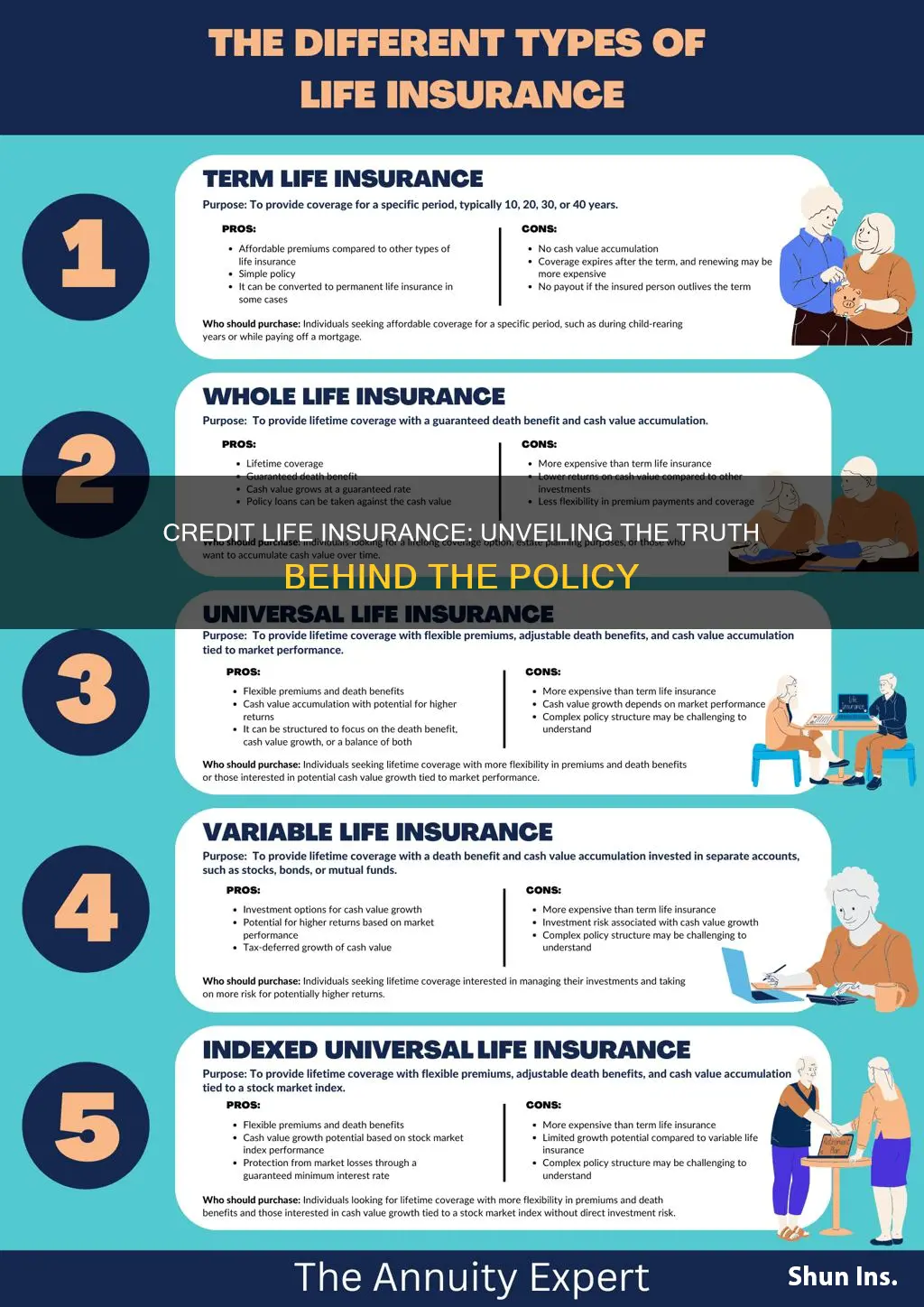

Credit life insurance is a financial product designed to protect borrowers and their families in the event of the borrower's death or permanent disability. It is typically offered as an add-on to a loan or credit agreement, providing coverage that can help pay off the remaining debt if the borrower is no longer able to do so. This type of insurance can offer peace of mind to borrowers and their loved ones, ensuring that financial obligations are met even in the face of unexpected circumstances. However, it's important to understand the terms and conditions of the policy, as well as the potential benefits and drawbacks, before making a decision.

What You'll Learn

- Credit Life Insurance Covers Debt: It pays off loans if the borrower dies

- Premiums: Costs vary based on age, health, and loan amount

- Lender Requirement: Some lenders mandate it for large loans

- Benefits: Provides financial support to dependents and loan repayment

- Limitations: May not cover all debts and has exclusions

Credit Life Insurance Covers Debt: It pays off loans if the borrower dies

Credit life insurance is a financial product designed to provide peace of mind and financial security for individuals with outstanding debts. One of the key aspects of this insurance is its ability to cover and manage debt obligations in the event of the borrower's death. When you take out a loan, whether it's for a mortgage, car, or personal debt, credit life insurance can be a valuable addition to your financial portfolio.

The primary purpose of credit life insurance is to ensure that your loved ones are protected and that your debts are managed in the event of your passing. Here's how it works: if the borrower dies, the insurance company will step in and pay off the remaining loan balance. This means that your family won't have to worry about the financial burden of the debt, and the loan will be settled according to the terms of the insurance policy. For example, if you have a $200,000 mortgage and a credit life insurance policy that covers this amount, the insurance provider will make the necessary payments to the lender, ensuring the loan is fully paid off.

This type of insurance is particularly beneficial for those with substantial debts, as it provides a safety net for their families. It allows individuals to leave a legacy for their loved ones without the added stress of financial obligations. By covering the debt, credit life insurance ensures that the borrower's death does not result in financial hardship for their dependents.

It's important to note that credit life insurance policies may vary in terms of coverage and eligibility criteria. Some lenders may offer this insurance as an optional add-on to loans, while others may require it for certain types of loans. When considering this insurance, it's advisable to review the policy details, understand the coverage limits, and assess whether it aligns with your financial goals and risk tolerance.

In summary, credit life insurance is a valuable tool for managing debt and providing financial security. By covering loans in the event of the borrower's death, this insurance ensures that debts are settled, and loved ones are protected. It is a practical consideration for individuals with significant financial obligations, offering peace of mind and a safety net for their families.

Life Insurance Payouts for Missing Persons: What You Need to Know

You may want to see also

Premiums: Costs vary based on age, health, and loan amount

Credit life insurance is a financial product designed to protect borrowers and their loved ones in the event of the borrower's death or permanent disability. When it comes to the cost of this insurance, several factors come into play, and understanding these can help borrowers make informed decisions. One of the primary determinants of the premium for credit life insurance is the age of the borrower. Younger individuals typically pay lower premiums compared to older adults. This is because younger people generally have a longer life expectancy, and the insurance company assumes a lower risk of the insured individual passing away or becoming permanently disabled during the policy term. As age increases, the risk of such events also increases, leading to higher premiums.

The health status of the borrower is another critical factor. Insurance companies often consider medical history and current health conditions when determining premiums. Individuals with pre-existing health issues or chronic illnesses may be considered higher-risk candidates for credit life insurance. As a result, they might be charged higher premiums to account for the potential increased cost of their care or treatment. Conversely, those with a history of good health and no significant medical conditions may benefit from lower premiums.

The loan amount also plays a significant role in premium calculations. Credit life insurance is often tied to a specific loan, and the insurance premium is typically a percentage of the loan amount. Larger loans will generally require higher premiums to cover the potential financial impact of the borrower's death or disability. For instance, if a borrower takes out a substantial loan, the insurance company may charge a higher premium to ensure that the financial burden of the loan is adequately protected.

It is essential for borrowers to understand that these factors can vary between insurance providers and may also be influenced by other individual circumstances. Some insurance companies might offer different premium structures or additional benefits based on their policies. Therefore, borrowers should compare offers from multiple providers to find the best coverage and pricing that suits their needs and budget.

In summary, the cost of credit life insurance premiums is influenced by age, health, and the loan amount. Younger individuals, those with good health, and borrowers with smaller loan amounts may benefit from lower premiums. Conversely, older individuals, those with health issues, and those with larger loans may face higher costs. Being aware of these factors can help borrowers make more informed choices when selecting credit life insurance coverage.

HPV and Life Insurance: What's the Connection?

You may want to see also

Lender Requirement: Some lenders mandate it for large loans

Many lenders, especially those offering substantial loans, require borrowers to purchase credit life insurance as a condition of securing a loan. This insurance is designed to protect the lender's interests by ensuring that the loan will be repaid, even if the borrower dies or becomes unable to work due to an accident or illness. The requirement for credit life insurance is often a stipulation in the loan agreement, and it can vary in terms of coverage and cost depending on the lender and the borrower's circumstances.

Lenders view credit life insurance as a safety net that reduces their financial risk. When a borrower takes out a large loan, the lender wants to ensure that the debt will be honored, even if the borrower is no longer able to make payments. By requiring credit life insurance, lenders can mitigate the potential loss they might incur if the borrower were to pass away or suffer a critical illness. This insurance policy typically pays off the remaining loan balance, providing the lender with reassurance and protecting their investment.

The cost of this insurance is typically built into the loan's interest rate or added as a separate fee. Borrowers should be aware that the premium for credit life insurance can vary widely, and it is essential to compare quotes from different insurance providers to find the most competitive rates. Some lenders may offer their own insurance products, while others might allow borrowers to choose their own provider, providing flexibility in this aspect of the loan process.

It is crucial for borrowers to understand the terms and conditions of the credit life insurance policy. They should review the coverage limits, exclusions, and any waiting periods before the policy takes effect. Additionally, borrowers should be aware of their right to cancel the insurance if they feel it is not necessary or if they find a more suitable alternative. While credit life insurance can provide valuable protection, it is essential to ensure that the policy meets the borrower's specific needs and financial situation.

In summary, some lenders mandate credit life insurance for large loans to safeguard their interests and reduce financial risk. Borrowers should be informed about this requirement and carefully consider the insurance options available to them. By understanding the terms and costs associated with credit life insurance, borrowers can make an informed decision and ensure that their loan remains protected even in the face of unforeseen circumstances.

Changing Globe Life Insurance Beneficiaries: A Step-by-Step Guide

You may want to see also

Benefits: Provides financial support to dependents and loan repayment

Credit life insurance is a type of coverage that is often associated with loans, particularly those taken out for significant purchases like homes, cars, or education. While it is sometimes seen as an optional add-on, understanding its benefits can be crucial for anyone considering such a loan. One of the most significant advantages of credit life insurance is the financial security it provides to your loved ones and the loan provider.

In the event of your death or permanent disability, credit life insurance ensures that your dependents are financially protected. This insurance policy typically pays out a lump sum or a regular income to your beneficiaries, which can be used to cover essential living expenses and provide financial stability during a difficult time. For example, if you were to pass away, the policy could help cover funeral costs, outstanding debts, and even daily living expenses for your family, ensuring they are cared for and their financial future is secure.

Moreover, credit life insurance can also benefit the loan provider or lender. In the unfortunate event of your death, the insurance company pays off the remaining loan balance, ensuring the lender gets their money back. This feature is especially important for large loans, as it protects the lender's interests and can prevent the loan from going into default, which could have negative consequences for the borrower's credit score and financial reputation.

The financial support provided by credit life insurance can also extend to loan repayment. If you become permanently disabled and are unable to work, the insurance policy may kick in and make regular payments on your behalf. This can be a significant relief, as it ensures that your loan remains current, and you avoid any potential financial strain or stress associated with missed payments. It provides a safety net, allowing you to focus on your health and recovery without worrying about the financial implications of your disability.

In summary, credit life insurance offers a valuable layer of protection for both borrowers and their loved ones. It provides financial security, peace of mind, and a safety net in the event of unforeseen circumstances. Understanding the benefits of this insurance can help individuals make informed decisions about their loans and ensure that their financial interests and those of their dependents are adequately protected.

Strategies for Emailing Life Insurance Clients: Tips for Success

You may want to see also

Limitations: May not cover all debts and has exclusions

Credit life insurance is a financial product designed to protect borrowers and their families in the event of the borrower's death or disability. It is typically offered as an add-on to a loan, providing coverage for the remaining loan balance if the borrower passes away or becomes unable to work due to an accident or illness. While it can offer valuable financial security, it's important to understand its limitations to make an informed decision.

One of the primary limitations of credit life insurance is that it may not cover all debts. The policy typically covers the remaining loan balance, but it might not extend to other financial obligations. For example, if a borrower has multiple loans, a credit life insurance policy might only cover the balance of one loan, leaving other debts uncovered. Additionally, it may not provide coverage for all types of debts. Some policies specifically exclude certain types of loans, such as student loans or personal loans, and may only cover mortgages or auto loans. This means that borrowers with diverse financial obligations might not receive comprehensive protection.

Exclusions are another critical aspect of credit life insurance. Policies often have specific conditions or events that are not covered. For instance, pre-existing medical conditions or certain high-risk activities might be excluded from the policy. If a borrower's death or disability is caused by a pre-existing condition or an excluded activity, the insurance company may not provide a payout. These exclusions can vary widely between policies, so it's essential to carefully review the terms and conditions to understand what is and isn't covered.

Furthermore, the coverage provided by credit life insurance is generally limited to the loan amount. If the borrower's debt exceeds the policy's coverage limit, the insurance may not fully compensate the lender or the borrower's estate. This limitation can leave a significant portion of the debt unpaid, especially if the borrower's death or disability results in a substantial loss of income.

In summary, while credit life insurance can offer valuable financial protection, it is essential to be aware of its limitations. Borrowers should carefully review the policy terms to understand which debts are covered, which are excluded, and what the coverage limits are. By doing so, individuals can make informed decisions about their financial security and ensure that their loved ones are protected in the event of unforeseen circumstances.

Life Insurance and Short-Form Death Certificates: What's Accepted?

You may want to see also

Frequently asked questions

Credit life insurance is a type of insurance policy that protects the lender in case the borrower dies or becomes permanently disabled and is unable to make the loan payments. It is typically offered as an add-on to a loan, such as a mortgage or an auto loan.

While credit life insurance primarily benefits the lender, it can also provide some financial security to the borrower's family in the event of their death. The policy pays out a death benefit, which can help cover funeral expenses and provide financial support to dependents.

No, credit life insurance is not mandatory. Lenders may offer it as an option, but it is not required by law. Borrowers should carefully consider the terms and costs before deciding to purchase this insurance.

Credit life insurance may have certain limitations. For instance, it typically only covers the remaining loan balance and may not provide full coverage for the entire loan term. Additionally, the policy may have restrictions based on age, health, and other factors.

Yes, borrowers usually have the right to cancel credit life insurance at any time. However, there may be penalties or fees associated with cancellation, especially if the policy has been in effect for a while. It's important to review the terms and conditions of the insurance policy.