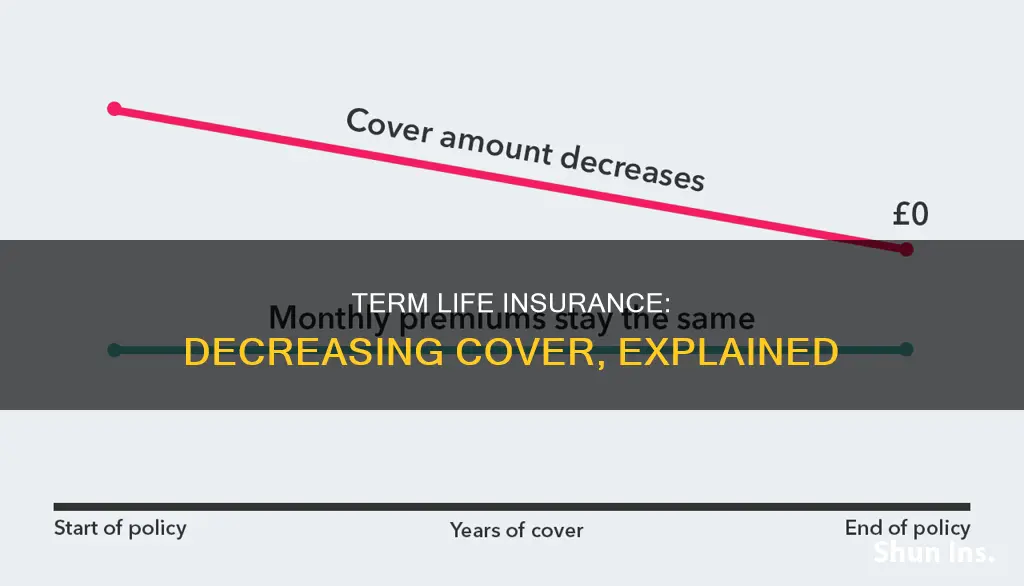

Decreasing term life insurance is a type of renewable term life insurance with coverage that decreases over the life of the policy at a predetermined rate. It is a temporary policy with a death benefit that gets lower over time. It is designed to provide coverage for a specific period, usually between 5 and 30 years, but the benefit amount decreases over time. This type of insurance is ideal for those who expect their beneficiaries to need less financial support once the policy expires.

| Characteristics | Values |

|---|---|

| Type of policy | Term life insurance |

| Coverage | Decreases over time |

| Purpose | Cover specific financial needs, e.g. loans or debts |

| Cost | Usually cheaper than level term life insurance |

| Death benefit | Decreases over time |

| Premium | Usually constant throughout the contract |

| Term | Between 1 and 30 years |

| Use cases | Personal asset protection, mortgage protection, business loan protection |

| Payout | Beneficiaries can file a claim for the death benefit available at the time of the policyholder's death |

| Availability | Not available from all insurers |

| Ideal for | Those who expect their beneficiaries to need less financial support once the policy expires |

| Main drawback | Death benefit declines over time |

What You'll Learn

How decreasing term life insurance works

Decreasing term life insurance is a type of renewable term life insurance with coverage that decreases over the life of the policy at a predetermined rate. The premiums are usually constant throughout the contract, and reductions in coverage typically occur monthly or annually. The terms of decreasing term life insurance policies can range from one year to 30 years, depending on the plan offered by the insurance company.

When purchasing a decreasing term life insurance policy, you select the number of years it will be active (typically between five and 30 years) and your starting death benefit. The payout that your beneficiaries will receive will then decrease by a certain percentage each month or year, depending on the policy. If you pass away during the policy's term, your beneficiaries can file a claim for the death benefit amount available at the time of your death. If you outlive the policy, the death benefit will have decreased to zero, and your coverage will terminate.

For example, let's say you take out a $300,000, 30-year decreasing term life insurance policy to help your spouse continue making mortgage payments if you pass away unexpectedly. The death benefit is set to decrease by 3.33% per year for the duration of the policy. If you die after 10 years, the payout would be around $210,000 or 30% of the original death benefit.

Decreasing term life insurance is often used to guarantee the remaining balance of an amortizing loan, such as a mortgage, student loan, car loan, or business loan. It can provide financial security for your loved ones by ensuring that they won't be burdened with your debt if something happens to you. The policy's decreasing benefit amount reflects the assumption that your loved ones will need less financial support over time as debts are paid off.

Compared to other types of life insurance, decreasing term life insurance is typically more affordable. This is because the death benefit gets smaller over time, reducing the insurer's risk and cost. However, it's important to note that your premiums usually remain the same throughout the policy, so you will be paying the same amount for less coverage towards the end of the term.

Life Insurance and Drug Testing: Does THC Matter?

You may want to see also

The cost of decreasing term life insurance

For example, a 30-year-old male non-smoker might pay a premium of $25 per month throughout the life of a 15-year $200,000 decreasing term policy. In contrast, a permanent policy with the same face amount of $200,000 could require monthly premium payments of $100 or more per month.

Decreasing term life insurance is typically more affordable than standard term life insurance policies since the payout gets smaller over time. The premiums for a decreasing term policy are usually lower than those for whole life and other types of permanent life insurance. Additionally, since the death benefit decreases over time, a decreasing term policy may also be less expensive than a standard term life insurance policy with a fixed death benefit.

However, it's important to note that decreasing term life insurance may not be available through all insurers, so individuals interested in this type of policy may need to shop around. Additionally, while decreasing term life insurance can provide security for decreasing expenses, it may not be sufficient for unexpected expenses that arise toward the end of the policy's term, as the death benefit may be too small to cover them.

Overall, decreasing term life insurance is a more affordable option for individuals who expect their loved ones to need less financial support over time and want to protect against significant shorter-term expenses.

Withholding Tax: Does It Affect Your Life Insurance?

You may want to see also

Who should consider a decreasing term life insurance policy?

A decreasing term life insurance policy is ideal for those who expect their beneficiaries to need less financial support once the policy expires. This type of insurance is usually purchased by those who want to protect their loved ones from being burdened by debt, such as a mortgage or loan, in the event of their death.

Decreasing term life insurance is often used to cover specific financial obligations, such as:

- A mortgage

- A business loan

- A car loan

- A personal loan

- A pension

- An annuity

It is also a good option for parents with teenagers who may need financial support with expenses such as tuition fees.

Small businesses may also benefit from decreasing term life insurance, as it can be used to cover business loans and ensure continuity and continued operations in the event of a partner's death.

If you have a particular debt that you expect to decrease over time and you want to protect your family in the event of your death, then a decreasing term life insurance policy is a good option. However, if you don't have specific debts or assets that you are protecting, you may be better off with level term life insurance or whole life insurance, which can provide a steadier and more reliable benefit.

Chlamydia and Life Insurance: Does It Affect Your Premiums?

You may want to see also

Advantages and disadvantages of decreasing term life insurance

Decreasing term life insurance is a type of renewable term life insurance with coverage that decreases over the life of the policy at a predetermined rate. This type of insurance is ideal for those who expect their beneficiaries to need less financial support once the policy expires. It is also used to guarantee the remaining balance of an amortizing loan, such as a mortgage or business loan.

Advantages

Decreasing term life insurance offers several advantages:

- It is more affordable than other types of life insurance, such as whole life or universal life insurance, as the death benefit gets smaller over time.

- It can provide security for decreasing expenses, such as large debts that will become smaller over time, including mortgages, student loans, or business loans.

- It is a flexible policy that can be customized to save money as financial obligations decrease.

- It can be helpful for small businesses that want to protect against indebtedness due to startup costs and operational expenses. In the event of a partner's death, the death benefit proceeds can help fund continuing operations or retire the remaining debt.

- It is a pure death benefit with no cash accumulation, resulting in modest premiums for comparable benefit amounts.

- It may be required by certain lenders to guarantee that the loan will be repaid if the borrower dies before the loan matures.

Disadvantages

There are also some disadvantages to consider:

- The main drawback is the declining death benefit over time, which may not provide sufficient coverage if unexpected expenses arise later in the policy's term.

- The availability of decreasing term life insurance varies by insurer, so it may not be offered by all insurance providers.

- The death benefit may not be sufficient to cover unexpected expenses towards the end of the policy's term.

Reliance Nippon Life Insurance: Check Your Policy Status Easily

You may want to see also

How decreasing term life insurance compares to other policies

Decreasing term life insurance is a type of renewable term life insurance with coverage that decreases over the life of the policy at a predetermined rate. This type of insurance is usually used to guarantee the remaining balance of an amortizing loan, such as a mortgage or business loan. It features a death benefit that gets smaller each year, along with decreasing premiums, according to a predetermined schedule.

Here's how decreasing term life insurance compares to other policies:

Level Term Life Insurance

Level term life insurance offers premiums and a death benefit that stays the same throughout the policy's duration. Unlike decreasing term life insurance, where the death benefit and premiums decrease over time, level term life insurance provides a consistent level of coverage and premiums.

Renewable Term Life Insurance

Renewable term life insurance allows individuals to renew their coverage at the end of the term without undergoing a medical exam or the risk of being turned down. It differs from decreasing term life insurance in that it has a renewal premium based on the current age of the insured individual.

Convertible Term Life Insurance

Convertible term life insurance enables policyholders to switch their coverage to permanent life insurance without a medical exam. While decreasing term life insurance premiums decrease over time, convertible term life insurance premiums typically increase. This type of insurance provides more long-term protection and flexibility.

Increasing Term Life Insurance

Increasing term life insurance is the opposite of decreasing term life insurance. With an increasing term life insurance policy, the death benefit increases over time, providing additional protection for the future. This type of insurance may be more suitable for individuals who anticipate growing financial responsibilities or those who want to ensure their loved ones have sufficient financial support.

In summary, decreasing term life insurance is a more affordable option compared to whole life or universal life insurance. It is ideal for those who want to protect against significant shorter-term expenses, such as mortgages, student loans, or business loans. However, it may not be sufficient for individuals with long-term financial dependents or those who require consistent coverage over an extended period.

Pan-American Life Insurance: Size and Reach Overview

You may want to see also

Frequently asked questions

Decreasing term life insurance is a type of renewable term life insurance with coverage that decreases over the life of the policy at a predetermined rate. It is designed to provide coverage for a specific period, but the benefit amount decreases over time.

Decreasing term life insurance is typically more affordable than other term life insurance policies, making it a viable way to protect against significant shorter-term expenses. It is also useful for those who expect their beneficiaries to need less financial support once the policy expires.

The main drawback of decreasing term life insurance is that the death benefit declines over time, so it may not provide the coverage needed in the future. Additionally, it may not be available from all insurers.