado, New York, and Vermont are considered to be small groups if they have up to 100 employees.

Large Group Coverage

Employers with 51 or more employees (or 101 or more in California, Colorado, New York, or Vermont) can obtain coverage in the large group market. Most large employers choose to self-insure instead of purchasing health coverage from an insurance company.

Grandfathered and Grandmothered Plans

Grandfathered health plans are those that were already in effect when the ACA was enacted in March 2010. Grandmothered plans, or transitional plans, took effect after the ACA was signed into law but before 2014. These plans are not required to be fully ACA-compliant but must follow some of the ACA's rules.

Understanding Term Life Insurance: A Guide to This Essential Coverage

You may want to see also

Premium Tax Credits

The Premium Tax Credit is a refundable tax credit that helps eligible individuals and families with low or moderate incomes afford health insurance purchased through the Health Insurance Marketplace, also known as the Exchange. The size of the Premium Tax Credit is based on a sliding scale, with lower-income earners receiving a larger credit to help cover the cost of their insurance.

When enrolling in Marketplace insurance, individuals can choose to have the Marketplace compute an estimated credit to be paid to the insurance company to lower their monthly premiums (advance payments of the Premium Tax Credit, or APTC). Alternatively, they can opt to receive the full benefit of the credit when filing their tax return for the year. If advance payments are chosen, the individual will need to reconcile the amount paid in advance with the actual credit computed when filing their tax return for the year. In either case, Form 8962, Premium Tax Credit (PTC), must be completed and attached to the tax return for the year.

To be eligible for the Premium Tax Credit, individuals must meet the following requirements:

- Have a household income that falls within a certain range (between 100% and 400% of the federal poverty line).

- File a tax return with a status other than "Married Filing Separately" (certain victims of domestic abuse and spousal abandonment are exempt from this rule).

- Not be claimed as a dependent by another person.

- Enroll in coverage (excluding "catastrophic" coverage) through a Marketplace.

- Be unable to obtain affordable coverage through an eligible employer-sponsored plan that provides minimum value.

- Be ineligible for coverage through a government program, such as Medicaid, Medicare, CHIP, or TRICARE.

- Pay the share of premiums not covered by advance credit payments.

The Premium Tax Credit can be used to lower monthly insurance payments (called "premiums") when enrolling in a plan through the Health Insurance Marketplace. The tax credit amount is based on the income estimate and household information provided on the Marketplace application. Individuals can choose to use all, some, or none of their premium tax credit in advance to lower their monthly premium. If they use more advance payments than they qualify for based on their final yearly income, they must repay the difference when filing their federal income tax return. On the other hand, if they use less premium tax credit than they qualify for, they will receive the difference as a refundable credit when filing their taxes.

The Intricacies of Subrogation: Unraveling the Insurance Industry's Complex Web

You may want to see also

Large Group Coverage

The Affordable Care Act (ACA) has brought about numerous health insurance reforms, including for large group coverage. In most states, large group coverage applies to employers with 51 or more eligible employees, but in California, Colorado, New York, and Vermont, the threshold is 101.

Large group plans must fully cover the cost of certain preventive care, but they are not required to cover the rest of the essential health benefits. However, most large group plans do cover them. For any essential health benefits covered under a large group plan, there cannot be any dollar limits on annual or lifetime benefits. The same out-of-pocket maximum that applies to individual and small group plans also applies to large group plans.

Young adults can remain on a parent's plan until the age of 26. Medical loss ratio rules apply to fully-insured large group plans, requiring them to spend at least 85% of premiums on medical costs and quality improvements. However, these rules do not apply to self-insured plans.

Large employers are more likely to self-insure, and they can negotiate premiums directly with insurance companies, which is not an option for small businesses. Large employers also often incorporate digital health programs, such as wellness, telemedicine, and wearable health technologies, into their health plans, which can improve employee health outcomes and drive down premiums over time.

The Redlining Practice: Uncovering Discrimination in Insurance Policies

You may want to see also

Grandfathered and Grandmothered Plans

Grandfathered Plans

Grandfathered health plans are those that were already in effect when the ACA was enacted in March 2010. These plans are allowed to remain in force indefinitely, provided they don't make any significant changes to the coverage. Grandfathered plans are exempt from many changes required under the ACA. However, they are required to disclose in their plan materials their status as a grandfathered plan and advise consumers on how to contact the relevant government departments with queries. Grandfathered plans can lose their status if they make certain significant changes that reduce benefits or increase costs to consumers.

Grandmothered Plans

Grandmothered plans, also known as transitional plans, took effect after the ACA was signed into law, between 23 March 2010 and 1 October 2013, when the exchanges opened for business. These plans exist in the individual/family and small group markets in most states. The federal government has allowed these plans to continue to renew until further notice, although some states no longer permit them. Grandmothered plans are subject to a Health and Human Services transition policy, which allows insurers to renew policies they would otherwise have had to cancel due to non-compliance with certain ACA insurance market reforms.

Choosing the Right Term Insurance Horizon: Navigating the Optimal Tenure for Peace of Mind

You may want to see also

Frequently asked questions

The ACA, also known as Obamacare, is a set of regulations that most types of health coverage in the United States must comply with.

ACA-compliant insurance covers essential health benefits, including maternity care, and covers pre-existing conditions. There are no lifetime or annual limits on coverage for essential health benefits, and young adults can stay on their family's insurance plan until the age of 26.

Individual/family, small group, and large group insurance plans can be ACA-compliant.

All ACA plans have a metal level in their name, such as Bronze, Silver, Gold, or Platinum. They also cover ten essential health benefits and offer premium tax credits and cost-sharing reductions.