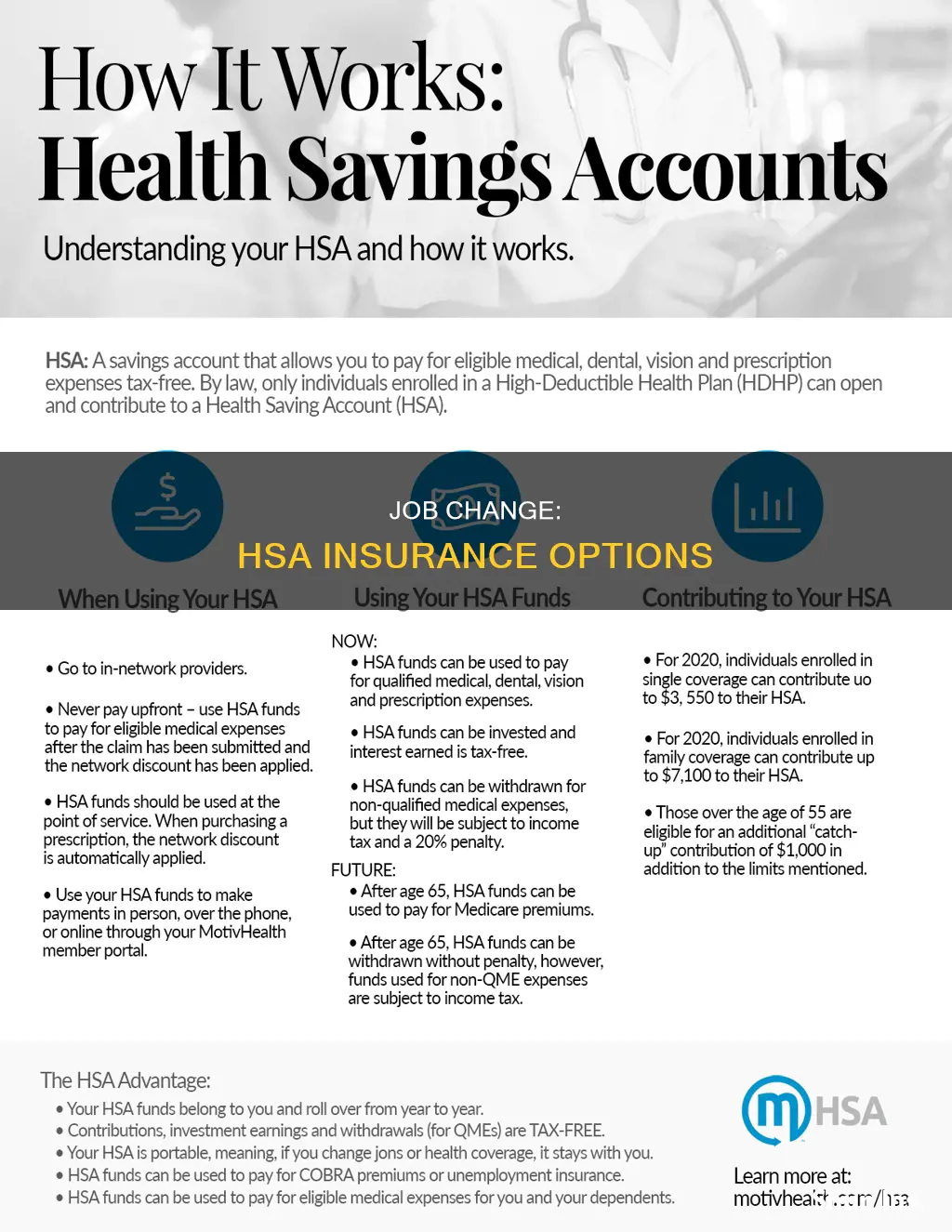

If you change jobs while having an HSA insurance plan, you can keep your HSA and continue withdrawing funds for eligible expenses, tax-free. However, you can only keep contributing to your HSA if your new job has a high-deductible health plan (HDHP). If your new employer offers an HSA, you can transfer the administration of your current account to them, or you can open a new HSA with your new employer while keeping your old one. Alternatively, you can do a rollover, which involves receiving a check for your HSA funds and then moving them into a new HSA within 60 days.

| Characteristics | Values |

|---|---|

| Can you keep your HSA if you change jobs? | Yes, your HSA is portable and remains with you no matter what. |

| Can you keep the funds in your HSA? | Yes, the funds in your HSA are yours to keep. |

| Can you keep contributing to your HSA after changing jobs? | Yes, but only if your new employer offers a high-deductible health plan (HDHP). |

| Can you keep your old HSA if you get a new one? | Yes, you can have multiple HSAs. |

| Can you transfer your HSA to a new employer? | Yes, you can transfer the administration of your account to the new employer. |

| Can you transfer your HSA to a new HSA provider? | Yes, you can do a trustee-to-trustee transfer or a rollover (once per year). |

| Are there any fees or penalties for changing jobs with an HSA? | No, there are no IRS fees or penalties for changing jobs with an HSA. |

What You'll Learn

You can transfer your HSA to your new employer

If you change jobs, your Health Savings Account (HSA) remains yours and you can transfer it to your new employer. This is the case whether your HSA was set up through your former employer or whether you opened it yourself at a bank or other financial institution. You can keep withdrawing funds from the account, tax-free, to pay for eligible medical expenses as long as there is money in the account.

If your new employer offers an HSA, you can transfer the administration of your current account to your new employer's HSA administrator. Your new employer will provide you with a transfer request form that authorises a new HSA custodian to take over the administration of your account. There are no IRS fees or penalties for this option.

You can also take a rollover approach, which is a process by which you receive a check for your HSA funds. You then have 60 days to move the money into a new HSA account. Be careful not to exceed the 60-day mark, as the funds will then be considered a distribution and you will be taxed and hit with a 20% penalty.

If you decide to leave your HSA with your old employer's HSA administrator, that's also okay. You can continue to withdraw funds for eligible expenses, but you can no longer contribute to the HSA unless your new employer also has a high-deductible plan.

The Fine Print: Understanding Insurance Warranties and Their Implications

You may want to see also

You can keep your old HSA

If you change jobs, you can keep your old HSA. This is because your HSA is yours, even if you leave the employer that sponsored your plan. You can keep your old HSA even if your new employer does not offer HSAs or provide HSA contributions. However, you can only continue to contribute to your old HSA if you remain in an HSA-eligible health plan. If your new job does not have a high-deductible health plan (HDHP), you will not be able to contribute to your old HSA.

If you decide to keep your old HSA, you can continue to withdraw funds for eligible expenses tax-free. You can also invest some or all of the funds. However, you may be charged fees that were previously covered by your employer.

There are a few things to keep in mind if you decide to keep your old HSA. First, you may need to start making contributions with post-tax dollars instead of pre-tax dollars. Second, be sure to review the investment options available, as they may not be a perfect match for what you are looking for. Finally, be careful about letting your old HSA sit inactive for too long, as some institutions may send HSA funds to the state as abandoned property after a period of inactivity.

The Confounding Conundrum of Unexpected Medical Bills

You may want to see also

You can roll over your HSA to a new provider

If you're changing jobs, you can roll over your HSA to a new provider. This is a great option if you want to consolidate your health savings accounts, minimise fees, or get access to investments that align with your goals.

There are two ways to roll over your HSA:

- Trustee-to-trustee transfer: Your new HSA provider contacts your current provider and handles the transfer without any check being cut to you. There is no limit on how many trustee-to-trustee transfers you can do in a year, and there is no risk of this becoming a taxable event.

- HSA rollover: Your old provider cuts you a check and it's your responsibility to get the money reinvested with your new provider within 60 days. You can only do one HSA rollover per year, and if you don't make the deadline, the IRS will consider it a taxable distribution with a 20% penalty.

It's important to note that you can only roll over your HSA if you remain enrolled in a high-deductible health plan. If you switch to a different type of health insurance, the rollover will be disallowed, and you'll owe taxes and a penalty on the amount you tried to roll over.

Understanding Insurance Billing for Partial Denture Procedures: Timing and Coverage

You may want to see also

You can open a new HSA with your new employer

If your new employer offers an HSA, you can open a new HSA through your workplace and start making contributions to it while still keeping your old HSA. There are several advantages to having multiple HSAs. For example, one HSA may have lower fees, while another has more diverse investment choices. Additionally, some employers also make contributions to your HSA on top of your own contributions. This benefit alone can justify opening a new workplace HSA, even if you already have an existing account.

Another option is to roll over your existing HSA, combining it with the new one. One benefit of doing a rollover is that multiple HSAs complicate record-keeping. Consolidating two HSAs can also save on fees, as many HSA providers charge a monthly maintenance fee per account.

If you decide to open a new HSA with your new employer, you can then choose to close your old HSA to consolidate and keep things simple. However, there is no rule against having multiple HSAs. The main point to understand with having multiple accounts is that you can't contribute more than the maximum annual HSA contribution limit set by the IRS across all your HSAs combined.

If you are thinking of opening a new HSA with a new employer, be sure to do your homework, as not all HSA providers are created equal.

Understanding Insurance Coverage for Pregnancy: Navigating Your Options

You may want to see also

You can keep your HSA but stop contributing to it

When you change jobs, you can keep your Health Savings Account (HSA) but you may not be able to continue contributing to it. This is because HSAs are linked to high-deductible health plans (HDHPs). If your new job offers an HDHP, you can continue to contribute to your HSA. If not, you will have to stop making deposits to your account, though you can continue to withdraw from it to cover eligible medical expenses.

If you are no longer able to contribute to your current HSA, you have a few options. You can leave your HSA where it is, though you may have to start making contributions with post-tax dollars and you may be charged fees that were previously covered by your employer. You can also roll over your HSA to a new provider or to a new employer-provided HSA, though you will need to check that you are still eligible to contribute to an HSA.

Update Tesla Insurance Payment Methods

You may want to see also

Frequently asked questions

Your HSA is yours even if you leave the employer sponsoring your plan. You can consolidate your old HSA into a new HSA offered by your next employer, keep your old HSA, or roll over to a new HSA under a different financial services firm.

Yes, you can keep your old HSA, but there may be fees that you will now be responsible for that were previously covered by your employer.

Yes, if your new employer offers an HSA, you can open a new HSA through your workplace and start making contributions to it while still keeping your old HSA.

Yes, you can transfer your HSA funds to a new HSA at a different provider. If your new employer offers an HSA, you can roll your existing HSA into a new account.