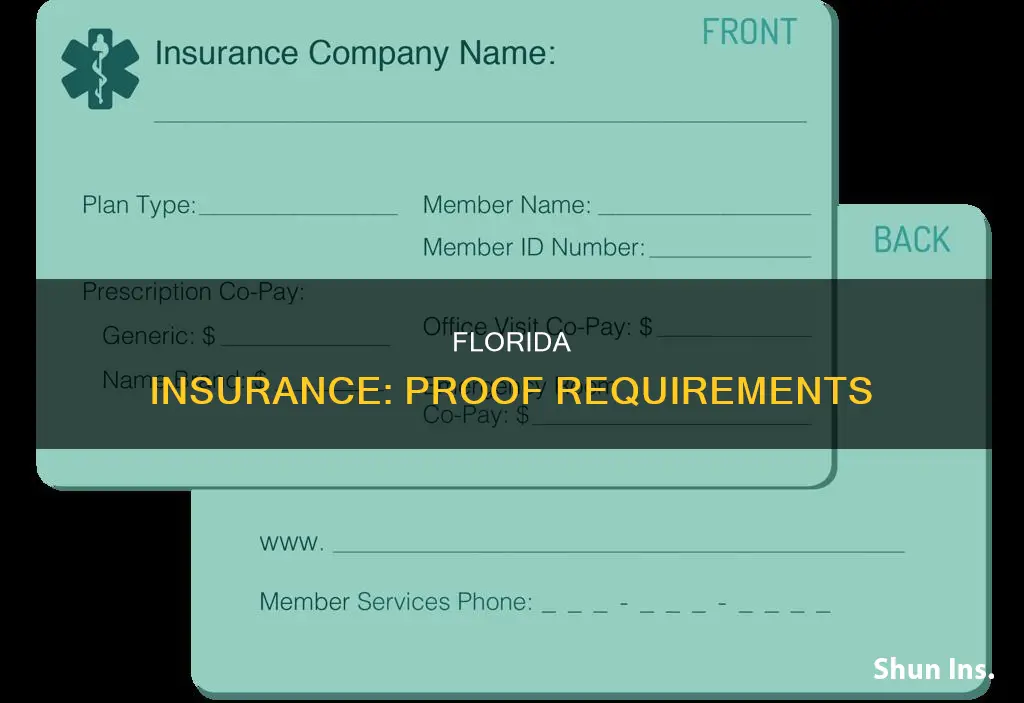

Florida is a no-fault state, meaning that all vehicle owners must carry two types of automobile insurance coverage: Personal Injury Protection (PIP) and Property Damage Liability (PDL). Before registering a car in Florida, every driver must show proof of insurance. This proof of insurance must be current and carried with the driver at all times when driving, in case they are pulled over or involved in an accident. Florida drivers must also carry this proof of insurance when registering a new vehicle.

| Characteristics | Values |

|---|---|

| Is car insurance required in Florida? | Yes |

| Is proof of insurance required? | Yes |

| Minimum Personal Injury Protection (PIP) | $10,000 |

| Minimum Property Damage Liability (PDL) | $10,000 |

| Is Bodily Injury Liability (BIL) required? | No |

| Is Collision coverage required? | No |

| Is Comprehensive coverage required? | No |

| Is Medical coverage required? | No |

| Is Roadside assistance required? | No |

| Is Uninsured/underinsured motorist coverage required? | No |

What You'll Learn

Florida's no-fault insurance law

Florida is one of the twelve states that operate under "no-fault" liability law. This means that each person pays for their own accident expenses, regardless of who is at fault. Personal Injury Protection (PIP) is a mandatory endorsement to auto policies in Florida and takes priority in paying the insured after an accident, regardless of fault.

The Florida No-Fault Motor Vehicle Law requires drivers to carry Personal Injury Protection (PIP) coverage as part of their auto insurance. PIP covers 80% of medical bills, 60% of lost wages, and 100% of replacement service costs (any service needed because of a loss of ability caused by the accident). The minimum limit for PIP in Florida is $10,000. This means that the insured would receive $10,000 of bodily injury coverage per person, with no more than $20,000 paid per accident. PIP is not liability insurance and only benefits the insured.

Florida's no-fault law was first adopted in the 1970s but was dropped in 2007 on a technicality and immediately reenacted. The no-fault law was intended to lower the number of tort lawsuits in relation to car accidents. However, fraud persisted, aided by lawyers, doctors, and auto glass contractors, making Florida one of the least affordable states for car insurance.

In 2021, the Florida legislature voted almost unanimously to repeal the no-fault law, but Governor Ron DeSantis vetoed the bill. The current debate around repealing the no-fault law in Florida centres around the high costs of auto insurance in the state, the potential increase in uninsured motorists, and the impact of fraud on insurance rates.

Domestic Appliances: What's Covered by Insurance?

You may want to see also

Required insurance coverage

Florida's auto insurance requirements are unique compared to other states due to its no-fault status. Florida law requires all drivers to carry certain amounts of car insurance coverage, and it is essential to understand these requirements to ensure compliance and adequate protection.

The two main types of mandatory insurance coverage in Florida are Personal Injury Protection (PIP) and Property Damage Liability (PDL). PIP coverage is essential as it provides protection regardless of who is at fault in a crash. It covers 80% of all necessary and reasonable medical expenses, up to a limit of $10,000, and can also help with lost wages. On the other hand, PDL coverage pays for damage to another person's property caused by the insured vehicle. The minimum PDL coverage required is also $10,000. It is important to note that these coverages must be maintained continuously, even if the vehicle is not being driven or is inoperable.

While Florida does not require bodily injury liability (BIL) insurance, it is highly recommended by experts. BIL insurance covers injury or death to others in an accident caused by the policyholder's negligence. Although Florida is a no-fault state, an injured party can still sue if their damages are extensive or exceed the policyholder's minimum insurance coverage. In such cases, the policyholder could be liable for paying damages out-of-pocket. Therefore, it is advisable to consider BIL insurance for added protection.

Additionally, it is worth noting that taxis have different insurance requirements in Florida. Taxis must carry BIL coverage of $125,000 per person and $250,000 per occurrence, along with $50,000 for PDL coverage.

Florida's insurance requirements serve to protect drivers and ensure they can cover potential expenses in the event of an accident. While the minimum requirements provide a basic level of protection, it is beneficial to consider additional coverage to ensure comprehensive protection and peace of mind.

Billing Insurance for Associate Dentists: Navigating the Reimbursement Journey

You may want to see also

Failure to provide proof of insurance

In Florida, car insurance is required by law. Before registering a vehicle with at least four wheels in Florida, you must show proof of Personal Injury Protection (PIP) and Property Damage Liability (PDL) automobile insurance.

If you receive a citation for driving without proof of insurance, you may be able to reduce your fine to $10 by providing a copy of your insurance, license, or registration, showing that it was valid on the date the citation was issued. If you cannot provide proof that your insurance was valid at the time the citation was issued, a conviction will be entered on your driving record, and your driver's license and registration may be suspended.

To avoid suspension and reinstatement fees, it is important to maintain continuous insurance coverage and to turn in your license plate before canceling your insurance. Additionally, if you are involved in a crash or receive a citation for driving without proof of insurance, you may be required to provide verification of insurance coverage.

Understanding Your Insurance Bill: The Vital Signs of Your Coverage

You may want to see also

Insurance company licensed in Florida

To be considered proof of insurance in Florida, the documentation must be issued by an insurance company licensed by the state to sell policies. Florida's Department of Financial Services' Division of Insurance Agent and Agency Services is responsible for licensing and appointing individuals and entities authorised to transact insurance in the state.

The process of obtaining a Florida insurance license is extensive and involves several steps. Firstly, prospective agents must decide which type of insurance license they require, such as Property and Casualty or Health and Life. This decision is based on the type of insurance policies they intend to sell. The next step is to meet the licensing requirements, which include being at least 18 years old, a Florida resident, and a US citizen or legal alien with work authorization. After that, applicants must complete the necessary prerequisites, including pre-licensing education courses or an insurance degree. The fourth step is to submit the license application through Florida's MyProfile account system, paying the associated fees. Following this, applicants must send proof of the completed prerequisites to the Department of Financial Services. The sixth step is to undergo a fingerprinting and background check procedure, which is conducted electronically or by mail through IdentoGO. Finally, applicants must pass the relevant Florida Insurance License Exam.

It is important to note that insurance agents in Florida are required to maintain their licenses by completing continuing education hours and complying with ethical standards. Additionally, insurance companies licensed in Florida must report policy initiation or cancellation electronically to the Florida Department of Highway Safety and Motor Vehicles.

The Intricacies of Insurance Billing Fees: Unraveling the Patient's Perspective

You may want to see also

Reinstatement fees

In Florida, reinstating a suspended or revoked driver's license typically involves paying fees, fulfilling certain requirements, and submitting the necessary documentation. The reinstatement fees and requirements depend on the nature of the suspension or revocation. Here is a detailed overview:

- The standard fee for reinstating a suspended license in Florida is $45.

- If your license has been revoked, the reinstatement fee increases to $75.

- For a second offense of letting your insurance lapse within three years, the reinstatement fee is $250.

- If the lapse occurs for a third or subsequent time within three years, the reinstatement fee rises to $500.

- If you are required to file an SR-22 or FR-44 certificate due to certain offenses, such as driving without insurance or driving under the influence, there is a small fee of around $15-$25 associated with these filings.

Requirements and Documentation:

- For traffic citations and court suspensions, you must fulfill court requirements, pay any outstanding charges, and contact the relevant traffic court. You will then need to send the receipt of fees or completion documents, along with the reinstatement fee, to your local Florida driver's license service center.

- In the case of driver violation points, you can apply for reinstatement after the suspension period by submitting proof of completing an Advanced Driver Improvement (ADI) course and paying the reinstatement fee.

- If your license has been revoked, you can usually apply for reinstatement once the revocation period ends. Follow the same procedure as for point suspensions, including completion of an ADI course and submission of proof to your local service center.

- Depending on the specific circumstances of your suspension or revocation, you may be required to take a drug and alcohol course, perform court-ordered community service hours, or complete a probation period.

- It is important to check your suspension notice to confirm the requirements you need to fulfill and the documentation you need to provide.

The Impact of Mental Health: Understanding How Depression May Affect Your Insurance Options

You may want to see also

Frequently asked questions

In Florida, proof of insurance is considered a binder, policy, card, or affidavit from a certified Florida agent or broker.

The proof of insurance in Florida must include Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage. PIP covers 80% of all necessary and reasonable medical expenses up to $10,000, and PDL coverage pays for damage to another person's property.

If you don't have proof of insurance in Florida, your license can be suspended or not renewed, and you may have to pay a reinstatement fee of up to $500.